Traders Increasingly Focused On US Election As Trump Odds Soar

Having ignored the election for far too long, rates traders are starting to price in US election risks to Treasury and volatility markets, according to Goldman strategists who continue to recommend shorting 10-year TSYs versus German bunds. Meanwhile, Citi took profit on a long breakevens position, while BMO looks to enter the trade should rates fall to more favorable buying levels.

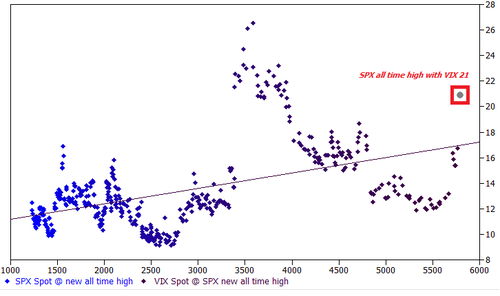

As a reminder, now that the Nov 5 election has entered the 30-day “catalyst window” of the VIX…

… the VIX remains stubbornly high, and in fact as Goldman trader Brian Garrett noted recently, it is extremely rare to see the VIX print above 20 when the S&P hits a new all time high as it just did.

A big reason for this is that the market is finally starting to sweat the outcome of the Nov 5 election, which at least until very recently, it would blissfully pretend doesn’t matter.

But before we take a look at how equity traders are assessing the election, here is a snapshot of what Wall Street’s rates traders and strategists are saying:

Bank of America (Mark Cabana, Meghan Swiber and others, Oct. 11 report, available to pro subscribers)

- Maintains dip-buying stance and real steepeners bias, favors adding duration with 10-year trading between 4% to 4.25%; five-year the preferred tenor

- “We prefer to allocate to longs at the belly vs back end of the curve as election remains a risk” while “We recommend holding off on adding to duration further out the curve until we pass peak election risk”

Barclays (Anshul Pradhan and others, Oct. 10 report, available to pro subscribers)

- Keeps view to pay 5y5y USD versus EUR rates (via OIS vs. ESTR, entered at 80bp): “US far forward rates still do not appear to be pricing in enough term premium, and EUR far forwards should reflect the risk of a low neutral rate”

- “All in all, the data argue against the need for a material easing beyond some further re-calibration, and Fedspeak implies risks are skewed towards over-easing”

BMO Capital Markets (Ian Lyngen and Vail Hartman, Oct. 11 report)

- Stays in 2s10s steepener (entered at 9.8bp, currently around 14bp) but were stopped out of 2s30s steepener

- Looks to enter long 10-year breakevens in the event they fall below 223bp, the close on Oct. 4 jobs report day

- “With CPI and PPI in hand, our read is that the September inflation profile has solidified expectations for a 25 bp rate cut next month” while “there is a very high bar for the remaining pre-Fed data to truly put a pause on the table for the November FOMC meeting”

Citi (Jabaz Mathai and others, Oct. 11 report, available to pro subs)

- Takes profit on long 10-year breakeven position around 2.342%, writing “The Treasury curve is now back to levels that are more consistent with a realistic assessment of benign/soft landing vs. hard landing probabilities for the economy”

- Upside data surprises like September CPI “raise the likelihood of a skip this year if payrolls don’t deteriorate into year-end. The Fed will in all likelihood go 25bp in November, as monetary policy is still quite some distance away from neutral”

Goldman Sachs (William Marshall and others, Oct. 11 report, available to pro subs)

- Maintains recommendation to be short 10-year Treasuries versus bunds, “which we think is positioned well for our baseline but can also benefit if the market presses on election-related risks (either fiscal or tariff-related)”

- Traders and vol market are increasingly focused on US election with most key data risks behind us (save for October jobs report)

- “Shorter expiry vol on longer term yields has richened on the surface since the start of the month, likely reflecting a combination of uncertainty shifting away from the very near-term Fed path towards terminal rate considerations, as well as a greater focus on post-election risks”

TD Securities (Gennadiy Goldberg and others, Oct. 11 report)

- Re-enters 5s30s steepeners, prompted by several reasons including:

- Easing inflation and jobs momentum hints at more gradual cuts ahead

- Less prohibitive carry

- Election uncertainty

- “We remain of the view that labor market dynamics are likely to continue driving policy decisions by the FOMC in the near term”

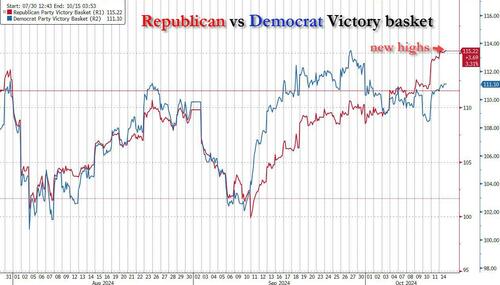

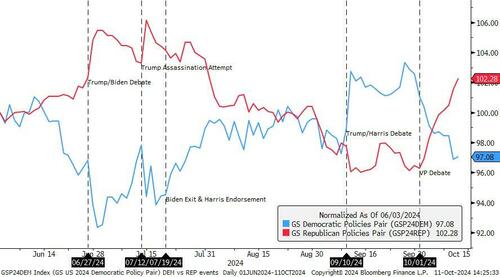

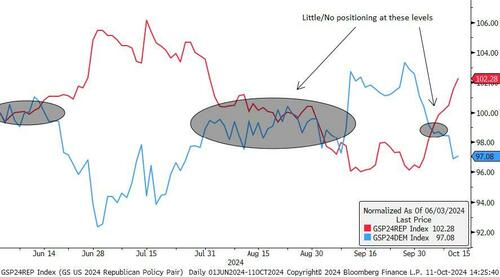

While rates strategists are dignified, nuanced creatures, stock traders, on the other hand, are simpler brutes, and here things are somewhat easier. Indeed, one can see a dramatic reversal with Goldman’s Republican Victory basket – a proxy for Trump’s odds – surging in recent days to new all time highs, while the Democrat Victory basket – a proxy for president Kamala – suddenly sinking.

Indeed, with just weeks to go until the election showdown between Kamala Harris and Donald Trump, odds are increasingly shifting in Trump’s favor: “A Trump victory would likely be positive for risk sentiment, though more for US assets at the expense of Europe and rest of the world,” Kumar said. “In our view, the environment remains broadly positive for risky assets.”

And while public polls remain irrevocably politicized, with massive Democrat oversampling still skewing results grotesquely to the point where most polls are meaningless – although even here we are seeing a massive surge in support for the former president with the latest poll by MSM flagbearer NBC showing Kamala’s 5 point lead evaporate…

New NBC poll: Harris 5 point advantage over Trump is now gone. pic.twitter.com/V3bEtZMTh0

— Shermichael Singleton (@MrShermichael) October 14, 2024

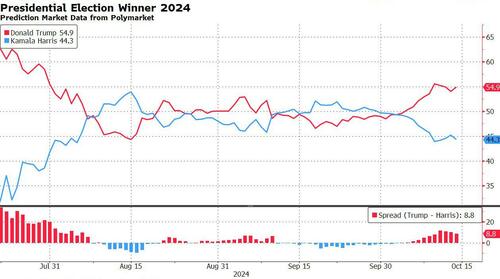

… in far more accurate online betting markets, Trump’s spread over Kamala on Polymarket is now the highest it has been and is approaching Trump’s blowout odds observed against Joe Biden… Pelosi.

… before he was forced to pull out of the race by Nancy

In its latest Weekly Rundown note (available to pro subscribers), Goldman advised clients to position themselves ahead of the election: “Buy GSP24REP if you expect a Republican sweep or Buy GSP24DEM if you expect a democratic sweep.“

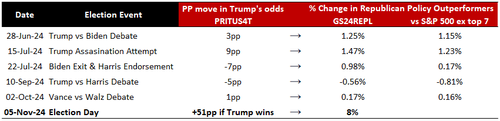

Some more from Goldman: “The sensitivity of our Republican Policy Outperformers (GS24REPL) to election events since this summer implies the it could move +8% if Trump wins the presidential election%. Over the summer, investors have tactically traded around election events and have shortly unwound their trades.”

And the punchline: “Considering we are only ~1 month away from election day, we notice a shift in focus: our client near-term outlook depends on the election outcome and they are becoming more comfortable positioning themselves accordingly.”

Finally, while some have speculated that whether Trump or Kamala wins, it doesn’t really matter unless there is a sweep, the reality is that while the market was frowning on the odds of either party winning both the House and the Senate, in the past few days we have seen a surge by the Republicans, where Polymarket odds of a sweep are now the highest they have been in three months.

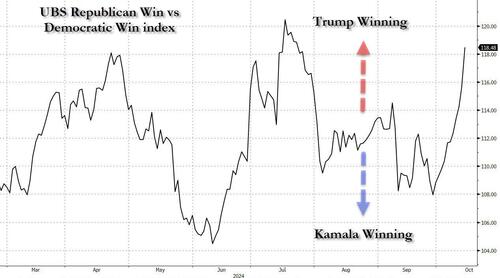

Finally, it’s not just Goldman: UBS writes that as recent election poll results seem to be shifting in favor of the Republican party, the bank’s Republican Win basket continued outperform the Democratic Win basket (BBG index UBPTREDE) by 2.4% on Monday, marking almost 6% over the past five sessions.”

In other words, while rigged polls do everything in their power to convince the marginal voter that Kamala is still in the lead, Wall Street traders have already taken the other side of the bet.

Tyler Durden

Mon, 10/14/2024 – 20:30

via ZeroHedge News https://ift.tt/9LPhnxd Tyler Durden