Tactically Bearish As Risks Increase

Authored by Lance Roberts via RealInvestmentAdvice.com,

In last week’s discussion with Thoughtful Money, I noted that we are becoming more “tactically bearish” as we progress into 2025. While we have remained primarily bullish in equity positioning over the last two years, several risks are now worth considering.

However, it is critical to note that being “tactically bearish” does NOT mean we are expecting a bear market or a severe market crash. Regarding portfolio management, the difference between being “tactically bullish” or “tactically bearish” is the level of equity risk we take in client portfolios. Over the last two years, we have been “tactically bullish” and have held more significant weightings in equities that have benefitted from market momentum and investor sentiment. However, shifting toward a “tactically bearish” position would suggest rebalancing exposure to more fundamental, value-oriented, dividend-paying companies that will reduce overall portfolio volatility. It also may mean owning less equity exposure and increasing cash levels.

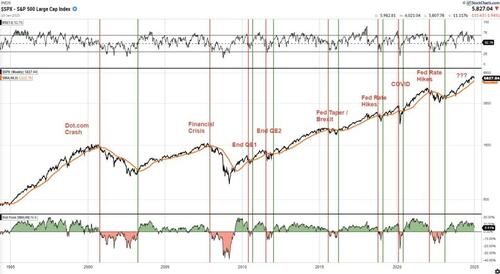

Could a “crash” happen? Yes. However, bear markets rarely happen all at once. In most bear markets, the market showed plenty of warning signs well before the “bear” came out of hibernation. Such gave investors ample time to exit the market, reduce risks, and raise cash to minimize the eventual reversion to capital. Even a simple technical signal, such as when the market violates the 48-week simple moving average, allowed investors to exit risk well before the rest of the correction occurred. Did you get out right at the top? No. Did you get back in at the exact bottom? No. Did you participate in most of the advance and avoid most declines? Yes.

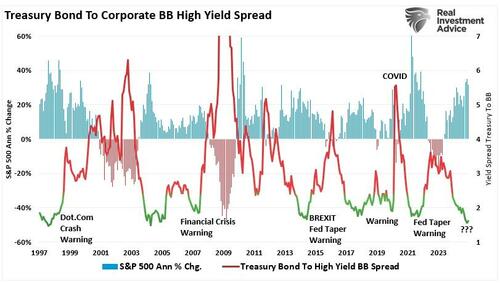

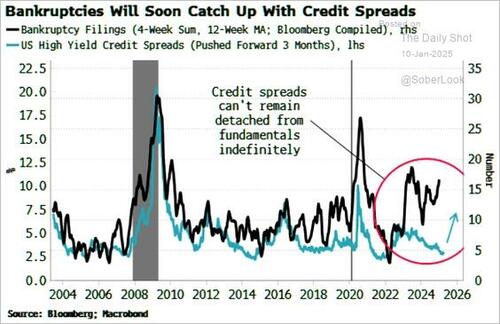

Furthermore, as discussed in “Credit Spreads,” the difference between Treasury and Junk bond yields tends to be one of the earliest signals that credit markets are pricing in higher risks. Unlike stock markets, which can often remain buoyant due to short-term optimism or speculative trading, the credit market is more sensitive to fundamental shifts in economic conditions.

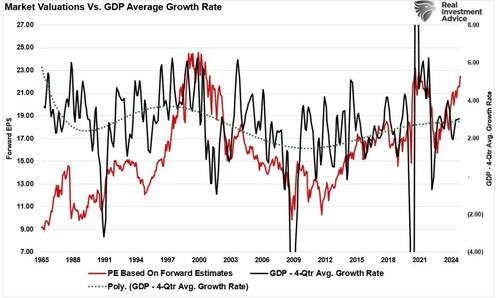

Currently, Wall Street analysts are very optimistic about 2025. Notably, earnings estimates for 2025 remain well deviated from historical long-term growth trends. That in and of itself is not a reason to be more cautious. However, current valuations suggest that stocks are priced for perfection as asset prices are well ahead of what a declining economic growth rate can deliver. This leaves little room for error. In other words, investors are essentially betting on corporations’ flawless execution in a year when macroeconomic uncertainties loom large.

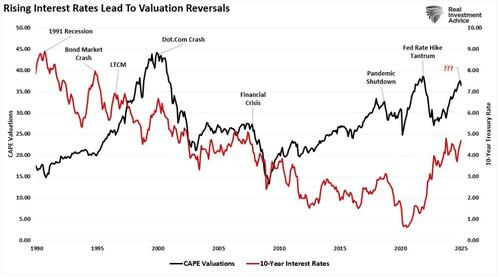

In the short term, valuations are a terrible timing tool for investors. However, there are times when valuations collide with other factors, making them a more significant short-term risk.

Interest rates are one of those factors.

Interest Rates Are An Unappreciated Risk

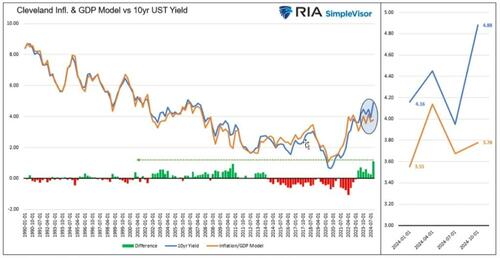

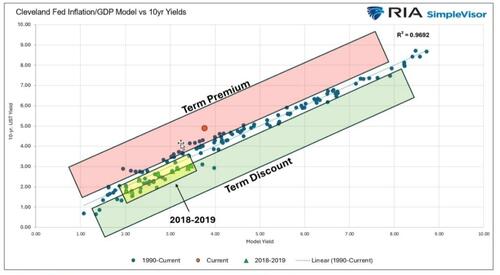

Over the last two months, interest rates have risen sharply due to fears of “tariffs” under the new Administration. Furthermore, there is concern that stronger-than-expected economic data might stall the Federal Reserve from cutting rates further. Notably, the rate increase is primarily a function of short-term sentiment, as economic data remains in a longer-term reversion process. Michael Lebowitz recently discussed the impact of sentiment on rates. The model below combines the Cleveland Fed Inflation Expectations Index and GDP into a model. (Economic activity is what creates inflation: supply vs demand). That model historically dictates where interest rates should be. While interest rates are nearing 5%, the economic and sentiment model says rates should be closer to 3%.

The next chart correlates the model and presents the “term” premium and discount. The orange dot shows where yields trade currently relative to the model, which is the highest in its 35-year history. Mike has also highlighted the 2018-2019 range when the Trump Administration previously imposed tariffs. While the bond market has sold off on fears of inflation from tariffs, the previous period resulted in lower yields, not higher.

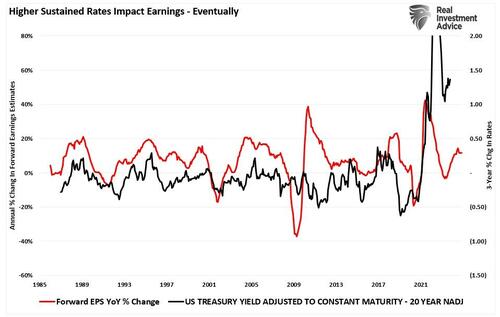

However, in the near term, higher yields present an unappreciated market risk to the market and the economy in general. Interest rates are a function of economic growth and inflation. Inflation is a byproduct of economic growth, which is curtailed by higher rates. Furthermore, increases in interest rates negatively impact corporate earnings as borrowing costs increase. Therefore, while rising interest rates do not immediately impair earnings growth, eventually, they do as economic growth slows.

Given that higher borrowing costs divert income into debt service, the negative impact on businesses is evident in an economy and financial market supported by rising debt levels. Over the last two years, corporate bankruptcies have increased sharply as borrowing costs have risen. While credit spreads have yet to reflect this reality, borrowers will eventually become more “risk averse.” This is why credit spreads, as shown above, are an important leading indicator of market risk.

Lastly, valuations are a function of earnings growth and investor sentiment. Therefore, rate increases pose a significant threat if earnings growth becomes impaired due to higher costs and slowing economic demand. Historically, rising interest rates have triggered more significant mean reverting events. This is because investors must reprice assets for lower expected earnings growth rates. With valuations at the highest level since the stimulus-induced frenzy in 2021, the risk of a reversion has increased. Such is particularly true if Wall Street’s bullish forecasts fail to become reality.

The good news is that during economic and earnings contraction periods, yields fall substantially as the markets are repriced to a new reality. Such eventually provides the base for the next bull market cycle.

But that will be a conversation for a later article.

Technicals Suggest Being More Tactically Bearish

While there are certainly some more significant macroeconomic concerns heading into 2025, the technical backdrop supports being more “tactically bearish” into the new year.

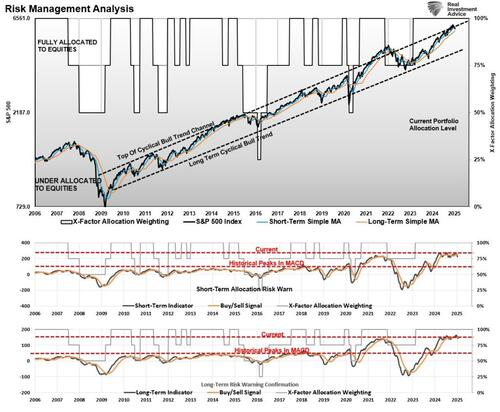

The following chart has provided a strong basis for our portfolio risk-management protocols over the years. It is a weekly price chart of the S&P 500 index showing the current bullish price trend channel that started in 2009 on a logarithmic scale. Whenever that market has traded at the top or bottom of that channel, it has been a significant indication to begin changing allocation levels in portfolio models. The bottom two panels are a short—and longer-term weekly Moving Average Convergence Divergence Indicator (MACD). Notably, the deviation of those indicators from the long-term norms post-2020 has been significant due to the flood of stimulus and surge in market speculation. Notably, both indicators are topping and beginning to signal a market warning. While these indicators can remain elevated for some time, the market will be in a more corrective process when the trends become consistently lower, as seen in 2022.

With the market still trading above longer-term means, it is not yet time to sound the warning bell to reduce portfolio risk significantly. However, given the combination of higher rates, excessive valuations, and the risk of slower earnings growth, focusing on risk heading into 2025 seems prudent. Therefore, it seems appropriate to restate something I wrote the last time we saw these divergences.

“Our job as investors is to navigate the waters within which we currently sail, not the waters we think we will sail in later. Higher returns come from the management of ‘risks’ rather than the attempt to create returns by chasing markets. Robert Rubin, former Secretary of the Treasury, defined this philosophy when he stated;

‘As I think back over the years, I have been guided by four principles for decision making. The only certainty is that there is no certainty. Second, every decision, as a consequence, is a matter of weighing probabilities. Third, despite uncertainty, we must decide and we must act. And lastly, we need to judge decisions not only on the results but also on how we made them.

Most people are in denial about uncertainty. They assume they’re lucky, and that the unpredictable can be reliably forecasted. Such keeps business brisk for palm readers, psychics, and stockbrokers, but it’s a terrible way to deal with uncertainty. If there are no absolutes, all decisions become matters of judging the probability of different outcomes, and the costs and benefits of each. Then, on that basis, you can make a good decision.’”

An Honest Assessment

For all of these reasons, we are becoming more “tactically bearish” as we ponder the outcomes of 2025. It should be evident that an honest assessment of uncertainty leads to better decisions. Still, the benefits of Rubin’s approach, and ours, go beyond that. Although it may seem contradictory, embracing uncertainty reduces risk, while denial increases it. Another benefit of acknowledging uncertainty is it keeps you honest.

“A healthy respect for uncertainty and focus on probability drives you never to be satisfied with your conclusions. It keeps you moving forward to seek out more information, to question conventional thinking and to continually refine your judgments and understanding that difference between certainty and likelihood can make all the difference.” – Robert Rubin

We must recognize and respond to changes in underlying market dynamics. If they change for the worse, we must be aware of the inherent risks in portfolio allocation models. The reality is that we can’t control outcomes. The most we can do is influence the probability of specific outcomes. Such is why we manage risk by investing in probabilities rather than possibilities.

Such is essential to capital preservation and investment success over time.

* * *

For more in-depth analysis and actionable investment strategies, visit RealInvestmentAdvice.com. Stay ahead of the markets with expert insights tailored to help you achieve your financial goals.

Tyler Durden

Wed, 01/15/2025 – 07:45

via ZeroHedge News https://ift.tt/xjut9yM Tyler Durden