Japan’s Ruling Coalition To Lose Majority For First Time Since 2009: What Happens Next And How Will Markets React

In a surprising turn of events, Japan’s ruling Liberal Democratic Party and its coalition partner are set to lose their majority in Sunday’s election, according to a forecast from public broadcaster NHK, raising questions about the future of Prime Minister Shigeru Ishiba.

Amid voter discontent over a slush-fund scandal, not to mention Japan’s worst runaway inflation in generations, the LDP and Komeito appear likely to fall short of the 233 seats needed for a majority in the lower house of parliament, NHK forecasts. Ishiba had aimed to secure a majority with his coalition partner, recognizing that the LDP would not retain the 247 seats it held before the election.

Falling short of that goal would mark the first time the LDP has lost a coalition majority in an election since 2009.

Public support for the LDP nosedived after the revelations last year that party members were secretly enriching themselves with funds from supporters, similar to what politicians do everywhere else around the world and especially in the US. As a result, nearly every poll before the election suggested the LDP would lose seats and possibly its majority with Komeito because of the scandal.

“We couldn’t dispel public anger over the political funds issue,” Ishiba said Sunday. When asked if he would consider forming a coalition with other parties, he said no decisions had been made, but added that he was willing to cooperate with others if policies align.

The early vote count shows the LDP and Komeito with a combined 145 seats, according to NHK. The main opposition Constitutional Democratic Party of Japan has 112 seats, the broadcaster said. CDP leader Yoshihiko Noda said he would seek to take over the government if the coalition loses its majority.

“If the LDP does indeed lose its majority powers, this could create a quagmire regarding the legislative process — a scenario which may not bode well for the yen and the Nikkei, at least in the short term,” said Tim Waterer, Sydney-based chief market analyst at KCM Trade.

What does this mean for Japan’s markets?

Below we share some preliminary thoughts from Goldman Japan FICC trader Ippei Yamaura, who writes that “the bottom line is negative for Japan equities” and while “positioning looks good, investors are too optimistic for helps from DPP and/or Ishin.”

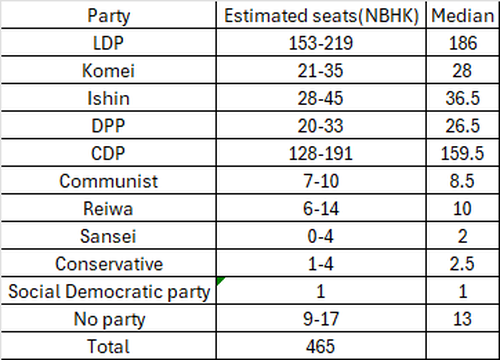

Estimated result

Here is the estimated range of each party as of now(9:40pm JST). Several news sources say LDP+Komei fail to keep majority(233 seats or more).

What is the expected price action?

In Yamaura’s view, the Nikkei will drop on Monday and end down 2% or so, less than option market indicated as of last Friday. This is because investors are somewhat prepared for this scenario. However, the selloff will continue for a week or so as investors realize that it will be difficult for LDP to get support from DPP and/or Ishin.

Is this surprising?

The outcome is not a big surprise but was not fully priced in. After Asahi (highly reputed poll conductor for general elections) reported the chance of LDP+Komei to lose majority, market started to price in it through selling equities. NKY option market looked pricing roughly 3-4% move on tomorrow as of last Friday. Assuming investors looked at 5% selloff in NKY in the scenario of LDP+Kome failure, market might price 60-80% chance of this result. From this point, the option market was well prepared but (as you know,) options are just one aspect of investors’ view. Experts(including Goldman’s political analyst) saw around 50% chance of this scenario. For these investors, this result should be a surprise.

What was the expected implication and how much was priced in as of last Friday?

- LDP would keep simple majority(233+)=5%. In this scenario, the expected market move would be equities to go higher, yen to strengthen.

- LDP+Komei would keep majority(233+) = 35%. In this scenario, the expected market move would be equities to go higher and JPY to go stable.

- LDP+Komei would fail to keep majority = 60%. In this scenario, the expected market move would be equities to go lower and JPY to weaken as LDP may need support from Ishin or CDP, both of which favor easy monetary policy.

So it means #3 scenario is realized although more investors might see it as main scenario.

What will happen now?

Prime minister Ishiba must hold a special diet session by Nov 26 and appoint the prime minister. The new prime minister will need to get nomination from both upper house and lower house. And if there is conflict between upper house and lower house, lower house nomination will be prioritized. Upper house nomination is not an issue as LDP+Komei have majority. But as they lose their majority in the lower house, without cooperation from some lower house members outside of LDP+Komei, they cannot nominate the new prime minister. Ishiba may now try to get support (with early Nov the likely limit). Here are some options.

1. Re-endorse LDP members who couldn’t get endorsement from LDP due to money scandals.

This is the most probable scenario. But there are 2 problems. First, there may not enough numbers of members this time. As of now, it is expected that only 4 members out of 10 non-endorsed members will be back to parliament. 4 is not enough to cover such a big loss. Second, it is unclear if the abused members will help Ishiba. Some LDP members, especially right wing members, already complained about Ishiba and cabinet during campaign period. According to Goldman, “there may be big dissatisfactions.”

2. Try to get support from CDP and/or Ishin

DPP and Ishin have some similarities like defense policies etc. As #1 is not effective option anymore, Ishiba may try to pursue this option by forming a cabinet together. It looks like majority of investors are optimistic about this option. However, it’s worth highlighting that the leader of both DPP and Ishin denied this option in advance. Of course, this can be a political bluff. But experts believe it is not. The reason is upper house election which will be held on July 25, 2025. Experts think if DPP and Ishin joined cabinet now, they would soon lose popularity as majority of voters for them expected they would fight with LDP.

What will happen if LDP+Komei cannot get help from anybody?

Ishiba may be forced to form “Minority government”. It means he would need to manage a cabinet without support from parliament. In order to get nomination from lower house, he may need to do many concession and get support from some opposition parties. As many of the majority parties’ policies are not market friendly, this can possibly affect market negatively. Opposition parties may change their stance policy by policy. It means Ishiba and LDP cannot implement their policies as they stand.

What are other things to watch?

The supplemental budget should be a big focus. Ishiba previously said he would form a supplemental budget of JPY13 trillion or more (although he previously denied such a big fiscal expenditure). LDP may want to form as big budget (including cash distribution to lower income people) as possible to recover popularity. But opposition parties may try to limit it. Usually, Japanese equities favor a bigger budget (as do all equities, everywhere). So closely watch what opposition parties say on this. Generally speaking, at least the DPP is supportive of fiscal expansion.

Tax is also a key focus too. Ishiba is generally supportive of raising taxes. However, after such a big loss, there may be big opposition for further tax hikes. DPP is said to be supportive for fiscal expansion. It means raising tax (especially income tax) is less likely now (Except for financial income tax).

What does the positioning look like now?

Overall positive.

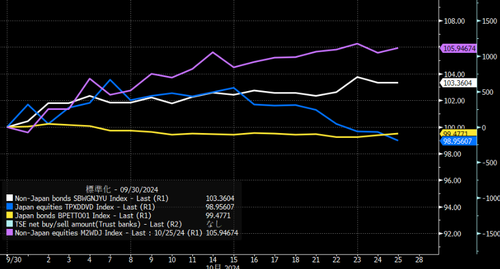

CTAs=Flat to slightly negative.

CTAs have already re-built longs for Japan equities. Goldman’s strats team expects CTA to sell again if the market goes lower. But also worth noting that positions for Japan equities is less than its peak.

Long/Short=flat

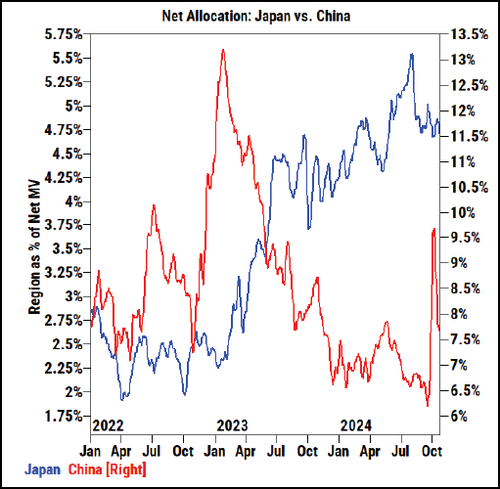

Our PB data suggests net allocation for Japan equities remain low despite big fluctuation of China market. Long/Short investors have not come back yet since the big selloff in early Aug.

Long onlys = Positive

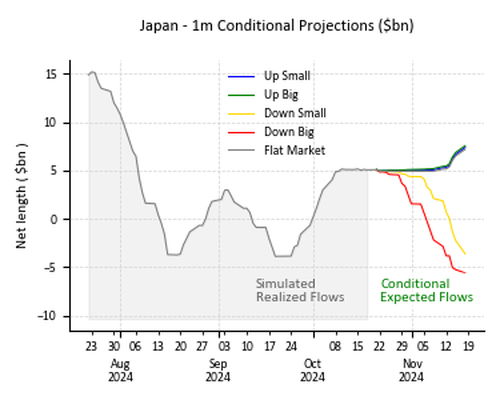

As Japanese equities went lower with weakening yen, the asset is the worst performance in major assets MTD. Yamaura expects some investors may need to buy Japan equities into month end to keep the same level of exposure.

Retail = Not bad

If you look at margin data, retail position has not been fully back yet since Aug selloff. They may have some room to buy on dip.

To summarize Goldman’s view: Monday’s selloff will be milder than the option market indicated, but the selloff will not be limited to just 1 day.

More in the full Goldman note available to pro subs.

Tyler Durden

Sun, 10/27/2024 – 12:15

via ZeroHedge News https://ift.tt/NYr72Qu Tyler Durden