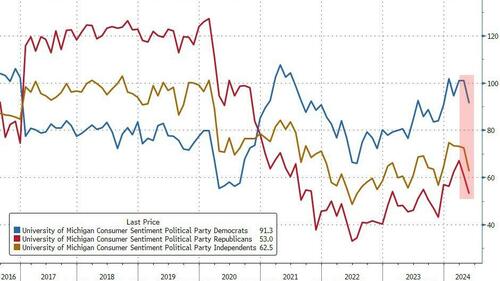

UMich Sentiment & Inflation Expectations Worsen In May (But Bounce From Flash Prints)

Today’s final UMich sentiment survey data was expected to confirm the ugly preliminary data, but it seems that – thanks, we suspect, to lower gas prices – sentiment improved intra-month as inflation expectations fell.

Inflation expectations did actually rise MoM (from 2.9% to 3.2% for the next 12 months), but that was well down from the preliminary 3.5% print.

Source: Bloomberg

A similar picture was seen in the headline sentiment signals which dropped MoM but are considerably better than the plunge sentiment suffered in the preliminary print.

“While consumers recognize that realized inflation has eased substantially since 2022, a considerable share of consumers still express the burden that high prices exert on their lives,” Joanne Hsu, director of the survey, said in a statement.

While the university’s final May consumer sentiment index improved from the preliminary reading, it still registered a notable 8.1-point decrease from April and stands at a six-month low of 69.1.

The current conditions gauge decreased to 69.6 in May from 79 in the prior months. A measure of expectations fell to 68.8 from 76.

Source: Bloomberg

In addition to high prices and borrowing costs that are raising concerns about the cost of living, respondents in the survey grew anxious about the labor market. They expect the jobless rate to rise and income growth to slow.

That represents a challenge for President Joe Biden in his bid for re-election.

Consumers also see less of a chance the Federal Reserve will lower interest rates in the coming year. Only 1 in 4 sees a rate cut now, compared with 37% in January.

Buying conditions for durable goods decreased to a one-year low, while consumers’ perception of their current financial situation was the worst in five months.

About four in 10 respondents blamed high prices for eroding living standards.

These deteriorating expectations suggest that multiple factors pose downside risk for consumer spending.

Tyler Durden

Fri, 05/24/2024 – 10:35

via ZeroHedge News https://ift.tt/iFTHwqr Tyler Durden