Elon Musk’s DOGE initiative will be an epic failure.

That’s the message from the latest forecast by the “non-partisan” Congressional Budget Office which projected staggering increases in federal budget deficits and debt over the next 30 years, coupled with a collapse in population growth and productivity, largely due to surging interest costs – the same soaring interest costs we have been warning about for years – as it laid out a dismal economic picture for the twilight days of the United States.

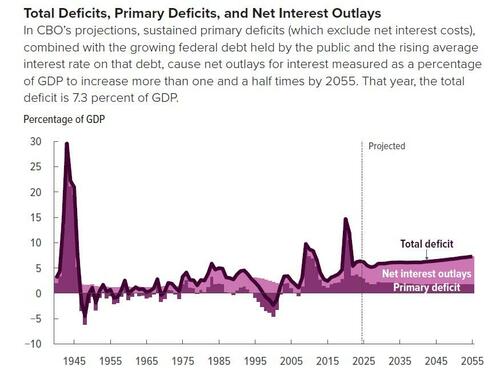

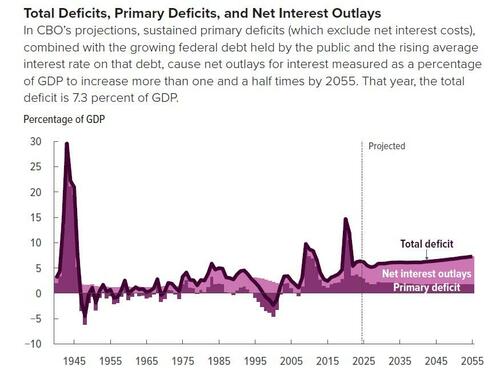

The CBO’s latest long-term budget projections show federal deficits accelerating to 7.3% of the economy in fiscal year 2055 from 6.2% in 2025. That is up from the 30-year average from 1995 to 2024 of 3.9%. In other words, the CBO is giving zero credibility to DOGE’s stated mission of slashing US spending and deficit. Just earlier today, Elon Musk said that his Govt Efficiency Department aims to finish $1 trillion in cuts by the end of May. Needless to say, the CBO disagrees.

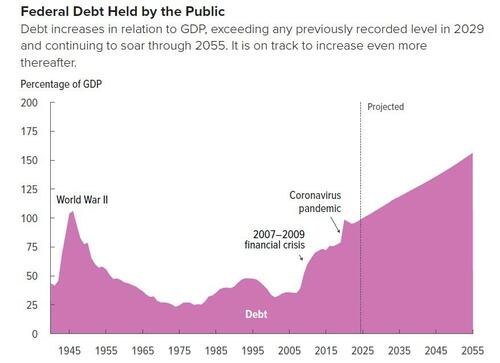

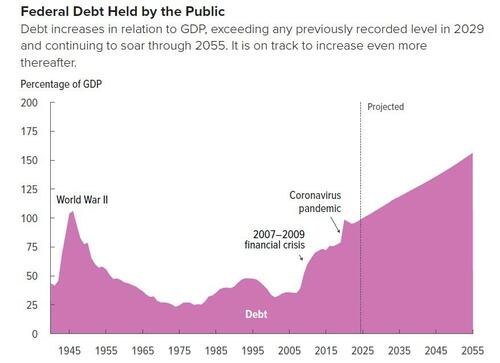

But where it gets really scary is the CBO’s update of what is arguably the scariest chart in the world: that of US public debt which is now seen rising alarmingly, to 156% of GDP in 2055 from 100% in 2025.

“Mounting debt would slow economic growth, push up interest payments to foreign holders of U.S. debt and pose significant risks to the fiscal and economic outlook,” the Long-Term Budget Outlook: 2025 to 2055 stated.

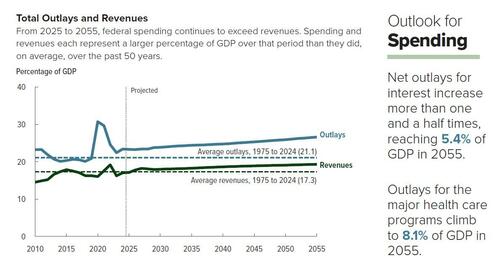

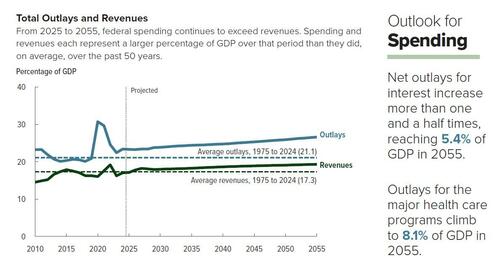

Of particular note, government interest payments on its ballooning debt were projected at 5.4% of GDP in fiscal year 2055, up from the anticipated 3.2% in the current fiscal year that ends on September 30.

That too is overly optimistic: as we noted previously, interest on the debt will surpass social security spending as the #1 outlay as soon as 2027 unless interest rates tumble or debt is drastically reduced. Neither is likely to happen.

At least the CBO acknowledges that interest costs are projected to be even larger than spending on the government’s “discretionary” programs, such as military operations, air traffic control, law enforcement and nutrition programs. Altogether, those will comprise 5.1% of GDP in 2055.

The “non-partisan” CBO quickly showed its partisan colors by advocating implicitly for a resumption of Biden’s illegal alien acceptance policies. According to the forecast, the aging US population will push spending on Social Security benefits to 6.1% of GDP in fiscal year 2055, up from 5.2% in 2025.

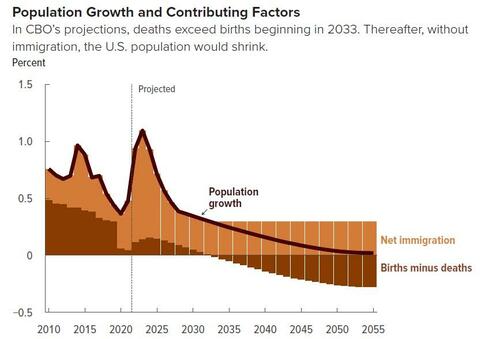

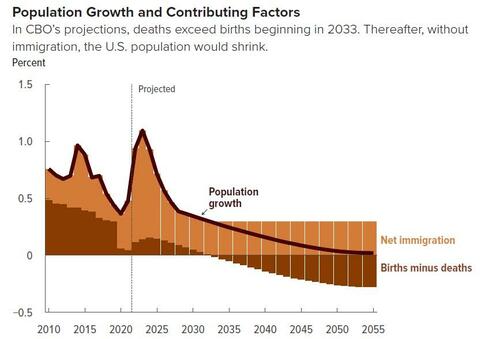

The CBO also forecast slower U.S. population growth over the next 30 years than during the past three decades largely due to reduced immigration. That will slow economic output in a shrinking labor force. Without mentioning Trump, it added: “Without immigration, the U.S. population would begin to shrink in 2033.”

Annual deaths are projected to exceed the number of births in the US just eight years from now, at which point net immigration would drive population growth. Last year, the CBO estimated the US population would begin to shrink in 2040, but that was thanks to Biden hoovering up every Venezuelan murdered-cum-illegal alien in hopes they would vote for him.

According to Bloomberg, the projection “showcases the risk of imposing draconian immigration policies at a time when the Trump administration has been implementing sweeping actions to curb the inflow of non-native-born people. Measures have included restricting deportation protections and sharply tightening border security. Border crossings in February were 94% lower than they were a year prior, according to US Customs and Border Protection data.”

Net immigration would “increase the size of the overall population in coming years and boost the share of people in age groups that have higher rates of labor force participation,” the CBO said in its outlook. What the CBO forgot to add is net ILLEGAL immigration, which has been the primary source of net immigration in the past decade.

Because how will the US ever survive without continuing to import every Latin American criminal?

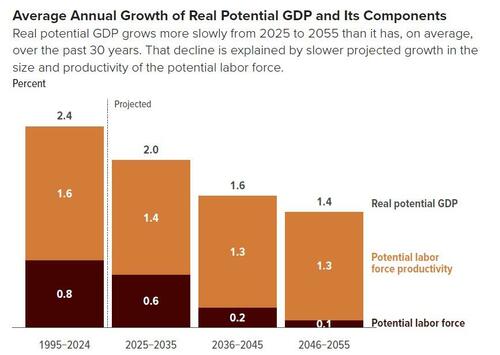

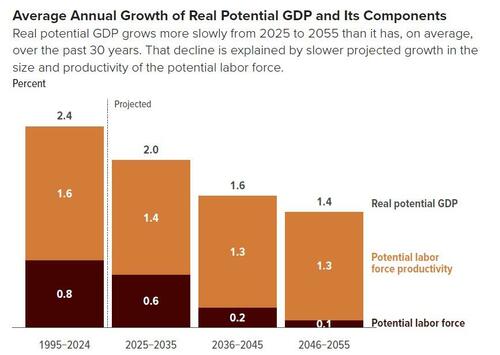

Overall, the CBO projected real economic growth, forecast at 2.1% in 2025, slowing to 1.4% in 2055.

At the same time, net immigration would “increase the size of the overall population in coming years and boost the share of people in age groups that have higher rates of labor force participation,” the CBO said in its outlook.

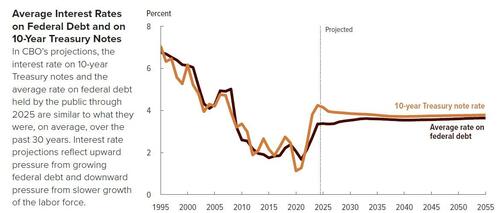

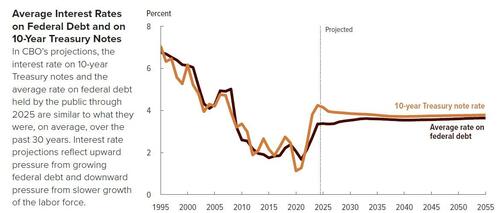

The silver lining to the economic slowdown is that it will keep rates on 10-year Treasury notes largely flat over the 30 years, “reflecting upward pressure from increases in federal borrowing and downward pressure from slowdowns in the growth of the labor force.”

But things could get much worse. The CBO bases its projections on current law, which could change significantly in the short-term. That is due in part to the push now underway by President Trump and Republicans to slash federal spending and the government’s workforce, while also extending tax cuts that are due to expire at the end of this year under current law.

“As bad as this outlook is, it represents an ‘optimistic scenario,’ because policymakers are currently considering adding trillions more in tax cut extensions, which would add to the debt,” said Michael Peterson, head of the Peter G. Peterson Foundation, which advocates fiscal policy reforms.

There are estimates that extending those tax cuts for a decade could add around $4.6 trillion to deficits and debt. House Republicans have proposed spending cuts, including to federal healthcare programs, to achieve some savings.

Trump also has ordered tough border security measures and efforts to deport immigrants that experts see potentially denting the economy as a result of labor shortages.

Another unknown factor is the outcome of court challenges to Trump policies that already are pending. The CBO does not include any consideration of the outcome of those court cases in its long-term projections. The report also does not factor in the potential impact on the U.S. economy from a broad range of tariffs Trump is implementing against foreign goods.

There was some good news: for now, the risk of a fiscal crisis “appears to be low,” but it’s not possible to reliably quantify the danger, the CBO said.

“In the agency’s assessment, no tipping point can be identified at which the debt-to-GDP ratio would become so high that it would make a crisis likely or imminent,” the report said. “Nor is there a specific tipping point beyond which interest costs would become so high in relation to GDP that they were unsustainable.” Uhm, maybe they should take a look at their debt forecast chart again.

But it’s not just DOGE that the CBO dissed: it also threw the entire AI bubble under the bus. You see, despite all the current fervor over the application of artificial intelligence, the CBO is projecting weaker productivity gains over coming decades. That’s in part due to slower investment because of a crowding-out effect from massive public-sector borrowing.

“Increased federal borrowing is projected to reduce the resources available for private investment,” the CBO said. Declines in federal investment relative to GDP are also seen as a drag on so-called total factor productivity — a term to describe efficiency gains.

Well if only the previous administration hadn’t listened to the CBO’s cheerful forecasts years ago when the “nonpartisan” budget office said to do… precisely what was done and lo and behold, here we are. And now the CBO wakes up?

The bottom line, however, is that the CBO has openly declared war on Musk and is daring him to shutdown whole swaths of the government, and if there is anything Elon lives for, it’s a dare. It sure would be ironic if the completely useless and thoroughly partisan CBO itself were to be the next to be eliminated.

Source: CBO