Luxury Downturn Over? Richemont Delivers “Massive” Sales Beat, Send Shares Soaring

Swiss luxury group Richemont reported third-quarter sales that topped Bloomberg Consensus estimates, fueling a rally in European luxury goods stocks. The earnings have ignited optimism that “demand for high-end goods may be recovering,” Goldman Sachs analysts told clients.

For the three months ending in December, the owner of Cartier reported an impressive 10% increase in sales at constant exchange rates, far exceeding Wall Street’s expectation of around 1%. Strong performance in Europe and the Americas drove the results, while sales in Asia Pacific were much better than estimates.

Richemont’s core jewelry division, home to Cartier and Van Cleef & Arpels, delivered better-than-expected sales for the quarter. These two brands continue to gain market share in the jewelry segment, supported by strong brand appeal and significant outperformance in Europe and the US, Stifel analyst Rogerio Fujimori noted. He added that this strength helped offset weakness in China.

Richemont and other luxury firms had been facing a downturn in high-end goods after years of aggressive price increases, elevated inflation across the West, and mounting consumer pressures. These results suggest the early beginnings of a recovery.

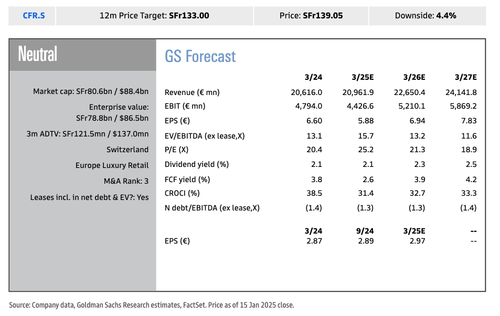

“We have been pushing long Luxury and long Richemont into earnings season. Today’s beat, I think, confirms our thesis. While Richemont remains an outperformer, the broad-based nature of strength in this release suggests there is more than just “brand momo” at play,” Goldman’s Natasha de la Grense wrote in a note.

She noted, “They reported beats and sequential improvement in all categories, channels and geographies (except Japan – this region beat as I had expected but still slowed a bit sequentially on tough comps). Within Jewellery Maisons (+14% cFX), the acceleration was not just Cartier and Van Cleef but smaller brands too. The key takeaway is that there was broad inflection in Luxury demand trends in Q4 and I think it’s right to stay long these names into LVMH’s print.”

In a separate note, Goldman’s Louise Singlehurst and Adrien Duverger summarized Richemont’s stellar third-quarter earnings for clients:

Richemont has delivered an impressive +10% cFX sales growth in Q325 (end December) materially ahead of Visible Alpha Consensus Data/GSE +1%. By division, the Jewellery Maisons outperformed with +14% cFX growth (cons +4%; GSE +5%), with the smaller divisions also ahead of forecasts. The Specialist Watchmakers -8% decline suggests the division may have now bottomed (-16% cFX decline in H125 end Sept) and the smaller ‘Other’ division (Chloe, Alaia, Montblanc) increased +11%. By region the key surprises were Europe and the US. Within Europe sales +19% driven by both tourism and local (we expect the strong growth also reflects an improvement post the Olympics in France during the summer). The company highlights strength across the region – notably France, Switzerland and Italy. For the Americas, a strong acceleration in the period to +22% (vs H125 +11%) and the company highlights the strength across all business areas. As expected, the trading momentum remains challenged in Greater China, although there was a sequential improvement (-18% cFX vs -27% in 1H25), and other Asian markets similarly improved in the quarter (-7% cFX vs -18% in 1H25). Whilst Japan decelerated, it continued to perform well (+19% cFx vs +42% in 1H25), supported by domestic and tourism demand.

Goldman remains “Neutral”…

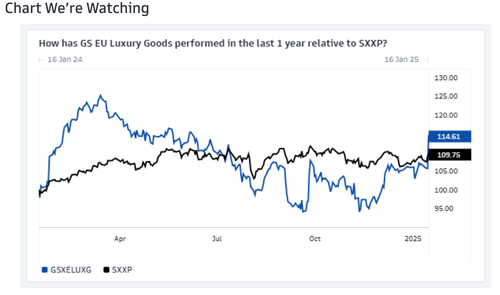

In markets, Richemont shares in Switerzland surged 17%, while French peers Kering and Hermes were up 8% and 5%, respectively. Italian high-end brands Brunello Cucinelli, Salvatore Ferragamo and Moncler increased 2%, 5.7% and 7.4%, respectively, while Burberry advanced 8%.

Goldman’s Luxury EU Goods Basket jumped 8.5%.

In addition to Stifel and Goldman analysts, here’s what the rest of Wall Street shared with clients this morning (list courtesy of Bloomberg):

Citi (buy)

- Richemont saw a strong festive season with the third-quarter beat driven by all divisions, regions and channels, says analyst Thomas Chauvet

UBS (buy)

- The details of the update show a meaningful acceleration across all regions ex-Japan and all divisions, with even specialist watchmakers showing a very strong sequential improvement, analyst Zuzanna Pusz writes

- However, implications to other categories, especially leather goods, may be risky to extrapolate for the broader luxury sector

Morgan Stanley (equal-weight)

- This is a strong beat from Richemont, says analyst Edouard Aubin, with sales one of the most significant beats in years

- Spend by Chinese nationals remained a drag in the quarter, but less so than in the previous quarter

Deutsche Bank (buy)

- Richemont has delivered a “massive” sales beat for the third quarter across both main divisions and most regions, says analyst Adam Cochrane

- The performance in its jewelry business is enough to continue the share-price momentum, and the better leverage is should offset some of the margin concerns seen at 1H

RBC (sector perform)

- Piral Dadhania says 3Q25 revenues were significantly stronger than expected, with an “exceptional” acceleration for its jewelry division

- Sees positive readacross for wider luxury sector

- Views results as “exceptionally strong;” is more positive on luxury as a sector for 2025

Jefferies (buy)

- James Grzinic says 3Q sales clearly beat expectations for a sequential improvement in momentum thanks to remarkable gains in jewelry, a sharper-than-expected reduction in pressures in watches, and more progress in soft luxury

- Sees likely upgrades to consensus following these results

Bloomberg Intelligence

- Richemont’s sales surge considerably outpaced expectations in all regions, even as China remained challenged, writes analyst Deborah Aitken

- It’s a positive readacross for the high-end luxury and fine jewelry makers

We would like to see robust earnings from LVMH and Kering in the coming weeks, confirming that the luxury sector is transitioning from a downturn to a recovery. If not, then this is all just hype. The question becomes the recovery’s shape…

Tyler Durden

Thu, 01/16/2025 – 08:15

via ZeroHedge News https://ift.tt/AkdxgzL Tyler Durden