Download GoldCore Outlook For 2014

CONTENTS

– Introduction

– Review of 2013

– Gold and Silver Have Torrid Year – Fall 27% and 35% Respectively

– Year Of Paper Selling But Robust Physical Demand – Especially From China

– Highlights Of Year – German Gold Repatriation, Record Highs In Yen, Huge Chinese Demand

– Lowlights Of Year – Massive Paper Sell Offs in April/June and Cypriot Deposit Confiscation

– Syria and the Middle East

– U.S. Government Shutdown and $12 Trillion Default Risk

– Continuing Central Bank Demand

– Regulatory Authorities Investigate Gold Rigging

Outlook 2014

– Geopolitical Tensions – The Middle East, Russia, China, Japan and the U.S.

– Ultra Loose Monetary Policies Set To Continue with Yellen as New Federal Reserve Chair

– Eurozone Debt Crisis Again – UK, U.S. Japan and China Also Vulnerable

– Enter The Dragon – Chinese Gold Demand Paradigm Shift To Continue

– Death Of Indian Gold Market Greatly Exaggerated

– Long Term (2014-2020) MSGM Fundamentals

Conclusion

Introduction

Happy New Year. We would like to take this opportunity to wish our clients and subscribers a prosperous, healthy and happy 2014.

With 2013 having come to a close, it is important to take stock and review how various assets have performed in 2013, assess the outlook in 2014, and even more importantly, the outlook for the coming years.

2013 was the year of the speculator and the year of the risk asset, such as equities, with global stocks doing well in the sea of liquidity and cheap money created by central banks.

Surprisingly to many gold bulls, these favourable monetary conditions did not lead to higher precious metal prices. Gold and particularly silver had a torrid year and significantly underperformed the vast majority of equity and bond markets.

The MSCI World Index was up 23% and the S&P 500, the Nasdaq and the FTSE were up 32%, 35% and 14% respectively.

MSCI World Index – 1970 to January 3, 2014 – Bloomberg

Bond investors did not fare as well as interest rates began to rise from all-time record lows. As bond prices fell, interest rates rose. The bellwether 10-year Treasury note closed the year at 3.028%, which was up from 1.76% at the start of 2013 and the highest since July 2011.

US 10 Year Note – 1964 to January 3, 2014 – Bloomberg

The Barclays US Aggregate bond index, which is dominated by Treasury, mortgage and corporate bonds and is the leading benchmark followed by institutional money, is set to record its first negative year of total returns since 1999. The bond market’s major benchmark registered a total return of minus 2.1% for 2013. It is only the benchmark’s third annual negative total return since 1976, according to Barclays.

REVIEW OF 2013

Gold and Silver Have a Torrid Year – Fall 28% and 36% Respectively

Gold fell in all major currencies in 2013 and fell 28% in dollar terms for its first annual price fall since 2000. Gold fell 40% in pound terms, 45% in euro terms. Gold fell much less in Japanese yen terms and was 16% lower in yen as the yen continued to be devalued and debased.

Silver was down by 36% in dollar terms and by more in the other currencies; silver had its poorest annual performance since 1984.

Gold came under pressure in the first half of 2013 and saw falls from near $1,700/oz at the start of the year to $1,180/oz by mid-year. Indeed, gold’s low for the year took place on June 28th, which was the last day of trading in Q2, and an important time frame for those evaluating gold’s longer term performance.

The price falls in the first half took place despite a positive fundamental backdrop and despite the risk of contagion in the Eurozone – especially from Spain, Italy and Greece. This risk was so great in the early part of the year that it led George Soros to warn in February that the Eurozone could collapse as the U.S.S.R. had.

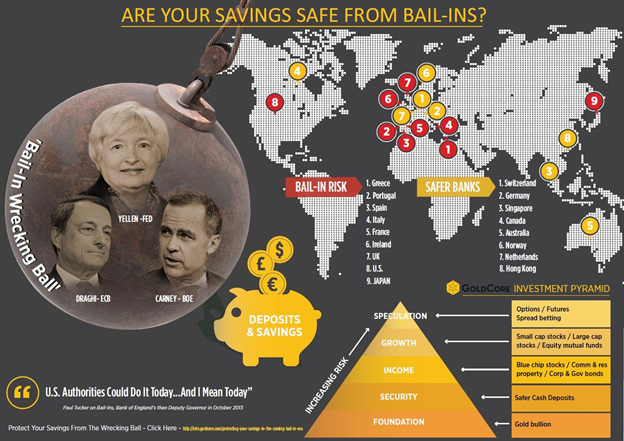

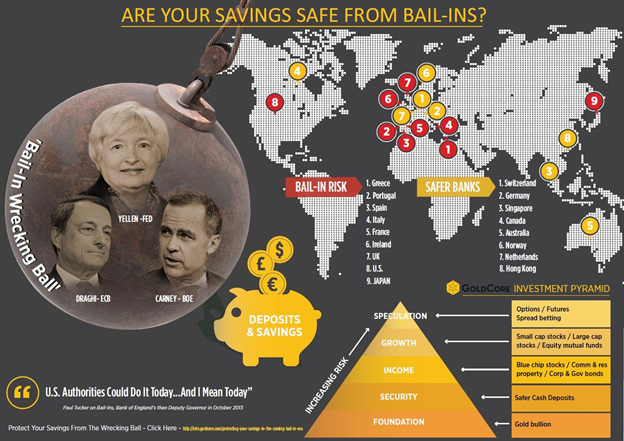

In March, Cyprus was the first country to experience a bank bail-in of depositors, where both individual and corporate account holders, experienced capital controls and a confiscation of nearly 50% of their deposits. In June and then again two weeks ago, the EU confirmed that depositors will be bailed in when banks are insolvent.

International monetary and financial authorities globally, including the ECB, the Bank of England and the Federal Deposit Insurance Corporation (FDIC), have put in place the regulatory and legal framework for bail-in regimes in the event of banks failing again.

Are Your Savings Safe From Bail-Ins

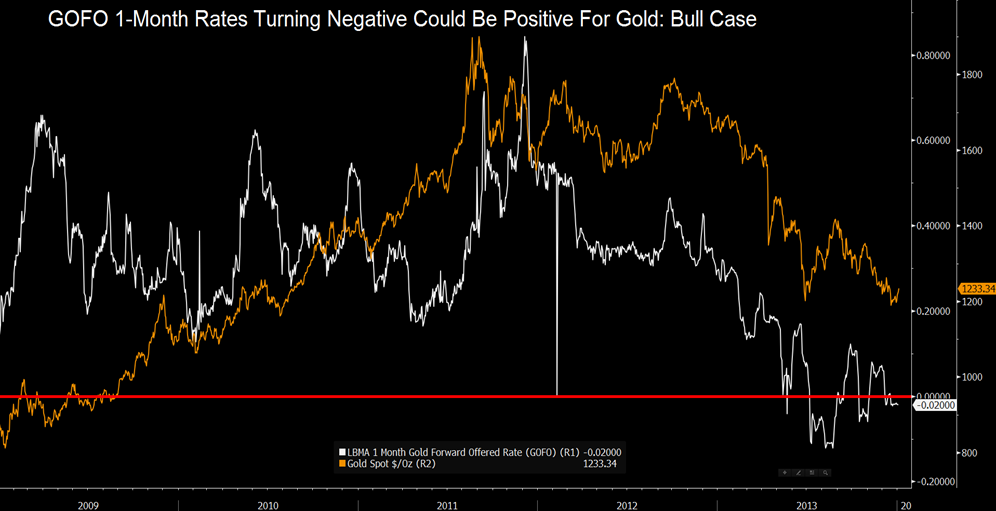

Gold saw a bit of a recovery in the third quarter with gains in July and August as gold interest rates went negative, bullion premiums in Asia surged and COMEX inventories continued to fall. Silver surged 12% in 5 trading days in mid August due to record silver eagle coin demand and ETF demand.

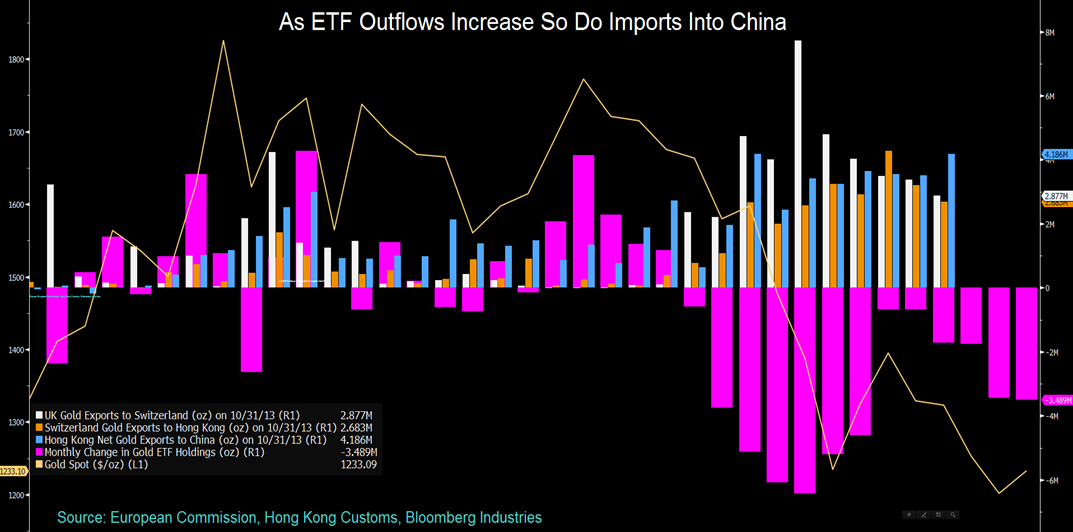

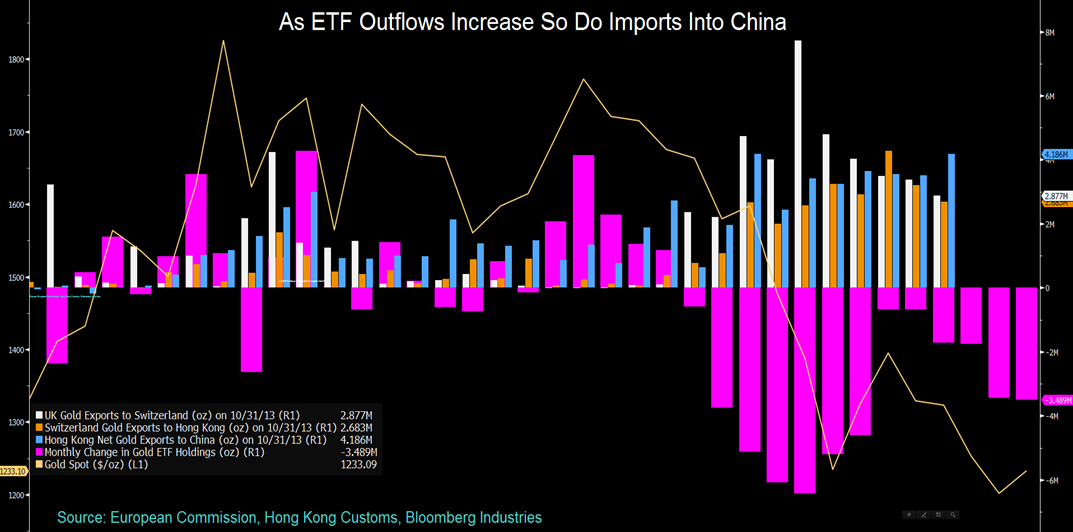

UK gold ‘exports’ to Switzerland increased greatly during the year due to demand for allocated gold in Switzerland due to Switzerland’s tradition of respecting private property throughout the centuries and its strong economy. However, more importantly, UK gold exports to Switzerland were due to the significant increase in store-of-wealth demand from China and many countries in Asia.

Institutional gold in the form of London gold delivery bars (400 oz) was exported to Swiss refineries in order to be recast into one kilogramme, 0.9999 gold bars used on the Shanghai Gold Exchange and in the Chinese market.

However, this was not enough to prevent further falls in the final quarter and in recent days when gold has again tested support at $1,200/oz.

Year Of Technical, Paper Selling But Robust Physical Demand

German Gold Repatriation

The year began with a bang, when news broke on January 17 that the German central bank was attempting to repatriate Germany’s gold reserves. The Bundesbank announced that they will repatriate 674 metric tons of their total 3,391 metric ton gold reserves from vaults in Paris and New York to restore public confidence in the safety of Germany’s gold reserves.

Bundesbank – Goldbarren

The repatriation of only some 20% of Germany’s gold reserves from the Federal Reserve Bank of New York and the Banque of Paris back to Frankfurt was meant to allay increasing German concerns about their gold reserves. But the fact that the transfer from the Federal Reserve is set to take place slowly over a seven year period and will only be completed in 2020 actually led to increased concerns. It also fueled concerns that the unaudited U.S. gold reserves may be less than what is officially recorded.

What was quite bullish news for the gold market, saw gold quickly rise by some $30 to challenge $1,700/oz. The news was expected to help contribute to higher prices but determined selling saw gold capped at $1,700/oz prior to falls in price in February.

Paper Selling On COMEX

Gold’s falls in 2013 can be attributed in large part to paper selling by more speculative players on the COMEX. This was graphically seen in April when there was a selling raid on the COMEX which led to a huge price fall of nearly 15% in two days prior to the emergence of “extraordinary” demand for gold internationally.

The sell off came as demand in Europe began to pick up due to concerns that the Cypriot deposit confiscation may be a precedent that could be seen in other EU countries.

The speed and scale of the sell off was incredible and even some of the bears were surprised by it. Many questioned the catalysts for the $150 two day sell off. The sell off was initially attributed to an unfounded rumour regarding Cyprus gold reserve sales – this was soon seen to be a non-story. The Cyprus rumour did not justify the scale of the unprecedented sell off.

Reports suggested that a single futures sell order worth $6 billion, equal to 4 million ounces or 124.4 tonnes of gold, by a large investment bank sent prices plummeting. The futures market then saw a further wave of selling of contracts worth some $15 billion, equivalent to 10 million ounces of selling or 300 tonnes, in just 35 minutes.

Gold futures with a value of over 400 tonnes were sold in a handful of trades in minutes. This was equal to 15% of annual gold mine production. The scale of the selling was massive and again underlines how one or two large banks or hedge funds can completely distort the market by aggressive, concentrated leveraged short positions.

Investment banks and hedge fund speculators can manipulate the paper or futures gold price in whichever direction they want in the short term due to the massive leverage they can utilise. The events in April further bolstered the allegations of manipulation by the Gold Anti-Trust Action Committee (GATA).

Significant Demand For Physical Gold Globally

Gold prices fell very sharply despite very high demand. However, the gold price decline was arrested by the scale of physical demand globally. This demand was particularly strong in the Middle East and in Asia, particularly China but was also seen in western markets with government mints reporting a surge in demand in 2013.

This demand for physical gold was seen in western markets throughout the year. In April, the US Mint had to suspend sales of small gold coins; premiums for coins and bars surged in western markets due to high demand.

Mints, refineries and bullion brokerages were quickly cleared out of stock in April and COMEX gold inventories plummeted. There were gold and silver coin and bar shortages globally.

This continued into May as investors and savers globally digested the ramifications of the Cypriot deposit confiscation. The crash of the Nikkei in May also added to physical demand in Japan and by nervous investors internationally.

This led to all time record gold transactions being reported by the LBMA at the end of May.

Chinese demand remained very robust and Shanghai Gold Exchange volumes surged 55% in one day at the end of May – from 10,094 kilograms to 15,641 kilograms. There were “supply constraints” for gold bars in Singapore and bullion brokers in Singapore and India became sold out of bullion product at the end of May.

This, and concerns about a very poor current account deficit and a possible run on the Indian rupee, prompted the Indian government to bring in quasi capital controls and punitive taxes on gold in June. Ironically, this led to even higher demand for gold in the short term and much higher premiums in India. Longer term, it has led to a massive surge in black market gold buying with thousands of Indians smuggling in gold from Bangkok, Dubai and elsewhere in Asia.

June saw another peculiar sudden 6% price fall in less than 24 hours. This again contributed to increased and very robust physical demand. U.S. Mint sales of silver coins reached a record in the first half of 2013 at 4,651,429 ounces and the UK’s Royal Mint saw a demand surge continuing in June after demand had trebled in April.

Asian markets continued to see elevated levels of gold buying. Gold demand in Vietnam was so high that buyers were paying a $217 premium over spot gold at $1,390/oz. Premiums surged again in China as the wise Chinese ‘aunties’ and wealthy Chinese continued to buy gold as a store of wealth.

Despite very high levels of demand for gold, in Asia especially, gold languished and sentiment in western markets continued to be very poor with gold falling to the lows of the year on June 28th.

July saw continuing strong demand for gold internationally as volumes surged to records on the Shanghai Gold Exchange (SGE). Premiums rose and feverish buying left many of Hong Kong’s banks, jewellers and even its gold exchange without enough gold bullion to meet demand.

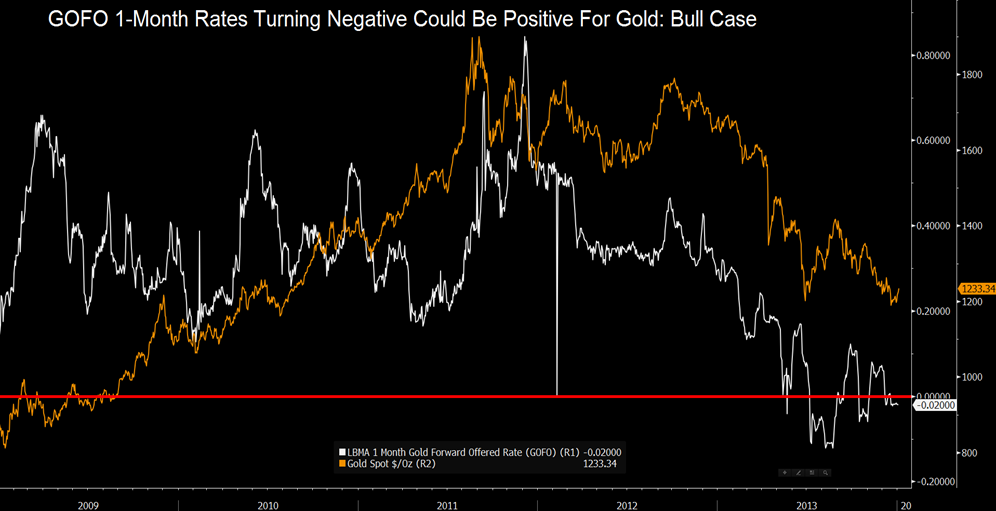

In August, demand remained elevated and gold forward offered rates (GOFO) remained negative and became more negative. This showed that physical demand was leading to supply issues in the highly leveraged LBMA gold market or the institutional gold bar market.

Today, as we enter the New Year gold, forward offered rates (GOFO) remain negative, meaning banks, which had lent their customers gold to obtain a positive return, and therefore increase the “paper” gold supply, will take the gold back. This should limit the amount of gold on the market and increase the gold price.

Chinese buyers are of increasing importance but it is important to note that physical demand rose significantly throughout the world in 2013 despite falling prices. This is seen in the levels of demand experienced by leading bullion dealers, refiners and government mints. This is clearly seen in the data released by the Perth Mint and the U.S. Mint which both saw increased demand for physical gold coins and bars in 2013. Other mints have yet to report their numbers.

The Perth Mint of Western Australia reported yesterday that they saw a very significant increase in sales in 2013 despite the falling prices. Gold sales from the Perth Mint, which refines most of the bullion from the world’s second-biggest producer Australia, climbed 41% last year.

Sales of gold coins and minted bars totalled 754,635 ounces in 2013 from 533,333 ounces a year earlier, according to data from the mint.

Silver coin sales surged 33% to about 8.6 million ounces from 6.5 million ounces in 2012, according to the Perth Mint.

Gold bullion sales expanded 12% to 58,944 ounces in December from 52,700 in November and about 51,778 ounces in December 2012, according to data from the mint. Gold sales fell to as low as 30,430 ounces in August and peaked at about 112,575 in April, when gold was hammered 14% lower on the COMEX in just two days.

Silver coin sales were 845,941 ounces last month from 807,246 in November and 452,389 a year earlier, it said.

The U.S. Mint also saw an increase in physical gold sales and sold 14% more American Eagle gold coins last year and sales climbed 17% to 56,000 ounces in December from November, according to data on the mint’s website as reported by Bloomberg.

Syria and the Middle East

Even bullish developments such as the prospect of war in Syria at the end of August, only led to small, short term price gains. War in Syria and in the Middle East, pitching the U.S. and western allies against China and Russia was expected by many to lead to “market panic” and to propel gold “much, much higher,” in the words of astute investor Jim Rogers.

Only the fact that President Obama and the U.S. were confronted with opposition by people internationally against another war and were outmaneuvered diplomatically, prevented the war with Syria.

The war had the potential to destabilise the region with ramifications for oil prices and the global economy.

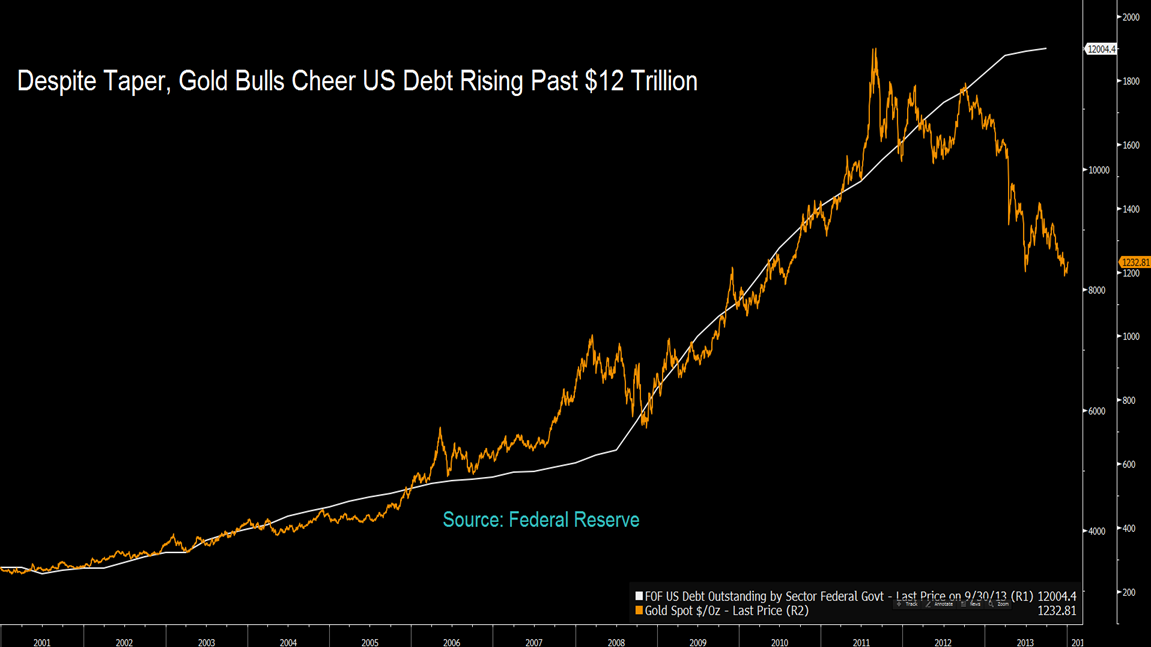

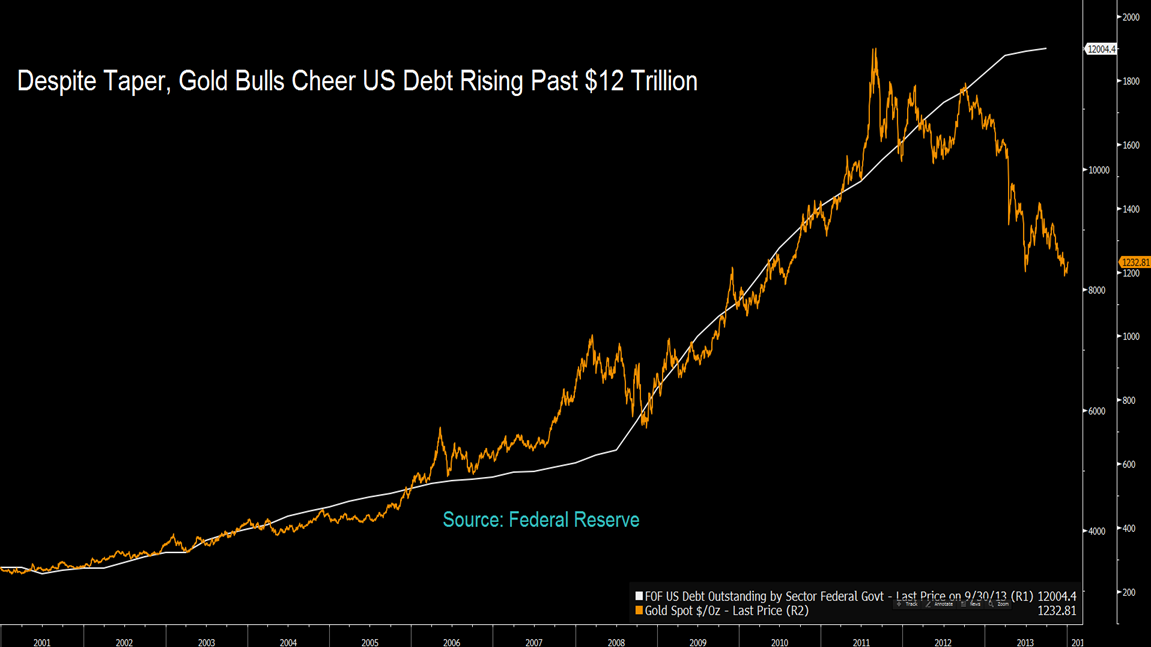

U.S. Government Shutdown and $12 Trillion Default Risk

Another very bullish development for gold came in late September and early October with the U.S. budget negotiations and government shutdown.

They highlighted the dire U.S. fiscal position and the complete failure of the American political and economic class to deal with their extremely precarious financial position in any meaningful way. The U.S. government is essentially bankrupt with a national debt of over $17 trillion and unfunded liabilities of between $100 trillion and $200 trillion.

In the coming months and years, it will lead to a lower dollar and much higher gold and silver prices.

However, in the year of paper gold selling that was 2013, even this did not lead to higher gold prices.

Continuing Central Bank Gold Demand

All year, central banks continued to accumulate gold with Russia, Kazakhstan, Azerbaijan, Kyrgyz Republic, Turkey and other central banks continuing to diversify their foreign exchange reserves.

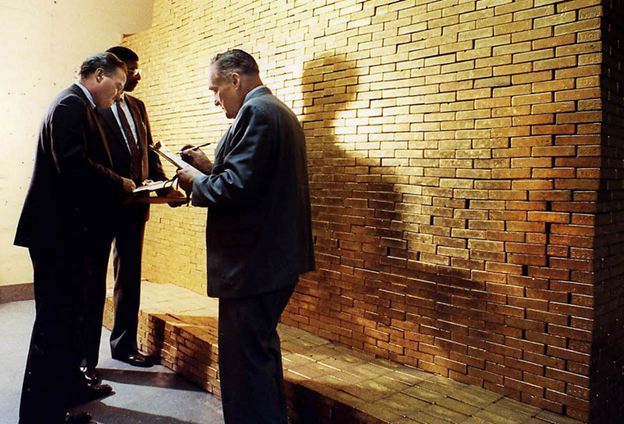

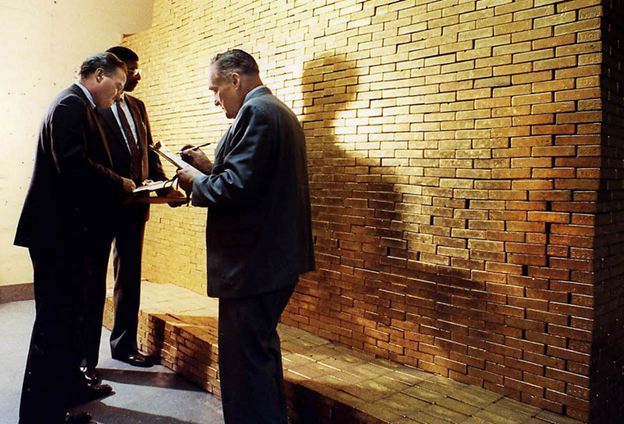

U.S. Federal Reserve employees in underground vault holding monetary gold

Central banks continued to be strong buyers of gold in 2013, albeit the full year data may show demand was at a slightly slower rate than the record levels seen in recent years. Q4 2013 will be the 12th consecutive quarter of net purchases of gold by central banks.

Total official central bank demand continued at roughly 100 tonnes every single quarter. However, this does not include the ongoing clandestine and undeclared purchases of gold by the People’s Bank of China. Conservative estimates put PBOC demand at 100 tonnes a quarter or at over 400 tonnes for the year. More radical projections are of demand of over 1,000 tonnes from the PBOC in 2013.

Regulatory Authorities Investigate Gold Rigging

Peculiar, single trade or handful of trades leading to sudden gold price falls were common in 2013 and contributed to the 28% price fall.

Therefore, those who have diversified into physical gold will welcome the move by the German financial regulator BaFin to widen their investigation into manipulation by banks of benchmark gold and silver prices. In December, the German banking regulator BaFin demanded documents from Germany’s largest bank, Deutsche Bank, as part of a probe into suspected manipulation of the gold and silver markets.

The German regulator has been interrogating the bank’s staff over the past several months. Since November, when the probe was first mentioned, similar audits in the U.S. and UK are also commencing.

Precious metal investors live in hope but their experience of such investigations is that they are often very lengthy affairs with little in the way of outcome, disclosure or sanction. The forces of global supply and demand, one anemic, the other very high, are likely to be more important and a valuable aid to gold and silver owners in 2014 and in the coming years. As ultimately, the price of all commodities, currencies and assets is determined by supply and demand.

Janet Yellen Becomes Fed Chair

At year end came confirmation that cheap money uber dove Janet Yellen was set to take over from Ben Bernanke as Chair of the Federal Reserve. Gold bulls cheered loudly at her appointment thinking that Yellen’s appointment would lead to a recovery in oversold gold prices. However, even this bullish development did not help embattled gold prices.

OUTLOOK FOR 2014

Introduction

2013 was a year of calm in the world of finance. 2014 may not be so calm and there is a risk of renewed turbulence on global financial markets. There are many unresolved risks which were present in 2013 but did not come to the fore and impact markets as they could have.

The Eurozone debt crisis is far from resolved and there remains an underappreciated risk of sovereign crises in other major industrial nations.

There are far more positives for gold than negatives and the positives include ultra-loose monetary policies, risk of sovereign and banking debt crises and systemic or contagion risk, the increasingly uncertain political and military situation globally and of course increased demand for gold from the Middle East, much of Asia and particularly China.

Download GoldCore Outlook For 2014

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/PXF6irLCW84/story01.htm GoldCore

![]()