US Q3 GDP Growth Disappoints, Despite Surging Personal, Government Spending

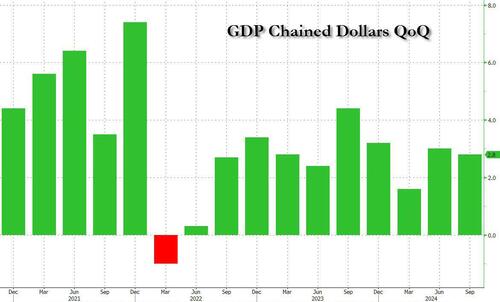

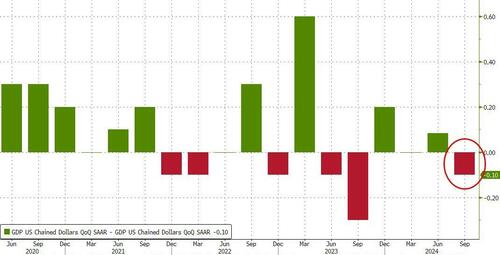

Just moments after ADP published a laughably slanted private payrolls report according to which the US labor force grew by 233K in October (even though we are still in October), 6 standard deviations above the median estimate, moments ago the Biden Bureau of Economic Analysis came out with its own surprise when it reported in its first assessment of Q3 GDP that the US economy grew at a 2.8% rate, down from 3.0% in Q2…

… and below the 2.9% median estimate, the first ‘miss’ since Q3 2023…

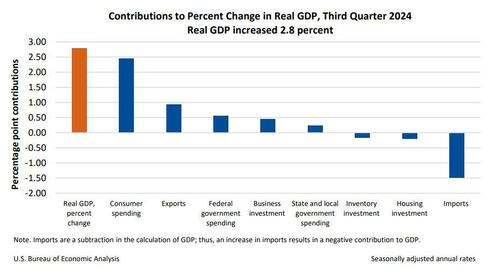

As the BEA notes, the increase in the third quarter primarily reflected increases in consumer spending, exports, and federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

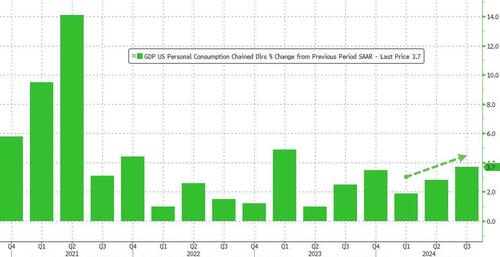

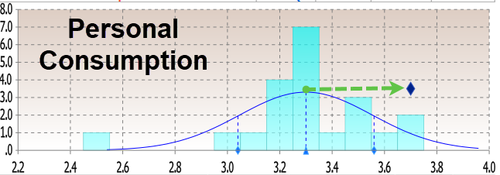

Yet while the overall number was weaker than expected, looking at the components one stick out: personal consumption surged more than expected, rising 3.7% SAAR vs 3.3% expected and 2.8% in Q2!

At a 3.7% annualized rate, personal consumption was a 2-sigma beat to expectations.

The increase in consumer spending reflected increases in both goods and services. Within goods, the leading contributors to the increase were other nondurable goods (led by prescription drugs) and motor vehicles and parts (led by used light trucks). Within services, the leading contributors to the increase were health care (led by outpatient services) as well as food services and accommodations.

A closer look at the components reveals the following breakdown:

- Personal Consumption added 2.46% to the bottom line number, up from 1.90% and accounting for 86% of total growth in Q3!

- Fixed Investment added 0.24%, down from 0.42% last quarter.

- Private Inventories subtracted 0.17% from the bottom line GDP print, a big drop from the 1.05% contribution in Q2.

- Net exports (exports less imports), subtracted 0.55% from the growth print, a smaller hit vs the 0.89% hit in Q2.

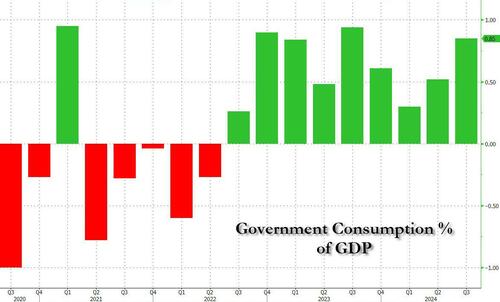

- Finally, government consumption added 0.85%, up from 0.52%

How much of a contribution is government spending? Here is the answer: government has contributed to “growth” for 9 consecutive quarters, and Q3 saw the biggest addition in the past year.

On the inflation side, the Core PCE buried inside the GDP data slowed to 2.2% from 2.8% (but that was slightly hotter than the 2.1% expected)…

So growth slower than expected, inflation higher than expected, and in this stagflationary mess consumption is somehow much higher than expected, just as the Fed launches its first easing campaign in years.

Tyler Durden

Wed, 10/30/2024 – 08:40

via ZeroHedge News https://ift.tt/4N9tSW6 Tyler Durden