Retail Sales To Beat Estimates According To Latest Card Spending Data

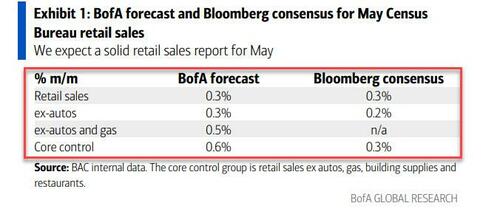

Last month was the first time in about a year, when the Bank of America retail sales forecast – one derived from real-time debit and credit card spending and which is usually spot on and unerringly correct – was wrong, predicting a small beat when in fact the final number was a big miss, printing unchanged on consensus estimates of a 0.4% increase, with the control group unexpectedly contracting by a whopping 0.3%.

So will tomorrow’s retail sales be two in a row when Bank of America’s cheerful forecast has been wrong? We doubt it: after all, as regular readers are aware the hit rate of BofA’s approach is remarkable.

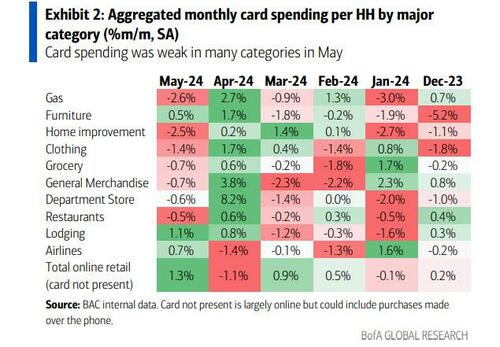

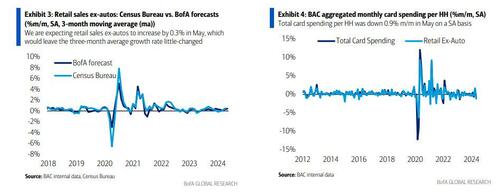

With that in mind, BofA reports that total card spending per household (HH), as measured by BAC aggregated credit and debit cards, was up 0.7% year-over-year (y/y) in May, if down 0.9% month-over-month (m/m) in May on a seasonally adjusted (SA) basis. This comes on the back of a 1.3% surge in BAC card spending per HH in April, and a 0.7% drop in March. The bank attributes these large fluctuations to the lingering effects of this year’s unusually early Easter weekend.

As BofA economist Aditya Bhave writes, “seasonal distortions have impacted retail sales in four of the last five months. We economists don’t enjoy writing about them, but here we go again. BAC card spending tends to be particularly low on Easter Sunday, which is usually in April. However, this year it fell on March 31. It seems that our seasonal factors do not fully account for this shift. This lowered SA spending levels in March and boosted them for April. In turn, we think SA spending growth in May looks soft because of an unfavorable base effect.“

In short another month where the underlying reality will be distorted by seasonal adjustments, and since it is unclear in what direction the Biden Census Bureau will seek to nudge the numbers, a prediction of tomorrow’s official print tomorrow could be a gamble.

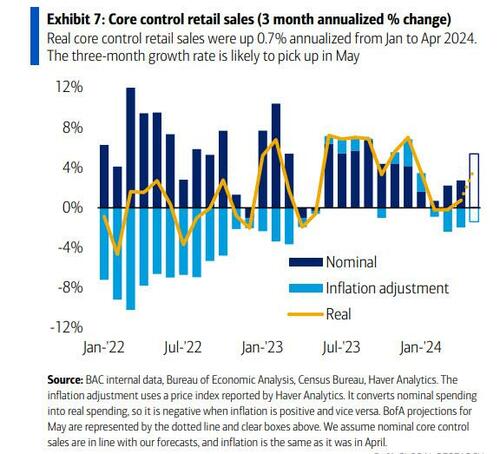

Still, that does not prevent BofA from making such a forecast, and writes that the Census Bureau’s seasonal factors appear to have leaned strongly the other way: retail sales were very strong in March and soft in April. As a result, the bank attempted to resolve the discrepancy between its own seasonal factors and those of the Census. This results in forecasts of 0.3% and 0.6% growth in retail sales ex-autos and the core control group (retail sales ex autos, gas, building materials and restaurants), respectively, in May.

That would mean in-line core and headline prints, and a far stronger control group number, printing at double the forecast.

There is another variable: the government’s retail sales data have been subject to significant revisions this year (as have all other data), both to the upside (in the March report) and the downside (in the January, February and April reports). The risk, BofA notes, “is that this trend will continue” (especially to the downside). Revisions to retail sales for prior months could impact the m/m growth rate for May, everything else being equal.

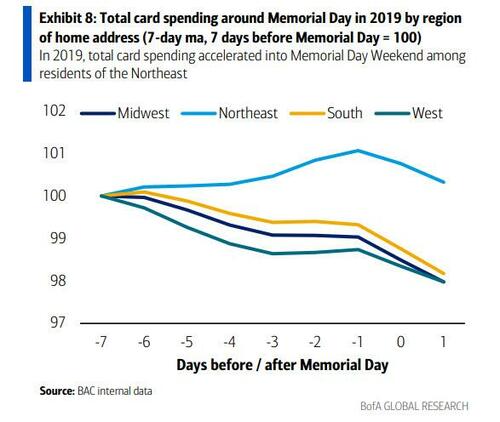

One other observation from BofA: in 2019, card spending accelerated among Northeasterners around Memorial Day, but slowed among residents of other regions.

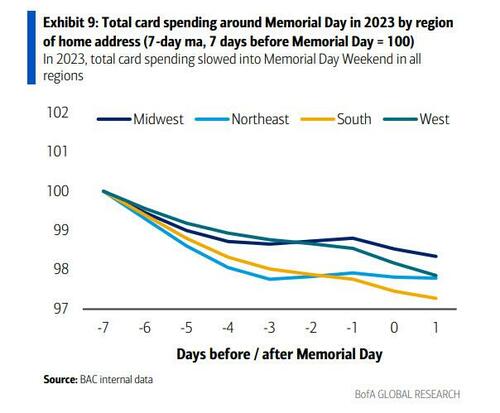

By contrast there was no “Memorial Day bump” in any region last year.

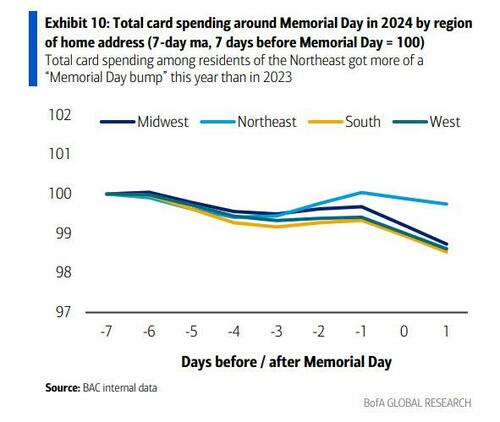

This year, Northeasterners raised their spending around Memorial Day again, although not to the same degree as in 2019.

This may suggest that the region continues to regain its economic vibrancy. Meanwhile, residents of other regions saw less of a spending drop than in 2019.

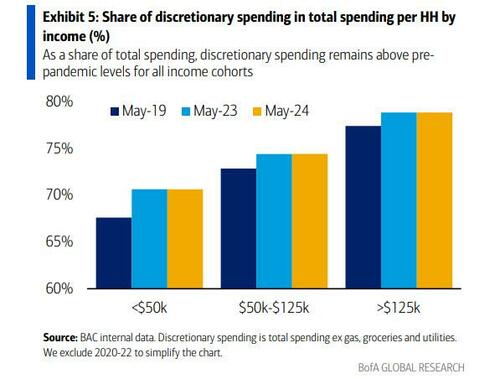

One final point: after enjoying a big jump from pre-covid levels to the post-covid reality (snapshot taken in May 2023), discretionary spending as a percentage of total is effectively unchanged in the past year.

More in the full note available to pro subs in the usual place.

Tyler Durden

Mon, 06/17/2024 – 22:00

via ZeroHedge News https://ift.tt/aCRUpxI Tyler Durden