Ugly 2Y Auction Sends Yields To Session High As Trump Odds Soar

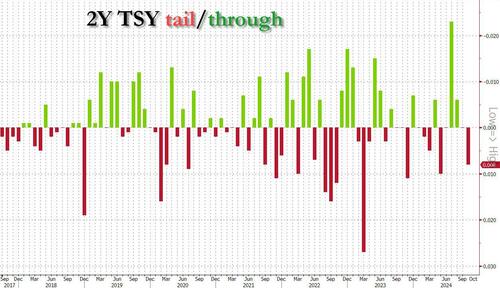

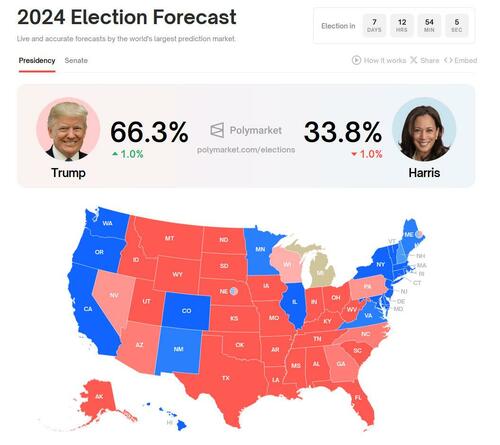

Not only is it an extremely busy week, but ahead of Wednesday’s quarterly refunding (when we are expected to learn about a surge in new Bill issuance which will drain the reverse repo in weeks), we also have a barrage of coupon issuance starting with two offerings today, a 2Y and a 5Y auction, the first of which just priced when $69BN in two year paper sold at a high yield of 4.130%, up sharply from 3.520% last month (thank the resurgent Trumpflation trade for the sharply higher yields as the market prices in much more debt issuance under president Trump 2.0), and the highest since July. The auction also tailed the 4.122% When Issued by 0.8bps, the first tailing 2Y auction since May.

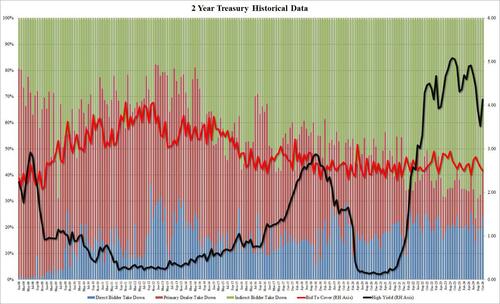

The bid to cover was 2.504, down from 2.588 last month and the lowest since May.

The internals were algo ugly with Indirects awarded just 58.2%, the lowest since May, and with Directs taking down a surprisingly high 23.8%, the most since May, Dealers were left with 17.9%, the biggest such award since December 2023.

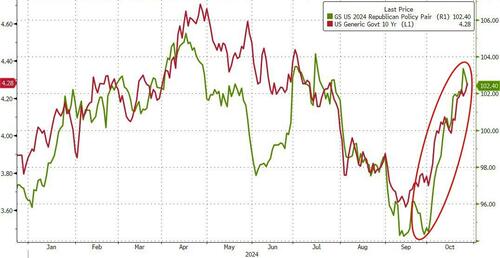

Whether it was because of the poor 2Y auction or just because the market is starting to really price in a Trump presidency…

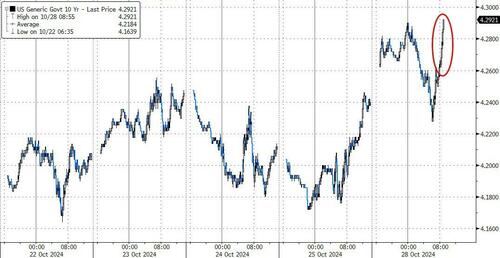

… yields spiked to session highs, with 10s now just shy of 4.30%, a level which even stocks will have no choice but to notice very soon.

Tyler Durden

Mon, 10/28/2024 – 12:04

via ZeroHedge News https://ift.tt/GOELnfm Tyler Durden