Meta Beats On Revenue, Misses On Ad Impressions, Raises CapEx Forecast; Stock Falls As Everyone Is Already Long

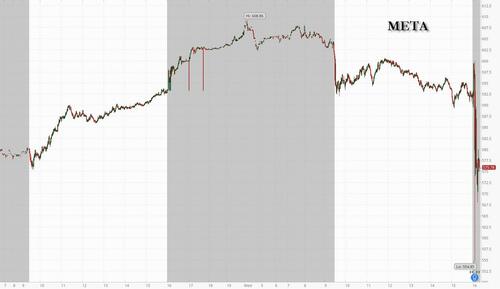

After two stellar Mag 7 earnings (TSLA and GOOGL) in the past week to kick of Q3 megacap tech reports, investors were hoping that the streak would continue when MSFT and META reported after the close (preview here). And while MSFT appears to have succeeded in also beating estimates (its stock is rising modestly after the close), it was buyside darling META that was the focus of attention today, although as UBS said, with a positioning score of 9.5/10, that “question what will be the incremental positive learning coming out of the print.” It turns out the answer is nothing, and the stock is dropping despite reporting relatively solid results while raising capex expectations higher.

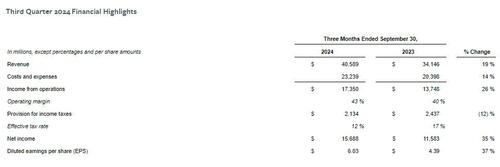

Here is the breakdown for Q3:

- Revenue $40.59 billion, +19% y/y, beating estimates of $40.25 billion

- Advertising rev. $39.89 billion, +19% y/y, beating estimates of $39.71 billion

- Family of Apps revenue $40.32 billion, +19% y/y, beating estimates of $39.92 billion

- Reality Labs revenue $270 million, +29% y/y, missing estimates of $312.8 million

- Other revenue $434 million, +48% y/y, beating estimates of $395.5 million

- Operating income $17.35 billion, +26% y/y, beating estimates of $16.24 billion

- Family of Apps operating income $21.78 billion, +25% y/y, beating estimates of $20.47 billion

- Reality Labs operating loss $4.43 billion, +18% y/y, beating estimates of loss $4.66 billion

- Operating margin 43% vs. 40% y/y, beating estimates of 39.6%

- EPS $6.03 vs. $4.39 y/y, beating estimates of $5.25

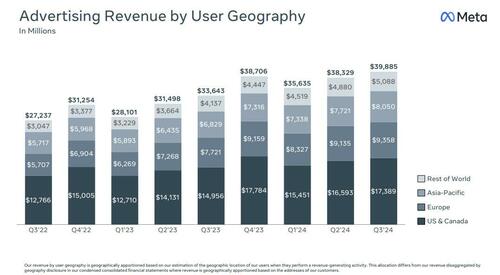

The ad revenue breakdown by geography shows that as usual the bulk of revenue came from the US and Canada, with Europe and Asia following.

Curiously while the total number of ad impressions both slowed and missed estimates for the second quarter in a row, the amount Meta charged per impression not only rose double digits and reversed last year’s decline, but came in almost double the expected. Good luck keeping those rates up in the recession, to wit:

- Ad impression growth declined from 10% in Q2 (when it missed estimates of 13%) to +7%, also missing estimates of +10.8%.

- Average price per ad rose 11%, vs a 6% drop a year ago, and above the 6.8% estimate

In brief remarks accompanying the earnings release, CEO Mark Zuckerberg said that “we had a good quarter driven by AI progress across our apps and business… We also have strong momentum with Meta AI, Llama adoption, and AI-powered glasses.”

Looking ahead, the CFO made the following forecasts:

- Expect Q4 total revenue to be in the range of $45-48 billion, vs sellside estimates of $46 billion

- Expect full-year 2024 total expenses to be in the range of $96-98 billion, up from the prior range of $96-99 billion. For Reality Labs, expects 2024 operating losses to increase meaningfully year-over-year due to ongoing product development efforts and investments to further scale our ecosystem.

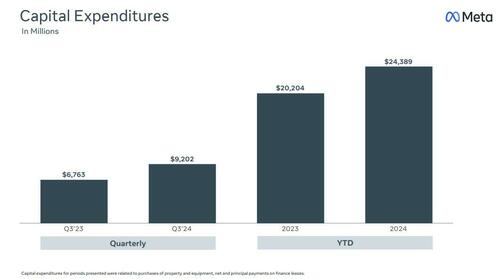

- Expect full-year 2024 capital expenditures will be in the range of $38-40 billion, up from the prior range of $37-40 billion. The company expects significant capital expenditures growth in 2025: “Given this, along with the back-end weighted nature of our 2024 capital expenditures, we expect a significant acceleration in infrastructure expense growth next year as we recognize higher growth in depreciation and operating expenses of our expanded infrastructure fleet.”

- Expect Q4 tax rate to be in the low-teens

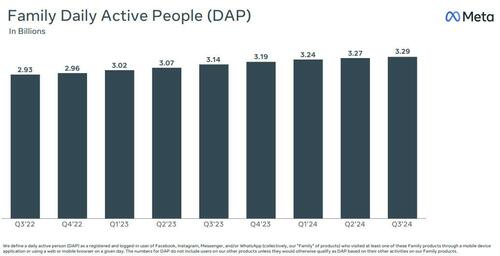

The company which no longer disclosed DAUs is also investing in large language models, the technology behind AI chatbots. It recently unveiled its largest model to date, which Zuckerberg said cost hundreds of millions of dollars in computing power to train. And while investors have been looking for signs of a positive impact on the business from all the spending, especially after Meta poured billions into another Zuckerberg passion project — the infamous metaverse — without generating much return, so far ad impression growth is sucking wind.

Turning to actual users, Facebook – which no longer reports Daily and Monthly Active Users since both have plateaued and are in the case of US and Europe decreasing – reported that its Family Daily Active People (or DAP, a made up category which the company can massage however it wants), rose to 3.29 billion, up 4.8%, and beating estimates of 3.25 billion. That’s right: we are supposed to believe that somehow half the world logs into Facebook every single day

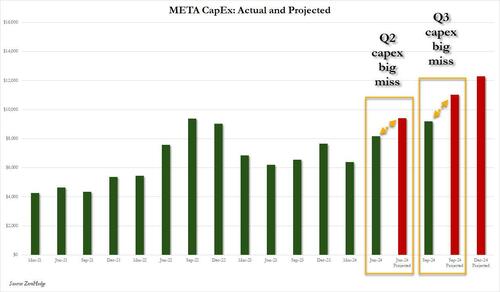

Yet while user metrics are easy to fudge, one place where META missed again was Capex, which in Q3 rose to $9.2 billion from $8.2 billion in Q2, and $6.8 billion a year ago, far below consensus of $11.0 billion, and another strong hint that spending on all those H100 or whatever Nvidia chips is starting to cool despite the company’s always cheerful guidance.

Bottom line: META capex has missed bigly for the second quarter in a row, and instead of investing in H100s or whatever, the company is instead aggressively buying back stock to push its price higher (and perhaps has little faith in the AI tech which it is supposed to be spending a ton of cash on). Either that, or somehow META will spend a record $13 billion – give or take – on capex in Q4.

The bottom line is that after surging to all time highs earlier this month, and with literally everyone, everywhere long the company (it is the Mag7 name with the heaviest concentration across at both Goldman and UBS), there was little META could say to surprise to the upside, and as a result, the stock is lower modestly after hours.

Tyler Durden

Wed, 10/30/2024 – 16:26

via ZeroHedge News https://ift.tt/qRgU81S Tyler Durden