Bonds & Bitcoin Dump, Dollar & Crude Jump As Leading Economic Index Hits 8 Year Lows

The day started off with a slow and gentle selloff in equity futures overnight and then US Leading Economic Indicators tumbled to their lowest since 2016 (with ironically and reflexively, only stock returns holding the index above some very ugly levels)…

Source: Bloomberg

…but interestingly, STIRs ignored it and shifted more hawkishly (with the market now pricing in just a 50% chance of a second rate-cut this year)…

Source: Bloomberg

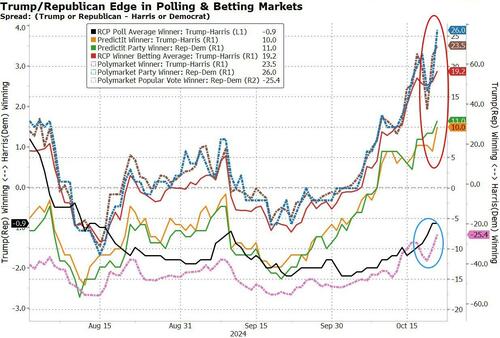

Gold and crypto prices surged early on but ended up being dumped. Crude and bond yields moved higher together along with the dollar as prediction markets and polls pull increasingly towards Trump…

Source: Bloomberg

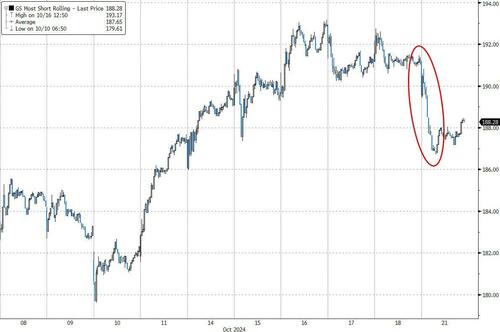

But, Goldman’s Chloe Garber summed up the day well: Sell everything to buy NVDA which is propping up the S&P by 60bps…

Source: Bloomberg

Coming into today, HFs had been buying equities for 6 straight sessions, that streak will end today as our desk is seeing the highest sell skew from HFs since 9/30.

Small Caps were the biggest losers (the most yield sensitive) while Nasdaq desperately clung to unchanged. The Dow lagged the S&P 500…

‘Most Shorted” stocks were monkeyhammered lower on the day…

Source: Bloomberg

Tech and Energy managed to eke out gains on the day while Real Estate stocks were clubbed like a baby seal as rates ripped higher…

Source: Bloomberg

VIX pushed back above 19 intraday…

Source: Bloomberg

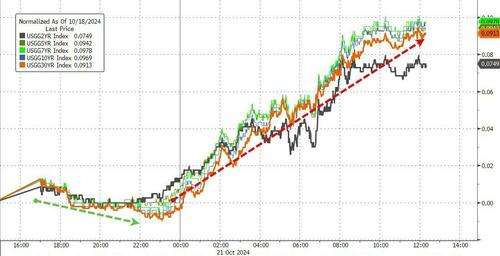

Another day, another bloodbath in bond-land (with yields up 7-10bps across the curve). Non-stop selling pressure from the European open…

Source: Bloomberg

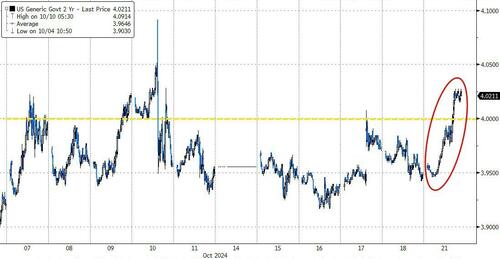

2Y yields are back above 4.00%…

Source: Bloomberg

…and 10Y yields back at 3mo highs, perfectly testing its 200DMA…

Source: Bloomberg

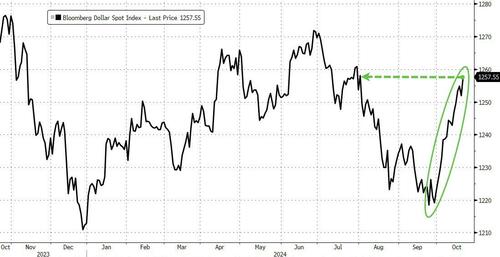

The dollar rallied once again to the highest since August 1st…

Source: Bloomberg

Gold surged to a new record high this morning before someone decided to pull the rug…

Source: Bloomberg

Silver continued to outperform Gold today

Source: Bloomberg

WTI rallied back above $70 today, erasing Friday’s losses…

Source: Bloomberg

Bitcoin rallied up to $69,500 before tumbling back to $67,000 today…

Source: Bloomberg

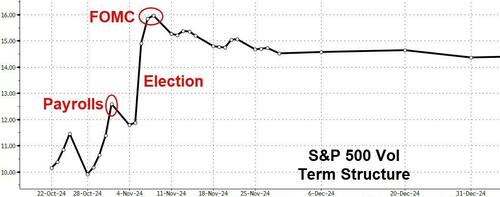

Finally, the event risk ‘lump’ is becoming more and more clear for that first week of Nov…

Source: Bloomberg

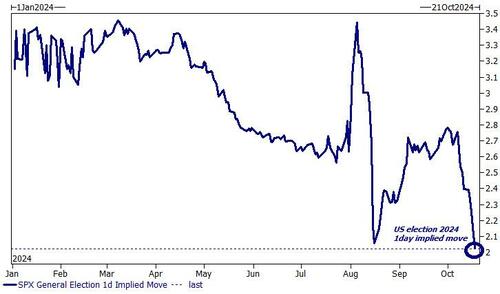

But, as Goldman Sachs Brian Garrett notes the implied move for the US presidential election stands at 2%…

“This is the lowest reading since we began tracking the excess variance…

I would start to argue this is perhaps getting a little too low.”

Source: Goldman Sachs

There are ten full trading sessions left between now and election day – do you feel lucky?

Tyler Durden

Mon, 10/21/2024 – 16:00

via ZeroHedge News https://ift.tt/y3EM19f Tyler Durden