Spirit Shares Crash After WSJ Says Airline Exploring Bankruptcy Filing

Who could have seen this coming?

Game over

Spirit Airlines Explores Bankruptcy Filing: WSJ https://t.co/TCpVkPFbVX

— zerohedge (@zerohedge) October 3, 2024

Shares of Spirit Airlines crashed in premarket trading in New York after a Wall Street Journal report revealed that the struggling airline has been in discussions with bondholders about the possibility of filing for bankruptcy following the collapse of its merger with JetBlue Airways.

The WSJ report was published late Thursday evening.

Here’s more color:

The budget carrier has also been exploring restructuring its balance sheet through an out-of-court transaction, though recent talks have been more focused on reaching an agreement with bondholders and other creditors to support a chapter 11 filing, the people said. The timing of such a filing, should it happen, wouldn’t be imminent, they said.

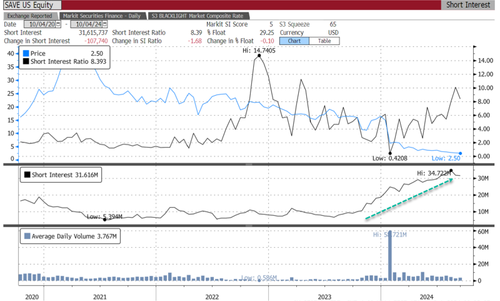

Shares in the premarket are around $1.54, down a little more than 31%. Earlier shares tanked as much as 42%. These levels are a record low for Spirit in its 13 years of trading on the public markets.

The latest Bloomberg data shows 31.6 million shares are short, equivalent to about 29.25% of the float.

WSJ said Spirit is in dire financial straits:

Spirit has been struggling with losses and declining revenue as it aims to address coming maturities within its $3.3 billion debt load, including more than $1.1 billion of secured bonds that are due in less than a year. Spirit also faces a deadline from its credit-card processor to refinance or extend those notes by Oct. 21.

The potential bankruptcy filing comes after Spirit’s failed merger with JetBlue Airways earlier this year. Biden’s DoJ struck down the deal because it would have reduced competition.

In August, Spirit Chief Executive Ted Christie told analysts that the airline was speaking with bondholders to address the maturities: “Because those conversations are ongoing, we are not going to go into detail or take any questions on this topic or speculate on potential outcomes. Needless to say, it is a priority and we are focused on securing the best outcome for the business as quickly as possible.”

Tyler Durden

Fri, 10/04/2024 – 09:00

via ZeroHedge News https://ift.tt/WxXugLQ Tyler Durden