Will Trump Tariffs Kill Commercial Real Estate?

Will the Trump administration’s proposed tariffs on Chinese, Mexican, and Canadian imports could send shockwaves through the already vulnerable U.S. commercial real estate market? With a 10% tariff on goods from China and 25% tariff on imports from Canada and Mexico, the additional cost will be passed along to the US builder and consumer — and is a stiff repudiation to the notion of free markets.

The Fed has predictably failed to get inflation under control before starting its rate-cutting bonanza, and tariffs will cause prices to skyrocket for materials like aluminum, steel and wood, all without addressing deficits. The price increases could a wave ripping through everything from food packaging, cars, trucks, ships, aircraft, and electronics to logistics, housing, and commercial construction. Or, in other words, just about everything. As Peter Schiff recently said:

Why doesn’t every country just impose tariffs if it doesn’t cost anything for their own citizens? …A tariff is a tax. It’s a tax on the consumer for buying stuff. 100% of it is paid by consumers. There’s nobody else to pay it!”

Higher packaging and logistics prices means more expensive products for Amercians across the board. Tariff-fueled price rises could also be the straw that breaks the back of the fragile commercial real estate market, which continues to teeter on the brink with high costs, bad loans, empty office buildings, and overexposed banks creating an explosive cocktail just waiting for a match.

The cost of essential building materials—like steel, aluminum, and wood—is set to rise significantly. Given that these materials form the backbone of construction, Trump tariffs and the price increases they’re guaranteed to cause could have dire implications for developers, lenders, and the broader economy.

In 2023, Canada was the US’s single steel supplier. As of 2022, it was also at the top of the list for wood, with China in spot number two and Mexico close behind. The US is a top global importer of iron and steel and is Mexico’s primary customer; Mexico accounted for approximately 15% of the total steel imported while China provided 5%. And while China is a minimal steel importer to the US compared to other countries, it’s a nation that has become a powerful symbol for the broader implosion of US manufacturing.

It means that with no manufacturing base to make anything domestically, we have nothing to fall back on. Market forces dictate that two things will happen. One, the goods and supplies that do get sent to the US will start to cost much more money. Two, countries that are heavy exporters to the US will reduce the amounts of goods that they sell us to begin with, creating less supply and driving up prices even more. Either way, the tariff plan is a heavy-handed state intervention that has no ability to empower Trump to lower taxes, as promised. Instead, it’s bound to increase the cost of everything as consumers struggle to figure out where all their clothes, toys, and other goods have gone, with whatever’s left on shelves now priced even more hopelessly out of their budget.

U.S. City Average Dollar Purchasing Power Since 1913, St. Louis Fed

U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: Purchasing Power of the Consumer Dollar in U.S. City Average [CUUR0000SA0R], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CUUR0000SA0R, December 14, 2024.

Meanwhile, iconic American steel producer US Steel is now pushing for a deal to be sold to Nippon Steel, Japan’s largest steelmaker [ZH: which has now been blocked]. The outlook for US manufacturing has gotten so bad that many working-class US Steel workers are celebrating, seeing the deal as the only thing that can save their good old American jobs. The Biden administration appears to be preparing to block the deal on the grounds of preserving “national security.” But they’re damned if they do, and the’re damned if they don’t.

As tariffs on Chinese and Mexican goods and materials significantly increase the cost of building, it will become even harder for CRE loans to be repaid as struggling developers have nowhere to go but back to the bank to borrow more money. Developers relying on Canadian, Chinese, and Mexican building materials, equipment, and supplies will face higher project costs as they juggle already razor-thin margins and risks like zoning complications, permitting issues, unexpected legal costs, and other extremely expensive snags common to their industry.

The economy can only handle so many powder kegs. As Peter Schiff said about tariffs on his November 27th episode of The Peter Schiff Show:

The best thing to do if a country wants to be dumb enough to try to limit the ability of its own citizens to trade freely is not to do the same thing to your citizens. Let your own citizens trade freely, and you’re going to win.”

According to Trepp, a leading provider of real estate analytics, nearly $1.5 trillion in commercial real estate loans are set to mature by 2025. Distressed loans are reaching a fever pitch for commercial properties like retail, buildings, apartments and other residential developments, and offices across the US.

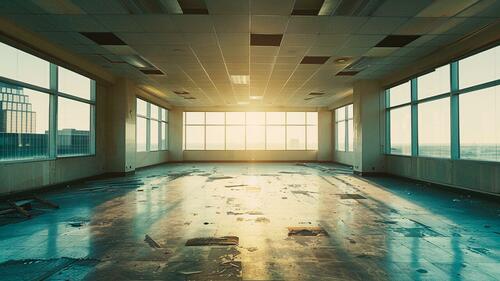

Mortgage-backed security delinquencies associated with office properties are nearing a rate not seen since the 2008 financial meltdown. And many office buildings associated with these troubled loans haven’t even come close to finding enough renters to fill them, becoming post-COVID phantom buildings in a zombie market. Now that remote work and Zoom meetings have cemented themselves as the permanent New Normal, developers are pivoting to desperate measures like expensive office-to-apartment conversions as a Hail Mary to save their projects.

Banks, particularly regional lenders, are trapped in a prison of overexposure to CRE. The FDIC’s Q2 2024 report shows that real estate loans account for 40% of the total loan portfolios for many small and mid-sized banks across America. The government and Fed like to pretend that it’s not a big deal since these are “smaller” banks, willfully ignoring the fact that a series of small bank failures often portends the unfolding of a broader crisis. A construction slump triggered by rising material costs and inflation from central bank meddling and the higher costs from import tariffs, could conspire with other factors to trigger a full-blown CRE collapse and banking crisis.

Having no manufacturing base in the US only makes a bad thing even worse. The catch-22 is that Trump wants to use tariffs to cut taxes and hopes it will somehow bring American companies and manufacturing back. But without manufacturing, you have no choice but to sacrifice consumers and developers and builders at the altar of foreign imports. It’s an economic ouroboros where the problem eats the solution.

The Fed wants to cut rates more to save CRE and banks, and in desperation, may fire up the money printer in big way. But it’s just adding fuel to a different fire.

In previous crises, such as the 2008 financial crash and COVID, QE “stabilized” markets with an epic run of money printing. With inflation still too hot as the Fed rushed to cut interest rates, it’s backed into a corner as usual: keep cutting to save the banks and CRE, throwing savers to the wolves as their purchasing power tanks, or stifle inflation with higher rates and let a banking and CRE crisis rip. We know what it will do. The Fed never sacrifices the banks to preserve the dollar’s purchasing power. They’d rather sacrifice savers and taxpayers with low rates and QE than play a game of bank failure dominos. Either way, the outlook is horrifying.

The CRE bomb has been building for quite some time now. The next round of upward price shocks, exacerbated by the shock of heavy tariffs when the US has close to zero manufacturing base left, could be what lights the fuse.

Tyler Durden

Fri, 12/20/2024 – 15:40

via ZeroHedge News https://ift.tt/yoPkeRV Tyler Durden