Price Action Indicates Lack Of Any True Conviction Or Depth Of Liquidity

By Peter Tchir of Academy Securities

Assume

I think it was in the Bad News Bears, where I first saw that “Assume” can make an a** out of U and Me. I couldn’t get a good clip of that but did come across a scene from The Odd Couple where they went through the same dissection of the word (The Odd Couple, believe it or not, was before my time).

I’ve chosen this word for today’s report as I think it is relevant on many fronts. I am also going back and trying to figure out how many things I “assume” that I should recheck. We will use presume as well, which seems like a less severe version of assume. Finally, we will discuss “mirroring” once again, as this could be very important in the coming weeks.

Markets

Last weekend we wrote about Fragility in a One Stock, Stock Market, and we followed up on Thursday with One Trick Pony. While much of the focus is on the difficulties and risks of interpreting broad market signals in a market that is led by a handful of stocks, we can probably rephrase it in terms of assumptions and presumptions. “Normally” we see X and can interpret Y. In some groups, there has been a lot of discussion of co-movement versus correlation. In this case, correlation is more persistent and there is an element of causation, as opposed to a few things that seem to move together from time to time. I’d lump Bitcoin and almost anything in this category, as somedays it seems very correlated to big tech, and others it beats completely to its own drum – a drum that is getting weaker, but more on that later this week.

Then we can add “passive” to the mix. The large “passive” rebalancing in XLK is over, but in general, for the largest indices, every inflow and outflow is disproportionately (by historical standards) impacting a small percentage of the stocks in the index.

For now, I’m sticking with the overall sentiment being one of “greedy, but less greedy than before.”

Monday’s large sell-off in the Nasdaq 100 was completely reversed on Tuesday. The index moved higher Wednesday and Thursday, only to wind up fractionally down on the week, as stocks faded into the close on Friday. Maybe I’m alone in struggling with this price action, but it does seem indicative of a lack of any true conviction or depth of liquidity (in either direction).

We “presumed” or concluded (or guessed) that the debate would highlight the deficit and the fact that neither candidate is particularly serious about getting it under control, let alone balancing the budget.

In terms of being right for the wrong reasons, the 10-year Treasury yield closed at 4.4%, smack in the middle of our 4.3% to 4.5% range. But it had nothing to do with the debate (based on the trading during and after the debate). It had absolutely nothing to do with the economic data, as inflation data came in nicely (should have been priced in), and Michigan inflation expectations were surprisingly down (not priced in, but easily ignored). In any case, we were at 4.26% before the market rolled over.

The Nasdaq 100 decided to follow Treasury prices and moved almost in lockstep with them. Whether there was causation or not remains to be seen. It was month-end and quarter-end, so that could have had an impact, though normally the “rebalancing” trades create both demand and supply for stocks/bonds. However, both were for sale. One “assumption” many use is that month-end is good for bonds, as index trackers “extend” duration into the close. That didn’t occur, again, making us wary of assumptions and rules of thumb. Adding to that, NVDA, which has been one of our main “tells” was higher for most of the day, before finishing the day lower.

Do we bounce on Monday as we start the new quarter? Or has momentum lost enough steam that selling continues? Will asset managers slow their purchases or sell now that they have finalized what they show clients on their quarter-end statement? I remain focused on the 50-day moving averages for the broad indices, which would indicate more selling to come.

Oil behaved differently. It traded strongly into the open, sold off with the economic data, and while finishing lower on the day, it had support into the close (unlike stocks or bonds). We will have more to come on oil as the best geopolitical risk trade.

Elections and Debates

European elections are nearing, and I’m leaning towards them causing some market hiccups in Europe. I’d avoid European risk here, and those elections could add pressure to U.S. markets.

While we are non-partisan here at Academy, it is impossible to ignore the debate. While it didn’t seem to have any immediate market impact, it is difficult to know if it had any influence on markets over the course of the day (I’d like to claim I was right and the debate was why Treasuries sold off, but that is a stretch).

There are two things that I think I can safely say about the debate:

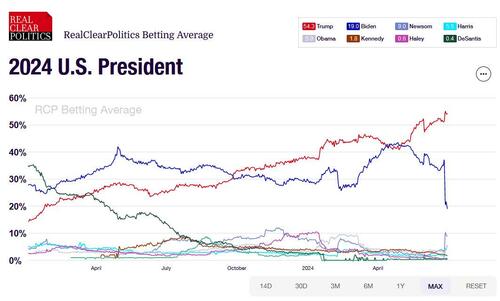

- Based on betting data, we saw President Biden’s odds decline, noticeably, but former President Trump’s odds increased marginally. Basically, the betters were taking chips off the Biden table, and spreading them around, not just throwing them all to Trump. I used RealClearPolling (the link seems ok, but I wouldn’t bother clicking it without a good VPN). It seemed comprehensive and in line with other reports I’ve seen. I do not know how easily manipulated the betting markets are (e.g., depth of liquidity). So, you can take this with a grain of salt, but I do think that we’ve seen a change in how people are thinking about the upcoming election.

- We can now see why the media has been very careful to say “presumptive” nominee, as there was a lot of chatter, from sources I would consider pro-Biden, that some consideration should be given to rethinking the Democratic ticket (which seems supported by the betting odds).

I don’t think this is what drove markets on Friday, as the day wore on, but I do think it is important from a geopolitical risk perspective.

Assumptions and “Mirroring”

We have discussed the concept of “mirroring” in many different reports. It is the “problem” that intelligence officers face when trying to extrapolate what an adversary might do. It is extremely difficult not to “mirror” your thoughts and perspectives when analyzing an adversary. It is one of the reasons why most military exercises have “red teams” – teams that play the role of opposition. Trying to gameplay things “properly” is important so that you are facing, in practice and simulation, the opponent that you will face on the battlefield.

The concept of “mirroring” or making incorrect assumptions is likely part of why Academy, with our geopolitical insight, has not only been correct on our trajectory with China but was also predicting it well ahead of time. We cut through some of the “mirroring” issues many seem to face. It is certainly one element of our The Threat of Made By China 2025.

But today, we are revisiting this concept, because it may prove important in understanding how our adversaries/competitors may take the debate.

- China (Xi), Russia (Putin), Iran (Khamenei), and North Korea (Kim) are all autocrats. They are in charge. What they say goes. While they likely “understand” at some level, how our House of Representatives and Senate work and how the Supreme Court has influence, it may be difficult for them to comprehend that the president (with “Executive Powers”) doesn’t have the same freedom of action that they do. It seems like there is at least a potential that these actors (and some others across the globe) may view the criticism of Biden’s performance as something bigger than it is.

- The U.S. media was (and is) completely domestically focused at the moment. U.S. media coverage always tends to be “parochial” (relatively small domestic events/human interest stories often take priority over potentially much more important events occurring globally). However, the U.S. media and social media are being dominated by the debate and the election.

- To the extent any of these actors were planning on influencing U.S. elections, they probably already have some elements in place.

- It seems plausible, that having watched the Ukraine funding debate and the relationship with Israel evolve since October 7th, any bad actor has potentially added some new influencing tools to their tool kit.

A combination of misunderstanding how the U.S. works and overconfidence in their ability to win a misinformation campaign may give these bad actors the incentive to act sooner than later.

In our recent Geopolitical Risks – Perception vs Reality we highlighted “wildcard risk.” The intensity and variety of geopolitical risks already seemed high (something we’ve mentioned in recent reports), and it seems that it is necessary to increase our estimate of geopolitical risk after Thursday.

The concern is that some adversary, or competitor, will try to take advantage of what they perceive as an opportunity, with the president facing some new questions, even from supporters.

The common denominators between these countries (and their likely actions) are commodities and trade.

I want to own energy and commodity related assets now (the commodities, but also the stocks of companies in those industries). Since I’m worried about trade, in the event of some act, I’m leaning more towards energy than industrial commodities. I’ve been asked about gold and silver (and Bitcoin), but I don’t have a strong opinion (though, gold and silver would certainly seem to fit my geopolitical risk thesis).

If you have time, re-reading The Game of Chicken in Today’s World seems like a good use of time, as all of the actors above are likely trying to figure out what, if anything, to do given the election news here and in Europe.

Bottom Line

Higher yields and less inverted curves. 4.3% to 4.5% is still our working range for 10s. The bias is now to break higher, but geopolitical risk, while not providing a “flight to safety” trade like it has done in the past, will support Treasuries (more at the front end).

Lower stocks and the “catch-up” will only occur in a down market at this stage.

With geopolitical risk rising, own commodities and commodity-related stocks (and bonds) with a bias towards energy.

Apologies to anyone we may have offended regarding politics or the debate. We have tried to stick to the obvious things that have been happening since the debate. It would be easier to avoid discussing it at all, but since our adversaries and competitors are analyzing it, and it could influence their behavior in the coming weeks, we felt that it was important to go down this uncomfortable path. Given Academy’s expertise in Geopolitical Risk, and often being asked when and how to hedge it, it seems more timely than ever to put some trades on that will benefit from increased activity (while hoping, on a personal level, that nothing occurs, as we already have more than enough fighting happening in this world).

In the meantime, we will continue to challenge our own assumptions and presumptions in this tricky market and world.

Tyler Durden

Sun, 06/30/2024 – 19:50

via ZeroHedge News https://ift.tt/InHZjid Tyler Durden