What Will Happen To Inflation Under A Trump Presidency

By Philip Marey of Rabobank

Summary

- With the elections approaching, Trump and Biden are outbidding each other to show who is the toughest on trade. Trump has proposed a universal tariff and even higher tariffs on China, while Biden has kept the Trump tariffs of 2018 and added specific tariffs on “strategic” imports from China.

- Since Trump is ahead in the polls and we expect the economic data to deteriorate, we made a Trump victory our baseline in February. A universal tariff would lead to a rebound of inflation in 2025. Recent simulations, which include retaliation by the EU and China, suggest a more prolonged inflationary effect extending into 2026 and an adverse effect on US GDP growth in 2026.

- If the Republicans also get control of the Senate and the House of Representatives, reduced immigration and tax cuts could reinforce the inflationary impact from the universal tariff.

- Meanwhile, it remains to be seen whether the Trump legal cases will lead to a sustained rebound for Biden in the polls. However, they are highlighting that “lawfare” has become a feature of the US elections, which are likely to be contested again. This leads to a further erosion of US institutions and undermines the long-run strength of the economy.

Introduction

In February, based on the opinion polls and our expectation of a deterioration of economic data in 2024, we decided to assume a Trump victory in our Q1 forecasting round for the global economy. While there are many uncertainties about the impact of a second Trump presidency on economic policy, a raise in import tariffs is highly likely. Trump showed a preference for tariffs in his first term in office and more recently he has been talking about a universal tariff on goods imports if he gets a second term. Also note that the US president can raise tariffs without support from Congress due to several laws that have been adopted over the years that have delegated trade policy powers from Congress to the White House.

Therefore, we think that a universal tariff is a robust assumption, that remains valid under different scenarios. For example, it does not depend on the outcome of the elections for the Senate and the House of Representatives that also take place on November 5. Since our assumption of a universal tariff depends only on Trump’s chances, the probability of our baseline is not diluted. After all, with each additional assumption, the joint probability of all assumptions turning out valid declines rapidly.

Institutions like the Congressional Budget Office usually assume no change in policy when making forecasts, unless they analyze alternative scenarios. However, if we follow this practice, this would essentially mean that we make the implicit assumption that a Biden victory is more likely than a Trump victory. Given the available polling data, and our expectation that the economy is slowing down, this does not seem plausible. Therefore, we have taken the step to assume a Trump victory in our baseline forecasts, expressed through its most robust policy implication: a universal tariff.

Trump’s universal tariff: what if the world retaliates?

The empirical evidence on the Trump tariffs of 2018 showed that the tariffs were mostly paid by US importers and US consumers, rather than foreign exporters. Going from specific tariffs to a universal tariff in 2025 would broaden the impact and likely have a substantial upward impact on consumer price inflation. This would also reduce the scope for policy rate cuts by the Fed. We already incorporated this in our previous (Q1) forecasting round with a rebound in US inflation in 2025, complicating the Fed’s mission to get inflation back to its 2% target in a sustainable manner. Ceteris paribus, this should reduce the amount of rate cuts that the Fed has in mind for 2025.

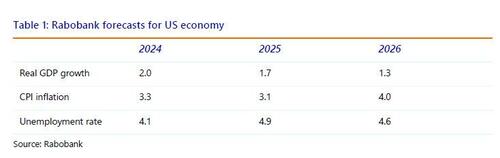

Our forecasts in Q1 reflected the imposition of a universal tariff by the US, without retaliation from trading partners. In our current forecasting round (Q2), we have made additional assumptions on retaliation by China and the EU. Moreover, our scenarios and projections team used the NiGEM global macroeconomic model to simulate the impact of a universal tariff and retaliation on the economies of the US, the EU, China and the rest of the world. Based on the simulation outcomes with retaliation, we have adapted our US forecasts to reflect a more prolonged inflationary effect extending into 2026 and an adverse effect on US GDP growth in 2026 (Note that CPI inflation falls to 2.5% in the first half of 2025, before rebounding to 4.0% by the end of the year). For more details, we refer to our most recent Monthly Outlook.

Timing, size and scope of the universal tariff

Trump’s team has two bills in mind to kick off his second term: a border security and immigration package and an extension of his 2017 tax cuts. It is unclear how much time this would take, and it also depends on the election outcomes in the Senate and the House of Representatives. Therefore, it is also unclear how much time it will take Trump to impose a universal tariff and additional tariffs on Chinese imports. However, he would not need support from Congress. Once the universal tariff has been imposed, we expect that its size and scope will be large and wide enough to have a noticeable upward impact on consumer price inflation. Note that both reduced immigration and tax cuts could be inflationary as well. While we expect Trump to start his second term in a stagflationary environment, if we get at most a mild recession in the second half of this year, it would not take long before the economy runs into constraints again, especially if labor supply is slowed down at the same time that aggregate demand gets a (sustained) boost from tax cuts.

While the timing of the universal tariff will be dependent on Trump’s policy progress, the size and scope of the tariffs could depend on Trump’s trade policy objectives. It could be that Trump starts his second term with an immediate implementation of a 10% universal tariff. However, if he wants to get concessions from trading partners, it could be worthwhile to start later and not apply the entire 10% immediately. For example, he may want to use the implementation of a universal tariff as a threat to get the EU aligned in a trade war against China. Note that current Treasury Secretary Janet Yellen, travelling to Europe in May, urged the EU to restrict Chinese imports of green technology, such as solar panels and wind turbines. Or Trump could aim for lower EU trade barriers against US imports, or both. To allow for these considerations, in our Q2 forecasting round we have made the assumption that the Trump administration implements a 5% universal tariff on goods (but not on services), starting in 2025Q3.

An upside risk to our baseline is that Trump will implement the full 10% universal tariff immediately after inauguration on January 20, 2025. The tariffs on imports on China may also turn out much higher than that. In fact, Trump has talked about 60% tariffs on Chinese imports and a 100% tariff on Chinese EVs from Mexico. This would also likely lead to stronger retaliation. However, this would only reinforce the mechanisms that are already at work in our baseline, i.e. higher inflation and more damage to international trade and economic growth.

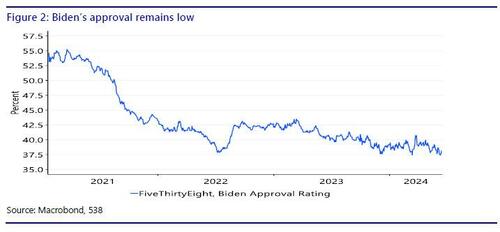

What if Biden makes a comeback?

The downside risk to our baseline is that Biden still manages to win the presidential election. Although Biden is trailing in the polls, both at the national level and in most swing states, a lot can happen in five months and he is not that far behind. One reason for a Biden rebound could be that the economy reaccelerates after the slowdown in the first quarter of 2024. However, we think that inflation then remains a problem for Biden’s approval. Another reason could be noneconomic, such as the fallout from the Trump legal cases. Of course, if it becomes clear before the elections that Biden’s chances have rebounded to such an extent that a Biden victory is the most likely outcome, we will change our baseline accordingly. How would that change our forecasts? Since we have expressed the assumption of a Trump win through the implementation of a universal tariff, a Biden win would show up in our forecasts as more targeted tariffs (mostly aimed at China) rather than a universal tariff. This also means that Europe would face lower tariffs under Biden. Without a universal tariff, the inflation trajectory will be lower and the damage to international trade and economic growth will be more modest. This would reduce the inflationary impact and allow for more Fed rate cuts in 2025 than we are assuming in our current baseline with a Trump victory.

However, US trade policy will remain protectionist and therefore inflationary. Keep in mind that the EV subsidies and battery requirements in the Inflation Reduction Act show that protectionism may take different forms. In May, after a review, Biden decided to leave the Trump tariffs on China intact and raise tariffs on Chinese EVs, advanced batteries, solar cells, steel, aluminum and medical equipment. These strategic hikes are meant to bolster the CHIPS and Science Act and the clean energy measures in the Inflation Reduction Act. Both were protectionist to begin with. When it comes to trade, both Republicans and Democrats have moved in the same direction, only the approach and the pace are different.

Stormy weather: lawfare and contested elections

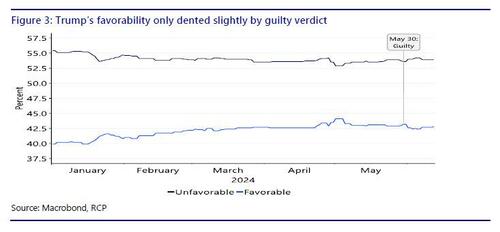

Although we have assumed a Trump victory based on recent polls and a deterioration of the economy, there is a possibility that Trump’s legal cases raise the chances of Biden in the presidential election. On May 30, a New York jury found Trump guilty of 34 felonies for falsifying records to cover up hush money paid to Stormy Daniels. The judge scheduled Trump’s sentencing for July 11, only days before the start of the Republican convention. Whether the sentence will be prison, probation or a fine remains unclear. Anyway, Trump is likely to appeal after sentencing, which could drag out the case for months or years. Meanwhile, even a prison sentence does not disqualify Trump for the presidential election in November. Three other criminal cases against him – two federal and one in Georgia – are not likely to go to trial before Election Day.

This means that the main impact of the Manhattan case will be electoral. For some voters, the guilty verdict may be a reason not to vote for Trump. However, this does not necessarily mean that they will vote for Biden. It is also not unthinkable that some voters who were sitting on the fence perceive the Manhattan trial as politically biased and decide to go for Trump. What’s more, a conviction is sure to energize the base, which means that this will push up the turnout of Republican voters. Keep in mind that Trump has put the prosecutions at the center of his campaign, claiming they are political rather than criminal. From his perspective, the guilty verdict in New York just proved his point. Therefore, the conviction does not change our assumption of a Trump victory in November.

However, it does underscore the continued polarization of US politics and society, and the increasing role of (perceived) lawfare in politics. Unfortunately, this also means that contested elections may become the rule rather than the exception. While strong institutions have been crucial to the economic success of the US, they are increasingly under siege, as we noted in Civil unrest and Insurrection. If institutions start to crumble, then so will the economy.

Conclusion

Biden’s recent decision to keep the Trump tariffs on China and add “strategic” tariffs are clearly part of the election campaign where Biden and Trump are outbidding each other to show that they want to bring jobs back to America. Although a Biden baseline would show lower inflation than a Trump baseline, and more Fed rate cuts, it is important to stress that both presidents will continue to follow a protectionist course, which means that inflation in both scenarios is higher than under a hypothetical free trade president. The same is true for Fed policy rates. When it comes to trade policy, both Republicans and Democrats have become protectionist, especially regarding China. This will lead to higher inflation and could slow down economic growth, especially if other countries retaliate against the US.

almost there pic.twitter.com/60MyeSUeVA

— zerohedge (@zerohedge) June 21, 2024

Meanwhile, the reactions to Trump’s New York legal case underline the degree of polarization in the United States. More importantly, the case shows that “lawfare” – perceived or real – has become part of US politics. Contested elections may become the rule rather than an exception for the United States. This could undermine the long-run strength of the economy.

Tyler Durden

Sun, 06/23/2024 – 10:30

via ZeroHedge News https://ift.tt/a4uWDXM Tyler Durden