Quarterly Refunding: Treasury To Hold Bond, Note Sales Steady For “Several Quarters”, Will “Modestly Increase” Bill Offering Size

Earlier this week, in our Quarterly Refunding preview we said that “the August refunding package will be identical to the one in May, with $125bn in gross issuance across 3y, 10y and 30y auctions. In addition, expect unchanged 5y TIPS new issue and 30y TIPS reopening (at $23bn and $8bn, respectively), and a $1bn increase to the 10y TIPS reopening (to $17bn) to commensurate with the increase in the 10y TIPS new issue auctioned this month.”

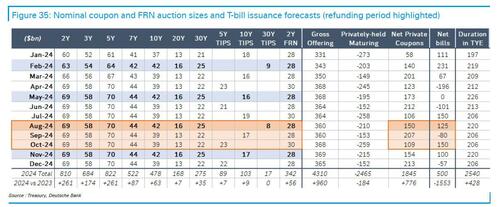

Well, that’s precisely what the Treasury revealed at 8:30am this morning, when it published its latest Quarterly Refunding Announcement (the funding needs were already reported on Monday when the Treasury revealed a debt issuance schedule in line with expectations) in which it reported that, as expected, the quarterly refunding would be $125 billion, with issuance raising $14 billion in new cash from private investors, as follows:

- $58 billion in 3-year notes

- $42 billion in 10-year notes

- $25 billion in 30-year bonds

Some rates strategist had cautioned of risk that the Treasury would revise its guidance to incorporate the potential for increasing issuance of longer-dated securities, given the outsize federal budget deficit. But the department reiterated its May language, preventing another bond market rout similar to the one seen exactly one year ago when Janet Yellen shocked the market with a big surge in bond issuance.

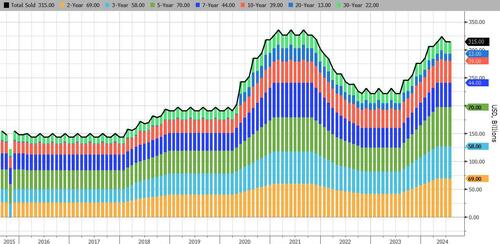

The refunding total is just shy of the record $126BN first reached in Feb. 2021; auction sizes across the curve began rising in 2018 to finance tax cuts and surged in 2020 to finance federal pandemic response

The Treasury confirmed expectations that the balance of Treasury financing requirements over the quarter will be met with regular weekly bill auctions, cash management bills (CMBs), and monthly note, bond, Treasury Inflation-Protected Securities (TIPS), and 2-year Floating Rate Note (FRN) auctions.

It also said that “its current auction sizes leave it well positioned to address potential changes to the fiscal outlook and to the pace and duration of future SOMA redemptions.” More improtantly, the Treasury forecast that “based on current projected borrowing needs, Treasury does not anticipate needing to increase nominal coupon or FRN auction sizes for at least the next several quarters.“

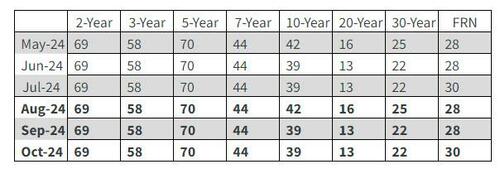

The table below presents, in billions of dollars, the actual auction sizes for the May to July 2024 quarter and the anticipated auction sizes for the August to October 2024 quarter:

Many dealers have said in recent weeks that the Treasury will have to bump note and bond sales higher again given the fiscal outlook as the US continues to run its largest federal deficit outside of crisis times, a deficit which will only get much larger regardless of who the next US president is. Marketable Treasury debt outstanding has already grown to $27 trillion from about $12 trillion a decade ago; and total US debt just hit $35 trillion on Monday.

Aside from Notes and Bonds, the treasury said it plans to address “any seasonal or unexpected variations in borrowing needs over the next quarter through changes in regular bill auction sizes and/or CMBs.”

The Treasury said that “given current fiscal forecasts” it plans to “modestly increase the offering size of short-dated bills being sold next week,” maintaining those sizes through August. It then expects to reduce offering sizes in early to mid-September in anticipation of the Sept. 15 non-withheld corporate tax date, and to subsequently increase all auction sizes over the course of October, based on expected fiscal outflows

The department will also continue with weekly issuance of the six-week CMB while it makes “necessary operational and systems changes in order to smoothly transition” issue to benchmark status. Timing of first benchmark auction will be provided at an upcoming refunding.

Sales of floating-rate debt were also kept unchanged for the coming three months, the Treasury said. With regard to Treasury Inflation Protected Securities, or TIPS, the department lifted the size of the October 5-year TIPS auction — the only new issue during the quarter — by $1 billion. It also boosted the September 10-year TIPS reopening by $1 billion.

The supply of bills has increased by around $2.2 trillion since the start of last year, enabling the rapid drain of the Fed’s reverse repo facility. That left their share of total debt above the 15%-to-20% range that TBAC previously recommended, before Wednesday’s new guidance, which suggests the uptrend will resume.

Treasury officials have repeatedly said this isn’t a problem and highlighted that TBAC in the past indicated there was flexibility around that recommendation. In Wednesday’s statement, TBAC doubled down on that argument: “the committee unanimously noted the importance for Treasury to retain flexibility to adapt this over time with evolving market dynamics.”

To that end, Treasury officials asked the TBAC, or Treasury Borrowing Advisory Committee (which we have dubbed previously as the shadowy group that runs the world) to take another look at the recommended share of bills, which the TBAC had previously recommended a 15% to 20% range.

“Most” TBAC members this time indicated that averaging around 20% over time was a good tradeoff between interest-rate costs, volatility in financing and the risk of rolling over a major amount of debt at one time, the panel said in a separate report.

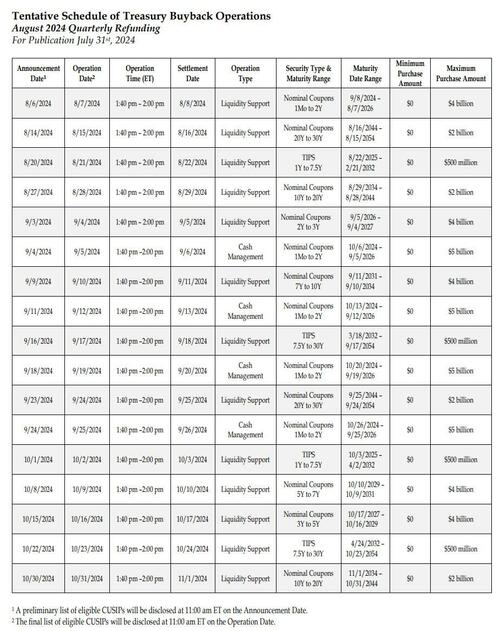

Just as notable, especially to those who keep track of the Treasury’s own recently launched “Not QE“, i.e., treasury buybacks, today the Treasury released a buyback schedule for the upcoming refunding quarter and updating its buyback FAQs. As the schedule indicates, Treasury plans to conduct weekly liquidity support buybacks of up to $4 billion per operation in nominal coupon securities. In longer-maturity buckets, Treasury will conduct two operations, each up to $2 billion, over the refunding quarter. Treasury also plans to conduct two operations, each up to $500 million, in each of the TIPS buckets.

Starting in August 2024, Treasury is removing the 20 CUSIP cap on eligible securities for each operation and will move towards operation sizes consistent with its previous guidance – i.e., a maximum of $30 billion per quarter across buckets for liquidity support, up from $15 billion previously. Indeed, while once upon a time the Fed’s POMO schedule served to goose the market on QE action days, so the Treasury’s bond buyback schedule will soon fill that void, at least until the Fed restarts full-blown QE.

With the Fed recently reducing the amount of Treasuries it’s letting mature each month without replacement, that has in turn eased the burden on the Treasury to sell more debt to the public to fund the fiscal deficit.

Later Wednesday, the Fed is widely expected to signal it will start lowering interest rates, offering further relief for the Treasury by reducing the government’s debt-servicing bill. The pace of so-called quantitative tightening — the amount the central bank is shrinking its balance sheet, is seen staying at the current amount of up to $25 billion a month for Treasuries.

Tyler Durden

Wed, 07/31/2024 – 09:02

via ZeroHedge News https://ift.tt/gWN52ia Tyler Durden