Near Record Foreign Demand For Tailing 10Y Auction

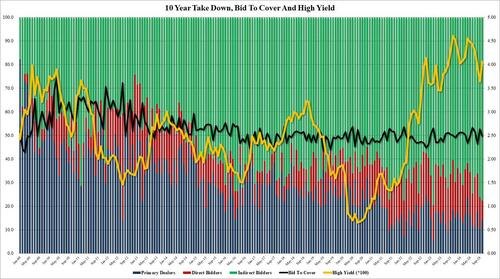

After yesterday’s ugly, tailing 3Y auction, which saw a plunge in foreign demand as a result of the recent spike in yields as faith in the Fed’s easing plans has been deeply shaken in recent weeks, moments ago the Treasury sold $39BN in 10Y paper (in the form of reopening of 9Y-10M cusip LF6), in a sale that was substandard at best.

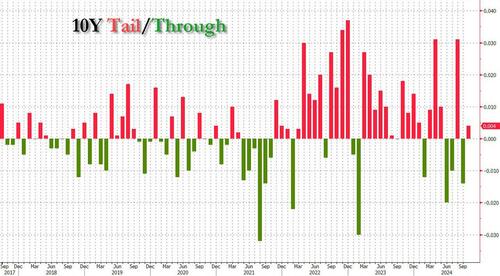

The auction stopped at a high yield of 4.066%, up sharply from last month’s 3.648% (which was the lowest since May 2023), and tailed the When Issued 4.062% by 0.4bps, a big reversal from last month’s 1.4bps through auction (but nowhere near as bad as the 3.1bps tail in August).

The bid to cover was subpar, sliding to 2.481 from 2.637 in September, and was also below the 6-auction average 2.50.

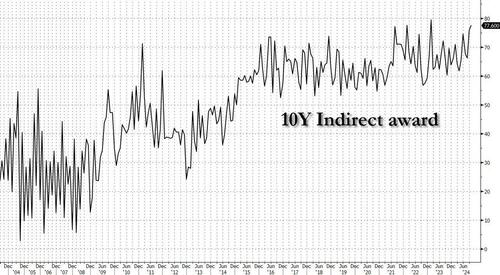

Curiously, the internals were not bad at all, perhaps as foreign central banks sought to load up on US paper now that yields are back over 4%, and the Indirect takedown rose to 77.6%from 761%, and just shy of the all time high hit in Feb 2023 when indirects took down just under 80%.

And with Dealers awarded 13.9%, that left Directs holding just 8.4% of the auction, the lowest since Nov 2018.

Overall, this was a curious auction, one which saw near record foreign demand yet where the metrics were subpar at best. Which is probably why after rising to a session high 4.07% just before the auction, yields were unchanged after the result. Meanwhile, stocks continue to push ever higher to new all time highs, completely obvious of the latest surge in yields.

Tyler Durden

Wed, 10/09/2024 – 13:23

via ZeroHedge News https://ift.tt/x8LhiOJ Tyler Durden