Authored by Alex Younger via The Mises Institute,

So much has been written about why we should end the Federal Reserve, and with the recent public demand for an audit, the message has finally reached the masses. Hopefully, if such an audit manifests, it will be the first step toward ultimately dismantling the Federal Reserve. (We should start with the extremely shady Bank Term Funding Program). But very little has been written about how to end the Federal Reserve, and that is what I wish to address here.

The How

You may read through my proposed plan and disagree with me on the details. But we must agree on this point: The key objective is to minimize any fluctuations in the current money supply as best we can. This can be done in a delicate manner that might even go unnoticed by the market, outlined in 5 steps:

1. Revoke All Federal Reserve Monetary Policy Privileges

The Federal Reserve should no longer have the ability to directly manipulate the money supply. Repeal the Federal Reserve Act.

2. Lock Down All Debt Assets on the Federal Reserve Balance Sheet

This refers to all assets on the balance sheet with a contractual expiration, such as US Treasuries, mortgage-backed securities, and other loan types. These assets make up roughly 99 percent of the Fed’s balance sheet. Rather than selling them, they should be allowed to expire naturally over the next 30 years—the longest duration of USTs and MBSs. During this period, the Fed may still collect interest payments on these assets and reinvest them to prevent removing those funds from the monetary base.

3. Gradually Sell Off Non-Expiring Assets

Any assets on the Federal Reserve’s balance sheet that lack a contractual expiration should be sold off gradually over a period of 1 to 5 years. At present, I have been unable to find a reliable estimate of how much of this asset type exists, but I suspect it is relatively small—possibly less than a billion dollars.

4. The Federal Reserve Becomes a True Private Institution with No Special Legal Privileges

The Federal Reserve should operate as a fully private institution, stripped of any special legal banking privileges. Its only remaining advantages would be its established market position, its role in facilitating bank-to-bank lending, the interest payments from existing assets on its books, and its historical significance. This is far more than it deserves, but the primary objective must be to dismantle its power without triggering economic catastrophe.

5. If the Federal Reserve Cannot Function as a Private Bank

If the Federal Reserve fails to maintain its market position—which is likely, given that it has never truly faced competition—then major banks will need to determine among themselves how to facilitate interbank lending. They may assign central banking functions to other private institutions, operating within the limits of private banking law. Alternatively, the market may simply deem the Federal Reserve obsolete, allowing it to wither away naturally. Either outcome would be entirely acceptable.

The Balance Sheet Details

As of this writing, the Federal Reserve holds $6.8 trillion on its balance sheet. This follows a sharp 25 percent reduction from its previous $8.9 trillion over the past two years—a decrease of $2.1 trillion. In other words, the Fed initially printed $8.9 trillion and used this newly-created money to purchase assets in the market.

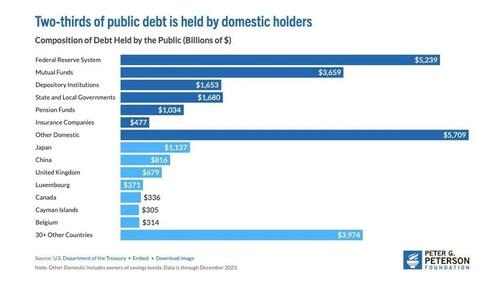

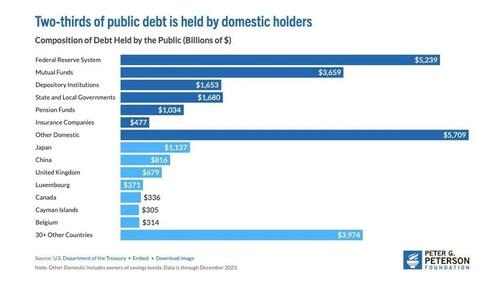

What has the Federal Reserve been buying? Primarily US debt. Our financial system functions like an ouroboros, with the Federal Reserve acting as a perpetual buyer of new government debt—funded by printed money. As of this writing, the Fed holds approximately $5 trillion of the national debt and artificially inflates domestic demand for it. Ending the Federal Reserve would severely restrict the government’s ability to create new debt, forcing a fundamental shift in government spending policy:

Fed Balance Sheet Composition

Currently, $4.2 trillion of the Federal Reserve’s balance sheet consists of US Treasury bonds (USTs), while another $2.2 trillion is made up of mortgage-backed securities (MBS). Together, these two asset classes account for $6.4 trillion, or about 94 percent of the total balance sheet. The remaining 6 percent is a mix of various other debt securities, including corporate debt, federal agency debt, and other loan types, all of which also have contractual expiration dates.

Natural Expiration of Debt Assets

Let’s consider the potential consequences of abandoning current monetary policy and requiring the Federal Reserve to let its debt assets naturally roll off the balance sheet. Debt contracts have expiration dates, meaning that once they reach maturity, they expire worthless and can simply be removed from the balance sheet without active intervention. This approach would gradually shrink the Fed’s holdings over time, reducing its influence on the financial system without the immediate shock of mass asset sales.

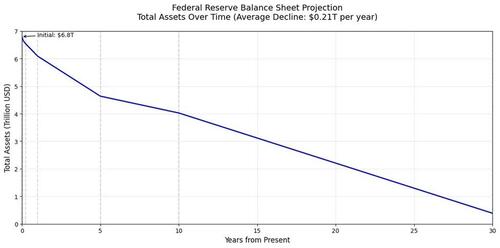

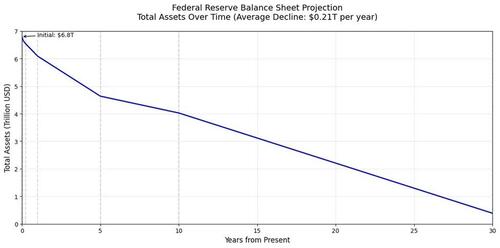

Here is a projection of the balance sheet over the next 30 years under this plan:

Projection of Assets Naturally Expiring on Fed Balance Sheet.

The debt expirations are front-loaded, meaning the Federal Reserve’s balance sheet would experience a sharp initial decline before tapering off over time. In the first year, we would see a significant 10 percent reduction, which would gradually level out to a 1.7 percent decrease per year. On average, the decline would be around 3.1 percent annually.

This projection assumes the Fed has purchased debt with an evenly distributed range of expiration dates across different maturity groups, which is likely accurate. In reality, the actual decline would be somewhat more volatile due to variations in the composition of the Fed’s holdings.

Not Quantitative Tightening

The key advantage of this approach is that it differs from traditional quantitative tightening. No funds would be actively removed from banks’ reserves—those reserves would remain at their current levels. Instead, the Federal Reserve’s balance sheet would shrink passively as debt assets naturally expire, avoiding the disruptive liquidity drain that comes with aggressive asset sales.

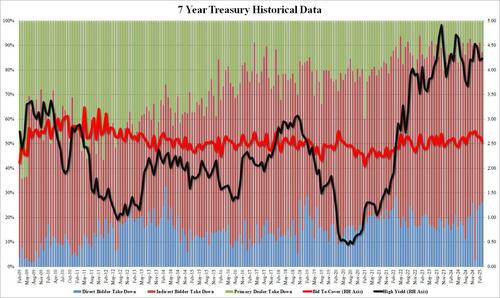

To fully understand this, a brief crash course in quantitative tightening (QT) is necessary. Admittedly, there is a certain genius to the way Federal Reserve monetary policy operates. When the Fed tightens, it sells assets from its balance sheet to primary dealers (large banks) on the open market. The Federal Reserve essentially functions as a “bank for big banks,” where major US banks store their reserves much like a savings account. These reserves not only remain at the Fed but also earn interest, just like a traditional savings account. This structure allows the Fed to influence liquidity in the financial system without directly impacting the day-to-day operations of commercial banks, making its monetary policy more indirect but highly effective.

When the Fed sells assets to primary dealers, it sells to banks that already have reserve accounts at the Fed. This means the money used to purchase these assets is already parked at the Federal Reserve. When the Fed either sells securities or allows them to mature without reinvesting, two things happen simultaneously: 1) the Fed’s assets decrease as the securities leave its balance sheet; 2) the bank’s reserve account at the Fed decreases by the same amount. These two changes cancel each other out, effectively removing that portion of the monetary base from circulation. This is how quantitative tightening (QT) functions—it contracts the money supply by destroying reserves, rather than directly pulling cash from the economy.

The key difference in my proposed approach is that the Fed would continue receiving interest payments on its remaining assets for the duration of their terms. The most realistic scenario is that these funds will be used to pay interest on reserves held by banks at the Fed, allowing normal banking operations to continue without disruption. However, unless the Fed finds an alternative revenue source, the interest on reserves rate can be expected to gradually decline over the next 30 years as assets roll off the balance sheet. This slow adjustment provides banks with ample time to determine how to manage their reserves in a post-Fed environment.

Inflationary vs. Deflationary Pressures

One likely outcome of this transition would be an increase in business investment by big banks. The interest on reserves paid by the Fed has historically discouraged banks from investing in the open market. From the bank’s perspective, why would I go make a risky investment into some startup, or some business which could hit rough waters and default, when I could just park my assets at the Fed and make a risk-free 4.4 percent? Basically, the Fed has been paying banks to not loan you money.

As the Fed’s ability to pay interest on reserves diminishes over time, banks would have a stronger incentive to deploy their capital elsewhere, likely fueling greater investment in businesses, loans, and other market-driven opportunities. This new pressure on banks to seek better investment opportunities within the first five years of this transition will create an inflationary counterbalance to the deflationary pressure that naturally comes with ending the Fed.

As banks shift their reserves into the market, increased lending and investment could stimulate economic activity, offsetting the contractionary effects of removing the Fed’s artificial demand for debt. This dynamic could help stabilize prices during the transition, preventing a sudden economic shock while still moving toward a more market-driven monetary system.

Conclusion

The ideal outcomes from this arrangement would be the following:

-

The Fed loses its extra-legal authority, operating solely as a private institution;

-

Direct central planning of interest rates ends, eliminating monetary supply manipulation;

-

Minimal fluctuation in the money supply, as bank reserves remain unaffected and the Fed continues receiving interest payments on its debt assets, preventing a liquidity drain;

-

Market stability, with little disruption to economic equilibrium;

-

Slight dollar appreciation, as the deflationary effects of ending the Fed are counterbalanced by banks investing their reserves;

-

No rush for banks to find alternative bank-to-bank lending solutions, ensuring a smooth transition;

-

No need to rewrite ACH payment systems, which currently rely on the Federal Reserve;

-

Greater urgency in reducing federal debt, as an appreciating currency increases the real debt burden;

-

A shift toward more prudent and productive financial behavior, as stronger purchasing power encourages saving and discourages reckless debt accumulation.