Two Trillion & Counting… The Mega-Cap Meltdown Continues

Since peaking on July 10th, the market cap of the Magnificent 7 stocks has dropped a mind-numbering $2 trillion…

Source: Bloomberg

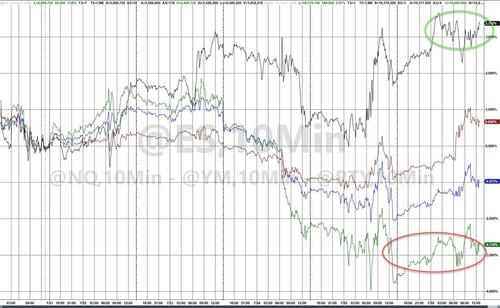

As another week goes by (the third in a row) with Small Caps (+3%) dramatically outperforming Nasdaq (-3%). The Dow ended the week green but S&P red (but closed above its 50DMA)…

That has crashed Nasdaq back into ‘normal’ range with the Russell for the last year…

Source: Bloomberg

And the biggest three week underperformance of Nasdaq vs Small Caps since the very peak of the DotCom bubble…

Source: Bloomberg

Treasuries have been broadly bid the last two days, with the long-end lagging (but managing to get back to unchanged on the week today) as the short-end yields tumbled…

Source: Bloomberg

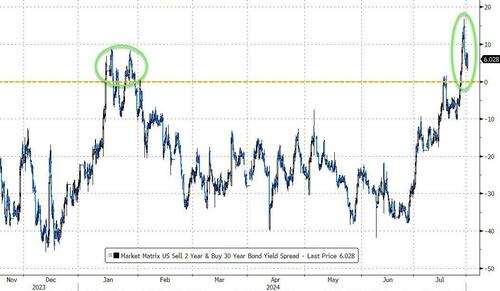

This drove the yield curve (2s30s) to disinvert most sine July 2022…

Source: Bloomberg

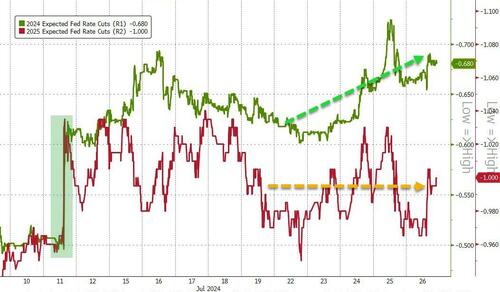

Rate-cut expectations rose modestly on the week (focused fully in 2024 as 2025 remained flat)…

Source: Bloomberg

The dollar drifted very modestly higher in a very noisy trading

Source: Bloomberg

Gold ended the week slightly lower, bouncing back today…

Source: Bloomberg

Crypto markets were mixed this week with Bitcoin bouncing back strongly today, back up to $68,000…

Source: Bloomberg

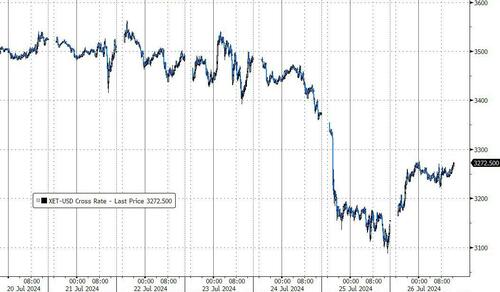

…but ETH seeing ‘sell the news’ relative pressure since the ETFs launched…

Source: Bloomberg

Oil prices ended the week lower, chopping around back in a tight technical range it has found comfortable for months…

Source: Bloomberg

Finally, it’s different this time… it’s bigger….

Source: Bloomberg

…and remember, next week is the busiest of the summer – massive macro events (JOLTs, BOJ, Euro CPI, US ECI, FOMC, BOE, NFP), coupled with massive earnings announcements (40% of SPX market cap next week).

Tyler Durden

Fri, 07/26/2024 – 16:00

via ZeroHedge News https://ift.tt/MQ4L6sw Tyler Durden