GM Reports “Solid” Demand For High Margin Vehicles, Tweaks Guidance Higher

Slow and steady is often the best case when you’re operating a low margin legacy auto business, and for now General Motors looks to be on course, despite the softening overall trend in autos.

The company reported “solid” U.S. demand for high margin vehicles and posted better than expected results this morning, tweaking its full year guidance higher in the process, according to Bloomberg.

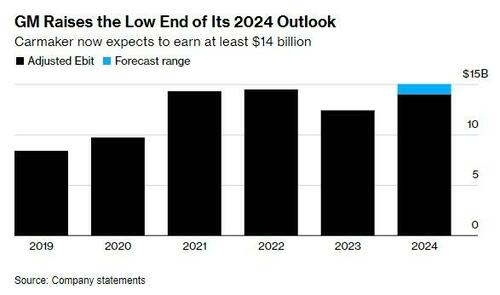

On Tuesday, GM raised its 2024 adjusted earnings forecast to at least $14 billion, up from $13 billion. While competitors cut prices to clear inventory, GM maintained strong profits from high-demand models like the GMC Yukon and Chevy Silverado, offsetting losses in its EV segment and struggles in China.

Chief Financial Officer Paul Jacobson said on Tuesday morning: “Our year-over-year performance has been very strong. We’ve been able to grow retail share with above average prices, below average incentives and well managed inventory. This has put us in a position to update guidance once again.”

The Bloomberg report said US new vehicle sales have declined for two consecutive quarters, dropping 1.9% in the latest period, as high prices and financing costs deter buyers. However, GM preserved margins through price discipline and inventory management.

For the quarter ending Sept. 30, GM reported flat net income of $3 billion, with adjusted earnings rising to $2.96 per share, beating analyst expectations of $2.45.

GM raised its 2024 adjusted automotive cash flow forecast to $12.5-$13.5 billion, up from a previous high of $11.5 billion, and ramped up stock buybacks, repurchasing nearly 250 million shares in the past year.

CEO Mary Barra commented on the upcoming election: “We’ll continue to engage constructively with the policy making process regardless of the election outcome. We’ll make adjustments to the extent that we can to continue to drive growth and profitability.”

This drove its per-share earnings beat, though GM slightly trimmed its full-year net income outlook by $300 million to $11.1 billion. Despite increasing EV production, the company continues to lose money on electric models, with CEO Mary Barra pledging to achieve profitability in the segment “as quickly as possible.”

Tyler Durden

Tue, 10/22/2024 – 12:45

via ZeroHedge News https://ift.tt/Wb38peI Tyler Durden