Submitted by Alasdair Macleod via GoldMoney.com,

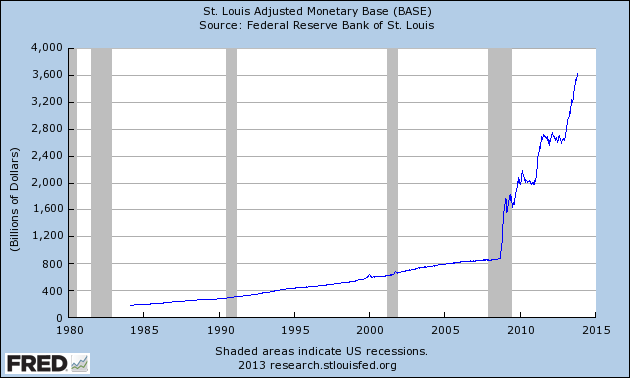

A number of people have asked me to expand on how the rapid expansion of money supply leads to an effect the opposite of that intended: a fall in economic activity. This effect starts early in the recovery phase of the credit cycle, and is particularly marked today because of the aggressive rate of monetary inflation. This article takes the reader through the events that lead to this inevitable outcome.

There are two indisputable economic facts to bear in mind. The first is that GDP is simply a money-total of economic transactions, and a central bank fosters an increase in GDP by making available more money and therefore bank credit to inflate this number. This is not the same as genuine economic progress, which is what consumers desire and entrepreneurs provide in an unfettered market with reliable money. The second fact is that newly issued money is not absorbed into an economy evenly: it has to be handed to someone first, like a bank or government department, who in turn passes it on to someone else through their dealings and so on, step by step until it is finally dispersed.

As new money enters the economy, it naturally drives up the prices of goods bought with it. This means that someone seeking to buy a similar product without the benefit of new money finds it is more expensive, or put more correctly the purchasing power of his wages and savings has fallen relative to that product. Therefore, the new money benefits those that first obtain it at the expense of everyone else. Obviously, if large amounts of new money are being mobilised by a central bank, as is the case today, the transfer of wealth from those who receive the money later to those who get it early will be correspondingly greater.

Now let’s look at today’s monetary environment in the United States. The wealth-transfer effect is not being adequately recorded, because official inflation statistics do not capture the real increase in consumer prices. The difference between official figures and a truer estimate of US inflation is illustrated by John Williams of Shadowstats.com, who estimates it to be 7% higher than the official rate at roughly 9%, using the government’s computation methodology prior to 1980. Simplistically and assuming no wage inflation, this approximates to the current rate of wealth transfer from the majority of people to those that first receive the new money from the central bank.

The Fed is busy financing most of the Government’s borrowing. The newly-issued money in Government’s hands is distributed widely, and maintains prices of most basic goods and services at a higher level than they would otherwise be. However, in providing this funding, the Fed creates excess reserves on its own balance sheet, and it is this money we are considering.

The reserves on the Fed’s balance sheet are actually deposits, the assets of commercial banks and other domestic and foreign depository institutions that use the Fed as a bank, in the same way the rest of us have bank deposits at a commercial bank. So even though these deposits are on the Fed’s balance sheet, they are the property of individual banks.

These banks are free to draw down on their deposits at the Fed, just as you and I can draw down our deposits. However, because US banks have been risk-averse and under regulatory pressure to improve their own financial position, they have tended to leave money on deposit at the Fed, rather than employ it for financial activities. There are signs this is changing.

Rather than earn a quarter of one per cent, some of this deposit money has been employed in financial speculation in derivative markets, or found its way into the stock market, gone into residential property, and some is now going into consumer loans for credit-worthy borrowers.

In addition to the government’s deficit spending, these channels represent ways in which money is entering the economy. Furthermore, anyone working in the main finance centres is being paid well, so prices in New York and London are driven higher than in other cities and in the country as a whole. They spend their bonuses on flashy cars and country houses, benefiting salesmen and property values in fashionable locations. And with stock prices close to their all-time highs, investors with portfolios everywhere feel financially better off, so they can increase their spending as well.

All the extra spending boosts GDP, and to some extent it has a snowball effect. Banks loosen their purse strings a little more, and spending increases further. But the number of people benefiting is only a small minority of the population. The rest, low-paid workers on fixed incomes, pensioners, people living on modest savings in cash at the bank, and part time employed as well as the unemployed find their cost of living has gone up. They all think prices have risen, and don’t understand that their earnings, pensions and savings have been reduced by monetary inflation: they are the ultimate victims of wealth transfer.

While luxury goods are in strong demand in London and New York, general merchants in the country find trading conditions tough. Higher prices are forcing most people to spend less, or to seek cheaper alternatives. Manufacturers of everyday goods have to find ways to reduce costs, including firing staff. After all if you transfer wealth from ordinary folk they will simply spend less and businesses will suffer.

So we have a paradox: growth in GDP remains positive; indeed artificially strong because of the under-recording of inflation, while in truth the economy is in a slump. The increase in GDP, which reflects the money being spent by the fortunate few before it is absorbed into general circulation, conceals a worse economic situation than before. The effect of an expansion of new money into an economy does not make the majority of people better off; instead it makes them worse off because of the wealth transfer effect. No wonder unemployment remains stubbornly high.

It is the commonest fallacy in economics today that monetary inflation stimulates activity. Instead, it benefits the few at the expense of the majority. The experience of all currency inflations is just that, and the worse the inflation the more the majority of the population is impoverished.

The problem for central banks is that the alternative to maintaining an increasing pace of monetary growth is to risk triggering a widespread debt crisis involving both over-indebted governments and also over-extended businesses and home-owners. This was why the concept of tapering, or putting a brake on the rate of money creation, destabilised worldwide markets and was rapidly abandoned. With undercapitalised banks already squeezed between bad debts and depositor liabilities, there is the potential for a cascade of financial failures. And while many central bankers could profit by reading and understanding this article, the truth is they are not appointed to face up to the reality that monetary inflation is economically destructive, and that escalating currency expansion taken to its logical conclusion means the currency itself will eventually become worthless.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/8ZxAPyhdcnQ/story01.htm Tyler Durden