US Futures Slide As Yields Rise Back Over 4%, Curve Reinverts, Oil Surges

US equity futures are lower as the selling in Treasuries accelerates after strong US jobs data slashed bets on a big interest-rate reduction next month from the Federal Reserve and an overnight surge in oil pushed Brent to $80 (see last night’s “A Historic Short Squeeze In Oil Has Only Begun“), which sent both the 2Y and 10Y above 4.00%. As of 8:00am ET, S&P futures are down 0.4% after closing just shy of an all-time high on Friday when the spike in yields failed to dent bullish sentiment, while Nasdaq futures drop 0.6% as most Mag 7s are lower; AMZN -1.9%, AAPL -1.4% and NVDA -1.2%. In rates, the entire curve is blowing out wider, with 2-, 5-, 10- and 30y yields up by 7bp, 6bp, 4bp and 2bp, respectively as swaps markets now price in less than a quarter-point rate cut next month, having expected a 50 basis-point move until recently. Oil has added another +2.3% amid growing fears of imminent Iran escalation with Israel launching a new offensive in Northern Gaza over the weekend; base metals are higher, while ags are lower. This week, the key macro focus will be CPI on Thursday and 12 Fed speakers throughout the week. We will have a number of Tech catalysts, including: NVDA’s AI Summit (Monday through Wednesday), AMZN’s Prime Day starting Tuesday, AMD’s Advancing AI event on Thursday, and TSLA’s Robotaxi unveil on Thursday. Q3 earnings will kick off with banks on Friday.

In premarket trading, Pfizer climbed more than 2% after Bloomberg reported activist investor Starboard Value had taken a stake of about $1 billion in the firm. Arcadium Lithium Plc. leapt 29% on news Rio Tinto Plc had made a non-binding takeover approach. Here are some other notable premarket movers:

- Air Products rises 6% after the Wall Street Journal reported activist investor Mantle Ridge has a more than $1 billion stake in the company, citing people familiar with the matter.

- Amazon.com slips 1.9% as Wells Fargo steps away from its bullish rating.

- Arcadium soars 29% after Rio Tinto made an approach for the lithium producer.

- Casino stocks are moving higher after Wynn Resorts received a commercial gaming operator’s license in the United Arab Emirates. Wynn (WYNN) +2%, Las Vegas Sands (LVS) +3%

- Garmin declines 3% as Morgan Stanley downgrades the stock to underweight, flagging concerns about product launch timing and market headwinds.

- Heidelberg Materials AG benefited from a report that the Adani Group has started talks to buy the company’s Indian cement operations, and luxury-goods firm Richemont rose after an announcement it would sell the online retailer YNAP to Mytheresa.

The drop in rate cut expectations will likely to weigh on equity markets, which have rallied to record highs recently amid signs of a robust US economy, easing inflation and big rate cuts. In addition, crude oil prices pushed higher to approach $80 a barrel, as investors await Israel’s response to the recent Iranian missile strike. Marija Veitmane, head of equity strategy at State Street Global Markets, said she still remains constructive on the equity outlook as economies remain resilient and inflation is easing. However, “we have to be a bit careful in terms of drivers, as we will probably not get a lot of big aggressive rate cuts,” Veitmane said on Bloomberg TV.

Investors are now looking ahead to the US inflation data due Thursday, with economists surveyed by Bloomberg expecting year-on-year price growth at 2.3%, a slight slowdown from the previous reading. The earnings season also kicks off this week with reports from big US banks. Earnings growth is seen robust though it’s expected to slow from the second quarter.

European stocks also edged lower as bond yields rose across the continent. The Stoxx 600 falls 0.4% with rate sensitive sectors – real estate and technology – leading declines. Heidelberg Materials AG benefited from a report that the Adani Group has started talks to buy the company’s Indian cement operations, and luxury-goods firm Richemont rose after an announcement it would sell the online retailer YNAP to Mytheresa. Germany sank deeper into recession after Industrial Production tumbled a worse than expected 5.8%, prompting many to wonder if even China’s bazooka can fix Europea this time.

Here are the top European movers:

- Shell shares rise as much as 0.7% after the oil company’s third-quarter update showed its upstream and integrated gas divisions continued to benefit from strong momentum, helping counter a weaker downstream performance, according to analysts

- Richemont shares gain as much as 2% after the luxury goods group sold its e-commerce platform YNAP to Mytheresa. Analysts were positive on the deal because the retail platform has struggled against a weaker spending backdrop

- Jenoptik gains as much as 6.8%, the most in two months, after Deutsche Bank upgraded its view on the German industrial optics firm to buy from hold, signposting a “three-step path to higher valuation”

- FD Technologies shares rise as much as 9.4% to hit their highest level in almost 14 months after agreeing to sell its First Derivative Business to EPAM Systems for an enterprise value of £230 million

- Sanofi shares slip as much as 3%, the most since May 13, after people with knowledge of the matter said bidders for its consumer healthcare unit are revising their offers in part to address concerns around potential liabilities related to a brand that sold talcum powder

- Bayer shares drop as much as 3%, worst performer in the Stoxx 600 Health Care Index on Monday morning, as analysts at Deutsche Bank and Morgan Stanley both predict a “soft” third quarter

- Neste falls as much as 3.1% as BNP Paribas Exane cuts its recommendation to underperform from neutral, saying it sees little reason to believe the energy firm’s margins will materially inflect next year

- Alten falls as much as 6.7% and TietoEVRY as much as 4.8% after Bank of America cut its ratings on the IT services firms to underperform in a review of the sector

Earlier in the session, Asian stocks snapped a three-day losing run, as a weaker yen buoyed Japanese equities and shares in Hong Kong extended their rally. The MSCI Asia Pacific Index rose as much as 1.2%. Exporters led gains in Japan as the yen slumped against the dollar following a stronger-than-expected US jobs report. TSMC and Recruit Holdings were among the biggest boosts to the regional gauge. Hong Kong-listed Chinese stocks continued to rally, despite a mid-day scare which saw stocks briefly dip, as traders awaited a press briefing by China’s top economic planner due Tuesday for more details on Beijing’s stimulus measures. Traders also prepared for the onshore market to reopen Tuesday after the week-long Golden Week holiday. Chinese equities have been cheap, and “we have added significant capital to China throughout the year,” said Vikas Pershad, a fund manager at M&G Investments, speaking on Bloomberg Television. “The initiatives coming out tomorrow may probably continue to support “consumer first and then moving on to other industries as well.”

In FX, the Bloomberg Dollar Spot Index is little changed. The yen is the best performer among the G-10’s, rising 0.2% against the greenback, even as Goldman expressed surprise about the move: “Surprising to see JPY is still long. Given our house view that US economy will fare well and BoJ’s dovish rhetoric, JPY longs look vulnerable. We see good scope for market re-initiating JPY shorts next few weeks” FX trader Kerem Cirpan wrote. The pound is the weakest with a 0.4% fall.

In rates, treasuries added to Friday’s sharp fall where surprisingly robust September US payrolls data undercut chances for another large interest-rate cut from the Federal Reserve. The US 10-year yield rises 4 bps to above 4% for the first time since Aug. 8. Meanwhile the 2s10s yield curve uninverted for the first time since Sept 18. European bonds follow suit with Gilts faring worse than their German counterparts.

In commodities, oil prices rise after their best week since January 2023, with Brent crude futures up ~2% at $79.70 a barrel. Spot gold is steady around $2,653/oz.

Looking at the day’s main event, US economic data calendar includes August consumer credit at 3pm. Ahead this week are CPI and PPI, as well as minutes of September FOMC on Wednesday Fed speakers scheduled include Bowman (1pm), Kashkari (1:50pm), Bostic (6pm) and Musalem (6:30pm)

Market snapshot

- S&P 500 futures down 0.3% to 5,784.00

- STOXX Europe 600 little changed at 518.07

- MXAP up 1.0% to 196.73

- MXAPJ up 0.6% to 627.93

- Nikkei up 1.8% to 39,332.74

- Topix up 1.7% to 2,739.39

- Hang Seng Index up 1.6% to 23,099.78

- Shanghai Composite up 8.1% to 3,336.50

- Sensex down 0.8% to 81,045.70

- Australia S&P/ASX 200 up 0.7% to 8,205.40

- Kospi up 1.6% to 2,610.38

- German 10Y yield little changed at 2.26%

- Euro little changed at $1.0977

- Brent Futures up 1.2% to $79.02/bbl

- Gold spot up 0.0% to $2,654.36

- US Dollar Index little changed at 102.44

Top Overnight news

- China’s home sales rose during the National Day holiday after a string of property stimulus measures to boost the country’s beleaguered real estate market since late September, state media said on Saturday. RTRS

- China’s NDRC (National Development and Reform Commission) will hold a news conference on Tues to unveil a “wide-ranging action plan” for implementing the government’s stimulus agenda. SCMP

- BOJ’s report on Japan’s regional economies suggest the central bank remains on a path to tighten policy, although doesn’t signal the need for immediate action. BBG

- Trump’s economic plan would explode the deficit by more than double Harris’s blueprint ($7.5T for Trump vs. $3.5T for Harris). WSJ

- The leader of Hamas, Yahya Sinwar, has become fatalistic after nearly a year of war in Gaza and is determined to see Israel embroiled in a wider regional conflict, U.S. officials said. NYT

- IDF said on Monday that it is targeting Hamas sites and rocket launchers throughout the Gaza Strip and it attacked a Hamas command and control post at the Al-Aqsa Martyrs Hospital. It was also reported that four projectiles were fired from Gaza as Israel began October 7 commemorations, according to AFP. Furthermore, Israeli media reported sirens sounded in Tel Aviv for fear of infiltration of drones and the Israeli military also announced that sirens sounded in Rishon Letsiyon in central Israel.

- Investment banks, forced to take big writedowns on risky merger and acquisitions loans after a global surge in interest rates, are now jumping back into leveraged buyouts — one of the most lucrative areas in finance. Traditional lenders and private credit managers are telling private equity firms, that they can provide more than $15 billion of debt on a single junk-rated deal. That’s about 50% more than last year, according to some market participants, when a number of loans were stuck on lenders’ balance sheets after central banks aggressively hiked rates to tame inflation. BBG

- TSLA was the subject of a cautious Barron’s cover story over the weekend, with the report expressing skepticism about the upcoming robotaxi catalyst (which might not have enough detail and specifics to spur further gains in the stock) and warning that an underwhelming event on Thurs could erode the perception of the company being anything other than an EV maker. Barron’s

- GOOGL’s dominance of the search market is gradually eroding thanks to Amazon, TikTok, and AI firms (Google’s share of the search ad market is expected to soon drop below 50%). WSJ

- Goldman cut its 12-month US recession probability back to the unconditional long-term average of 15% (from 20%), where it stood before the jump in the unemployment rate from 4.054% in June to 4.253% in July. GIR

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week on the front foot following last Friday’s gains on Wall St owing to the blockbuster jobs report, while Japanese stocks led the advances on the back of recent currency weakness. ASX 200 shrugged off early indecision as strength in tech, financials and miners picked up the slack from weakness in defensives. Nikkei 225 gapped above the 39,000 level with the rally facilitated by recent JPY weakness, while a Reuters analysis report suggested that a preference by Japan’s new leadership for loose monetary policy raises the hurdle for rate hikes. Hang Seng climbed at the open ahead of tomorrow’s resumption of trade in the mainland and the NDRC’s news conference to discuss implementing a package of policies to promote economic growth, although the gains were initially capped by weakness in some property stocks and China-EU tariff frictions.

Top Asian News

- Chinese officials will brief on economic policy implementation with the state planner to conduct a news conference on Tuesday at 10:00 local time (03:00BST/22:00EDT).

- Chief China correspondent at the WSJ posted on X “Source in Beijing told me there are lots of ‘misunderstandings in the market’ about what China will do next to support growth. Yes, some fiscal measures “in the pipeline” but nothing as big as some had speculated”.

- Japanese Finance Minister Kato said a weak yen has both merits and demerits, while he added that they will need to monitor how excessive forex moves will affect corporate activities and households.

- UMC (2303 TW) Sept (TWD) Sales 18.94bln, -0.58% Y/Y.

- BoJ Osaka Branch Manager said firms in Kansai region all share the view that FX moves should be moderate; expects more firms to strive towards raising wages next year.

- BYD (002594 CH) said new energy vehicle sales volume for September was 419,426 units (prev. 287,454 Y/Y).

- Samsung Electronics (005930 KS) CEO says he is not interested in spinning off foundry or system LSI business; adds new chip factory project in Texas is tough due to changing situation.

European bourses, Stoxx 600 (-0.4%) began the session on a modestly firmer footing, but soon after the cash-open, sentiment soured. Indices are now mostly in negative territory and reside near session lows. European sectors initially opened with a modest firm bias which turned into a mixed picture within the first 15 minutes of cash trade and then mostly negative within the first half hour of trade, although no theme can be seen. Energy leads whilst Real Estate lags, given the relateively higher yield environment. US equity futures (ES -0.5%, NQ -0.7%, RTY -0.8%) are entirely in the red, continuing similar price action seen in Europe. US data docket ahead is light, but focus will be on Fed speak from Kashkari, Bostic & Musalem.

Top European News

- UK Chancellor Reeves seeks to reassure investors that guardrails will be placed around extra borrowing for investment and confirmed she was looking to revise her fiscal debt rule to take account of the benefits of investment and not just the costs, according to FT. It was also reported that Chancellor Reeves is to spare private equity bosses from the top 45p tax rate in the upcoming Budget as she looks for a compromise agreement to close tax loopholes that won’t drive investors out of Britain.

- UK PM Starmer’s Chief of Staff Sue Gray resigned on Sunday citing concerns about increasing news reports regarding her salary and role risk becoming a distraction to the government, according to AP.

- UK ministers were warned that power market reforms pose a danger to the industry and investment with trade groups warning proposals for regional pricing could risk deindustrialisation and higher costs, according to FT.

- UK’s job market continued to show more cooling in September as a survey by REC and KPMG showed growth in starting pay for people hired in permanent roles was at the slowest since February 2021.

- ECB’s Villeroy said the ECB will quite probably cut rates in October due to the rising risk of inflation undershooting the 2% target, according to a La Repubblica interview.

FX

- USD is net flat vs. peers following last week’s surge which saw DXY pick up from a 100.17 low to a 102.68 peak post-NFP. The next upside target for DXY comes via the 103 mark; not breached since 16th August. Docket today is light, but Fed’s Kashkari, Bostic & Musalem are due to speak.

- EUR is slightly lower vs. the USD in comparison to last week’s hefty losses, slipping from a 1.12 handle to a low of 1.0951 on account of the hawkish repricing at the Fed and endorsement of an October cut at the ECB. EUR/USD currently 1.0963.

- Cable is found at the foot of the G10 chart, despite the lack of fresh UK-specific drivers. GBP/USD currently trades towards the bottom end of today’s 1.3072-1.3134 range.

- JPY is a touch firmer vs. the USD but gains pale into insignificance compared to the losses seen last week which drove USD/JPY from a 141.64 low to a 149.12 high overnight.

- AUD/USD is slightly lower after a bruising end to the week last week which saw the pair dragged lower onto a 0.67 handle. NZD/USD has slipped below Friday’s 0.6145 low to a session trough of 0.6136. Focus for NZD is on this week’s RBNZ rate decision.

Fixed Income

- USTs are extending the downside seen in the wake of last week’s unambiguously hot NFP print which saw the odds of a 25bps rate cut rise from around 65% to current levels of 93%. US data docket today is light, so focus will be on US CPI/PPI later in the week. The US 10yr yield has climbed above 4% for the first time since Aug 8.

- Bunds are on the backfoot in an extension of the price action seen late last week. As it stands, market pricing currently has a 25bps cut next week at 98% with another 25bps cut in December fully priced. The German 10yr yield has climbed as high as 2.252%; highest since 4th September.

- Gilts are extending their downside with the Dec’24 contract at its lowest level since July. In terms of fresh UK drivers, there hasn’t been a great deal to go off over the weekend and that could remain the case throughout the week with Friday’s GDP print the main highlight. The UK 10yr yield has been as high as 4.189%; highest since July 4th.

Commodities

- Crude is firmer across the board and extending on gains amid the backdrop of heightened geopolitics on the first anniversary of the Israel-Hamas conflict, which has broadened to include Lebanon (with a new “focused and specific” ground operation in Southern Lebanon announced today), whilst an Israeli retaliation on Iran also looms. Brent Dec resides in a USD 77.23-78.85/bbl parameter.

- Mixed trade across precious metals with the complex failing to gain on geopolitics this morning, but likely taking a breather after the NFP-induced volatility on Friday. Spot gold resides in a current USD 2,639-2,656.44/oz range

- Flat/mixed base metals complex with copper futures rangebound on either side of USD 10k following a similar overnight session despite the mostly positive risk tone in APAC which later faded in Europe. 3M LME copper resides currently in a USD 9,928.00-10,023.00/t parameter.

- Saudi Arabia set the November Arab Light Crude Official Selling Price to Asia at a premium of USD 2.20 vs Oman/Dubai and to NW Europe at minus USD 0.45/bbl vs ICE Brent, while it set the OSP to the US at plus USD 3.90/bbl vs ASCI.

- Qatar set the November Marine Crude Official Selling Price at a premium of USD 1.00/bbl vs Oman/Dubai and Land Crude OSP at a premium of USD 0.85/bbl vs Oman/Dubai.

- Iraq’s Kerala refinery is undergoing extensive maintenance which started on September 25th and is currently non-operational with the maintenance expected to last for around a month, according to a source with direct knowledge cited by Reuters.

- Goldman Sachs sees Brent to trade in the USD 70-85/bbl range and forecasts an average price of USD 77/bbl in Q4 2024 and USD 76/bbl for 2025. Goldman Sachs added that assuming a 2mln bpd 6-month disruption to Iranian supply, it estimates that Brent could temporarily rise to a peak of USD 90/bbl if OPEC rapidly offsets the shortfall.

- NHC said Milton is strengthening over the Southern Gulf of Mexico, storm surge and and hurricane watches issued for portions of Florida

- NHC said tropical storm Milton is about 845 miles west-southwest of Tampa Florida and that the risk of life-threatening impacts is increasing for portions of Florida’s west coast, while NHC said Milton is expected to become a major hurricane in the next day or so.

- BP (BP/ LN) abandons 2030 oil and gas output reduction targets, via Reuters citing sources; BP eyes investments in Iraq, Kuwait and Gulf of Mexico to boost oil output in the coming years.

- Shell (SHEL LN) Q3 update note: The Chemicals sub-segment adjusted earnings are expected to reflect a marginal loss in Q3 2024.

Geopolitics: Middle East

- “Israeli media: Raising the state of high alert as more rockets expected from Gaza”, according to Al Jazeera.

- Israel opposition leader Lapid calls to attack Iran’s oil facilities, via Walla News’s Elster.

- Hamas claims the latest strike on Tel Aviv and Rishon Lezion, via Al Jazeera. These rockets were reportedly fired from Gaza. Five rockets fired at the Tel Aviv area and Iron Dome were detected, some of which were intercepted. Israel media report “A number of people injured as a result”

- “Palestinian resistance factions: There is still a lot of strategic consequences for the enemy in the coming days”, according to Al Jazeera.

- “IDF announces the start of a focused and specific ground operation in southern Lebanon”, according to Al Arabiya

- Israel conducted a strike on a mosque in Deir Al-Balah in the central Gaza Strip over the weekend which killed at least five people and wounded 20, according to Reuters.

- Israel continued its wave of airstrikes on Lebanon in what was the heaviest 24 hours of bombing since it stepped up its campaign against Hezbollah, according to a report on Sunday by FT.

- Lebanese media reported rocket barrages fired from Lebanon towards the Galilee and the Haifa area in Israel, according to Asharq News. Furthermore, sources reported a direct hit on a restaurant in Haifa, Israel after rockets were fired by Hezbollah from southern Lebanon and Israel’s ambulance service separately announced 10 were wounded after Hezbollah fired rockets at Haifa, including one in serious condition.

- Israel’s military issued new evacuation alerts on Sunday for areas in southern Lebanon, while it separately announced that areas of Manara, Yiftah and Malkia in northern Israel declared a closed military zone, according to Reuters.

- Israel’s military announced changes to the Home Front defensive guidelines which apply to several areas including communities near the Gaza Strip in which gatherings of up to 2,000 participants will be permitted and the activity scale will be changed to partial activity in a number of central Galilee communities, while the rest of the country’s guidelines remain unchanged, according to Reuters.

- Israeli military spokesperson said their response to Iran’s missile attack will come at the timing that Israel decides is best, while the spokesperson confirmed that two Israeli airbases were hit in Iran’s attack on Tuesday but noted its air force and the bases remain fully operational, according to Reuters.

- Israel’s military said Hamas official Muhammad Hussein Ali Al-Mahmoud who served as Hamas’s executive authority in Lebanon and Hamas military wing in Lebanon member Said Alaa Naif Ali were killed by an Israeli air strike and operation on Saturday. It was also reported that a Lebanese security source said Hezbollah leader Hashem Safieddine was ‘unreachable’ since Israeli air strikes on Friday.

- Hamas official said Israel is blocking a ceasefire agreement despite Hamas’s flexibility and urged world countries to stop the double-standards policy over Gaza and Lebanon, according to Reuters.

- Hezbollah political official Qmati said Hezbollah is now being jointly led internally and picking a new Secretary-General will take some time, while he responded that Israel is not allowing a search to progress when asked about the fate of Hezbollah’s senior official Hashem Safieddine.

- Iranian security officials said Quds Force commander Esmail Qaani, who travelled to Lebanon, has not been heard from since Israeli strikes on Beirut last week, according to Reuters.

- Iran’s Oil Minister said he was not worried about the crisis amid reports of Israeli threats to strike Iran’s oil facilities, according to Reuters.

- Iran’s Mehr news agency cited an official who stated all flights were cancelled in Iran’s airports from Sunday at 21:00 (18:30BST/13:30EDT) to Monday at 06:00 (03:30BST/22:30EDT). However, it was later reported that all flight restrictions were lifted after ensuring favourable and safe conditions.

- Syria confronted hostile targets in the central region, according to state TV.

- US Defense Secretary Austin spoke with Israel’s Defence Minister Gallant on Sunday to discuss Iran’s destabilising actions in the Middle East and the current situation with Lebanon and Gaza, while they reiterated commitment to deterring Iran and Iranian-backed partners and proxies from taking advantage of the situation, according to the Pentagon.

- US Secretary of Defense Austin will host Israeli Defence Minister Gallant at the Pentagon on October 9th to discuss the ongoing Middle East security developments.

- US State Department commented regarding the latest Israeli bombing of Lebanon in which it stated that military pressure at times can enable diplomacy but could also lead to miscalculation and that Israel has a right to pursue extremist targets but civilian infrastructure should not be targeted. Furthermore, it stated that the US is continuing discussions with Israel and that the US goal is to reach a ceasefire to provide space for diplomacy, according to Reuters.

Geopolitics: Other

- Ukraine’s air forces said on Sunday morning that Russia launched 87 drones and 3 missiles at Ukraine.

- Russia took control of the settlement of Zhelanne Druhe in Ukraine, according to IFX.

- Netherlands’s Defence Minister pledged EUR 400mln for a drone action plan with Ukraine.

- Chinese hackers reportedly breached US court wiretap systems, according to WSJ.

- Philippine President Marcos said the Philippines and South Korea elevated relations to strategic partnership and he exchanged views with South Korea’s President on regional and international issues including the South China Sea and the Korean Peninsula. Furthermore, South Korean President Yoon said South Korea concurred with the Philippines a strategic partnership on the security front and will actively take part in Philippine military modernisation.

- China is reportedly likely to launch military drills this week near Taiwan, according to Reuters citing Taiwanese officials, coinciding with Taiwanese President Lai’s speech on October 10th

US Event Calendar

- Oct. 7-Oct. 18: Sept. Monthly Budget Statement, est. $4.3b, prior -$380.1b, revised -$380.1b

- 15:00: Aug. Consumer Credit, est. $12b, prior $25.5b

Central Bank speakers

- 13:00: Fed’s Bowman Speaks in at Independent Bankers Assoc of Texas

- 13:50: Fed’s Kashkari Participates in Q&A

- 18:00: Fed’s Bostic Moderates Conversation with Steve Koonin

- 18:30: Fed’s Musalem Speaks on Economy, Policy

DB’s Jim Reid concludes the overnight wrap

Morning from what already looks like the start of a sunny day here in Berlin and welcome to a new week with the one we just left behind containing plenty of surprises, twists, and turns. Stronger US data, culminating in a blockbuster payrolls number, and increased geopolitical risk led to the largest weekly increase in US 2yr yields (+36.4bps) since June 2022, the largest weekly increase in Brent (+8.43%) since January 2023, and the largest weekly increase in the Dollar index for over two years.

Meanwhile, even with China closed until tomorrow, the Hang Seng (+10.2% on the week) hit its highest level since March 2022.

We’re currently in-between US payrolls from last Friday and US CPI this Thursday which will be the highlight of this week. The first of these was a knockout report with the headline number up +254k as against expectations of +150k and with the unemployment rate falling a tenth to 4.1% (4.05% unrounded). My colleague Francis Yared always calls payrolls the “random number generator” but even with that caveat it was an impressive report and completely against recent fears. The main impact was a +21.6bps increase in 2yr US yields on Friday and the probability of a 50bps cut next month declining from around 33% to effectively zero in the process. My personal view was always that the amount of rate cuts priced in since mid to late summer was only likely if we had a recession. If we didn’t, then the rates market overall was too pessimistic. I would still say that today.

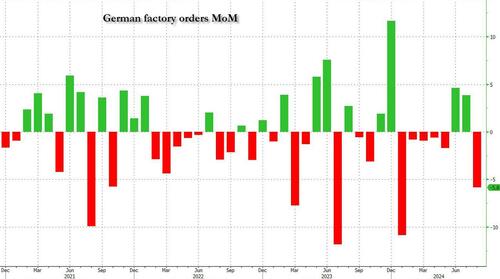

In terms of moving this argument on, it’s a relatively quiet week in the US apart from Thursday’s CPI but in terms of the main global day-by-day highlights we have the following. Today sees Germany factory orders and Eurozone retail sales, tomorrow sees German Industrial Production, and Swedish CPI, Wednesday sees the last FOMC minutes and a 10yr UST auction, Thursday sees the release of the account of the last ECB meeting, France present its budget proposal, Japanese PPI, German retail sales, Italian industrial production, Norway and Denmark CPI, and a 30yr UST auction, with Friday home to US PPI, the US University of Michigan survey, UK August monthly GDP and US Earnings season kicking off with JPMorgan, Wells Fargo, BlackRock, Bank of New York Mellon all reporting.

In terms of this week’s US CPI, DB is expecting headline CPI (+0.05% forecast vs. +0.19% previously, consensus +0.1%) to be tame with core (+0.24% vs. +0.28%, consensus +0.2%) edging lower but more elevated than headline. If DB is correct, headline YoY CPI would dip a couple of tenths to 2.3%, with core staying around the same level at 3.2%. However, the six-month annualised core rate would fall from 2.7% to 2.4%. Rents will again take centre stage after recent strength. As for PPI on Friday, DB and consensus expect headline (+0.1% vs. +0.2% last month) and core (+0.2% vs. 0.3% last month) to be directionally similar to CPI. The market will as ever pay closest attention to the categories that feed into the core PCE deflator – namely, health care services, airfares and portfolio management. Staying with inflation, Friday’s preliminary University of Michigan consumer sentiment survey will have inflation expectations which last month picked up a tenth to 3.1% for the long-run measure but fell the same amount to 2.7% for the 1yr measure.

As you’ll see in the day-by-day calendar of events, it’s also a busy week of Fed speakers. So it’ll be interesting to see how they all react to the bumper payrolls print. The last FOMC meeting minutes on Wednesday will be a bit stale but may give us a better understanding as to how policy might evolve under various scenarios.

As noted above, Friday will mark the start of the Q3 earnings season with several US banks releasing results. Samsung, PepsiCo and BlackRock also report throughout the week. Our equity strategists put out a preview of the upcoming earnings season here. They expect S&P 500 earnings growth to slow from 11.8% in Q2 to 9% in Q3, driven by a narrow group of sectors such as energy and mega cap growth & tech, with growth for the others staying steady in the mid-single digits.

Asian equity markets are strong this morning with the Nikkei up +2.1% and the Topix rising +1.9%. The Kospi (+1.52%), Hang Seng (+1.15%) and S&P/ASX 200 (+0.7%) are also strong. US futures are fairly flat. The Yen had briefly nudged up above 149 earlier this morning, the weakest since early August but has since rallied to be +0.15% higher at 148.44.

Looking ahead in Asia, three central banks are scheduled to announce their interest rate decisions this week: the Bank of Korea (Friday), the Reserve Bank of New Zealand and the Reserve Bank of India (both Wednesday).

Remember also that today is the one-year anniversary of the attacks by Hamas on Israel and with the region of high alert following last week’s attacks on Israel from Iran, we are subject to events and risks this week. Oil has actually started the week a touch lower following on from weakness late on Friday after President Biden publicly tried to persuade Israel from attacking Iran’s oil fields.

Looking back at last week now, risk appetite took a hit thanks to mounting geopolitical risk in the Middle East, even as the macro data turned decisively more positive. That was particularly evident from Friday’s US jobs report, with fears of a recession continuing to decline. Markets had been pricing in 34bps of cuts for the Fed’s November meeting prior to the release, so a 35% likelihood of a 50bp cut, but that fell to just 25bps by the close on Friday and effectively wiping out the pricing of 50. And looking further out the curve, an entire rate cut was taken out of the 2025 profile, with the rate priced in by December 2025 moving up +26bps on Friday alone.

With a recession being priced out, that led to a massive sell-off in US Treasuries, with the 2yr yield up +21.8bps on Friday and +36.4bps over the week as a whole, leaving it at 3.92% by the close on Friday. That made it the biggest weekly gain for the 2yr yield since June 2022, when the Fed was about to accelerate to a 75bps hiking pace. In the meantime, the 10yr yield was up +21.6bps over the week, and +12.1bps on Friday, taking it up to 3.97%, which is its highest level since early August.

That pattern was echoed globally, albeit to a lesser extent. For instance, the 10yr bund yield ended the week up +7.7bps (+6.6bps Friday) at 2.21%, even as investors grew more confident that the ECB would cut rates at their October meeting. That confidence partly came about thanks to continued falls in inflation, and the latest data last week showed Euro Area headline inflation was beneath the ECB’s target in September for the first time in over three years.

Geopolitics was the other major theme last week, as growing tensions in the Middle East led to a significant rise in oil prices. In fact, Brent crude ended the week up +8.43% (+0.55% Friday) at $78.05/bbl, marking its strongest weekly gain since January 2023. The rising geopolitical risk premium coupled with stronger US data saw the US Dollar index rise every day last week to post its strongest weekly gain in over two years (+2.13%).

Lastly, equities saw a mixed performance, with the boost from stronger data narrowly outweighing the geopolitical fears for US stocks. The S&P 500 just about posted a fourth consecutive weekly gain (+0.22%), thanks to a +0.90% increase following payrolls on Friday. In Europe, the sentiment was more negative, with the STOXX 600 down -1.80% (+0.44% Friday), whilst Germany’s DAX fell by a similar -1.81% (+0.55% Friday). However, the Hang Seng surged by another +10.20% last week (+2.82% Friday), building on its +13.00% gain from the previous week to close at its highest level since March 2022.

Day-by-day calendar of events

Monday October 7

Data: US August consumer credit, China September foreign reserves, Japan August leading index, coincident index, Germany August factory orders, Eurozone August retail sales

Central banks: Fed’s Kashkari, Bowman, Bostic and Musalem speak, ECB’s Cipollone, Lane, Nagel and Escriva speak

Tuesday October 8

Data: US September NFIB small business optimism, August trade balance, Japan August labor cash earnings, household spending, BoP current account and trade balance, September Economy Watchers survey, Germany August industrial production, France August current account balance, trade balance, Canada August international merchandise trade, Sweden September CPI

Central banks: Fed’s Kugler, Bostic and Collins speak, ECB’s Nagel speaks

Earnings: Samsung Electronics, PepsiCo

Auctions: US 3-yr Notes ($58bn)

Wednesday October 9

Data: US August wholesale trade sales, Japan September machine tool orders, Germany August trade balance

Central banks: Fed FOMC meeting minutes, Jefferson, Bostic, Logan, Goolsbee, Collins and Daly speak, ECB’s Villeroy and Elderson speak, RBNZ decision

Auctions: US 10-yr Notes ($39bn, reopening)

Thursday October 10

Data: US September CPI, initial jobless claims, UK September RICS house price balance, Japan September PPI, bank lending, Germany August retail sales, Italy August industrial production, Norway and Denmark September CPI, Sweden August GDP indicator

Central banks: Fed’s Barkin and Williams speak, ECB account of the September meeting

Earnings: Domino’s Pizza, Fast Retailing, Seven & I

Auctions: US 30-yr Bonds ($22bn, reopening)

Friday October 11

Data: US September PPI, October University of Michigan survey, UK August monthly GDP, Japan September M2, M3, Germany August current account balance, Canada September jobs report, August building permits

Central banks: Fed’s Goolsbee and Logan speak, BoC’s business outlook

Earning: JPMorgan, Wells Fargo, BlackRock, Bank of New York Mellon

Tyler Durden

Mon, 10/07/2024 – 08:16

via ZeroHedge News https://ift.tt/EASXRmN Tyler Durden