Submitted by Charels Hugh-Smith of OfTwoMinds blog,

By standards of previous generations, the middle class has been stripmined of income, assets and purchasing power.

What does it take to be middle class nowadays? A recent paper, The Distribution of Household Income and the Middle Class, used Census data to discuss what sort of income it takes to qualify as middle class, but reached no firm conclusion: people tend to self-report that they belong to the middle class based on income, but income is not the only the metric–indeed, it can be argued that 12 other factors are more telling measures of middle class membership than income.

In Why the Middle Class Is Doomed (April 17, 2012) I listed five "threshold" characteristics of membership in the middle class:

1. Meaningful healthcare insurance

2. Significant equity (25%-50%) in a home or other real estate

3. Income/expenses that enable the household to save at least 6% of its income

4. Significant retirement funds: 401Ks, IRAs, etc.

5. The ability to service all debt and expenses over the medium-term if one of the primary household wage-earners lose their job

I then added a taken-for-granted sixth:

6. Reliable vehicles for each wage-earner

Author Chris Sullins suggested adding these additional thresholds:

7. If a household requires government assistance to maintain the family lifestyle, their Middle Class status is in doubt.

8. A percentage of non-paper, non-real estate hard assets such as family heirlooms, precious metals, tools, etc. that can be transferred to the next generation, i.e. generational wealth.

9. Ability to invest in offspring (education, extracurricular clubs/training, etc.).

10. Leisure time devoted to the maintenance of physical/spiritual/mental fitness.

Correspondent Mark G. recently suggested two more:

11. Continual accumulation of human and social capital (new skills, networks of collaborators, markets for one's services, etc.)

And the money shot:

12. Family ownership of income-producing assets such as rental properties, bonds, etc.

The key point of these thresholds is that propping up a precarious illusion of consumption and status signifiers does not qualify as middle class. To qualify as middle class (that is, what was considered middle class a generation or two ago), the household must actually own/control wealth that won't vanish if the investment bubble du jour pops, and won't be wiped out by a medical emergency.

In Chris's phrase, "They should be focusing resources on the next generation and passing on Generational Wealth" as opposed to "keeping up appearances" via aspirational consumption financed with debt.

What does it take in the real world to qualify as middle class? Let's start by noting that real (adjusted for inflation) income has barely budged in 40 years, while household income has declined: Soaring Poverty Casts Spotlight on ‘Lost Decade’:

According to the Census figures, the median annual income for a male full-time, year-round worker in 2010 — $47,715 — was virtually unchanged, in 2010 dollars, from its level in 1973, when it was $49,065.Overall, median household income adjusted for inflation declined by 2.3 percent in 2010 from the previous year, to $49,445. That was 7 percent less than the peak of $53,252 in 1999.

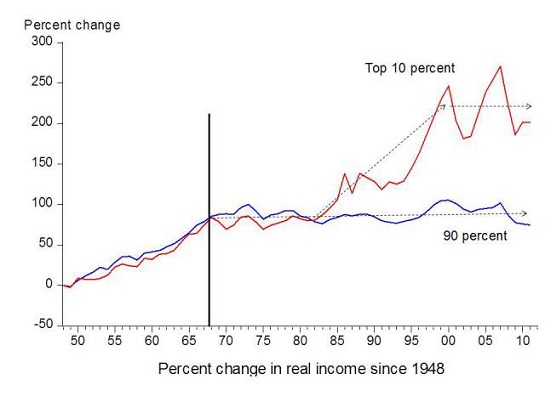

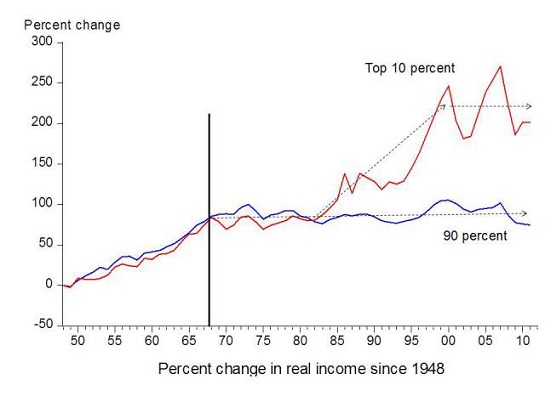

Here is a chart of the real income of the lower 90% and the top 10%, which by definition cannot be "middle class":

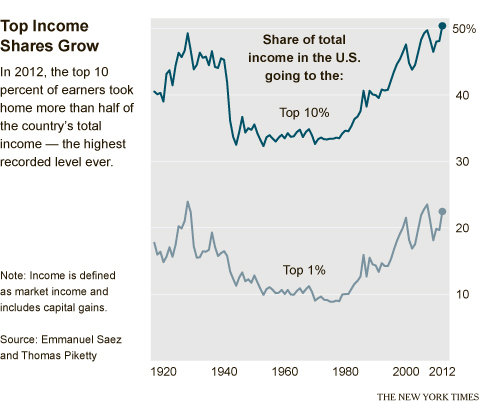

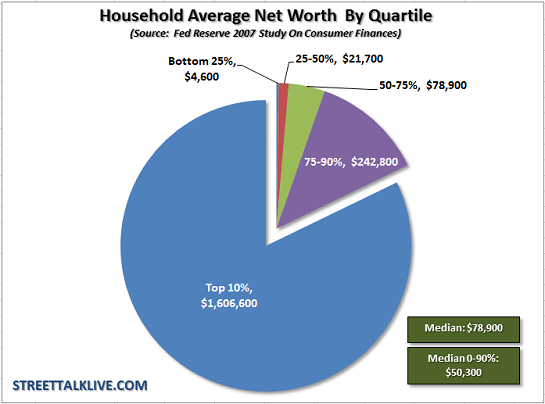

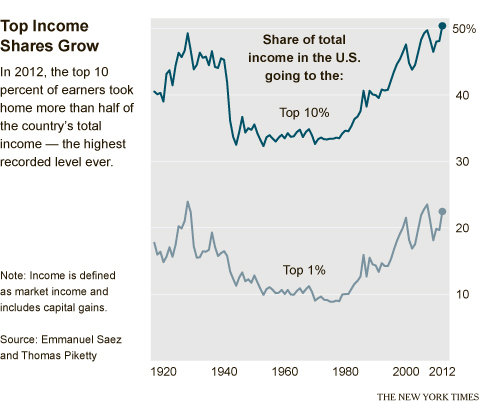

The top 10% takes home 51% of all household income:

Here are my calculations based on our own expenses and those of our friends in urban America. We can quibble about details endlessly, so these are mid-range estimates. These reflect urban costs; rural towns/cities will naturally have significantly lower cost structures. Please make adjustments as suits your area or experience, but please recall that tens of millions of people live in high-cost left and right-coast cities, and millions more have high heating/cooling/commuting costs.

The wages of those employed by Corporate America or the government do not reflect the total cost of benefits. Self-employed people like myself pay the full costs of benefits, so let's "get real" and count *all* costs paid to maintain a middle-class lifestyle.

1. Healthcare. Let's budget $13,000 annually for healthcare insurance. Yes, if you're 23 years old and single, you will pay a lot less, so this is an average. If you're older (I'm 60), $13,000 a year only buys you and your spouse stripped down coverage: no eyewear, medication or dental coverage–and that's if your existing plan is grandfathered in. (If you want non-phantom ObamaCare coverage, i.e. a Gold plan, the cost zooms up to $2,000/month or $24,000 annually.)

Add in co-pays and out-of-pocket expenses, and the realistic annual total is between $15,000 and $20,000 annually: Your family's health care costs: $19,393 (this was before ACA).

Let's say $15,000 annually is about as low as you can reasonably expect to maintain middle class healthcare.

2. Home equity.<

/b> Building home equity requires paying meaningful principal. Let's say a household has a 15-year mortgage so the principal payments are actually meaningfully adding to equity, unlike a 30-year mortgage. Let's say $5-$10,000 of $25,000 in annual mortgage payments is interest (deductible) and $15-$20,000 goes to principal reduction.

3. Savings. Anything less than $5,000 in annual savings is not very meaningful if college costs, co-pays for medical emergencies, etc. are being anticipated, and $10,000 is a more realistic number given the need to stockpile cash in the event of job loss or reduced hours/pay. So let's go with a minimum of $5,000 in cash savings annually.

4. Retirement. Let's assume $6,000 per wage earner per year, or $12,000 per household. That won't buy much of a retirement unless you start at age 25, and even then the return at current rates is so abysmal the nestegg won't grow faster than inflation unless you take horrendous risks (and win).

5. Vehicles. The AAA pegs the cost of each compact car at $6,700 annually, so $13K per year assumes two compacts each driven 15,000 miles. The cost declines for two paid-for, well-maintained clunkers. Average cost of auto ownership: $8,946 per year. let's assume a scrimp-and-save household who manages to operate and insure two vehicles for $10,000 annually.

6. Taxes. Self-employed people pay full freight Social Security and Medicare taxes: 15.3% of all net income, starting with dollar one and going up to $113,700 for SSA. Since an adjusted gross income (AGI) of $66,193 or more puts you in the top 25% of earners, let's use a base income (self-employed) of $68,000 to calculate our SSA/Medicare taxes: that's about $10,000 annually.

Property taxes: These are low in many parts of the country, but let's assume a New Jersey/New York/California level of property tax: $10,000 annually.

Income tax: Since the mortgage interest is only $5-$10K a year, itemized deductions are less than the standard deductions of around $18,000. One-half of the self-employment tax is deductible, as well as the health insurance and IRA retirement contributions, so that's another $30,000 in deductions. That leaves about $20,000 in taxable income and about $3,000 in Federal tax, and let's assume $2,000 in state and local taxes for a total of $5,000.

7. Living expenses: Some people spend hundreds of dollars on food each week, others considerably less. Let's assume a two-adult household will need at least $12,000 annually for food, utilities, phone service, Internet, home maintenance, clothing, furnishings, books, films, etc., while those who like to dine out often, take week-ends away for skiing or equivalent will need more like $20,000.

8. Donations, church tithes, community organizations, adult education, hobbies, etc.: Let's say $2,000 annually at a minimum.

Note that this does not include the cost of maintaining boats, RVs, pools, etc., or the cost of an annual vacation.

Here's the annual summary:

Healthcare: $15,000

Mortgage: $25,000

Savings: $5,000

Retirement: $12,000

Vehicles: $10,000

Property taxes: $10,000

Other taxes: $15,000

Living expenses: $12,000

Other: $2,000

Total: $106,000

Oops. That's more than double the median household income. OK, let's assume the mortgage is a bit high, ditto the property taxes. Let's say we need "only" $96,000.

Oops again: our tax calculations were based on $68,000 in self-employed net earnings. To earn $96,000, our taxes are going to skyrocket, as we're still paying the full 15.3% SSA/Medicare taxes while we'll jump into the 25% tax bracket when our taxable income exceeds $35,000. Since we'll be paying at least $15,000 more in SSA and income taxes, then we're up to $111,000 as the minimum household income to maintain a middle class lifestyle for two self-employed adults.

An individual earning $111,000 is in the top 10% of all wage earners. A household earning $111,000 is in the 80%-90% income bracket–the lower half of the top 20%. This suggests that the "middle class" has atrophied into the 10% of households just below the top 10%. Households in the "bottom 80%" are lacking essential attributes of a middle class lifestyle that was once affordable on a much more modest income.

Note that this $111,000 household income has no budget for lavish vacations, boats, weekends spent skiing, etc., nor does it budget for luxury vehicles, SUVs, large pickup trucks, etc. There is no budget for private schooling. Most of the family income goes to the mortgage, taxes and healthcare. Savings are modest, along with living expenses and retirement contributions. This is a barebones budget.

If costs had stagnated along with wages, it would take a lot less to maintain a middle class lifestyle. But costs for most middle class essentials have skyrocketed. I was struck by something I read recently in a history of the Tang Dynasty in China, circa 700-900 A.D. When costs are cheap, goods and trade are abundant and prosperity is widely distributed. Once costs rise, trade declines and living standards stagnate. Poverty and unrest rise.

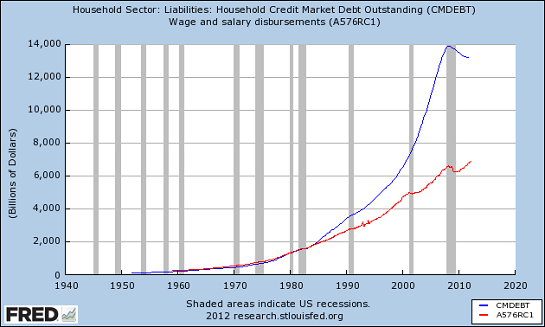

Here are a few charts that illustrate the pressures on the middle class:

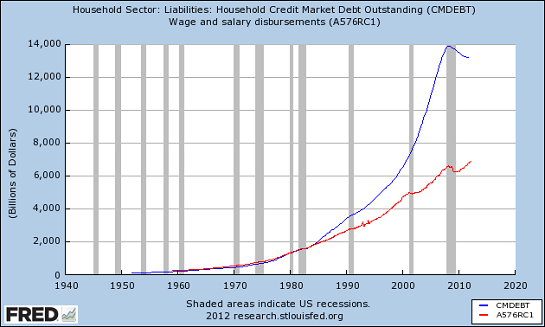

Wages have risen modestly while debt has increased enormously.

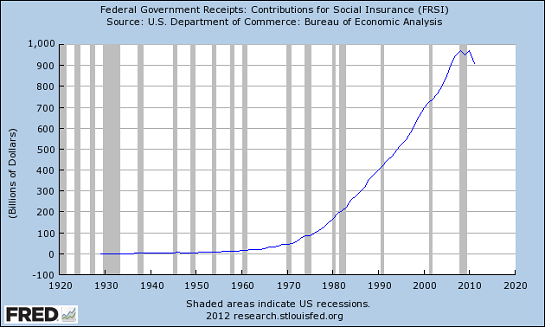

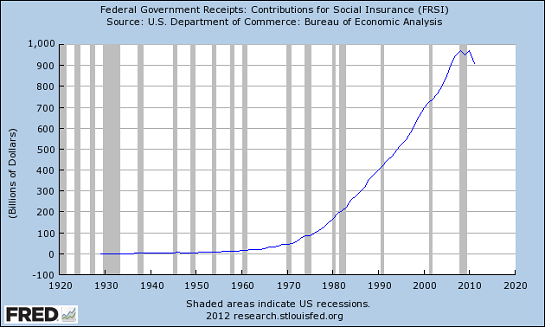

Social Security taxes have skyrocketed:

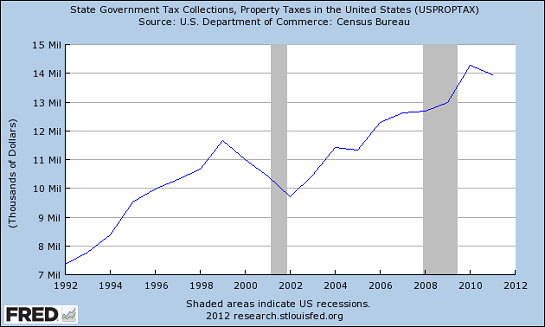

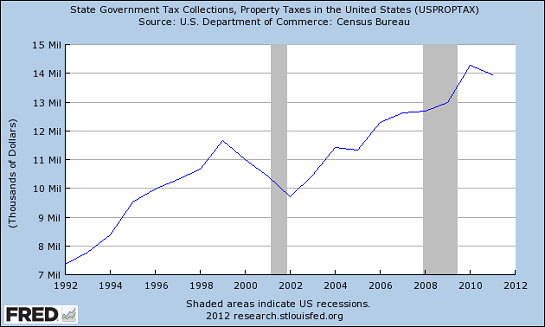

So have property taxes: they rose right through the last recession even as property values tanked:

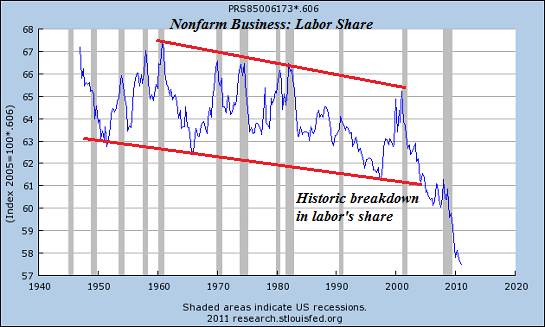

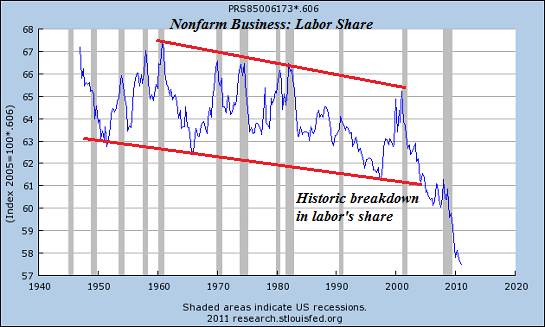

Labor's share of national income has plummeted:

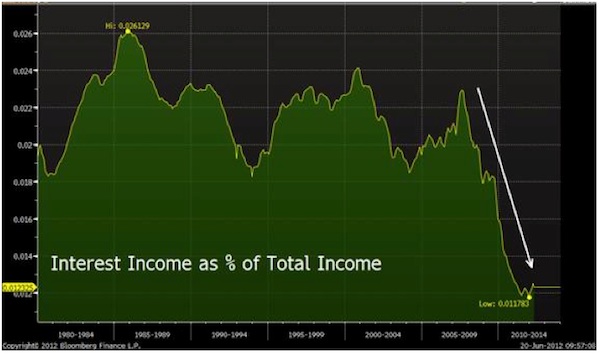

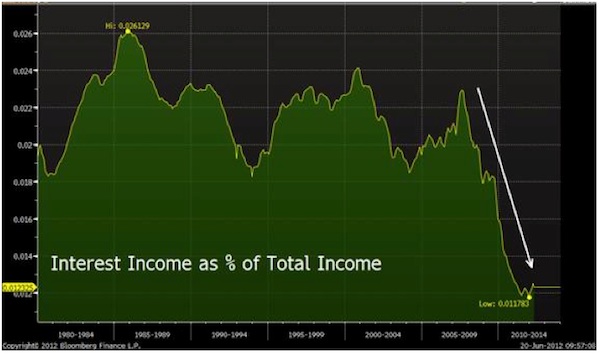

Interest income has fallen through the floor (thank you, Federal Reserve):

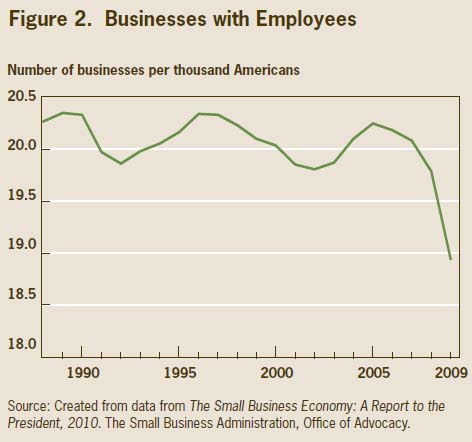

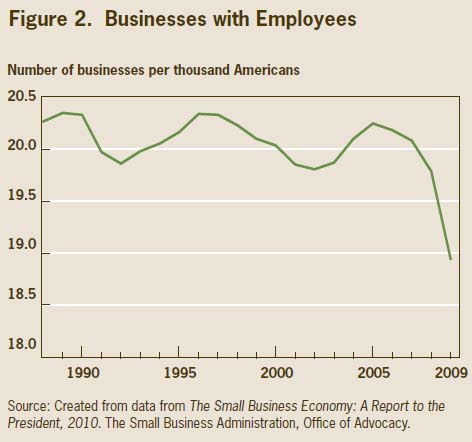

The bedrock of Main Street, small business, has cratered:

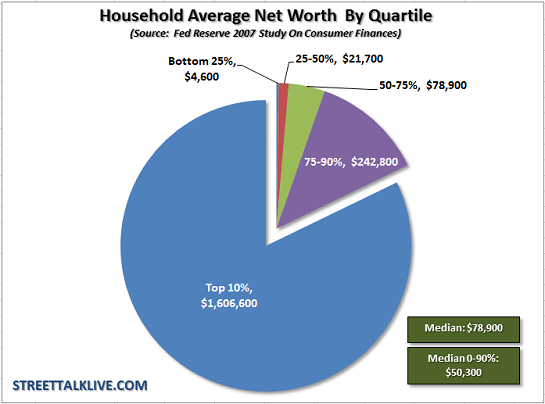

Net worth of the middle income households has been reduced to a sliver:

As costs have risen faster than incomes for decades, households have been priced out of the middle class. By standards of previous generations, the middle class has been stripmined of income, assets and purchasing power.

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/t_B5vcMWTSs/story01.htm Tyler Durden

![]()