PCE Preview: A 3 Year Low?

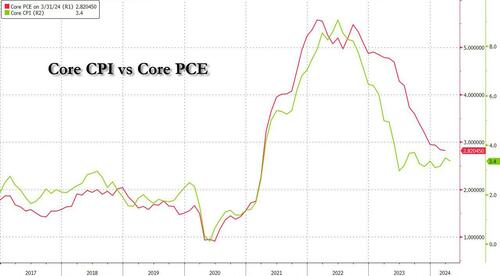

Two weeks after the latest CPI print came in fractionally below estimates and sent yields to their May lows, tomorrow at 8:30am, we will get the Fed’s preferred inflation metric, the April core PCE inflation numbers.

EXPECTATIONS: headline PCE prices are seen rising +0.3% M/M in April (prev. +0.3%), with the annual rate expected to be unchanged at 2.7%. The core measure is seen rising +0.3% M/M (prev. +0.3%), while the core rate of annual PCE is seen unchanged at 2.8% Y/Y, although even a modest dip in the annual print would lead to the lowest annual increase in three years, since April 2021.

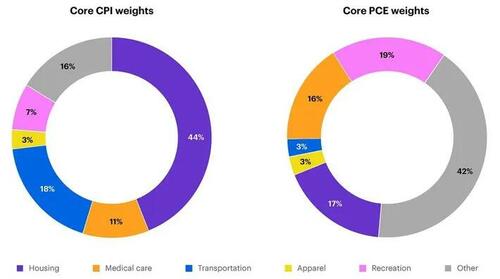

CPI AND PPI: As noted above, and as Newsquawk writes in is PCE preview, headline CPI data was cooler than expected in April, while the core CPI metric saw the smallest increase since December; and while the PPI data for the month surprised to the upside in the month, analysts noted that the internals — components that feed into the PCE data – were more constructive (insurance sectors, health and medical components, air transportation). As a reminder, PCE gives far lesser weight to Housing/Shelter, as well as transportation (recall that transportation insurance is soaring right now and is the biggest drive of CPI inflation), which is why overall core inflation viewed through the lens of PCE is far lower.

Ahead of the data, Goldman Sachs said using CPI, PPI and import prices, “we estimate that core PCE increased 0.26% M/M, a pace well below the 0.36% average of the prior three months, but probably not sufficient for a July cut if maintained in May and June.” That said Goldman estimates that the market-based core PCE index—which has been referred to by Fed Chair Powell in recent remarks—rose just 0.18%, a pace GS says would be quite consistent with a July cut if maintained.

FED: After a hawkish set of FOMC meeting minutes, and some cautious chatter from Fed officials, as well as constructive incoming data (decent PMI data for the month saw Fed cut pricing diminish sharply); money markets are pricing no easing at the Fed’s June 12th meeting, and only a 10% chance of a cut in July. The first fully discounted rate cut is seen in December, although markets are assigning a c. 80% probability of a cut in November. Goldman recently pushed its first rate cut forecast from July to September.

Tyler Durden

Thu, 05/30/2024 – 23:04

via ZeroHedge News https://ift.tt/Sw6GNaO Tyler Durden