US stock futures are up small with Tech lagging on rotation fears, though major indices are off their overnight lows. The AI narrative has been flipped upside down, with traders focused on perceived losers, most of which are in the Software sector, where “there’s no floor” according to one investment manager. As of 8:00am ET, S&P futures are up 0.2%, well off session lows; Nasdaq futures rise 0.2%, pressured by weakness in AMD which tumbled 8% after projections which disappointed Wall Street; Alphabet is set to report after the close. Pre-market, Mag7 are mixed with AAPL, AMZN, and GOOG higher with Semis under pressure (AMD -7%, AVGO -0.8%, NVDA -0.1%). Both Cyclicals and Defensives are mixed without a clear leader. The USD is bid as bond yields are higher by 1-2bps.Commodities are stronger led by Energy and Metals, with gold blasting off back over $5k, and silver rising above $90. Today’s macro data focus is on ISM Services where an in line / stronger print may create a renewed bid for stocks.

In premarket trading, Mag 7 stocks are mostly higher: Alphabet +1% ahead of earnings due after the market close (Microsoft +0.1%, Amazon +0.3%, Apple +0.3%, Nvidia +0.3%, Meta little changed, Tesla -0.06%)

- AMD (AMD) slides 9% after the chipmaker’s sales forecast underwhelmed investors, a sign that it’s not making the AI inroads that some on Wall Street anticipated.

- Boston Scientific (BSX) falls 9% after the maker of medical devices gave a profit and sales growth forecast for 2026 that fell short of Wall Street’s expectations.

- Chipotle (CMG) falls 5% after the restaurant chain operator’s underwhelming annual comparable sales forecast.

- Eli Lilly & Co. (LLY) rises 7% after providing an upbeat sales forecast for the year as strong demand for its weight loss drug cemented its position at the top of the obesity market.

- Emerson Electric (EMR) rises 4% after the automation technology provider reported 9% growth in underlying orders in its first quarter. Citi said orders and other results show a “largely healthy demand environment.”

- Johnson Controls (JCI) rises 8% after the HVAC company boosted its adjusted earnings per share forecast for the full year to a figure above what analysts expected.

- Lumen Technologies (LUMN) falls 4% after the wireline telecommunications company’s results and outlook prompted a downgrade from Raymond James.

- Lumentum (LITE) rises 10% after the maker of optical and photonic products posted stronger-than-expected second-quarter results and gave a robust forecast.

- Match Group (MTCH) jumps 7% after the dating service provider reported revenue for the fourth quarter that beat the average analyst estimate.

- Silicon Laboratories (SLAB) jumps 53% after agreeing to be acquired by Texas Instruments for $231 per share in cash.

- Sonos (SONO) rises 12% after the speaker company’s first-quarter results beat expectations on key metrics.

- Take-Two Interactive (TTWO) rises 5% after the video game publisher raised its fourth-quarter bookings forecast. Analysts are positive about the company reiterating the launch date of its highly anticipated Grand Theft Auto VI.

- Uber Technologies Inc. (UBER) falls 6% after giving a weak profit outlook and promoted an outspoken driverless-vehicle bull to be its new chief financial officer, signaling further investment in a closely watched area of the ride-hailing company’s business.

Economically sensitive shares were Wednesday’s biggest gainers, with futures for the Russell 2000 index of small caps advancing 0.4%, while tech treaded water after a historic rout for SaaS/Software names. The rotation into cyclical stocks persisted as renewed fears over AI-driven disruption weighed on markets. Tuesday’s selloff was sparked by a new automation tool from Anthropic PBC, with losses spilling into financial services and asset managers. Caution lingered on Wednesday, with a European basket of stocks seen at risk from AI disruption falling another 1.1%.

“I don’t think the market has fully resolved whether this move was based on fear or fundamentals. What’s clear is that we’ve had a confidence break, really, at the category level,” said Stephanie Niven, portfolio manager at Ninety One. “Before convictions can be rebuilt at that really important company level, we are seeing this kind of indiscriminate selling.”

Disruption fears have added a new layer of complexity in distinguishing winners from losers in AI. With valuations stretched and earnings season under way, investors have already punished companies that failed to live up to elevated expectations. The mood among investors about software stocks and other sectors deemed at risk of AI advances is grim, according to JPMorgan Chase & Co. analyst Toby Ogg. Ogg met more than 50 investors across Europe and the US over two weeks and said he found that they had significantly reduced software holdings over the past 12 to 18 months. Even after the latest pullback, “the general appetite to step in remains generally low,” he said in a client note.

No one is interested in buying the dip, according to JPMorgan analyst Toby Ogg, and even good earnings won’t be enough, since AI disruption is a long-term issue. “We are now in an environment where the sector isn’t just guilty until proven innocent but is now being sentenced before trial,” he said.

“There’s clearly indiscriminate selling across the entire software cluster,” said Karen Kharmandarian, senior equity investment manager at Mirova in Paris. “There’s no floor, the downward momentum is too strong. It looks a bit like capitulation, which could offer opportunities selectively once things stabilize”.

The pain isn’t just in equities, with banks unable to sell a software loan deal. In options, the implied volatility of software stocks is blowing out versus the S&P 500 ETF.

Another test looms for the AI trade when Alphabet reports after the close. The stock has been the top performer among the Magnificent Seven megacaps since the beginning of 2025. Peers Microsoft Corp. and Meta Platforms Inc. saw divergent reactions to their results last week, reflecting views over whether heavy AI spending is paying off.

“The biggest risk regarding tonight’s publication is the fact that there is a decoupling between Google’s long-term stature as an AI winner, thanks to its vertically integrated approach, and short terms trends in search and monetization, which might prove more erratic,” said Jacques-Aurélien Marcireau, co-head of equities at Edmond de Rothschild Asset Management.

European stocks reverse an earlier decline as an initial extension of the Anthropic-sparked software selloff eases. Stoxx 600 now up by 0.3% as gains in telecoms and chemicals offset mixed results from the financials sector and a large drop for drugmaker Novo Nordisk, which sank 16% after a disappointing sales outlook. Here are some of the biggest movers on Wednesday:

- Handelsbanken gains as much as 4.4% after posting a top-line beat in its full-year report.

- DNB Bank shares rise as much as 3.5% after the Norwegian bank reported net profit ahead of expectations, driven by beats in net interest income and fees.

- Mediobanca shares rise as much as 7.8% after MF daily reported that the board of the Banca Monte Paschi di Siena is begining to tilt toward a delisting of the taken over bank.

- Wendel shares rise as much as 7% after Germany’s Henkel agreed to buy Stahl Parent from Stahl Group, which is majority-owned by the French investment firm. BASF and Clariant also have stakes.

- AMS Osram shares rise as much as 13% after agreeing to offload its sensor business to Infineon for €570m in cash.

- Novo Nordisk shares plunge as much as 20% in Copenhagen after the drugmaker forecast a steep decline in sales this year that was also wider than analyst expectations.

- Software, IT, data services, ad agencies and exchanges are among the equity sectors leading losses in the European session on Wednesday, as they extend a selloff following persistent investor concerns over potential disruption from AI tools.

- UBS shares dropped as much as 5.5% despite a beat on 4Q earnings as it announced a below-expected $3 billion buyback program for 2026 that could increase during the year and maintained its financial targets for 2028.

- Santander shares drop as much as 5% after the Spanish lender announced the acquisition of Webster Financial in a $12 billion deal.

- Watches of Switzerland tumbles as much as 5.1% after the watch retailer cut the midpoint of its margin goal, countering the improved outlook for sales growth.

- DSV falls as much as 4.5% after the Danish shipping and logistics group guidance for 2026 disappointed, overshadowing decent 4Q figures.

- Novartis shares drop as much as 3.1% after the Swiss drugmaker reported net sales for the fourth quarter that missed expectations, while its 2026 Ebit forecast was also below estimates.

- Atalaya Mining Copper shares fall as much as 8.9% to 937 pence, slipping below the offering price after holder Trafigura Group sold 14 million shares at 945 pence per share.

Earlier in the session, Asian stocks slipped in another session dominated by technology concerns, after a broad selloff in the US on fears of disruption from artificial intelligence. The MSCI Asia Pacific Index fell as much as 0.6%, with software makers among the biggest decliners after Anthropic’s launch of a new automation tool. Hong Kong led losses and Japan’s Nikkei 225 also dropped, while stocks rose in South Korea, Australia and Thailand.

Eli Lilly, Uber and Yum! Brands are among companies expected to report before the market open. Lilly investors will be looking for guidance on how the company sees the obesity market expanding following a deal with the Trump administration to widen access for some patients with Medicare. Rival Novo Nordisk’s guidance fell well short.

In FX, the dollar is stronger and the yen extended losses for a 4th session as traders anticipated a victory for Prime Minister Sanae Takaichi’s Liberal Democratic Party in this weekend’s poll.

In rates,treasuries are slightly cheaper across the curve, with yields around 1bp higher vs Tuesday’s close and lagging European bonds, which are higher after euro-area January inflation data and services PMIs. US session includes ISM services gauge, following Treasury quarterly refunding announcement at 8:30am. US 10-year yield near 4.28% is more than 1bp cheaper on the day while German counterpart is richer by about 2bp; UK 10-year is higher by less than 1bp European bonds rising and outperforming gilts and Treasuries. Euro-zone inflation cooled to the lowest level in more than a year.

In commodities, gold moves back above $5,000/oz and silver up to around $89/oz. Oil prices up, Brent above $67/barrel. Bitcoin hovered near $76,000.

The dollar and Treasuries were little changed.

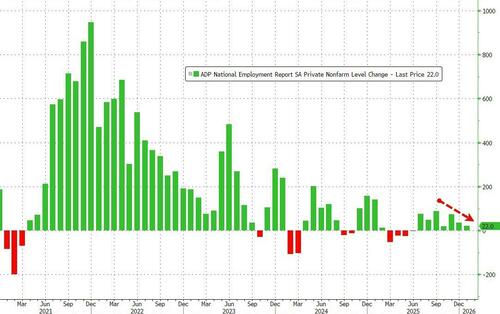

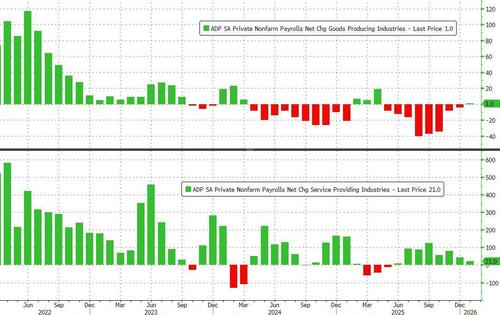

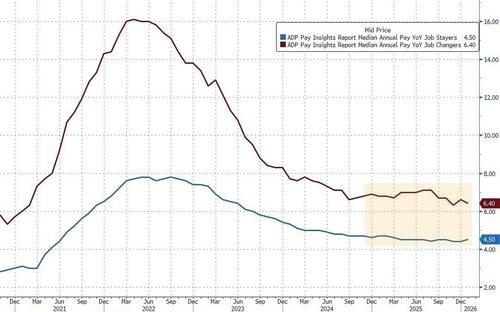

US economic calendar includes January ADP employment change (8:30am), January final S&P Global US services PMI (9:45am) and January ISM services index (10am).Fed speaker slate includes Governor Cook on monetary policy and the economic outlook at the Economic Club of Miami (6:30pm)

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini little changed

- Russell 2000 mini +0.3%

- Stoxx Europe 600 little changed

- DAX -0.1%, CAC 40 +0.7%

- 10-year Treasury yield +1 basis point at 4.28%

- VIX -0.1 points at 17.94

- Bloomberg Dollar Index +0.2% at 1189.69

- euro little changed at $1.1814

- WTI crude +0.7% at $63.66/barrel

Top Overnight News

- Donald Trump reiterated that the US and Iran are maintaining diplomatic talks, even after an American warplane shot down an Iranian drone in the Arabian Sea. BBG

- Trump’s Federal Reserve chair nominee Kevin Warsh faces a battle in the Senate after lawmakers threatened to hold up his confirmation until the DoJ halts its probes into Jay Powell and Lisa Cook. FT

- Nvidia is nearing a deal to invest $20 billion in OpenAI as part of its latest funding round, people familiar said. BBG

- Prime Minister Sanae Takaichi should not count on the Bank of Japan’s help in taming sharp bond yield rises given the huge cost of intervention, including the significant risk of igniting unwelcome yen falls, sources say. RTRS

- Hedge funds are using leverage to reap 28% returns from the safest of bonds. A key ingredient is their use of borrowed cash to juice returns, in some cases amplifying positions up to 15 times their initial investment. BBG

- Investors are ramping up bets on higher long dated Treasury yields and a steeper yield curve as incoming Federal Reserve Chair Kevin Warsh is expected to press for interest rate cuts while shrinking the U.S. central bank’s balance sheet. Warsh’s preference for a materially smaller Fed balance sheet, currently around $6.59 trillion, implies a withdrawal of meaningful government demand for Treasuries, a move which tightens financial conditions because the central bank is not providing liquidity to the market. RTRS

- Euro-area inflation slowed to 1.7% in January, the weakest reading in more than a year and further below the ECB’s 2% target. BBG

- Novo shares plunged after the drugmaker forecast sales decline of up to 13% in 2026, amid price pressure in obesity drugs. But Eli Lilly LLY is now +8% in the pre on Strong 4Q GLP-1 Momentum + Guidance Ahead of Street Quelling Last Minute Fear from NVO Guide. BBG, GS Trading

- NVDA CEO Jensen Huang dismissed fears that artificial intelligence will replace software and related tools, calling the idea “illogical”, after a significant selloff in global software stocks on Tuesday. RTRS

- Department of Labor said all agencies will fully resume to normal operations from the 4th of February 2026.

Trade/Tariffs

- US Senators push for USD 70bln funding deal to support US President Trump’s critical minerals agenda, FT reported.

- Indian Trade Minister said the US trade deal will offer a competitive advantage to Indian exporters and our priority is to energy security for our citizens. Need to bolster capabilities in many sectors including nuclear energy and data centres. India will raise trade with the US.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed as the region partially shrugged off the downbeat handover from Wall Street, where sentiment was mired by renewed tech-selling, while participants in the region also reflected on the latest Chinese PMI data and the end of the partial US government shutdown. ASX 200 climbed higher with the upside led by outperformance in miners as metal prices continued their recovery, but with gains in the index capped by heavy losses in the tech sector. Nikkei 225 slumped at the open but is off worst levels, while risk appetite was pressured following recent earnings, including disappointing results from Nintendo, which saw its shares suffer a double-digit percentage drop. Hang Seng and Shanghai Comp saw two-way price action as participants digested stronger-than-expected Chinese RatingDog Services PMI data, and after the PBoC drained liquidity, while it was also reported that NVIDIA AI chip sales to China are stalled by a US security review and that Chinese customers are meanwhile not placing H200 chip orders with the company.

Top Asian News

- China’s market regulator unconditionally approves CATL (3750 HK), Chery (9973 HK) and others joint venture formation.

- China’s Vice Finance Minister said China is facing persistent headwinds and policy uncertainty.

- New Zealand ANZ Commodity Price Index MM (Jan) +2.0% (Prev. -2.1%).

European bourses (+0.1%) are broadly firmer across the board, though the DAX 40 (-0.1%) has been pressured by post-earnings losses in Infineon (-2.3%). European sectors hold a positive bias. Telecoms and Chemicals leads whilst Healthcare is the clear laggard, hampered by post-earning losses in Novo Nordisk (-17.6%) and Novartis (-1%). The former reported strong headline metrics, though its 2026 guidance disappointed.

Top European News

- Germany sold EUR 3.197bln vs exp. EUR 4.0bln 2.50% 2032 Bund: b/c 1.51x (prev. 1.2x), average yield 2.60% (prev. 2.33%), retention 20.1 (prev. 23.87%).

- Germany’s VDA announces that 2025 EV production comes out at 1.67mln vehicles, +23% Y/Y.

- Europe’s safest corporate bond spreads drop to its lowest level since 2007.

Central Banks

- Fed Governor Miran resigned on Tuesday from his position as Chair of Council of Economic Advisers, Barron’s reported citing a White House official.

- BoJ won’t come to the rescue of a Takaichi-driven bond rout, with sources stating that Japanese PM Takaichi should not count on the BoJ’s help in taming sharp yield rises given the high cost of intervention including risk of igniting unwanted yen declines.

- PBoC announces plan to build a multi-level financial service system to support domestic demand, tech innovation and SMEs. To continue to support debt risk resolutions for financing platforms, back local government in market oriented reforms and guide financial institutions to provide services based on marker and legal principles.

- Riksbank Minutes: President Thedeen said “at present I assess that monetary policy is following a stable and reasonable course, and we can tolerate minor deviations in data outcomes without immediately needing to adjust the course we have set.

FX

- DXY resides within a narrow range within Tuesday’s 97.298-97.692 range after seeing weakness yesterday against most major peers, giving back some of the post-ISM spoils, while JOLTS data was delayed, and there were several comments from Fed speakers, but failed to move the dial. Overnight, US President Trump signed the USD 1.2tln spending bill to end the government shutdown, as expected, and thus NFP will likely be released next week (TBC). Today, however, desks are eyeing the private ADP and ISM Services PMIs.

- JPY is the underperformer vs the USD, EUR, and GBP, as the Japanese currency continued to lag amid the ongoing expectations for a landslide victory by Japanese PM Takaichi’s ruling LDP at the snap election on Sunday. USD/JPY topped yesterday’s 156.08 peak to print a current high of 156.59, but is still some way off the 23rd Jan high of 159.23.

- EUR/USD trades flat with little notable action seen on the Final Services and Composite PMIs. Little move also seen on the EZ HICP metrics, which were broadly in-line / cooler-than-expected. A report which will have little impact on policymakers at the ECB, who are set to meet on Thursday – as a reminder, the Bank is expected to keep its deposit rate steady at 2.00%.

- GBP/USD sees modest gains and narrowly gains despite the revisions lower in Final PMIs, but likely lifted by the GBP/JPY pair testing highs from 23rd Jan as the cross looks to test 215 to the upside, residing at levels last seen in 2008.

- Antipodeans are mixed with the Aussie buoyed by rebound in gold prices, whilst the NZD posts losses following ultimately mixed employment and labour cost data from New Zealand.

Fixed Income

- USTs are essentially flat in quiet trade and currently trading in a narrow 111-17 to 111-21+ range. Focus overnight was on the end of the US shutdown after the House voted (217-214) to pass the USD 1.2tln spending package to fund the government. Following this, the Department of Labor announced that all agencies will fully resume normal operations from the 4th of February 2026; there are currently no further details or guidance on whether the NFP due on Friday will be released.

- Nonetheless, focus turns to US data later; the monthly ADP national employment data will be released, where analysts expect 48k from the prior 41k. The ISM services PMI headline is expected to ease to 53.5 from 54.4, where employment is seen nudging up a little, but prices and new orders are seen easing a touch. From the supply front, the QRA is also due today.

- Bunds initially held a downward bias but then gradually picked up as the morning progressed; currently at the upper end of a 127.72-127.88 range. There have been a number of Final PMI metrics this morning, with the EZ figure revised a touch lower; the accompanying report suggested that the ECB may highlight growing services inflation in its policy decision this week. EZ HICP printed in line with expectations, and cooled from the prior; core metrics were a touch short of expectations. Overall, a report which will not shift much ahead of the ECB confab on Thursday. As a reminder, the Bank is expected to keep its deposit rate steady at 2.00% and largely reiterate that rates are at a good place. Next up, a 2032 Bund auction.

- Gilts are essentially flat and trade within a 90.88-91.06 range. Action has been fairly choppy this morning, but has moved off its best levels in recent trade. Aside from the UK’s PMI (revised a touch lower), catalysts for the benchmark are incredibly light. Focus now on the BoE on Thursday, where rates are expected to be kept unchanged.

- UK DMO plans to hold a programmatic gilt tender for a long conventional gilt on February 11th.

- Australia sold AUD 1.1bln 4.25% 2036 bonds, b/c 3.73, avg. yield 4.9012%.

Commodities

- Crude benchmarks initially held onto the gains seen in the latter end of Tuesday’s session, which came from reports that the US shot down an Iranian surveillance drone approaching the USS Abraham Lincoln. WTI and Brent peaked at USD 64.16/bbl and USD 68.25/bbl, respectively, early in the APAC session, just shy of Tuesday’s high, before steadily paring back and retracing to the key USD 63/bbl and USD 67/bbl handle.

- Spot XAU continues to rebound, with the yellow metal returning above the USD 5k/oz handle after hovering just shy of the level throughout Tuesday’s session. Gold rose throughout the APAC session, peaking at USD 5092/oz, before oscillating in tight c. USD 40 range. Similarly, spot silver has gradually bid higher and briefly held above USD 90/oz before falling back below the level as European trade continues.

- 3M LME Copper has thus far traded on both sides of the unchanged mark, fluctuating in a USD 13.29k-13.52k/t band, as risk tone overnight was mixed. Heightened concerns over AI weighed on the tech-heavy NQ during Tuesday’s trading day, and this followed through into Asia-Pacific equities.

- Morgan Stanley raises near-term Brent forecasts as geopolitical risk premium is likely to persist, but expects prices to fall below USD 60/bbl later this year.

- Ukraine’s Naftogaz said Ukraine has received a delivery of 100MCM batch of US LNG, making it the first delivery expected in 2026.

- Venezuela’s top Economic Advisor Ortega said he wants Venezuela to be known as a country with one of the highest oil production levels.

- China expands subsidies for energy storage industry as it seeks to support the country’s green transition and ensure reliable electricity supplies.

Geopolitics

- Ukrainian peace negotiators have arrived in Abu Dhabi and have started their first meetings, IFX reported.

- Russia’s Kremlin said it will defend its interest in the Arctic, via Sky News Arabia.

- Russia’s Kremlin said it has not seen any new developments when it comes to India and Russian oil.

- Russia’s Kremlin said Russia will continue its Special Military Operation until the relevant decisions are made by Ukraine.

- Ukraine’s Naftogaz said Ukraine has received a delivery of 100MCM batch of US LNG, making it the first delivery expected in 2026.

- China’s President Xi is to hold a video call with Russian President Putin, CCTV reported.

- Iran is to announce major structural and administrative decisions in the defence sector to respond to new threats, Iran’s Noor News reported.

- “Deputy Speaker of Iran’s Parliament: Iran and the United States likely reached preliminary understandings before sitting down at the negotiating table”, Sky News Arabia reported.

- Israeli artillery shelling reported in central Gaza, via Al Jazeera news.

- Israeli army announces airstrikes and tank shelling on militants after an Israeli officer was seriously injured, according to Sky News Arabia. IDF said shooting at our forces is a violation of the ceasefire agreement in Gaza, according to Al Arabiya.

- US President Trump said we are still negotiating with Iran and that there is more than one meeting with Iran.

US Event Calendar

- 7:00 am: United States Jan 30 MBA Mortgage Applications, prior -8.5%

- 8:15 am: United States Jan ADP Employment Change, est. 45k, prior 41k

- 9:45 am: United States Jan F S&P Global US Services PMI, est. 52.5, prior 52.5

- 9:45 am: United States Jan F S&P Global US Composite PMI, est. 52.9, prior 52.8

- 10:00 am: United States Jan ISM Services Index, est. 53.5, prior 54.4, revised 53.8

- 6:30 pm: United States Fed’s Cook Speaks on Monetary Policy and Economy

DB’s Jim Reid concludes the overnight wrap

It was a pretty brutal day in markets yesterday that wouldn’t be obvious with a quick glance of the screens, as a majority of the S&P 500’s constituents rose on the day. The reason was that Anthropic launched a new AI automation tool servicing legal work, which was perceived as a big threat to software firms and related stocks. So in Europe, RELX Plc, Wolters Kluwer, Experian, Thomson Reuters, and the LSE all fell around -10 to -15%, while in the US Gartner (-20.87%), Paypal (-20.31%) and Expedia (-15.26%) led the declines in the S&P 500. In turn, the overall US Software index (-4.60%) saw 104 decliners and only 9 risers, and its 6th successive decline to put the index back to April levels. Even the blue-chip Microsoft was down -2.87% and is now down -24% from its peak on October 28 last year.

So yesterday marked a dramatic acceleration of the trend we’d seen of late, and it means the 9 worst-performing companies in the S&P 500 YTD are all in the software and related services sectors, having now seen declines of 25% or more. While the question over the end-winners from AI is unlikely to be answered in 2026, recent months have seen a clear shift in markets from AI euphoria towards more differentiation between companies, and growing concern about its disruption to existing business models.

Those huge moves helped push the S&P 500 (-0.84%) down, despite being on course for another record high at the US open. The Nasdaq (-1.43%) and Mag-7 (-1.53%) clearly suffered more. And they’re still struggling for momentum this morning, with futures on the S&P 500 (+0.04%) basically flat.

To be fair, it wasn’t all bad news yesterday, with most of the S&P 500 constituents moving higher on the day. The ongoing rotation meant materials (+2.00%) and consumer staples (+1.71%) sectors extended Monday’s post-ISM gains, while energy stocks (+3.29%) were boosted by a renewed rise in oil. Those gains included Walmart (+2.94%), which became the 11th US company to reach a $1trn valuation. And the small cap Russell 2000 rose by +0.31% despite being down -1.30% at the day’s lows. Meanwhile in Europe, the STOXX 600 (+0.10%) just about managed to hit another record high, whilst Italy’s FTSE MIB (+0.90%) closed at its highest level since 2000, despite the broader struggles among tech stocks.

Another beneficiary of yesterday’s session were precious metals, which finally showed signs of stabilising after their recent slump. In fact, gold prices (+6.12%) posted their biggest daily gain since 2008, moving up to $4,947/oz, whilst silver (+7.43 %) was back up to $85.16/oz. Clearly they’re still a long way from the highs, but it was clear that dip buyers were coming back in after the biggest slump in decades. And that trend has continued overnight, with gold (+2.72%) now back up to $5,081/oz. The volatility was also visible in Bitcoin (-2.96%), which fell by as much as -7% to below $73k intra-day, which was its lowest level since Trump’s election victory in November 2024.

By contrast, it was a very steady day for US Treasuries, which saw little movement in either direction. In the end the risk-off backdrop sent yields lower, with the 2yr yield (-0.2bps) down to 3.57%, whilst the 10yr yield (-1.3bps) fell to 4.27%. But there were few concrete drivers behind that. Admittedly, we did hear from Richmond Fed President Barkin, who acknowledged the persistence of above-target inflation, and said “I take this sustained miss seriously”. But market pricing for the Fed was little changed yesterday either.

Those moves came as the latest US government shutdown came to end after four days, with the House passing the funding package that had been approved by the Senate last Friday. The legislation, which was then signed by Trump, will fund most government agencies through September, though Congress still faces a showdown over funding for the Department of Homeland Security which was extended only until next Friday (February 13) amid partisan tensions over immigration enforcement.

The market backdrop wasn’t helped by the continued geopolitical noise, with oil prices spiking after news that the US shot down an Iranian drone that approached a US aircraft carrier. Oil marginally pared its gains as the White House said that US-Iran talks led by Steve Witkoff were still scheduled for Friday, with Trump himself saying that “We are negotiating with them right now”. But Brent crude still closed +1.55% higher at $67.33/bbl, and has risen another +0.76% this morning to $67.84/bbl as we go to print.

Earlier in Europe, it was a bit more eventful as the 30yr German yield (+3.4bps) hit a post-2011 high of 3.55%. That comes as investors are increasingly focused on the fiscal stimulus, with higher debt issuance having pushed up long-end bond yields in recent months. Those moves for long-end German yields were part of a wider selloff across Europe, with yields on 10yr bunds (+2.2bps), OATs (+1.7bps) and BTPs (+1.7bps) all moving higher, not helped by the latest rebound in oil prices. To be fair, we did get a downside surprise in the flash CPI print from France yesterday, which fell to just +0.4% in January, thus raising hopes that today’s Euro Area-wide print would come in on the softer side. But the commodity rebound ultimately offset that, and the RBA’s rate hike earlier in the day further added to the sense that hikes elsewhere could eventually be back on the agenda.

Overnight in Asia, we’ve seen a mixed performance this morning. On the positive side, the KOSPI (+1.39%) is at another record high, and the Shanghai Comp (+0.01%) has eked out a modest gain. However, other indices have moved lower, including the CSI 300 (-0.05%), the Hang Seng (-0.17%) and the Nikkei (-0.83%). We’ve also started to see some of the services and composite PMIs from the region, with China’s RatingDog Services PMI up to a 3-month high of 52.3 (vs. 52.0 expected), whilst Japan’s final services PMI reached to an 11-month high of 53.7. However, the Japanese yen has continued to weaken a bit ahead of this weekend’s election, down -0.33% to 156.27 per dollar.

Looking at the day ahead, US data releases include the ISM services index for January and the ADP’s report of private payrolls for January, whilst in the Euro Area we’ll get the flash CPI print for January. Otherwise, we’ll get the final services and composite PMIs for January for the US and Europe. The US Treasury will also be releasing its quarterly refunding announcement, detailing the breakdown of planned issuance. Elsewhere, central bank speakers include the Fed’s Cook, and today’s earnings releases include Alphabet.