‘An Ugly Report’

Authored by Peter Tchir via Academy Securties,

Such an ugly report – at least on the surface!

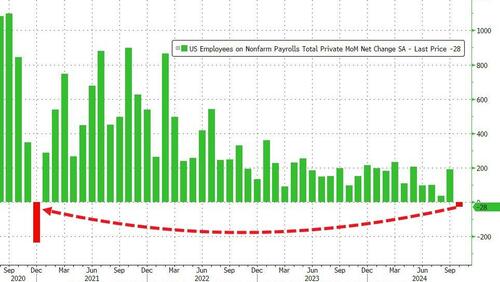

Not only were only 12k jobs created, all of the jobs were in the public sector (government). Private payrolls dropped 28k.

What impact did hurricanes play?

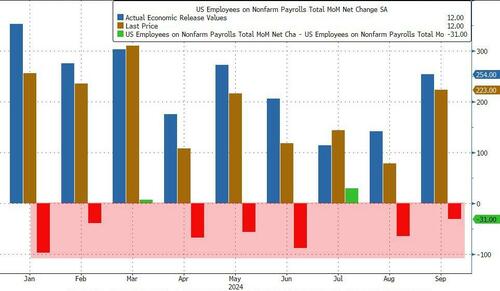

I admit, this is outside of my NFP skillset. Presumably the hurricanes had an impact, but why didn’t the hurricanes affect ADP which came in at 233k with upward revisions to the prior month?

Also, we had downward revisions of 112k which isn’t good, but seems impossible to be hurricane related.

Nothing good about the headline NFP data.

Having said that, hours worked ticked up – one good sign.

The unemployment rate kind of stayed the same at 4.1% (down from 4.3% back in July). It was actually 4.145% versus 4.051%, about as close to a 0.1% increase as you can get without it showing up when displayed as 1 decimal place (but the Fed will notice this). The Household survey added 150k jobs, but the main reason the unemployment rate didn’t rise to 4.2% (asides from rounding) was that the labor participation rate dropped 0.1% to 62.6%.

While not alarming on the surface, the Fed will have to think about this as at least a 0.1% move if not 0.2% move in the wrong direction on the unemployment rate when they meet next week.

The “good” news (for workers) is that monthly earnings “stayed” at 0.4% – they were originally reported as 0.4% last month, but that too, has been revised lower.

Not to scare anyone, (Halloween was yesterday, after all), but the birth/death model ADDED 368k to the jobs report. I believe this is before seasonal adjustments are applied, but how miserable would jobs have been without this plug?

As one example, it claims 8k were added in manufacturing and 26k in construction – but the establishment survey reports -46k this month and -6k last month (I find it difficult to believe a lot of new businesses were created in areas that are losing jobs, but who knows).

The one chart I keep coming back to from all the jobs data.

The quit rate in JOLTS didn’t get this low until almost midway through 2008. The NBER, I think said the recession started in December 2007 (though they didn’t tell us until much later).

I like the QUIT rate as I believe it has an element of “crowd sourcing”. Every individual has a decent idea of how easy it is for them to leave and get a similar or better job, and without a doubt, individuals are telling us the job prospects don’t seem great to them.

I expect part of this fits our “covid inflation model” quite well, where we believe we are well past peak “services inflation/usage” and that is showing up in the jobs data.

Bumpy Landing

I’ve been argued that we will see a “bumpy” landing. Not recession, but not necessarily smooth. While to some extent today’s data fits that nicely, it is worse than I thought. I’m far more inclined to think about a really bumpy landing, than I am to dismiss the data.

With the hurricanes, and some other data not as negative (though the QUIT rate is screaming at me), I will not be in fear mode (after all, we were bumpy, not soft), but the market certainly has to rethink soft!

Bottom Line

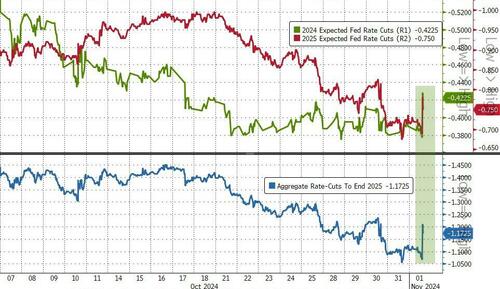

Fed cuts 25 next week.

That has been our base case and see absolutely no reason to change it (even with some inflation data ticking higher).

This should help bond yields rally, for a bit, especially at the front end, but I’d use the rally to start setting shorts again, especially at the longer end of the curve:

-

Will this data influence the election? There has been a lot of early voting, but this is not the sort of report incumbents want to see (the arguments about hurricane effects could easily get lost).

-

Nothing about the rising deficit changes with today’s numbers and I think that along with positioning has been a bigger driver of the rate move (see Who Will Win and What Does it Mean?)

Equities. Maybe this helps equities recover from yesterday’s shellacking, but stocks moving on lower yields for the wrong reasons has not been sustainable. Stocks will likely face pressure as we start to think about all the possible election permutations (anything from landslide victories, to dead heats, to aggressively contested results, are on the table). Earnings will be a factor and there were just enough good ones last night post the close to help stock futures bounce overnight, but all too often in the past week we’ve seen opening strength deteriorate over the course of the day.

Maybe yesterday was the dip to be bought, but I’m not participating in that, think we have more downside in the coming days.

Good luck and can we all agree that turning back our clocks this weekend and losing daylight at the end of the day, is just bad idea?

Tyler Durden

Fri, 11/01/2024 – 09:45

via ZeroHedge News https://ift.tt/cMLb5Za Tyler Durden