Futures Higher As Performative Israeli ‘Retaliation’ Sends Oil Plunging

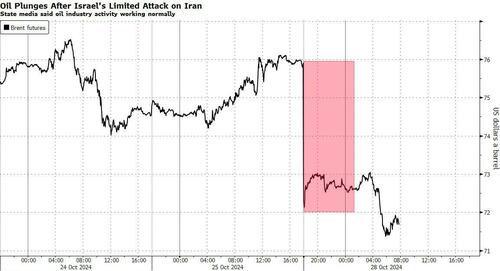

As we enter the most hectic two-week period of the year, futures are stronger following the S&P’s first weekly loss in 7 weeks; both Tech and Small-Caps are outperforming with the yield curve bear steepening and USD flat reversing an earlier spike as a splunge in the yen also reversed following a shock outcome to Japan’s election this weekend which saw the ruling LDP lose its parliamentary coalition majority for the first time since 2009. A sense of relief swept through markets after Israel’s retaliatory strikes against Iran was just as performative as back in April, and avoided oil and nuclear facilities, with crude tumbling 5%. As of 8:00am ET, S&P futures were up 0.5%, but well off session highs; Nasdaq futures gained 0.6% with Mag 7 and semi stocks higher premarket. Oil/Energy commodities plunge, WTI down 6%, as the latest Israeli attack was another “straight to DVD” production and avoided energy facilities in Iran. Base metals have a bid but the balance of the commodity complex is lower. It’s an extremely busy week, with payrolls on Friday and over 40% of the S&P reporting earnings, but today’s macro calendar is light with only Dallas Fed calendar but keep any eye on Japanese politics and any potential read-through for the US yield curve and Credit demand.

In premarket trading, airlines, whose fuel costs are linked to oil prices, were among the biggest gainers while energy stocks fell. Exxon Mobil (XOM) declined 2%, falling with other energy stocks amid a drop in Brent crude. Occidental Petroleum (OXY) -2%, Schlumberger (SLB ) -2% and others were also down big. United Airlines (UAL) gained 2%, climbing with other airline stocks which are getting a boost as a drop in Brent crude prices signaled a potential impact on jet fuel costs. Boeing declined after launching $19 billion share sale to address liquidity needs. Here are some other notable premarket movers:

- ADT (ADT) slips 2% after holder Apollo Global Management offers 56 million shares.

- Procept BioRobotics (PRCT) rises 14% after the surgical robotics company boosted its year forecast.

- Sunrun Inc. (RUN) gains 5% as the company is in discussions with data center developers to supply distributed solar power generation for their facilities.

- Delta Air Lines (DAL) +2%, American Airlines (AAL) +3%

Oil slumped more than 6%, while gold also retreated after Israeli jets struck military targets across Iran on Saturday, delivering on a vow to retaliate for a missile barrage at the start of the month, but the attack was far more muted than most had expected. Israel’s shekel strengthened the most among about 150 currencies tracked by Bloomberg.

Iran said its oil industry was operating normally following Israel’s attacks on military targets. That eased geo-political tensions as markets prepare for a week packed with key economic data and corporate earnings. Among those are results for five of the “Magnificent Seven” big-tech behemoths, as well as eurozone and US economic-growth prints and a monthly payrolls report. And then comes the presidential election on Nov. 5, with markets increasingly pricing in a stocks-boosting victory for Donald Trump and the Republicans.

“Four factors are driving US equities higher right now: better macro data, solid third-quarter earnings, rising expectations of a Republican sweep and lower risk of an escalation in the Middle East,” said Wolf von Rotberg, an equity strategist at Bank J. Safra Sarasin. The Magnificent Seven earnings “are likely to provide another lift to S&P 500 earnings growth,” he said.

For the US bond market, already stung by the worst selloff in six months, the coming days will be crucial, as they feature the Treasury Department’s announcement on Wednesday on the scale of its debt sales. The 10-year Treasury yield rose about two basis points, while a gauge of the dollar was steady.

In Europe, the Stoxx Europe 600 erased an early gain, as heavy losses in oil-related shares offset gains in construction and media stocks which were the best performers. Energy majors Shell Plc, TotalEnergies SE and BP Plc weighed on the gauge. Royal Philips NV dropped 18% after the Dutch medical-technology firm cut its sales outlook. Porsche AG shares fell after the German carmaker reported earnings that fell short of analysts’ expectations. Here are some of the biggest movers on Monday:

- Sonova shares rise as much as 6.4%, most since May and to the highest level in over two years, as analysts flag plans by Costco to resume selling Sonova’s hearing aids.

- Trainline shares rise as much as 12%, hitting their highest level in more than six months, after the e-ticketing platform raised its guidance for the second time this year.

- Opmobility shares surge as much as 13%, the most since Nov. 2020, after the French auto parts maker outperformed analyst expectations in the third quarter.

- Eurofins shares climb as much as 1.9% in Paris after the laboratory-testing company said it will buy Synlab’s clinical diagnostics operations in Spain.

- Philips shares plunge as much as 18%, the most since September 1998, after the Dutch medical-technology firm reported third-quarter sales that missed expectations and lowered its comparable sales forecast for the full year.

- Porsche shares fall as much as 3.8% after the German firm reported results on Friday evening where automotive free cash flow was called a major miss by Bernstein.

- Wacker Chemie shares fall as much as 1.7% after the German chemicals company’s third quarter Ebitda and free cash flow missed consensus estimates.

- Traton shares fall as much as 3.5% as the German truckmaker reported what analysts called unsurprising results, with Warburg pointing out that unlike Volvo and Paccar, the firm has yet to provide a FY25 market outlook.

- Computacenter shares drop as much as 2.1%, hitting their lowest level in more than a year, after the company warned it experienced a softer end to the third quarter than hoped and that annual adjusted pretax profits will be modestly below the year before.

- KPN shares fall as much as 2.5% as the Dutch telecom operator reported weaker-than-expected sales at its consumer-facing arm.

Earlier in the session, Asian stocks edged higher, as gains in Japan offset losses in some other markets in the region. The MSCI Asia Pacific Index rose as much as 0.3%, snapping a five-day drop, with Japanese exporters including Toyota Motor among the biggest boosts to the index after the yen extended losses. Political risk put pressure on the currency as investors mulled the implications of the failure by Japan’s ruling coalition to win a majority in parliament. Stocks swung between gains and losses in mainland China after profits at industrial firms declined at a faster pace in September compared with a month earlier. Investors will also be watching for earnings from Chinese banks for clues on the impact of Beijing’s stimulus measures. Shares in Hong Kong traded higher.

“Despite the political noise, yen weakness, more spending and structural corporate reforms in Japan may keep Japanese equities attractive, especially amid potential supply chain shifts and Japan’s role as a stable regional player,” said Charu Chanana, chief investment strategist at Saxo Markets in Singapore.

In FX, the Bloomberg Dollar Spot Index is little changed, drifting slightly lower as traders awaited key data including non-farm payrolls later this week. The yen underperformed all other Group-of-10 currencies after Japan’s ruling coalition failed to win a majority in parliament for the first time since 2009, setting the country up for a period of instability. USD/JPY rose as much as 1% to 153.88, the highest since July, as a gamble by Prime Minister Shigeru Ishiba to call an early election backfired. Dollar buy stops above the Oct. 23 high of 153.19 were triggered, some of which were momentum-related, according to an Asia-based FX trader. However, since its earlier gap lower, the yen pared declines and at last check the USD/JPY was up 0.2% at 152.60, down more than 100 pips from session highs. “Uncertainty around whether Ishiba can continue as Prime Minister and also the formation of the next government in Japan will likely keep some weakening pressure in JPY in the near-term,” MUFG analyst Michael Wan writes in note.

In rates,longer-dated Treasuries remain slightly cheaper on the day, with yields in retreat following an opening gap higher as oil slumps. 10-year yields rose 2bps to 4.26%, after rising as high as 4.29% earlier; Longer-dated yields are cheaper by 1bp-2bp with shorter maturities little changed, steepening 2s10s and 5s30s spreads by ~1bp; UK and German 10-year yields are now slightly lower with bunds and gilts in the sector outperforming by 2.5bp and 3bp on the day. US session includes auctions of 2- and 5-year notes, while Fed officials are in self-imposed quiet period ahead of Nov. 7 policy announcement. The final Treasury auction cycle of the August-to-October financing quarter begins with $69b 2-year note at 11:30am New York time, followed by $70b 5-year note at 1pm. Cycle concludes Tuesday with $44b 7-year notes

In commodities, oil prices gapped lower at the open and slid further during the European morning session, aiding a rebound in European government bonds. Brent was about 6% lower after the much-awaited Israeli attack on Iran steered clear of oil infrastructure

Looking at today’s US economic data calendar we only have the October Dallas Fed manufacturing activity at 10:30am; ahead this week are JOLTS job openings, consumer confidence, ADP employment change, PCE price indexes and jobs report. Tech giants slated to report quarterly results this week include Google, Meta, Microsoft, Apple and Amazon

Market Snapshot

- S&P 500 futures up 0.5% to 5,878.00

- STOXX Europe 600 up 0.3% to 520.60

- MXAP up 0.3% to 187.06

- MXAPJ little changed at 600.08

- Nikkei up 1.8% to 38,605.53

- Topix up 1.5% to 2,657.78

- Hang Seng Index little changed at 20,599.36

- Shanghai Composite up 0.7% to 3,322.20

- Sensex up 1.0% to 80,232.43

- Australia S&P/ASX 200 up 0.1% to 8,221.52

- Kospi up 1.1% to 2,612.43

- German 10Y yield little changed at 2.32%

- Euro up 0.1% to $1.0812

- Brent Futures down 4.6% to $72.57/bbl

- Gold spot down 0.4% to $2,736.26

- US Dollar Index little changed at 104.31

Top Overnight News

- Boeing Co. launched a nearly $19 billion share sale, one of the largest ever by a public company, to address the troubled planemaker’s liquidity needs and stave off a potential credit rating downgrade to junk. Goldman is lead underwriter: BBG

- Chinese industrial profits dive in Sept, raising anticipation even further for the upcoming NPC (11/4-8), at which Beijing is expected to unveil additional fiscal steps aimed at bolstering the economy. SCMP

- The yen slid to a three-month low after Japan’s ruling LDP coalition failed to win a majority in parliament, setting the stage for more political wrangling. Export-related companies led Nikkei 225 gains. BBG

- BOJ officials pledge to improve their communication with markets to avoid the type of turmoil sparked by its Aug rate hike. RTRS

- Israel’s assault on Iran early Saturday, coordinated with Washington and limited to missile and air defense sites, was more restrained than many expected and may help diplomatic efforts to return hostages and limit the combat in both Lebanon and Gaza. BBG

- France’s credit rating was placed on neg. watch by Moody’s due to the country’s rising fiscal challenges. BBG

- Economists increasingly worried about upside inflation risks after the election as Harris and Trump have both proposed policies that could push prices higher (although Trump’s agenda is much more inflationary than Harris’s platform). WSJ

- VW aims to close at least three German plants, the company’s top labor official said. The carmaker is also seeking a 10% salary cut for all employees, the works council said. BBG

- Russia is receiving top-end Dell servers, containing AI chips made by Nvidia or AMD, from an Indian pharma company, trade-tracking data show. The findings underscore the holes in US and EU attempts to shut off Moscow’s access to sensitive technology. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive as markets digested key events over the weekend including Israel’s strike on Iran which was aimed at military targets and not petroleum or nuclear facilities, while the election in Japan saw the ruling coalition lose its majority. ASX 200 traded indecisively as gains in tech and the mining sectors offset the weakness in real estate, utilities and energy. Nikkei 225 quickly shrugged off the initial post-election jitters and surged on the back of a weaker currency and prospects that the political uncertainty could delay the resumption of the BoJ’s rate normalisation. Hang Seng and Shanghai Comp swung between gains and losses but ultimately eked mild gains after the PBoC announced it is to utilise outright reverse repo operations today, which will be conducted on a monthly basis and is a new policy tool aimed at managing liquidity.

Top Asian News

- PBoC announced to conduct an outright reverse repo operation today and will conduct monthly outright reverse repo operations once a month with a tenor of less than one year which it will use to trade with primary dealers in the opening market. Chinese press noted that the PBoC’s new outright reverse repo will cover tenors including 3-month and six-month, while it will improve liquidity adjustments in the year ahead with the tool meant to counteract the maturing Medium-term Lending Facility loans towards year-end.

- CNOOC (883 HK) Q3 (CNY): Net 36.9bln, +9% Y/Y, Revenue 99.2bln (prev. 114.8bln Y/Y).

- Sinopec (386 HK) Q3 (CNY) IFRS Net 8.03bln, -55% Y/Y.

European bourses, Stoxx 600 (+0.4%) are almost entirely in the green (ex-AEX), with traders garnering optimism following the relatively moderate Israeli attack on Iran, which saw the former avoid hitting energy/nuclear facilities; indices have slipped off best levels in recent trade. European sectors hold a strong positive bias; Construction & Materials takes the top spot with Chemicals in second and Media in third. Energy is by far the clear underperformer, hampered by losses in the crude complex, following the aforementioned geopolitical updates. US Equity Futures (ES +0.4%, NQ +0.5%, RTY +0.4%) are entirely in the green, continuing the price action seen in Europe, which have ultimately benefited from the moderate Israeli attacks on Iran over the weekend.

Top European News

- UK PM Starmer said the Budget will include tough decisions and a long-term plan, with Chancellor Reeves due to announce tax hikes and extra borrowing, according to Bloomberg. The Times suggests that tax hikes could amount to GBP 35bln.

- UK Chancellor Reeves said the UK government is to announce GBP 500mln in aid from energy suppliers, while the announcement could be made in the upcoming budget.

- UK retail investors are “piling” into Gilts amid fears that the Labour government will raise the capital gains tax rate on shares in the budget this week, according to The Times.

- ECB’s Knot said he expects the Eurozone economy will strengthen and inflation risks have become more balanced, while he added it is too soon to declare victory over inflation and that it is important the ECB keeps all options on rates. Furthermore, Knot said need to see a bit more conviction that wages will fall as forecast and the labour market is tight, as well as noted that the market has brought forward the path for rate cuts and they will have to see in December if that was over-enthusiastic.

- ECB’s Nagel said they shouldn’t be too hasty in taking action on rates.

- Georgian President Zourabichvili said regarding the election results that they have been the victims of a Russian special operation and that Georgian authorities took away citizens’ right to choose, while she does not recognise the election results due to fraud and called for protests against the results. Furthermore, European Council President Michel said they call on Georgia’s central election committee and other authorities to swiftly, transparently and independently investigate and adjudicate electoral irregularities and allegations.

- Moody’s affirmed France at Aa2; Outlook revised to negative from stable.

Japanese Election

- Japan’s ruling coalition lost its parliamentary majority in Sunday’s election in which the LDP and its junior coalition partner won 209 seats with all but 20 of the 465 seats accounted for, which is short of the 233 needed for a majority although the ruling party may seek partners in an effort to form a government, according to reports citing Japanese press.

- Japanese PM Ishiba said the election results were very difficult, while he responded “That would be the case” when asked if he would continue in his current position despite the election results. Furthermore, Ishiba commented that they cannot allow any gaps in domestic politics amid very difficult security and economic conditions, while he added that they must go ahead with various measures including compiling an extra budget. Furthermore, Ishiba said he is not thinking at this moment specifically about a new coalition and will compile an economic stimulus package and extra budget taking into account various parties’ ideas.

- Japan’s gov’t & ruling bloc are to arrange to convene a special parliament session to vote on the PM on November 11th, via Kyodo.

FX

- USD is mixed vs. peers (softer vs. EUR, firmer vs. JPY) with DXY a touch lower but firmly on a 104 handle. Today’s docket is fairly thin, but picks up in the form of US ADP, GDP, PCE, NFP and ISM Manufacturing all due later in the week.

- EUR is firmer vs. the USD and the best performer across the majors in an attempt to claw back recent losses that dragged the pair as low as 1.0760 last week. EUR/USD has made its way back onto a 1.08 handle but is yet to threaten Friday’s 1.0839 peak.

- GBP is marginally firmer vs. the USD but with Cable unable to make its way above Friday’s high at 1.2999 and back onto a 1.30 handle. UK Budget will be in focus this week; Chancellor Reeves is expected include a series of tax hikes but ultimately be viewed as expansionary. For now, Cable is pivoting around its 100DMA at 1.2969.

- JPY is the laggard across the majors following the Japanese general election which has seen the ruling coalition lose its parliamentary majority. USD/JPY has made its way onto a 153 handle and is now at levels not seen since late July.

- Antipodeans are both flat vs. the USD. After printing a fresh multi-month low overnight, AUD/USD has pared losses and moved back above the 0.66 mark. NZD/USD remains stuck on a 59 handle.

- PBoC set USD/CNY mid-point at 7.1307 vs exp. 7.1311 (prev. 7.1090).

Fixed Income

- USTs are pressured by the removal of geopolitical risk premia though also find themselves off lows as the pullback in energy prices begins to weigh on yields and exert upward pressure on benchmarks; though, still very much in the red. US docket is front-loaded on account of the Fed, with 2yr & 5yr supply today serving as another bearish factor and likely explaining the relative. USTs are currently trading around 110-25 and off the lows of 110-18+.

- Bunds are on the back-foot given the aforementioned removal of geopolitical risk premia. Overnight pressure was also a function of ECB speakers, with Knot & Nagel both making relatively hawkish remarks; in recent trade, the complex has lifted off worst levels, given the continued pressure in oil prices; currently looking to test 133.00 to the upside.

- Gilts are softer in-fitting with the above but finding itself under slightly more pressure with the count down to the budget in its final stages. Gilts gapped lower by 71 ticks before slipping a handful further to a 95.52 trough.

Commodities

- The crude complex is under marked pressure after Israel’s retaliation against Iran targeted military targets and avoided petroleum or nuclear facilities. Attacks which caused crude to gap lower by around USD 3/bbl before slipping further to current troughs of USD 67.14/bbl and USD 71.00/bbl respectively for WTI & Brent.

- Spot gold is softer, as the metal is tarnished by the removal of some geopolitical premia from the market after Israel’s retaliation. Pressure which has taken gold to a USD 2724/oz base, still comfortably above the last two week’s troughs at USD 2717/oz and USD 2715/oz respectively.

- Base metals are under pressure despite the constructive risk tone. However, the pressure is relatively modest in nature with 3M LME Copper comfortably clear of USD 9.5k.

- China’s September YTD gold output fell 1.17% Y/Y to 268 metric tons and gold consumption fell 11.18% Y/Y to 741.7 metric tons, according to the Gold Association.

Geopolitics: Middle East

- Parties concerned (re. Israel) are looking into the possibility of resuming negotiations and meeting technical teams within days, via AJ Breaking.

- Israel conducted a military strike on targets in Iran early on Saturday and the military said the retaliatory strike has been completed with the objectives achieved, while targets included missile manufacturing facilities used by Iran in its attacks on Israel over the past year. Furthermore, a US official noted that Israel’s strikes were on military targets in Iran as opposed to oil infrastructure or nuclear sites, while Iran said the Israeli strike killed four people who all served in the country’s military air defence.

- Israeli PM Netanyahu said the Israeli air force hit hard Iran’s ability to defend itself and its ability to produce missiles, while he added Israel’s attack on Iran was strong, precise and achieved all of their objectives, according to Reuters.

- Israeli politicians inside and outside PM Netanyahu’s coalition lamented the strikes as not aggressive enough, according to The New York Times. It was also reported that estimates in Israel indicate Iran would need a year before it can rebuild its missile capabilities, according to Sky News Arabia.

- Israel’s Channel 13 quoted military officials that stated they do not rule out that the Air Force will have to carry out another military operation in Iran in which any further attack on Iran will focus on government targets and infrastructure, while they will not strike any Iranian nuclear targets in any new attack, according to Sky News Arabia.

- Israel expects that Iran would launch a counterattack against the Jewish state in response to its successful strike against Iranian military targets including missile production facilities, according to security sources cited by Jerusalem Post.

- Iran’s Supreme Leader Khamenei said Israel’s attack should neither be downplayed nor exaggerated and noted officials should determine how best to demonstrate Iran’s power to Israel, according to IRNA.

- Iran’s President said Iran is not seeking war but will respond appropriately to Israel’s attack, according to state media.

- Iran’s Foreign Minister said Iran has no limits in defending its territorial integrity, according to Tasnim. The minister also stated in a letter to the UN Secretary-General that Tehran reserves the right to respond to Israel’s criminal aggression.

- Iranian air defence said Israel attacked certain military centres in Tehran, Khuzestan and Ilam, while it successfully tracked and countered Israeli aggression although limited damage was caused to some locations, according to Reuters. It was also reported that Israel sent a message to Iran before the attack and warned it not to respond, according to Axios. Furthermore, Sky News Arabia quoted unanimous sources that stated Iran informed Israel through a foreign mediator that it will not respond to the strike.

- IRGC commander said the Israeli attack failed to achieve its goals and the failure confirms Israel’s miscalculation, while the commander added that bitter and unimaginable consequences await Israelis, according to Sky News Arabia.

- US President Biden said he hopes the Israeli strikes against Iran are the end and it looks like Israel didn’t hit anything except military targets. It was separately reported that a senior Biden official said the direct military exchange between Israel and Iran should be over and warned that there will be consequences for Iranian responses, according to Reuters.

- Israel conducted an airstrike that targeted some military sites in central and southern areas of Syria, according to Syrian state media.

- Hezbollah urged residents of more than two dozen Israeli settlements to immediately evacuate and said these settlements have become bases for the Israeli military and are now legitimate targets. Hezbollah also said it targeted Israel’s Tel Nof airbase south of Tel Aviv with drones, according to Reuters.

- Egyptian President Sisi said Egypt proposed a two-day ceasefire in Gaza to exchange four Israeli hostages with some Palestinian prisoners, while he added talks will take part within 10 days of implementing a temporary ceasefire to reach a permanent one. However, Israeli media later reported that two ministers rejected the proposal by Egypt regarding a Gaza ceasefire, according to Sky News Arabia.

- Iran’s Interior Ministry said ten Iranian border guards were killed in the attack in southeastern Iran in the latest clash with suspected Sunni Muslim militants.

Geopolitics: Other

- Russian President Putin said he hopes NATO heard his words about permitting Ukraine to fire Western long-range weapons at Russia and warned Russia will use a range of responses if Ukraine is permitted to strike into Russia with Western long-range weapons, according to TASS.

- Russian forces took control of the village of Izmailivka in Ukraine’s Donetsk region and captured Oleksandropil in eastern Ukraine, according to RIA.

- NATO said a high-level delegation from South Korea will brief the North Atlantic Council on Monday regarding North Korean troop deployment to Russia.

- Foreign and defence ministers from South Korea and the US will hold talks on October 31st.

- US State Department approved the potential sale of radar turnkey systems to Taiwan for an estimated cost of USD 828mln and the potential sale of advanced surface-to-air missiles system to Taiwan for an estimated cost of USD 1.19bln. It was also reported that China said it filed a diplomatic complaint with the US and reserved the right to retaliate after the weapons sales to Taiwan, according to Bloomberg.

US Event Calendar

- 10:30: Oct. Dallas Fed Manf. Activity, est. -9.2, prior -9.0

DB’s Peter SIdorov concludes the overnight wrap

For markets, the positive mood that dominated so far this autumn saw a mini-scare last week, as the S&P 500 fell for the first time in six weeks, while the bond sell-off continued apace. There’ll be plenty to test the market nerves with this week’s bumper set of data releases, including US payrolls on Friday, and earnings reports, with five of the Magnificent 7 reporting. Meanwhile, the tight US election campaign will enter its final stretch.

One market fear that has eased over the weekend is escalation risks in the Middle East. This comes as overnight into Saturday Israel carried out retaliatory strikes against Iran, but with these targeting military facilities and avoiding oil or nuclear installations. The targeted scope of the attack and the absence of an immediate retaliation signal have seen markets price out some of the geopolitical risk premium. Brent crude is down around -4.5% lower to below $73/bbl in Asia trading, reversing last week’s 4% rise. Gold is down -0.60% from Friday’s record high, while US equity futures are posting decent gains with those on S&P 500 and NASDAQ +0.50% and +0.65% higher, respectively.

Meanwhile, Treasuries are extending their recent decline. 10yr yields are +3.2bps higher to 4.27% as I type, their highest level since July, having now risen by 65bps from their September lows. This rise has come amid both rising term premia, partly driven by concerns about US fiscal deficits, and growing skepticism that the Fed will deliver rapid rate cuts given solid US data. Indeed, Fed funds futures for end-25 are up to 3.53% this morning, having priced out three 25bps cuts over the past six weeks.

With the Fed now in the blackout period ahead of next Thursday’s meeting, the data will be doing the talking this week, with the marquee release being the October payrolls report on Friday. Our US economists foresee a sizeable slowing in headline (+100k forecast vs. 254k previously) and private (+75k vs. 223k) payrolls. However, this envisages a nearly -70k drag due to striking workers (mostly Boeing) and the weather impact of Hurricane Milton. The weather effect may also push up average hourly earnings (+0.6% vs. +0.4%). DB expects unemployment to tick up a tenth to 4.2% amid rising labour force participation, but the risk is that it remains at 4.1%. Given the likely noise in the payrolls, the market may pay extra attention to Tuesday’s JOLTS report for September. Given the strong September payrolls, the hiring rate may pick up from the historically low 3.3% in August. The last JOLTS print also saw the quits rate, one of the best leading indicators of wage growth, fall to 2.1%, its weakest since 2015 if one excludes the first few months of Covid. Other labour market data will include the Q3 Employment Cost Index reading (DBe: +0.9% vs. +0.9%), which is the Fed’s preferred measure of wage growth.

In other US data, we will pay attention to the September personal income release on Thursday, which includes the Fed’s preferred core PCE inflation measure. DB expects core PCE inflation to rise by +0.29% (vs. +0.13% previously), its strongest since March. And Wednesday’s advance Q3 real GDP is expected to show continued solid growth (DBe +2.7% vs. +3.0% previously). On the fiscal side, we have the US Treasury refunding announcement, with borrowing estimates on Monday and the refunding policy statement on Wednesday. Our rates strategists’ preview can be found here.

Over in the euro area, the highlights will be the Q3 GDP print on Wednesday and the October flash inflation release on Thursday, with the latter preceded by the Spain and Germany CPI prints on Wednesday. Our European economists see headline euro area inflation rising from 1.7% to 1.9% but with core inflation slowing by a tenth to +2.6%, which would be its lowest level since January 2022. See our economists Inflation Chartbook here for more.

In the UK, the focus will be on the Autumn Budget on Wednesday. This will be the Labour Government’s first budget in almost 15 years and our UK economist previews it here. Over in Asia, we will have the latest BOJ decision on Thursday, where a hold is widely expected (see our Japan economist’s preview here). And in China, the official PMIs on Thursday and the Caixin manufacturing PMI on Friday will be closely watched to gauge the effectiveness of the stimulus measures outlined by Beijing over the past month.

It will be a bumper week for earnings, with more than 40% of the S&P 500 by market cap expected to report. Following on the blockbuster earnings report from Tesla last week, five more of the Magnificent 7 are reporting this week, including Alphabet (Tuesday), Microsoft and Meta (Wednesday), Apple and Amazon (Thursday). See the rest of the week’s earnings and data releases in the day-by-day calendar at the end.

Last but certainly not least, the US election campaign will enter its final weekahead of the next Tuesday’s vote. Over 40 million early votes have already been cast and the latest polls continue to show a very tight race. The FiveThirtyEight average gives Harris a 1.5pp lead in national polls, but with a 0.6pp lead for former President Trump on average across the seven swing states, all of which see leads of less than 2pp for either candidate. The RealClearPolitics betting average now has former President Trump with a 61% likelihood of victory. That’s the highest it’s been since President Biden dropped out of the race in July, though it has largely stabilised in the past week.

Sticking with politics, a key event over the weekend was Japan’s Lower House election on Sunday, which saw the LDP-led ruling coalition lose its majority for the first time since 2009, getting 215 out of 465 seats. With the main opposition CDP well short of a majority on 148 seats, this leaves a highly uncertain political situation. See our Japan economist’s reaction note here for a discussion of the key points to watch on how this uncertainty will be resolved.

Following on the vote, the Japanese yen is -0.77% lower against the dollar this morning, sliding past the 153 level and touching its lowest level since July. In response, Japanese stocks are rallying this morning with the Nikkei 225 and the Topix trading +1.72% and +1.38% higher, respectively, while 10yr JGB yields are 1.5bps higher at 0.95% as I type. Other Asian markets are showing mixed moves. Chinese markets are mostly lagging behind with the Hang Seng (-0.24%) and the CSI (-0.21%) trading in the red, though the Shanghai Composite is up +0.17%. Elsewhere, the KOSPI (+0.79%) is also trading decently higher whilst the S&P/ASX 200 struggling to find direction in early trading with key inflation data due later this week.

Staying on Asia, data over the weekend showed that industrial profits in China fell -27.1% in September from a year earlier, marking the largest decline this year.

Recapping last week now, markets finally slipped back after a relentless run higher over the preceding weeks, with the S&P 500 ending a run of 6 consecutive weekly gains. By the end of the week, the index was down -0.96% (-0.03% Friday). The Magnificent 7 outperformed, rising by +3.49% over the week (+1.27% Friday) led by Tesla’s +21.97% gain. By contrast, the small cap Russell 2000 fell -2.99% (-0.49% Friday), marking its biggest weekly underperformance versus the Mag-7 since early July. Outside the US, equities mostly struggled, with Europe’s STOXX 600 falling -1.18% (-0.03% Friday), and Japan’s Nikkei down -2.74% (-0.60% Friday).

Sovereign bonds also lost ground last week, and US Treasuries fell back in particular. By the end of the week, the 10yr Treasury yield was up +15.7bps (+2.8bps Friday) to 4.24%, while the 2yr yield was up +15.8bps (+2.6bps Friday). Friday’s move higher was supported by the University of Michigan’s final consumer sentiment index for October, which saw its highest reading in 6 months (70.5 vs. 69.0 expected). European sovereign bonds also lost ground, with yields on 10yr bunds up +10.8bps last week, whilst those on 10yr OATs were up +14.7bps.

Tyler Durden

Mon, 10/28/2024 – 08:26

via ZeroHedge News https://ift.tt/JlgwM89 Tyler Durden