ECB Preview And Cheat Sheet: How To Trade The 3rd Rate Cut

The ECB is expected to cut interest rates Thursday for the third time this year and for a second-straight meeting, quickening the speed of easing as a rapid retreat in inflation accompanies a deteriorating economy.

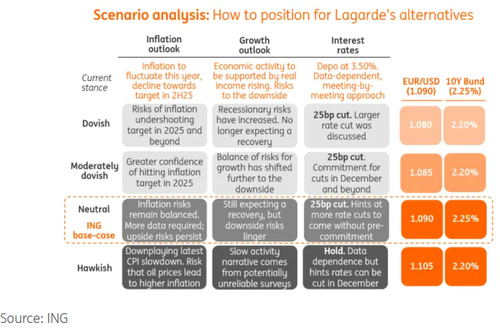

Analysts polled by Bloomberg unanimously predict that the deposit rate will be decreased by another quarter-point on Thursday, to 3.25%. The euro is set for a fourth day of losses against the US dollar with anticipation policymakers will signal a willingness to loosen policy again soon. Here is a scenario analysis courtesy of ING Economics:

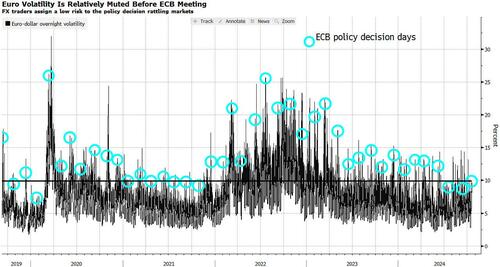

According to Bloomberg FX strategist Vassilis Karamanis, options traders aren’t predicting fireworks for the euro from the ECB meeting, but positioning could make all the difference. Overnight volatility in the common currency hits one of the lowest readings ahead of a ECB decision since officials started increasing interest rates in July 2022. On Wednesday, hedging costs were at the lowest level in three years on the eve of a meeting day.

Relatively low volatility reflects market consensus for a quarter-point cut and low expectations for concrete forward guidance from President Christine Lagarde. So it’s down to positioning adjustments to see higher-than-expected realized volatility.

According to CFTC data, hedge funds were close to holding a neutral exposure for the week ending Oct. 8, while real money accounts were still long the euro but with waning conviction. Europe-based interbank traders say that aggregate short-term positioning is around -1.5 on a scale from -5 to +5.

One-day breakeven in the euro stands at around 50 dollar pips which poses a low bar for a surprise should investors decide to rebalance their spot exposure, even if Lagarde sticks to script and keeps all options open for the December meeting. A clearly dovish or hawkish cut is bound to see wider ranges than expected.

Deep Dive Into Markets:

EUR/USD is trading modestly lower at 1.0866 as of 7:35am ET; it’s down 1.6% year-to-date and heads for a third week of declines for the first time since June. Technically, the euro remains within a bullish trend channel initiated a year ago, with support currently coming around 1.0770; a short-term MA bearish crossover weighs on sentiment:

- Euro longs need mean reversion to take over and 1.0835, the 61.8% Fibonacci retracement of gains since mid-April, to hold on a closing basis

- Euro bears target a move to the Aug. 1 low at 1.0778 which could result in profit-taking bias taking over

Overnight volatility trades at 9.75% for a breakeven of around 50 dollar pips

- One-week 25d risk reversals trade at 32 basis points, puts over calls, and are in consolidation mode this week; downside exposure trades at a premium across tenors, which widens as one moves further out the curve; see 3-D surface

- Large expiries Thursday include 1.0800 (€988m) and 1.0975 (€914m): DTCC

Positioning, according to traders in Europe: Interbank desks have shifted this month into sell-the-rally mode while fast money enter the decision long the greenback; real money names still hold on longs.

Tyler Durden

Thu, 10/17/2024 – 07:40

via ZeroHedge News https://ift.tt/PFTkGvM Tyler Durden