“We’re an easy target for recruiters,” one homeless man explains. “We turn up here with all our bags, wheeling them around and we’re easy to spot. They say to us, are you looking for work? Are you hungry? And if we haven’t eaten, they offer to find us a job.” As Reuters exposes, 3 years after the earthquake and tsunami that caused the meltdown at Fukushima’s nuclear facility, Northern Japanese homeless are willing to accept minimum wage (from yakuza-based entities) for one of the most undesirable jobs in the industrialized world: working on the $35 billion, taxpayer-funded effort to clean up radioactive fallout across an area of northern Japan larger than Hong Kong.

Seiji Sasa hits the train station in this northern Japanese city before dawn most mornings to prowl for homeless men.

He isn’t a social worker. He’s a recruiter. The men in Sendai Station are potential laborers that Sasa can dispatch to contractors in Japan’s nuclear disaster zone for a bounty of $100 a head.

“This is how labor recruiters like me come in every day,”

…

It’s also how Japan finds people willing to accept minimum wage for one of the most undesirable jobs in the industrialized world: working on the $35 billion, taxpayer-funded effort to clean up radioactive fallout across an area of northern Japan larger than Hong Kong.

…

In January, October and November, Japanese gangsters were arrested on charges of infiltrating construction giant Obayashi Corp’s network of decontamination subcontractors and illegally sending workers to the government-funded project.

In the October case, homeless men were rounded up at Sendai’s train station by Sasa, then put to work clearing radioactive soil and debris in Fukushima City for less than minimum wage, according to police and accounts of those involved. The men reported up through a chain of three other companies to Obayashi, Japan’s second-largest construction company.

Obayashi, which is one of more than 20 major contractors involved in government-funded radiation removal projects, has not been accused of any wrongdoing. But the spate of arrests has shown that members of Japan’s three largest criminal syndicates – Yamaguchi-gumi, Sumiyoshi-kai and Inagawa-kai – had set up black-market recruiting agencies under Obayashi.

“We are taking it very seriously that these incidents keep happening one after another,” said Junichi Ichikawa, a spokesman for Obayashi. He said the company tightened its scrutiny of its lower-tier subcontractors in order to shut out gangsters, known as the yakuza. “There were elements of what we had been doing that did not go far enough.”

…

Reuters found 56 subcontractors listed on environment ministry contracts worth a total of $2.5 billion in the most radiated areas of Fukushima that would have been barred from traditional public works because they had not been vetted by the construction ministry.

…

“If you started looking at every single person, the project wouldn’t move forward. You wouldn’t get a tenth of the people you need,” said Yukio Suganuma, president of Aisogo Service, a construction company that was hired in 2012 to clean up radioactive fallout from streets in the town of Tamura.

…

“There are many unknown entities getting involved in decontamination projects,” said Igarashi, a former advisor to ex-Prime Minister Naoto Kan. “There needs to be a thorough check on what companies are working on what, and when. I think it’s probably completely lawless if the top contractors are not thoroughly checking.”

…

“I don’t ask questions; that’s not my job,” Sasa said in an interview with Reuters. “I just find people and send them to work. I send them and get money in exchange. That’s it. I don’t get involved in what happens after that.”

…

“The construction industry is 90 percent run by gangs.”

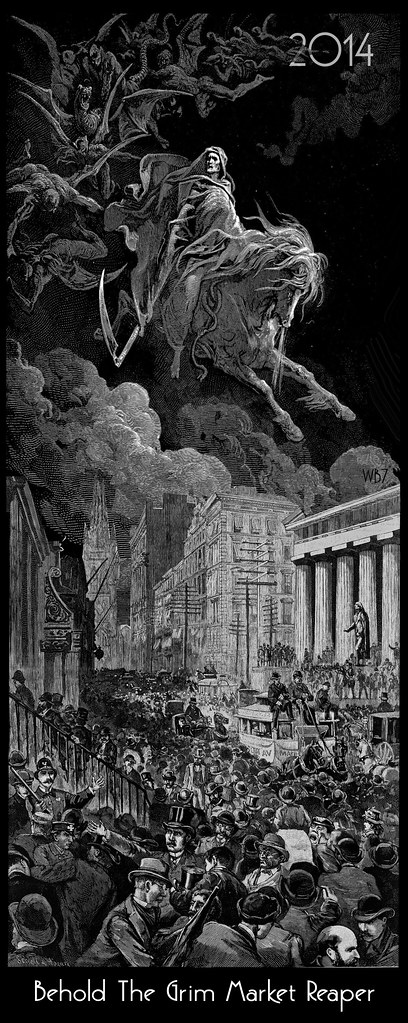

It would seem, perhaps, that France (and the US) need their own nuclear accident to unleash an employment boom…

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/kpHZRldbvBs/story01.htm Tyler Durden