Swiss Franc Pinned Against Dollar, Euro, But Has Tailwind Versus Yen

Authored by Ven Ram, Bloomberg cross-asset strategist,

The Swiss franc has had a twin life so far this year, weakening against the dollar and the euro, but proving to be resilient against the yen.

That double role may persist so long as real rates in the US stay aloft.

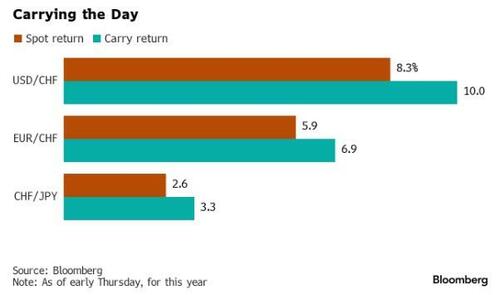

This is broadly how the franc has performed this year:

Outlook against the dollar:

The franc has been hobbled against the dollar and the euro, with higher nominal and inflation-adjusted yield differentials proving to be a particular handicap against the US exchange rate. Against the dollar, the franc will continue to be on the back foot so long as real rates in the US stay higher for longer. The Swiss National Bank is perturbed sufficiently by the prospect of weakness in the franc stoking domestic inflation as to warn that it might intervene in the currency markets.

Indeed, the franc has recovered some 0.6% on the day on the back of SNB President Thomas Jordan’s comments. While the SNB may be willing to put a floor on the franc, it’s unlikely that it will be able to turn the tide entirely on what is a broader dollar move.

The franc will claw its way back against the dollar when signs emerge that a rate cut from the Federal Reserve is imminent, but we aren’t yet at that point.

Outlook against the euro:

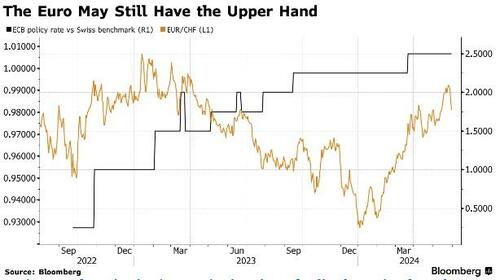

The euro is also better placed against the franc given that nominal rate differentials between the euro zone and Switzerland will continue to work in favor of the former in the months to come.

Traders are factoring in about 60 basis points of policy loosening from the European Central Bank this year, though as noted before, there is a chance that we could get only two cuts. The carry on a long euro position against the franc is, therefore, bound to be significant, which will deter gains in the Swiss currency. Even with Jordan’s warning echoing in the background, EUR/CHF isn’t too far from parity.

Outlook against the yen:

The franc has proved more resilient against the yen than I expected it to be, though the bulk of that performance has stemmed from carry returns. An investor who is long the franc against the yen is essentially getting paid to put on the trade, which has underpinned the spot move in CHF/JPY so far this year.

The broader yen is dogged by immense gloom, which has sent Japan’s exchange rate tumbling a lot lower than it ought to have. While the franc may yet stay supported against the yen, traders will find that the carry that is enticing them won’t be sufficient to buffer the cross when broad sentiment toward the yen turns.

Tyler Durden

Fri, 05/31/2024 – 04:00

via ZeroHedge News https://ift.tt/FVdouOb Tyler Durden