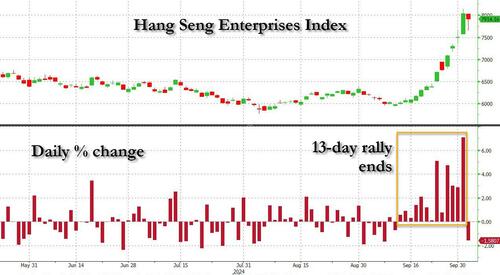

Futures Drop As Record Hong Kong 13-Day Rally Finally Ends

US stock futures are lower, but off session lows, in line with declines seen across Europe and Asia, while yields, the dollar and oil rise as the risk of escalating conflict in the Middle East damps risk appetite. As of 8:00am ET, S&P futures are down 0.1% after closing up 0.01% on Wednesday; Nasdaq futures slide 0.3% with MegaCap Tech mixed: NVDA is up +0.7%, while TSLA extends yesterday selloff and is down -1.6% pre-market. Bloomberg’s dollar index gained for a fourth day, bolstered by a rise in Treasury yields; market snapshot: RTY -70bps // UST10yr +2.5bps @ 3.80bps // WTI +2% @ $71.50 // Bitcoin unch @ $60,900 as global equities trade mixed with escalating geopolitical tensions/ the awaiting of the size/scale Israel’s response to Iran weighs on markets, which has pushed oil prices up another 1.9% this morning; elsewhere in commodities base metals are also higher, while precious metals and ags are lower: Jobless claims, factory orders and the ISM services reading (est 51.7, Last 51.5) are all on the slate as traders prepare for Friday’s jobs report, while the Federal Reserve’s Jeff Schmid, Neel Kashkari and Raphael Bostic are all scheduled to speak.

In premarket trading, Levi Strauss shares plunged 11% after the apparel company lowered its revenue growth outlook for the full year. Here are some other premarket movers:

- EVgo (EVGO) rises 12% after JPMorgan upgraded the EV charging firm on the view that companies like EVgo, which have an owner-operator model, will outperform peers.

- Hims & Hers Health (HIMS) drops 9% as the FDA said Eli Lilly’s weight-loss drugs are no longer considered to be in shortage in the US, a ruling that threatens to upend knockoffs that became popular when patients couldn’t find the brand-name medicines. Hims has been selling compounded semaglutide to treat obesity.

- Wolfspeed (WOLF) declines 5% as Mizuho cut its recommendation of the semiconductor device company to underperform, noting slower global EV sales in second half and next year.

Global equities are on course for their first weekly loss in four as the world awaits Israel’s response to a missile strike by Iran. Israel’s warplanes bombed Beirut overnight, after eight of its soldiers were killed in southern Lebanon in battles against Hezbollah. Amid the geopolitical uncertainty, investors are also bracing for a raft of US data, including jobless claims today, for signals on the health of the economy. In other news, Warren Buffet’s sales of Bank of America shares slowed, fetching some of the lowest prices since he began a spree of liquidations in mid-July. Meanwhile, OpenAI has raised $6.6 billion in a new funding round that gave the company a valuation of almost $160 billion

International conflict has returned as a driver for markets, which have lately been directed mainly by the US economic cycle, said Michael Metcalfe, head of macro strategy at State Street Global Markets. “There might be a pressure to rebalance, because markets are stretched and I don’t see that as being particularly positive for US equities,” he said.

Richmond Fed President Tom Barkin on Wednesday noted progress on inflation and added the labor market is in “good shape,” but cautioned it’s too early for the central bank to declare victory. Stronger-than-expected ADP jobs data on Wednesday led traders to pare bets on aggressive Fed rate cuts. Swaps traders were penciling in some 34 basis points of policy easing at the central bank’s November meeting, down from 44 basis points just last week.

Fed officials will see fresh labor market data Friday. The unemployment rate is forecast to hold steady at 4.2% in September while payrolls are expected to rise by 150,000.

“I am of course nervous heading into tomorrow’s jobs report,” Kallum Pickering, chief economist at Peel Hunt, said on Bloomberg TV. “If the unemployment rate ticks up, I wouldn’t be surprised that markets would shift back toward expecting 50 basis points and then it is a question of how the Fed may react.”

European stocks fall for the third time in four sessions with the Stoxx 600 down 0.9%. Auto, mining and construction shares are underperforming in Europe; utilities was the only sector in the green. The Stoxx 600’s automotive subindex was the biggest underperformer, weighed down by a number of bearish cuts in the sector from Barclays. France’s CAC 40 stock benchmark underperformed, falling as much as 1%, after French President Emmanuel Macron endorsed a temporary tax on the country’s largest companies. German software maker SAP SE dropped after US prosecutors broadened a probe of potential price-fixing. Stellantis NV shares were down more than 3% after the company slashed vehicle production in its key Italian market. Here are the biggest movers Thursday:

- Stora Enso gains as much as 6.0% after the Finnish paper and forest products firm said it will sell about 12% of its total forest assets in Sweden to strengthen its balance sheet and reduce debt

- Tesco shares rise as much as 2.6%, bouncing off a one-month low, after the UK’s largest supermarket chain raised its full-year profit outlook alongside first-half results

- Voltalia shares rise as much as 4.4% after Stifel initiated coverage of the French renewable-energy producer with a recommendation of buy, citing a fast growing market

- Stellantis falls as much as 4.9% and Porsche Automobil Holding as much as 3.2% after the stocks were downgraded alongside Mercedes-Benz at Barclays in a review of European carmakers

- FDJ shares slide as much as 5.9% after CIC Market Solutions analysts downgrade the lottery operator to neutral from buy, citing the potential for incoming tax rises on gambling in France

- Bouygues shares drop as much as 6.1%, the most since November 2022, after the French company said its telecoms business will launch a new brand and product range targeting families

- VP plunges as much as 12% after the equipment rental firm’s profit guidance for the year came in below expectations. Analysts at Peel Hunt warned they expect the stock to remain under pressure

Asian stocks also fell as Hong Kong shares took a breather after a record rally fueled by Beijing’s stimulus blitz. Japanese equities rose boosted by the plunge in the yen. The MSCI Asia Pacific Index dropped as much as 0.9%, weighed down by Chinese tech shares including Alibaba and Tencent. A gauge of Chinese stocks in Hong Kong fell 1.6%, snapping its 13-day winning streak.

While there’s growing optimism that the current rally may be different from previous short-lived rebounds, some skepticism remains over the effectiveness of the government’s stimulus measures. The mainland Chinese market is closed through Oct. 7 for the Golden Week holiday.

“The stimulus momentum has stalled with China away on holiday,” said Charu Chanana, global markets strategist at Saxo Markets. “While undervaluation has helped, markets still remain uncertain about the impact of the announcements to address China’s structural headwinds.”

In FX, the pound tumbled over 1% against the dollar, on course for its worst day against the euro since 2022 after the Guardian reported Bank of England Governor Andrew Bailey saying the central bank could be a “bit more aggressive” with interest-rate cuts. Money markets fully priced in a quarter-point cut by the BOE in November and assigned a 70% probability to a reduction in December, an increase from about 40% Wednesday. The Bloomberg Dollar Spot Index rises 0.3%. The yen falls 0.4% to near 147 as PM Ishiba’s unexpected warning against raising rates is pushing back bets of another hike this year.

In rates, treasuries are under modest pressure as the US trading day begins, amid steeper declines for most euro-zone bond markets and rising oil prices. US yields are higher by 2bp-3bp, with intermediate sectors leading losses and curve spreads narrowly mixed; 10-year at 3.81% is about 2.7bp higher on the day vs increases of at least 5bp for most euro-zone 10-year yields. UK bonds outperform led by the short-end after BOE Governor hinted at more aggressive rate cuts; UK two-year yields dropping 5 bps to 3.96%. US session includes weekly jobless claims and September ISM services index (factory index released Tuesday showed notable weakness in employment and prices paid).

In commodities, oil prices rise for a third day as traders await Israel’s response against Iran. Brent crude climbed near $75 a barrel, on course for the longest run of daily gains since August, while West Texas Intermediate was above $71. Investors are concerned that, should Israel strike key Iranian assets, the Islamic Republic will lash out and escalate their conflict, dragging in more countries and potentially disrupting global energy shipments. Spot gold falls $13 to around $2,645/oz.

Looking at today’s calendar, US economic data calendar includes September Challenger job cuts (7:30am), weekly jobless claims (8:30am), September final S&P Global US services PMI (9:45am), August factory orders and September ISM services index (10am). Fed speakers scheduled include Kansas City’s Schmid (10am) and Minneapolis’s Kashkari and Atlanta’s Bostic (together at 10:40am)

Market Snapshot

- S&P 500 futures down 0.4% to 5,735.75

- STOXX Europe 600 down 0.9% to 516.57

- MXAP down 0.5% to 194.77

- MXAPJ down 1.2% to 622.17

- Nikkei up 2.0% to 38,552.06

- Topix up 1.2% to 2,683.71

- Hang Seng Index down 1.5% to 22,113.51

- Shanghai Composite up 8.1% to 3,336.50

- Sensex down 2.1% to 82,503.93

- Australia S&P/ASX 200 little changed at 8,205.19

- Kospi down 1.2% to 2,561.69

- German 10Y yield little changed at 2.14%

- Euro little changed at $1.1045

- Brent Futures up 1.1% to $74.73/bbl

- Gold spot down 0.6% to $2,644.02

- US Dollar Index up 0.15% to 101.83

Top Overnight News

- A leading economist in China said the country has room to ramp up fiscal support for the economy by issuing as much as 10 trillion yuan ($1.4 trillion) in special debt, reflecting rising expectations for Beijing to expand public spending as part of its stimulus package: BBG

- BOJ board member Asahi Noguchi sees a need for the central bank to maintain an accommodative monetary policy stance given Japan’s long history of deflation, he said Thursday, echoing remarks from the country’s new prime minister. WSJ

- Softbank’s Son says artificial general intelligence will be achieved within 2-3 years, with artificial super intelligence occurring within 10 years. WSJ

- The pound tumbled after Governor Andrew Bailey told the Guardian that the BOE may become a “bit more aggressive” in cutting rates if news on inflation remains good. Money markets fully priced a quarter-point reduction in November and assigned a 70% chance of a consecutive move in December, up from about 40% yesterday. BBG

- Swiss inflation weakened to the slowest pace in more than three years, pointing to further monetary easing by the country’s central bank. Consumer prices rose 0.8% from a year ago in September, Switzerland’s statistics office said Thursday. That’s much lower than the 1% median estimate in a Bloomberg survey and compares with 1.1% in August. BBG

- France, Greece, Italy and Poland will vote on Friday in favor of tariffs of up to 45% on imports of electric vehicles (EVs) made in China, sources said, enough to push through the European Union’s highest profile trade measures, risking potential retaliation from Beijing. RTRS

- OPEC has enough spare oil capacity to compensate for a full loss of Iranian supply if Israel knocks out that country’s facilities but the producer group would struggle if Iran retaliates by hitting installations of its Gulf neighbors. RTRS

- Iran would require not weeks but many months, and possibly as long as a year, to construct a nuclear weapon. NYT

- After Israel invaded Lebanon to confront Iran’s strongest ally, Hezbollah, and Iran’s second massive missile attack on Israel in less than six months, Israel seems ready to strike Iran directly, in a much more forceful and public way than it ever has, and Iran has warned of massive retaliation if it does. NYT

- Israel’s warplanes bombed Beirut overnight, after eight of its soldiers were killed in southern Lebanon in ongoing ground battles against Hezbollah: RTRS

- Long lines of container ships queued up outside major U.S. ports on Thursday as the biggest dockworker strike in nearly half a century entered its third day preventing unloading and threatening shortages of everything from bananas to auto parts. No negotiations were scheduled between the International Longshoremen’s Association and employers, but the port owners, under pressure from the White House to hike their pay offer to land a deal, signaled late on Wednesday they were open to new talks. RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed amid the backdrop of several holiday closures and ongoing geopolitical tensions, while Hong Kong participants booked profits. ASX 200 lacked direction alongside varied data releases including downward PMI revisions and mixed trade figures. Nikkei 225 outperformed on the back of a weaker currency after yesterday’s dovish-leaning remarks from Japanese PM Ishiba who said they are not in an environment for an additional rate hike following a meeting with BoJ Governor Ueda, while Ueda said the BoJ will adjust the degree of monetary easing if the outlook is realised, but will take careful steps to determine that as it takes time. Hang Seng suffered heavy losses amid profit taking and in a possible sign that the China stimulus euphoria has finally worn out.

Top Asian News

- BoJ Board Member Noguchi said they must patiently maintain loose monetary conditions and it will take a considerable time for the public to shift to a mindset where inflation can sustainably hit 2%, while he believes the consumption uptrend is likely to become clearer and noted the cost pressure from wage hikes is gradually being reflected in service price rises. Furthermore, he said the BoJ will likely gradually adjust the degree of monetary support while cautiously examining whether inflation stably hits 2%, accompanied by wage gains, as well as noted that the BoJ can spend time and move cautiously, in reducing its balance sheet. Does not comment of PM Ishiba’s remarks on monetary policy; expects BoJ to adjust degree of monetary policy if economy moves in line with forecast, even at a very slow pace. “personally feel we need to proceed very carefully in adjusting degree of monetary support”. “Need to scrutinise whether consumers’ sentiment will shift to one where they can swallow price hikes.”. “As Governor Ueda has said, we have time to scrutinise economic developments, before contemplating rate hike.”. “The current financial environment is sufficiently easy.” “Japan’s economy can withstand if the JPY becomes stronger gradually.”. “Will not deny there is room to adjust the degree of monetary support further.”. “Given it is hard to come up with a concrete estimate on the neutral rate, the BoJ must check the impact of the past rate hike before carefully proceeding with the next one.”. “The one-sided, sharp JPY fall seen in July has subsided.”. “The upside inflation risk from a weak JPY has subsided.”

- Japanese PM Kishida is to direct a compilation of economic package on Friday, according to Kyodo.

- Japan’s Finance Minister Kato has affirmed the government, BoJ will continue to coordinate closely; also said he wants to watch the FX market with a sense of urgency including speculative moves. “We will communicate thoroughly with markets”. Will aim to exit deflation soon, working closely with BoJ.

- Japan’s Economy Minister Akazawa said in broad terms, policy rate of 0.25% is an accommodative state. “We are moving towards monetary policy normalisation but existing deflation is a top priority”. “We must not cool down the economy”.

European bourses, Stoxx 600 (-0.7%), opened modestly in negative territory and continued to edge lower as the morning progressed, with indices now generally just off lows. The FTSE 100 (+0.2%) remains in positive territory after BoE Governor Bailey’s dovishly-received comments. European sectors are negative across the board with Energy also turning red following a positive open. There is no clear theme or bias across European sectors. Autos and Parts once again lag. Basic Resources also resides as one of the losers amid the pullback in base metal prices. US Equity Futures (ES -0.4%, NQ -0.5%, RTY -0.7%) are softer across the board amid the broader risk-averse mood despite the lack of any fresh drivers during the session, but ahead of risk events including the weekly jobless claims and ISM Services PMI ahead of tomorrow’s US jobs report. Barclays has upgraded the EU Autos & Parts sector to neutral from negative

Top European News

- BoE Governor Bailey said the bank could be a “bit more aggressive” in cutting rates provided the news that inflation continues to be good, in an interview with The Guardian.

- UK PM Starmer conceded during his first visit to Brussels that his “reset” with the EU won’t be easy, according to AFP.

- Riksbank’s Jansson said the bank is not too worried about a consumption driven uptick in inflation as a result of rate cuts. Need to see an economic recovery if inflation is not undershoot. Would be good for the economy if fundamental factors were reflected in the value of the crown.

- BoE Monthly Decision Maker Panel data (September 2024). Expectations for CPI inflation a year ahead declined by 0.1 percentage point to 2.6% in the three months to September. The corresponding measure for three-year ahead CPI inflation expectations was also 2.6% in the three months to September, and 0.1 percentage points lower than in the three months to August. Expected year-ahead wage growth remained unchanged at 4.1% on a three-month moving-average basis in September.

FX

- USD is broadly stronger vs. peers with DXY up for a fourth consecutive session in a week that has been characterised by geopolitical tensions and comments from Fed Chair Powell guiding markets towards a step down to a 25bps rate cut next month. DXY is currently eyeing the 102.00 mark, and may take impetus from today’s US busy data docket, with ISM Services likely the highlight.

- EUR is softer vs. the USD but to a lesser extent than most peers. ECB officials seemingly endorsing a rate cut later this month has definitely acted as a drag on the pair, with attention now on if the pair can hold above the 1.10 mark.

- GBP is the standout laggard across the majors following dovishly-received comments from BoE Governor Bailey; he said in an interview with The Guardian, the bank could be a “bit more aggressive” in cutting rates provided the news that inflation continues to be good.

- JPY is softer vs. the USD after breaching the September peak for USD/JPY at 147.21 overnight. As a reminder, on Wednesday, PM Ishiba downplayed the likelihood of another immediate BoJ rate hike. USD/JPY currently stands at around 146.83.

- Both antipodes are struggling vs. the broadly firmer USD. After an indecisive session yesterday, AUD/USD has extended its move lower on a 0.68 handle.

Fixed Income

- USTs are extending on yesterday’s downside that was triggered in part by Wednesday’s strong ADP release in the run-up to Friday’s NFP print. Today’s US data docket is a busy one with ISM Services PMI the likely highlight. US 10yr yield is currently just above the 3.8% mark but below Wednesday’s 3.817% peak.

- Bunds are lower in an extension of Wednesday’s US-led price action, but it remains to be seen how long the downside can continue given the increasingly dovish tones seen out of the ECB with comments from hawk Schnabel helping to cement expectations of an increasingly dovish ECB. The German 10yr yield is back above the 2.1% after delving as low as 2.01% earlier in the week.

- Gilts the standout outlier across the fixed income space on account of dovish comments from BoE Governor Bailey who said the bank could be a “bit more aggressive” in cutting rates provided the news that inflation continues to be “good”. The UK 10yr yield is currently holding just above the 4% mark.

- Spain sells EUR 4.54bln vs exp. EUR 4-5bln 2.50% 2027, 1.45% 2029 and 4.70% 2041 Bono and EUR 0.512bln vs exp. EUR 0.25-0.75bln 2.05% 2039 I/L.

- France sells EUR 11.98bln vs exp. EUR 10-12bln 1.25% 2034, 3.00% 2034, 3.00% 2049, and 3.25% 2055 OAT.

Commodities

- Crude is firmer intraday in a continuation of the upside seen since the recent geopolitical escalation. Updates from the region has been light thus far, as markets still await Israel’s response which will reportedly be “harsh”. Brent Dec briefly rose above USD 75/bbl to trade in a current USD 74.46-75.11/bbl parameter.

- Softer trade across precious metals as the firmer Dollar and lack of fresh geopolitical escalations (as we await Israel’s response) allow traders to book some profits before scheduled risk events such as the US jobless claims and ISM Services PMIs.

- Base metals are softer across the board against the backdrop of a risk-averse mood across the market. Newsflow has been light this morning but the angst surrounding a wider geopolitical escalation in the Middle East remains. As a reminder, Chinese markets were closed overnight as they observe their Golden Week Holiday.

- Kinder Morgan (KMI) reports a mechanical failure on gasoline pipeline repaired at Sacramento County, California; pipeline is shutdown, personnel is on route to the site to get eyes on assessment.

- Kazakhstan’s 400k BPD Kashagan repairs reportedly postponed, now due to start on Oct 7th, according to Ifax.

Geopolitics

- IDF orders another 25 villages evacuated in southern Lebanon, according to ELINT News

- “An Israeli infantry group and vehicles retreat beyond the Blue Line after infiltrating towards the town of Maroun al-Ras”, according to Al Jazeera

- “Private sources for Sky News Arabia: A positive atmosphere prevailed in the meeting in Doha between Abbas and Hamas leaders”, according to Sky News Arabia.

- Israeli Military said it assassinated head of Hamas government Rawhi Mushtaha in Gaza strip.

- Hezbollah said it confronted an attempt by Israeli forces to advance at Lebanese border’s Fatima Gate.

- “US sources say Washington is ready to sell F-15s to Ankara”, according to journalist Soylu; “Sources say if Turkey finally returns to F-35 program, Ankara might be involved in production line”, “Turkey’s F-16 deal is still being finalised”.

- Pro-Iranian factions target an international coalition base in north-eastern Syria, via Sky News Arabia.

- Israel conducted raids on 3 sites in the neighbourhoods of Mouawad, Al-Amrikan and Zaghloul in Beirut. It was also reported that an Israeli strike hit central Beirut, while a building targeted by the Israeli raid in Bachoura reportedly housed the office of Beirut’s Hezbollah deputy Amin Sherri.

- Israeli army called on residents of several buildings in Haret Hreik, Burj al-Barajneh and Hadath West in the southern suburbs of Beirut to evacuate and a Sky News Arabia correspondent reported a new series of Israeli raids targeting the suburbs of Beirut.

- Israeli Home Front announced sirens sounded in several areas of the Golan and that sirens sounded in Shlomi in the western Galilee in northern Israel. Furthermore, Israeli media reported that 4 marches launched from Yemen exploded at a low altitude in the airspace of Tel Aviv, according to Asharq News.

- Clashes were reported between Hezbollah and Israeli soldiers on the outskirts of Aitaroun, southern Lebanon, according to an Al-Arabiya correspondent.

- Israeli press cited an official who stated that the response to Iran may include more than one option and not necessarily through airstrikes. The official added it is not certain that Washington will agree with them but it knows that they have to respond, while they should not go too far in our response although it will be much stronger than the response to the April attack.

- Israeli official cited by Yedioth Ahronoth said there are no limits to the response to Iran, according to Al Arabiya.

- Iran’s President vowed a stronger response if Israel retaliates.

US Event Calendar

- 07:30: Sept. Challenger Job Cuts 53.4% YoY, prior 1.0%

- 08:30: Sept. Initial Jobless Claims, est. 221,000, prior 218,000

- Sept. Continuing Claims, est. 1.83m, prior 1.83m

- 09:45: Sept. S&P Global US Services PMI, est. 55.4, prior 55.4

- Sept. S&P Global US Composite PMI, est. 54.4, prior 54.4

- 10:00: Aug. Durable Goods Orders, est. 0%, prior 0%

- Aug. Durables-Less Transportation, est. 0.5%, prior 0.5%

- 10:00: Aug. Factory Orders, est. 0.1%, prior 5.0%

- Aug. Factory Orders Ex Trans, est. 0.2%, prior 0.4%

- Aug. Cap Goods Ship Nondef Ex Air, prior 0.1%

- Aug. Cap Goods Orders Nondef Ex Air, est. 0.2%, prior 0.2%

- 10:00: Sept. ISM Services Index, est. 51.7, prior 51.5

DB’s Jim Reid concludes the overnight wrap

Morning from Amsterdam after a day in The Hague yesterday. Markets remained on edge over the last 24 hours, but better US jobs data than the previous day took the edge off fears of a potential escalation in the Middle East following Iran’s strikes on Tuesday. So far we haven’t seen any fresh escalation since those strikes, but Israeli PM Netanyahu has said they intend to retaliate, warning that Iran “will pay” for its actions. So the big fear is there could be a further ratcheting up of hostilities if you get repeated rounds of retaliation from each side, raising the risks of a broader regional conflict. However late in the day, we heard US President Biden urging Israel to not to attack Iran’s nuclear facilities. So there doesn’t seem to be a desire from the US at the moment for a sizeable escalation.

In terms of the market reaction, that’s already led to a further rise in oil prices, and early in yesterday’s session Brent crude had been on track for its biggest 2-day gain of 2024 so far. Those gains (+3.5% to above $76/bbl at the highs) were mostly pared back into the afternoon, but it rose slightly again late on and is a further +1.03% higher this morning at $74.66/bbl as I type.

Whilst investors awaited any geopolitical news, the other main story yesterday was a substantial bond selloff. That was primarily driven by the ADP’s latest report of private payrolls from the US, which came in at +143k in September (vs. +125k expected). So that was an important sign of strength in the US labour market, particularly ahead of tomorrow’s all-important jobs report, and it also ended a run of 5 consecutive months where the ADP reading had kept slowing down.

The stronger numbers in the ADP report led investors to dial back the chance of aggressive rate cuts over the coming months. For instance, the amount of cuts priced by December 2025 was down -4.4bps on the day to 188bps. This came also amid somewhat cautious comments from Fed’s Barkin, who noted that while progress has been made, “It remains difficult to say that the inflation battle has yet been won”. This backdrop helped to spark a decent selloff for US Treasuries, with the 10yr yield ending the day up +5.1bps at 3.78%.

Those moves were evident in Europe as well, where yields on 10yr bunds (+5.5bps) moved back up to 2.09%, having closed at their lowest level since January in the previous session. That went alongside a fresh round of curve steepening, as investors became increasingly confident that the ECB would cut rates again in a couple of weeks’ time, with overnight index swaps giving that a 96% probability by the close. ECB commentary did little to dissuade October rate cut expectations. Later on in the day, we heard from Schnabel, one of the most prominent hawkish ECB voices in recent years, who said that “we cannot ignore the headwinds to growth” and that “a sustainable fall of inflation back to our 2% target in a timely manner is becoming more likely, despite still elevated services inflation and strong wage growth”. Elsewhere in European rates, there was a slight tightening in the Franco-German 10yr spread, which came down by -1.0bps to 77bps.

Whilst bonds were selling off, for equities it was a pretty subdued session as geopolitical fears came up against the stronger-than-expected data, meaning that the major indices saw little change overall even if sentiment improved as the US session progressed. The S&P 500 (+0.01%) was essentially flat on the day, despite a drag from the Magnificent 7 (-0.66%). The latter came amid a -3.49% decline for Tesla, which posted slower than expected quarterly vehicle sales. More broadly, both the NASDAQ (+0.08%) and the small cap Russell 2000 (-0.09%) saw muted moves. In Europe, the STOXX 600 (+0.05%) was also little changed, with a decline for the DAX (-0.25%) but slight gains for the CAC (+0.05%) and FTSE 100 (+0.17%).

Over in Asia, yesterday brought a clear weakening in the Japanese Yen after new PM Shigeru Ishiba said that “I don’t think the environment is ready for an additional rate hike”. So among investors, that led to a bit more scepticism about the chances of another BoJ hike anytime soon, and it meant that the yen weakened by -1.97% against the US Dollar yesterday and is down another quarter percent this morning. But the weaker yen has also led to a sharp surge in the Nikkei overnight (+2.18%).

In contrast, the Hang Seng is down by -3.20% this morning as the rally from China’s stimulus has finally abated for now, while the S&P/ASX 200 is just below flat, down by -0.08%. Meanwhile, markets in Mainland China and South Korea are closed for holidays. S&P 500 (-0.18%) and NASDAQ (-0.30%) futures are lower even as Nvidia’s CEO has said the demand for their Blackwell chip is “insane”. They were up around +1.6% after hours.

Early morning data showed that Japan’s service sector activity expanded for the third consecutive month, although the pace slowed slightly in September. The final estimate of the au Jibun Bank services PMI fell to 53.1 in September from 53.7 in August. Additionally, Australia’s trade surplus was A$5.64 billion in August, slightly above the expected A$5.50 billion, compared to a downwardly revised A$5.63 billion surplus the previous month.

There wasn’t too much other data yesterday, but we did get the latest weekly data from the Mortgage Bankers Association in the US. That showed the average rate on a 30yr fixed mortgage ticked up to 6.14% in the week ending September 27, up from 6.13% in the previous week, which is significant as that ends a run of continuous weekly declines in mortgages rates throughout August and early September. Over in the Euro Area, we also found out that the unemployment rate remained at 6.4% in August, in line with expectations, and still its joint-lowest since the single currency’s formation.

To the day ahead now, and data releases from the US include the ISM services for September, the weekly initial jobless claims, and August’s factory orders. We’ll also get the final services and composite PMIs from around the world, and Euro Area PPI inflation for August. From central banks, we’ll hear from the Fed’s Schmid, Kashkari and Bostic.

Tyler Durden

Thu, 10/03/2024 – 08:19

via ZeroHedge News https://ift.tt/AyNV49o Tyler Durden