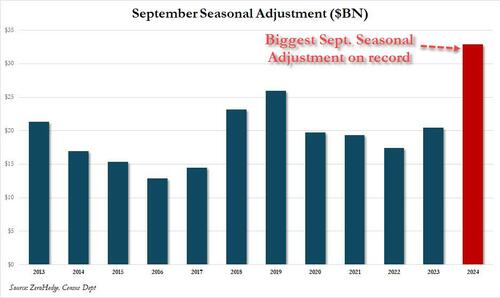

Retail Sales ‘Reality Check’: This Was The Biggest Positive September Seasonal-Adjustment Ever!

As we warned in our preview last night, the almost omniscient folk at BofA warned, ‘brace’ for a blowout retail sales print this morning, forecasting a huge 0.8% MoM rise in spending (well above the 0.2% consensus) all due to seasonal adjustments.

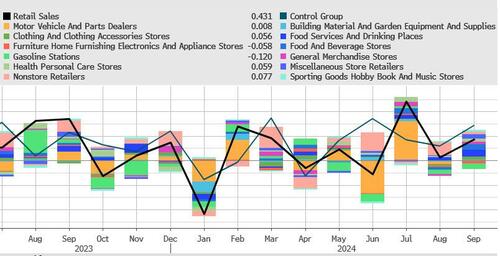

BofA was mostly right with all the retail sales cohorts coming in hot – headline +0.4% (+0.3% exp), ex-autos +0.5% MoM (+0.1% exp), and most notably the control group (which flows into the GDP calc) +0.7% MoM (+0.3% exp).

Headline retail sales MoM beat was not enough top keep the YoY print improving as it dropped to +1.7% YoY – the weakest since January…

Source: Bloomberg

On an unadjusted basis, Retail sales fell a shocking 7.5% MoM…

Source: Bloomberg

This was the biggest positive September seasonal adjustment in history…

Source: Bloomberg

In case it’s hard to see above… how do you know it’s an election year (and Dem support is waning over a bifurcated economy or haves and have-nothings)…

However, Core retail sales rose 4.0% YoY…

Source: Bloomberg

Spending at Gas stations and Furniture Stores fell on a MoM basis while Food Services and Food & Beverage Stores spending jumped most…

Source: Bloomberg

On an unadjusted basis, retail sales were flat (0.0%) YoY which means (roughly speaking) real retail sales were down notably on a YoY basis…

Source: Bloomberg

So, take your pick – is retail spending ‘hot’ or is inflation eating into personal incomes more than many think?

Tyler Durden

Thu, 10/17/2024 – 08:45

via ZeroHedge News https://ift.tt/FOYzakX Tyler Durden