FOMC Minutes Show ‘Almost All’ Fed Members See Higher Inflation Risks, Cite Trump Policies

Tl;dr: Fed officials are worried about the inflation impacts from Trump‘s policies: Minutes

So the Fed is not reactive (even when inflation is biting it in the ass), but is PROACTIVELY hostile toward the policy of a president it disagrees with even if said policy doesn’t even exist?

* * *

Since The Fed’s last meeting (Dec 18th) where they issued a ‘hawkish cut‘, bonds and stocks have been dumped while crude and gold have strengthened along with the dollar…

Source: Bloomberg

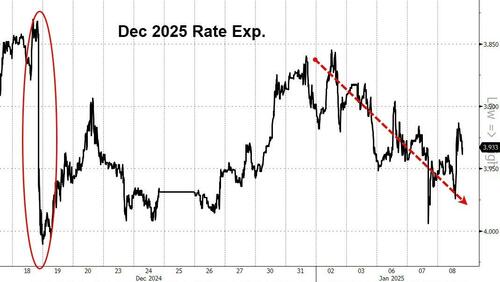

More notably, rate-cut expectations have oscillated all over the place but are back near the spike lows from FOMC day (implying a 50-50 chance of 1 or 2 cuts this year)…

Source: Bloomberg

…and the yield curve has steepened dramatically, with the much-watched 3m10Y spread now uninverted at its steepest since Oct 2022…

Source: Bloomberg

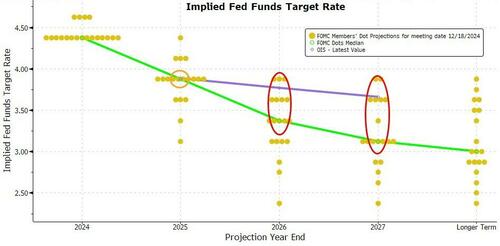

The market remains significantly more hawkish about future cuts than The Fed still…

Source: Bloomberg

So the big question is – what does The Fed want us to see from The Minutes? Remember this was the meeting where Powell flip-flopped from uber-dove to super-hawk after Trump won the election.

Will they mention concerns about Trump’s policies driving inflation? Will the topic of their independence come up? Will fears of sticky inflation be mentioned by more than ‘a few’ members?

Key headlines from the minutes include:

-

“Many participants suggested that a variety of factors underlined the need for a careful approach to monetary policy decisions over coming quarters.”

-

“Some participants stated that there was merit in keeping the target range for the federal funds rate unchanged,”

-

“A majority of participants noted that their judgments about this meeting’s appropriate policy action had been finely balanced.”

- “Several observed that the disinflationary process may have stalled temporarily or noted the risk that it could.”

It’s Trump’s fault:

The Fed’s staff incorporated “placeholder assumptions” about potential policy changes under incoming US President Donald Trump, resulting in an economic growth forecast that was slightly slower, with inflation also expected to remain firm.

‘Almost all‘ participants judged that upside risks to the inflation outlook had increased

The minutes showed “a number” of policymakers indicated they also included placeholder assumptions in their updated economic projections.

Forgive us our ignorance here – admittedly we are not PhDs – but we do not remember the staff and members ‘citing’ inflation fears when the Biden admin dropped multi-trillion dollar spending bills (and called them Inflation Reducers)?

Fed officials are worried about the inflation impacts from Trump’s policies: minutes

So the Fed is not reactive (even when inflation is biting it in the ass), but is PROACTIVELY hostile toward the policy of a president it disagrees with even if said policy doesn’t even exist

— zerohedge (@zerohedge) January 8, 2025

Read the full Minutes below…

Tyler Durden

Wed, 01/08/2025 – 14:00

via ZeroHedge News https://ift.tt/bHB8UhL Tyler Durden