5 Out Of 12 Fed Districts Show Flat Or Declining Economic Growth

Authored by Mike Shedlock via MishTalk.com,

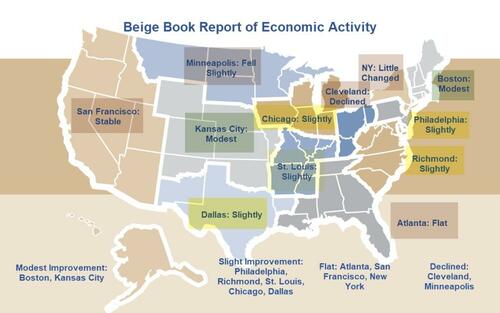

Let’s tune into the Fed’s Beige Book summary of economic activity in the twelve Federal reserve districts.

Summary below from The Beige Book Summary of Commentary on Current Economic Conditions.

Beige Book Overall Activity Key Points

-

Seven Districts reported some level of increase in activity, five noted flat or declining activity—three more than in the prior reporting period.

-

Wages continued to grow at a modest to moderate pace in most Districts, while prices were generally reported to have risen modestly.

-

Household spending was little changed this period according to most District banks. Auto sales varied across Districts this cycle, but some Districts noted that sales were lower due in part to a cyberattack on dealerships and high interest rates.

-

Most Districts saw soft demand for consumer and business loans. Reports on residential and commercial real estate markets varied, but most banks reported only slight changes, if any, in recent weeks. Travel and tourism grew steadily and was on par with seasonal expectations.

-

Districts also reported widely disparate trends in manufacturing activity ranging from brisk downturn to moderate growth.

Boston: Economic activity rose modestly on balance. Prices increased slightly, and wage growth was slow amid stable employment levels. Residential real estate activity increased with improvements in supply, but commercial activity remained flat with increasing concerns for office leasing activity. The outlook remains cautiously optimistic, but contacts continue reporting elevated uncertainty.

New York: On balance, regional economic activity was little changed. Labor market conditions continued to moderate, with labor demand easing and the supply of workers increasing noticeably. Consumer spending was up slightly and remained solid. Though inventory increased, home sales activity remained restrained. Selling prices continued to increase at a modest pace.

Philadelphia: Business activity continued to grow slightly in the current Beige Book period. Nonmanufacturing activity lifted job growth to a modest pace; however, wage inflation remained modest. Firms reported modest increases in costs paid and prices received and noted increased competition in consumer-facing sectors. Expectations for future growth remained slightly positive overall—waxing for most firms, but waning for manufacturers.

Cleveland: District business activity declined slightly in recent weeks, and contacts expected flat activity in the months ahead. Consumer spending continued to decline modestly, and demand for manufactured goods softened. Employment levels remained flat. Overall, contacts indicated that wage and input cost growth remained moderate, and that selling prices grew modestly.

Richmond: The regional economy grew slightly this period, down from a modest pace of growth reported last cycle. Consumer spending on goods and food services was generally flat to up only slightly; however, spending on leisure travel increased moderately, particularly in coastal areas of our region. Employment grew slightly and wage growth continued to exceed price growth, putting downward pressure on margins for some businesses. Price growth remained moderate.

Atlanta: Economic activity was relatively flat. Labor markets stabilized; wage growth eased. Nonlabor inputs cost growth slowed, on net. Consumer demand remained flat. Business and group travel improved. Home sales were flat or slightly down. Transportation activity was mixed. Loan demand was flat. Energy activity was mixed. Agricultural conditions improved.

Chicago: Economic activity increased slightly. Employment was up modestly; business and consumer spending rose slightly; nonbusiness contacts saw little change in activity; and manufacturing and construction and real estate activity edged down. Prices were up modestly, wages rose moderately, and financial conditions loosened a bit. Prospects for 2024 farm income decreased slightly.

St. Louis: Economic activity across the Eighth District has continued to slightly increase since our previous report. Inflation pressures increased modestly, with slower price growth than in previous reports. Reports on consumer spending were mixed. District crop conditions remain stable with high rainfall mitigating excessive heat.

Minneapolis: District economic activity fell slightly. Employment grew but labor demand softened. Wage pressures remained moderate, and prices ticked up modestly. Consumer spending was flat but some segments remained healthy. Manufacturing fell and the outlook was negative. Commercial and residential construction improved slightly, and home sales were mixed. Agricultural conditions fell as farm income weakened.

Kansas City: The Tenth District economy expanded at a moderate pace. Hiring activity slowed as many businesses pulled back on new job postings, but employment levels were stable. Ongoing strength in labor markets supported modest growth in wages. Consumer spending grew at robust pace, driven by discretionary spending with particularly strong growth in travel-related consumption. Prices grew at a modest pace as pass-through of costs remained difficult.

Dallas: Economic activity rose slightly over the reporting period, buoyed by growth in nonfinancial services, finance, and energy sector activity. Housing demand and retail sales weakened in part due to elevated pricing and borrowing costs, while manufacturing output held steady. Employment increased, and wage growth was moderate, though pressures eased. Outlooks were less pessimistic overall.

San Francisco: Economic activity and employment levels were stable. Wages and prices grew slightly, while retail sales fell slightly. Activity was mixed in services, manufacturing, and commercial real estate sectors, but continued to slow in residential real estate. Conditions in agriculture weakened a bit. Financial sector conditions were little changed.

The Progression

-

Modest to Slight or Flat (2)

-

Slight to Flat or Decline (5)

-

Flat to Decline (3)

-

Already Declining (2)

This looks very recessionary because it is very recessionary. I think within 2-3 months a majority will be in decline.

Recession When?

I thought recession started in May or June and I have seen little to change my minds but perhaps I am a couple months early.

For discussion, please see Weak Data Says a Recession Has Already Started, Let’s Now Discuss When

Tyler Durden

Thu, 07/18/2024 – 10:05

via ZeroHedge News https://ift.tt/N69ZpVW Tyler Durden