Hawkish Fed Minutes Hammer Stocks, Bonds, Gold, & Oil

An ugly home sales print (but record April home prices) combined with declining traffic and smaller spend data from Target threw some shade on the market early on but it was the FOMC Minutes that sparked the waterfall with their more hawkish comments.

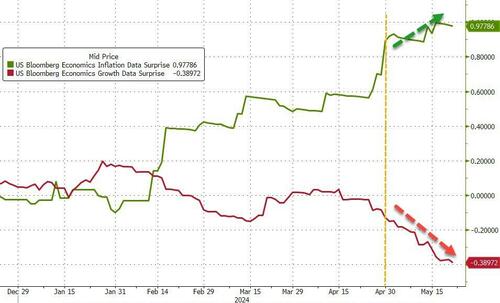

For any and all that say “yeah but they’re stale, we had CPI and Retail Sales since”, see the chart below which shows growth macro data disappointing since the last FOMC and inflation macro data rising still – no let up in the stagflation scenario…

Source: Bloomberg

Plenty of FedSpeak again today left stocks red by the close (despite a late day rebound attempt) with Small Caps lagging. Nasdaq was the prettiest horse in today’s glue factory managing to ramp into the close and end unchanged…

Goldman’s trading desk noted that volumes were elevated +15% vs the trailing 2 weeks with S&P top of book +50% (we have continued to see this strengthen).

Our floor is skewed 3% better to buy led by HF demand in Tech + Discretionary names. HF’s are small for sale in Industrials and Hcare, led by long sales.

L/O passive demand remains consistent (mostly concentrated in tech and HC), but overall activity feels extremely muted.

Corporates are large buyers and CTAs are small buyers.

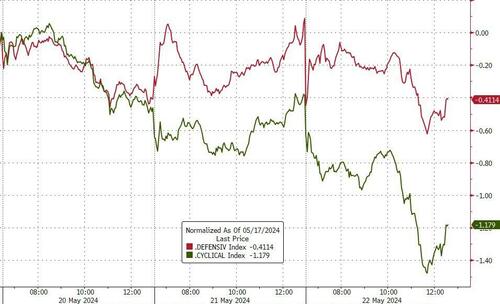

Traders still tilted towards defensives over cyclicals but both were hit today…

Source: Bloomberg

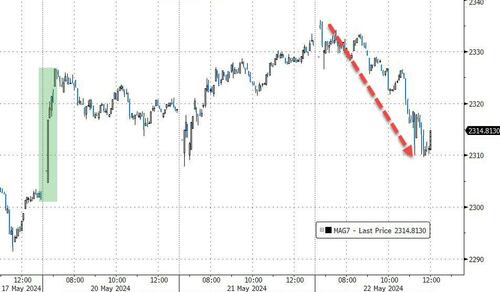

The basket of Mag7 stocks were weak today ahead of tonight’s NVDA earnings…

Source: Bloomberg

Treasury yields were mixed today with the short-end lagging notably (2Y +5bps, 30Y unch)…

Source: Bloomberg

Which flattened the yield curve (2s30s) to its most inverted since April’s CPI plunge…

Source: Bloomberg

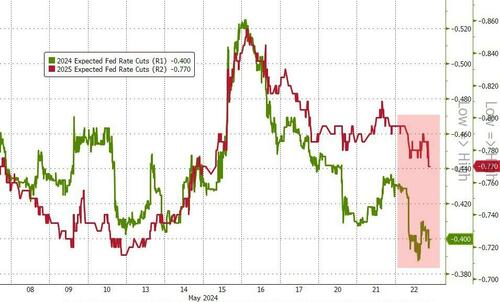

Rate-cut expectations dropped (hawkishly) after the Fed Minutes…

Source: Bloomberg

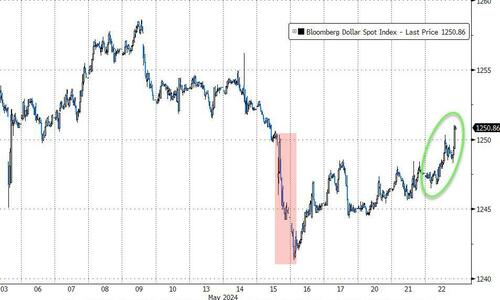

The dollar extended its latest rebound, erasing all the post-CPI losses…

Source: Bloomberg

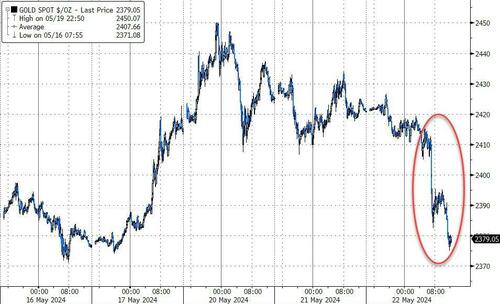

Gold was clubbed like a baby seal today for its worst day since April…

Source: Bloomberg

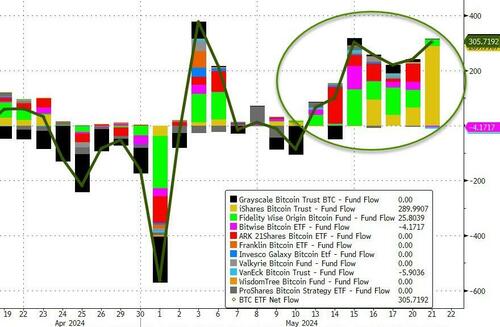

Cryptos actually held up well today – after another solid net inflow yesterday into BTC ETFs, and further hope for the approval of ETH ETFs…

Source: Bloomberg

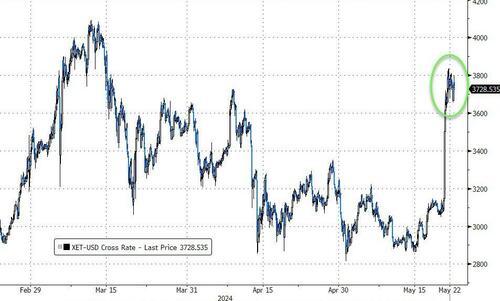

ETH tagged $3800 and hovered just below it…

Source: Bloomberg

Bitcoin oscillated around the $70,000 level all day ending practically unch…

Source: Bloomberg

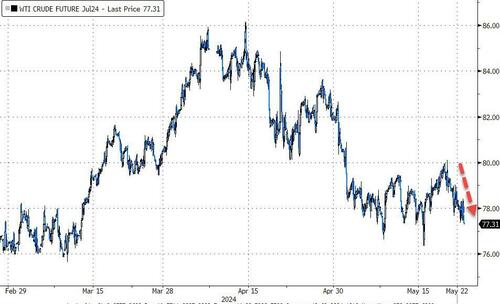

Oil prices slipped back towards 3 month lows (despite a crude draw)…

Source: Bloomberg

Today’s drop sent WTI back below its 100- and 200DMA…

Source: Bloomberg

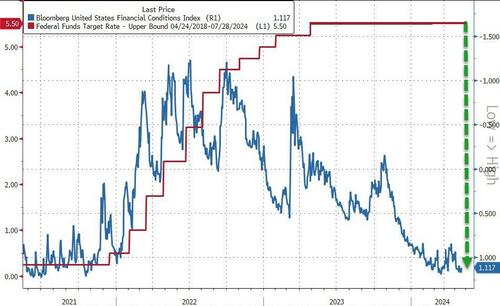

Finally, the FOMC Minutes showed some Fed members feared that despite a ‘restrictive’ monetary policy, financial conditions were too easy…

Source: Bloomberg

They are right!! And the reason financial conditions are so easy is because of the constant pivot jawboning about a possible rate-cut and premature victory celebrations by The Fed for vanquishing inflation… instead they conjured stagflation back to life, with stocks at record highs.

Tyler Durden

Wed, 05/22/2024 – 16:00

via ZeroHedge News https://ift.tt/3fkNxbd Tyler Durden