Savings-Rate Revisions Erase $140BN In American’s Wealth As Fed’s Favorite Inflation Indicator Jumps To 6-Month High

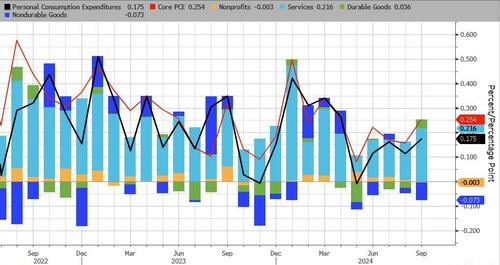

The Fed’s favorite (when it’s going down) inflation indicator – Core PCE – ticked up noticeably in October to +2.8%, the highest since April…

Source: Bloomberg

Headline PCE rose 0.2% MoM (as expected) lifting it 2.3% YoY (up from +2.1% YoY prior)…

Source: Bloomberg

A jump in Services and Durable Goods costs drove the reignition of inflation…

Source: Bloomberg

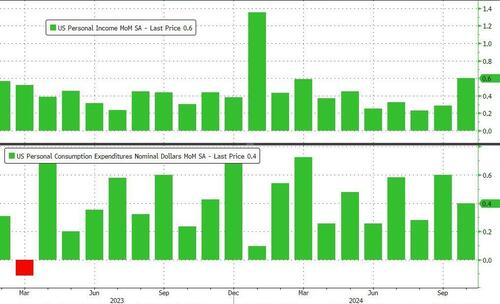

Incomes – for once – grew at a faster rate than spending (+0.6% MoM vs +0.4% MoM respectively)….

Source: Bloomberg

…and while that bumped up the savings rate MoM, thanks to massive revisions, Americans lost $140BN in personal savings… out of nowhere…

Oh look, the savings rate was just revised sharply lower for most of 2024 and some $140BN in personal savings was magically erased. pic.twitter.com/T3lGgLCIEQ

— zerohedge (@zerohedge) November 27, 2024

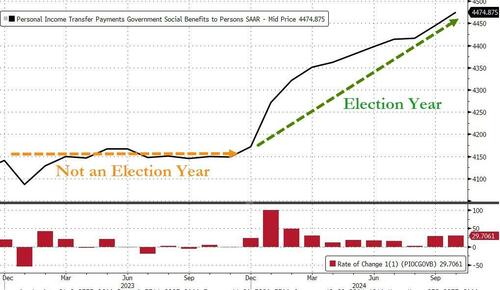

Remember when they revised it from 2.4% to 5.0% in late September to bump up GDP? Well, we guess Kamala isn’t president.. so all bets (adjustments) are off…

And finally, imagine how bad things would be if the government wasn’t handing over billions to ‘we, the people’ all of a sudden…

Source: Bloomberg

Bye, bye, rate-cut expectations!…

Tyler Durden

Wed, 11/27/2024 – 10:11

via ZeroHedge News https://ift.tt/QELaI73 Tyler Durden