Submitted by James H. Kunstler of Kunstler.com,

Many of us in the Long Emergency crowd and like-minded brother-and-sisterhoods remain perplexed by the amazing stasis in our national life, despite the gathering tsunami of forces arrayed to rock our economy, our culture, and our politics. Nothing has yielded to these forces already in motion, so far. Nothing changes, nothing gives, yet. It’s like being buried alive in Jell-O. It’s embarrassing to appear so out-of-tune with the consensus, but we persevere like good soldiers in a just war.

Paper and digital markets levitate, central banks pull out all the stops of their magical reality-tweaking machine to manipulate everything, accounting fraud pervades public and private enterprise, everything is mis-priced, all official statistics are lies of one kind or another, the regulating authorities sit on their hands, lost in raptures of online pornography (or dreams of future employment at Goldman Sachs), the news media sprinkles wishful-thinking propaganda about a mythical “recovery” and the “shale gas miracle” on a credulous public desperate to believe, the routine swindles of medicine get more cruel and blatant each month, a tiny cohort of financial vampire squids suck in all the nominal wealth of society, and everybody else is left whirling down the drain of posterity in a vortex of diminishing returns and scuttled expectations.

Life in the USA is like living in a broken-down, cob-jobbed, vermin-infested house that needs to be gutted, disinfected, and rebuilt — with the hope that it might come out of the restoration process retaining the better qualities of our heritage. Some of us are anxious to get on with the job, to expel all the rats, bats, bedbugs, roaches, and lice, tear out the stinking shag carpet and the moldy sheet-rock, rip off the crappy plastic siding, and start rebuilding along lines that are consistent with the demands of the future — namely, the reality of capital and material resource scarcity. But it has been apparent for a while that the current owners of the house would prefer to let it fall down, or burn down rather than renovate.

Some of us now take that outcome for granted and are left to speculate on how it will play out. These issues were the subjects of my recent non-fiction books, The Long Emergency and Too Much Magic (as well as excellent similar books by Richard Heinberg, John Michael Greer, Dmitry Orlov, and others). They describe the conditions at the end of the cheap energy techno-industrial phase of history and they laid out a conjectural sequence of outcomes that might be stated in shorthand as collapse and re-set. I think the delay in the onset of epochal change can be explained pretty simply. As the peak oil story gained traction around 2005, and was followed (as predicted) by a financial crisis, the established order fought back for its survival, utilizing its remaining dwindling capital and the tremendous inertia of its own gigantic scale, to give the appearance of vitality at all costs.

At the heart of the matter was (and continues to be) the relationship between energy and economic growth. Without increasing supplies of cheap energy, economic growth — as we have known it for a couple of centuries — does not happen anymore. At the center of the economic growth question is credit. Without continued growth, credit can’t be repaid, and new credit cannot be issued honestly — that is, with reasonable assurance of repayment — making it worthless. So, old debt goes bad and the new debt is generated knowing that it is worthless. To complicate matters, the new worthless debt is issued to pay the interest on the old debt, to maintain the pretense that it is not going bad. And then all kinds of dishonest side rackets are run around this central credit racket — shadow banking, “innovative” securities (i.e. new kinds of frauds and swindles, CDOs CDSs, etc.), flash trading, insider flimflams, pump-and-dumps, naked shorts, etc. These games give the impression of an economy that seems to work. But the reported “growth” is phony, a concoction of overcooked statistics and wishful thinking. And the net effect moves the society as a whole in the direction of more destructive ultimate failure.

Now, a number of stories have been employed lately to keep all these rackets going — or, at least, keep up the morale of the swindled masses. They issue from the corporations, government agencies, and a lazy, wishful media. Their purpose is to prop up the lie that the dying economy of yesteryear is alive and well, and can continue “normal” operation indefinitely. Here are the favorites of the past year:

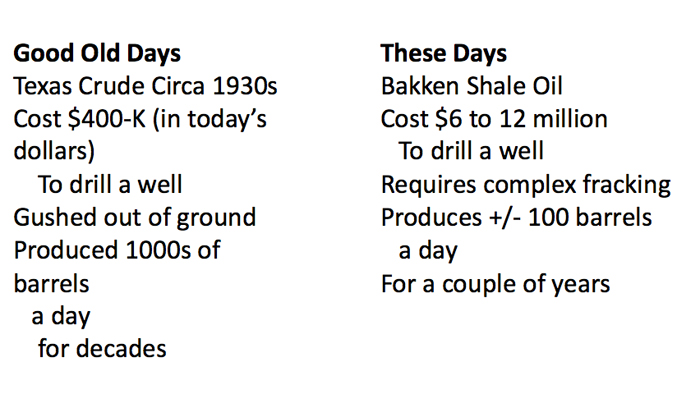

- Shale oil and gas amount to an “energy renaissance” that will keep supplies of affordable fossil fuels flowing indefinitely, will make us “energy independent,” and will make us “a bigger producer than Saudi Arabia.” This is all mendacious bullshit with a wishful thinking cherry on top. Here’s how shale oil is different from conventional oil:

- A “manufacturing renaissance” is underway in the US, especially in the “central corridor” running from Texas north to Minnesota. That hoopla is all about a few chemical plants and fertilizer factories that have reopened to take advantage of cheaper natural gas. Note, the shale gas story is much like the shale oil story in terms of drilling and production. The depletion rates are quick and epic. In a very few years, shale gas won’t be cheap anymore. Otherwise, current talk of new manufacturing for hard goods is all about robots. How many Americans will be employed in these factories? And what about the existing manufacturing over-capacity everywhere else in the world? Are we making enough sneakers and Justin Beiber dolls? File under complete fucking nonsense.

- The USA is “the cleanest shirt in the laundry basket,” “the best house in a bad neighborhood,” the safest harbor for international “liquidity,” making it a sure bet that both the equity and bond markets will continue to ratchet up as money seeking lower risk floods in to the Dow and S & P from other countries with dodgier economies and sicker banks. In a currency war, with all nations competitively depreciating their currencies, gaming interest rates, manipulating markets, falsely reporting numbers, hiding liabilities, backs

topping bad banks, and failing to regulate banking crime, there are no safe harbors. The USA can pretend to be for a while and then that illusion will pop, along with the “asset” bubbles that inspire it.

- The USA is enjoying huge gains from fantastic new “efficiencies of technological innovation.” The truth is not so dazzling. Computer technology, produces diminishing returns and unanticipated consequences. The server farms are huge energy sinks. Online shopping corrodes the resilience of commercial networks when only a few giant companies remain standing; and so on. Problems like these recall the central collapse theory of Joseph Tainter which states that heaping additional complexity on dysfunctional hyper-complex societies tends to induce their collapse. Hence, my insistence that downscaling, simplifying, re-localizing and re-setting the systems we depend on are imperative to keep the project of civilization going. That is, if you prefer civilization to its known alternatives.

Notice that all of these stories want to put over the general impression that the status quo is alive and well. They’re based on the dumb idea that the stock markets are a proxy for the economy, so if the Standard & Poor’s 500 keeps on going up, it’s all good. The master wish running through the American zeitgeist these days is that we might be able to keep driving to Wal-Mart forever.

The truth is that we still have a huge, deadly energy problem. Shale oil is not cheap oil, and it will stop seeming abundant soon. If the price of oil goes much above $100 a barrel, which you’d think would be great for the oil companies, it will crash demand for oil. If it crashes demand, the price will go down, hurting the profitability of the shale oil companies. It’s quite a predicament. Right now, in the $90-100-a-barrel range, it’s just slowly bleeding the economy while barely allowing the shale oil producers to keep up all the drilling. Two-thirds of all the dollars invested (more than $120 billion a year) goes just to keep production levels flat. Blogger Mark Anthony summarized it nicely:

…the shale oil and gas developers tend to use unreliable production models to project unrealistically high EURs (Estimated Ultimate Recovery) of their shale wells. They then use the over-estimated EURs to under-calculate the amortization costs of the capital spending, in order to report “profits”, despite of the fact that they have to keep borrowing more money to keep drilling new wells, and that capital spending routinely out paces revenue stream by several times… shale oil and gas producers tend to over-exaggerate productivity of their wells, under-estimate the well declines…in order to pitch their investment case to banks and investors, so they can keep borrowing more money to keep drilling shale wells.

As stated in the intro, these perversities reverberate in the investment sector. Non-cheap oil upsets the mechanisms of capital formation — financial growth is stymied — in a way that ultimately affects the financing of oil production itself. Old credit cannot be repaid, scaring off new credit (because it is even more unlikely to be repaid). At ZIRP interest, nobody saves. The capital pools dry up. So the Federal Reserve has to issue ersatz credit dollars on its computers. That credit will remain stillborn and mummified in depository institutions afraid of lending it to the likes of sharpies and hypesters in the shale gas industry.

But real, functioning capital (credit that can be paid back) is vanishing, and the coming scarcity of real capital makes it much more difficult to keep the stupendous number of rigs busy drilling and fracking new shale oil wells, which you have to do incessantly to keep production up, and as the investment in new drilling declines, and the “sweet spots” yield to the less-sweet spots or the not-sweet-at-all spots… then the Ponzis of shale oil and shale gas, too will be unmasked as the jive endeavors they are. And when people stop believing these cockamamie stories, the truth will dawn on them that we are in a predicament where further growth and wealth cannot be generated and the economy is actually in the early stages of a permanent contraction, and that will trigger an unholy host of nasty consequences proceeding from the loss of faith in these fairy tales, going so far as the meltdown of the banking system, social turmoil, and political upheaval.

The bottom line is that the “shale revolution” will be short-lived. 2014 may be the peak production year in the Bakken play of North Dakota. Eagle Ford in Texas is a little younger and may lag Bakken by a couple of years. If Federal Reserve policies create more disorder in the banking system this year, investment for shale will dry up, new drilling will nosedive, and shale oil production will go down substantially. Meanwhile. conventional oil production in the USA continues to decline remorselessly.

The End of Fed Cred

It must be scary to be a Federal Reserve governor. You have to pretend that you know what you’re doing when, in fact, Fed policy appears completely divorced from any sense of consequence, or cause-and-effect, or reality — and if it turns out you’re not so smart, and your policies and interventions undermine true economic resilience, then the scuttling of the most powerful civilization in the history of the world might be your fault — even if you went to Andover and wear tortoise-shell glasses that make you appear to be smart.

The Fed painted itself into a corner the last few years by making Quantitative Easing a permanent feature of the financial landscape. QE backstops everything now. Tragically, additional backdoor backstopping extends beyond the QE official figures (as of December 2013) of $85 billion a month. American money (or credit) is being shoveled into anything and everything, including foreign banks and probably foreign treasuries. It’s just another facet of the prevailing pervasive dishonesty infecting the system that we have no idea, really, how much money is being shoveled and sprinkled around. Anything goes and nothing matters. However, since there is an official consensus that you can’t keep QE money-pumping up forever, the Fed officially made a big show of seeking to begin ending it. So in the Spring of 2013 they announced their intention to “taper” their purchases of US Treasury paper and mortgage paper, possibly in the fall.

Well, it turned out they didn’t or couldn’t taper. As the fall equinox approached, with everyone keenly anticipating the first dose of taper, the equity markets wobbled and the interest rate on the 10-year treasury — the index for mortgage loans and car loans — climbed to 3.00 percent from its May low of 1.63 — well over 100 basis points — and the Fed chickened out. No September taper. Fake out. So, the markets relaxed, the i

nterest rate on the 10-year went back down, and the equity markets resumed their grand ramp into the Christmas climax. However, the Fed’s credibility took a hit, especially after all their confabulating bullshit “forward guidance” in the spring and summer when they couldn’t get their taper story straight. And in the meantime, the Larry-Summers-for-Fed-Chair float unfloated, and Janet Yellen was officially picked to succeed Ben Bernanke, with her reputation as an extreme easy money softie (more QE, more ZIRP), and a bunch of hearings were staged to make the Bernanke-Yellen transition look more reassuring.

And then on December 18, outgoing chair Bernanke announced, with much fanfare, that the taper would happen after all, early in the first quarter of 2014 — after he is safely out of his office in the Eccles building and back in his bomb shelter on the Princeton campus. The Fed meant it this time, the public was given to understand.

The only catch here, as I write, after the latest taper announcement, is that interest on the 10-year treasury note has crept stealthily back up over 3 percent. Wuh-oh. Not a good sign, since it means more expensive mortgages and car loans, which happen to represent the two things that the current economy relies on to appear “normal.” (House sales and car sales = normal in a suburban sprawl economy.)

I think the truth is the Fed just did too darn much QE and ZIRP and they waited way too long to cut it out, and now they can’t end it without scuttling both the stock and bond markets. But they can’t really go forward with the taper, either. A rock and a hard place. So, my guess is that they’ll pretend to taper in March, and then they’ll just as quickly un-taper. Note the curious report out of the American Enterprise Institute ten days ago by John H. Makin saying that the Fed’s actual purchase of debt paper amounted to an average $94 billion a month through the year 2013, not $85 billion. Which would pretty much negate the proposed taper of $5 billion + $5 billion (Treasury paper + Mortgage paper).

And in so faking and so doing they may succeed in completely destroying the credibility of the Federal Reserve. When that happens, capital will be disappearing so efficiently that the USA will find itself in a compressive deflationary spiral — because that’s what happens when faith in the authority behind credit is destroyed, and new loans to cover the interest on old loans are no longer offered in the non-government banking system, and old loans can’t be serviced. At which point the Federal Reserve freaks out and announces new extra-special QE way above the former 2013 level of $85 billion a month, and the government chips in with currency controls. And that sets in motion the awful prospect of the dreaded “crack-up boom” into extraordinary inflation, when dollars turn into hot potatoes and people can’t get rid of them fast enough. Well, is that going to happen this year? It depends on how spooked the Fed gets. In any case, there is a difference between high inflation and hyper-inflation. High inflation is bad enough to provoke socio-political convulsion. I don’t really see how the Fed gets around this March taper bid without falling into the trap I’ve just outlined. It wouldn’t be a pretty situation for poor Ms. Janet Yellen, but nobody forced her to take the job, and she’s had the look all along of a chump, the perfect sucker to be left holding a big honking bag of flop.

We’re long overdue for a return to realistic pricing in all markets. The Government and its handmaiden, the Fed, have tweaked the machinery so strenuously for so long that these efforts have entered the wilderness of diminishing returns. Instead of propping up the markets, all they can accomplish now is further erosion of the credibility of the equity markets and the Fed itself — and that bodes darkly for a money system that is essentially run on faith. I think the indexes have topped. The “margin” (money borrowed to buy stock) in the system is at dangerous, historically unprecedented highs. There may be one final reach upward in the first quarter. Then the equities crater, if not sooner. I still think the Dow and S &P could oversell by 90 percent of their value if the falsehoods of the post-2008 interventions stopped working their hoodoo on the collective wishful consciousness.

The worldwide rise in interest rates holds every possibility for igniting a shitstorm in interest rate swaps and upsetting the whole apple-cart of shadow banking and derivatives. That would be a bullet in the head to the TBTF banks, and would therefore lead to a worldwide crisis. In that event, the eventual winners would be the largest holders of gold, who could claim to offer the world a trustworthy gold-backed currency, especially for transactions in vital resources like oil. That would, of course, be China. The process would be awfully disorderly and fraught with political animus. Given the fact that China’s own balance sheet is hopelessly non-transparent and part-and-parcel of a dishonest crony banking system, China would have to use some powerful smoke-and-mirrors to assume that kind of dominant authority. But in the end, it comes down to who has the real goods, and who screwed up (the USA, Europe, Japan) and China, for all its faults and perversities, has the gold.

The wholesale transfer of gold tonnage from the West to the East was one of the salient events of 2013. There were lots of conspiracy theories as to what drove the price of gold down by 28 percent. I do think the painful move was partly a cyclical correction following the decade-long run up to $1900 an ounce. Within that cyclical correction, there was a lot of room for the so-called “bullion banks” to pound the gold and silver prices down with their shorting orgy. Numerous times the past year, somebody had laid a fat finger on the “sell” key, like, at four o’clock in the morning New York time when no traders were in their offices, and the record of those weird transactions is plain to see in the daily charts. My own theory is that an effort was made — in effect, a policy — to suppress the gold price via collusion between the Fed, the US Treasury, the bullion banks, and China, as a way to allow China to accumulate gold to offset the anticipated loss of value in the US Treasury paper held by them, throwing China a big golden bone, so to speak — in other words, to keep China from getting hugely pissed off. The gold crash had the happy effect for the US Treasury of making the dollar appear strong at a time when many other nations were getting sick of US dollar domination, especially in the oil markets, and were threatening to instigate a new currency regime by hook or by crook. Throwing China the golden bone is also consistent with the USA’s official position that gold is a meaningless barbaric relic where national currencies are concerned, and therefore nobody but the barbaric yellow hordes of Asia would care about it.

Other nations don’t feel that way. Russia and Switzerland have been accumulating gold like crazy at bargain prices this year. Last year, Germany requested its sovereign gold cache (300

tons) to be returned from the vaults in America, where it was stored through all the decades of the cold war, safe from the reach of the Soviets. But American officials told the Germans it would take seven years to accomplish the return. Seven years ! ! ! WTF? Is there a shortage of banana boats? The sentiment in goldville is that the USA long ago “leased” or sold off or rehypothecated or lost that gold. Anyway, Germany’s 300 tons was a small fraction of the 6,700 tons supposedly held in the Fed’s vaults. Who knows? No auditors have been allowed into the Fed vaults to actually see what’s up with the collateral. This in and of itself ought to make the prudent nervous.

I think we’re near the end of these reindeer games with gold, largely because so many vaults in the West have been emptied. That places constraints on further shenanigans in the paper gold (and silver) markets. In an environment where both the destructive forces of deflation and inflation can be unleashed in sequence, uncertainty is the greatest motivator, trumping the usual greed and fear seen in markets that can be fairly measured against stable currencies. In 2014, the public has become aware of the bank “bail-in” phenomenon which, along with rehypothication schemes, just amounts to the seizure of customer and client accounts — a really new wrinkle in contemporary banking relations. Nobody knows if it’s safe to park cash money anywhere except inside the mattress. The precedent set in Cyprus, and the MF Global affair, and other confiscation events, would tend to support an interest in precious metals held outside the institutional framework. Uncertainty rules.

Miscellany

I get a lot of email on the subject of Bitcoin. Here’s how I feel about it.

It’s an even more abstract form of “money” than fiat currencies or securities based on fiat currencies. Do we need more abstraction in our economic lives? I don’t think so. I believe the trend will be toward what is real. For the moment, Bitcoin seems to be enjoying some success as it beats back successive crashes. I’m not very comfortable with the idea of investing in an algorithm. I don’t see how it is impervious to government hacking. In fact, I’d bet that somewhere in the DOD or the NSA or the CIA right now some nerd is working on that. Bitcoin is provoking imitators, other new computer “currencies.” Why would Bitcoin necessarily enjoy dominance? And how many competing algorithmic currencies can the world stand? Wouldn’t that defeat the whole purpose of an alternative “go to” currency? All I can say is that I’m not buying Bitcoins.

Will ObamaCare crash and burn. It’s not doing very well so far. In fact, it’s a poster-child for Murphy’s Law (Anything that can go wrong, will go wrong). I suppose the primary question is whether they can enroll enough healthy young people to correct the actuarial nightmare that health insurance has become. That’s not looking so good either now. But really, how can anyone trust a law that was written by the insurance companies and the pharmaceutical industry? And how can it be repealed when so many individuals, groups, companies, have already lost their pre-ObamaCare policies? What is there to go back to? Therefore, I’d have to predict turmoil in the health care system for 2014. The failure to resolve the inadequacies of ObamaCare also may be a prime symptom of the increasing impotence of the federal government to accomplish anything. That failure would prompt an even faster downscaling of governance as states, counties, communities, and individuals realize that they are on their own.

Sorry to skip around, but a few stray words about the state of American culture. Outside the capitals of the “one percent” — Manhattan, San Francisco, Boston, Washington, etc. — American material culture is in spectacular disrepair. Car culture and chain store tyranny have destroyed the physical fabric of our communities and wrecked social relations. These days, a successful Main Street is one that has a wig shop and a check-cashing office. It is sickening to see what we have become. Our popular entertainments are just what you would design to produce a programmed population of criminals and sex offenders. The spectacle of the way our people look —overfed, tattooed, pierced, clothed in the raiment of clowns — suggests an end-of-empire zeitgeist more disturbing than a Fellini movie. The fact is, it simply mirrors the way we act, our gross, barbaric collective demeanor. A walk down any airport concourse makes the Barnum & Bailey freak shows of yore look quaint. In short, the rot throughout our national life is so conspicuous that a fair assessment would be that we are a wicked people who deserve to be punished.

Elsewhere in the World

Globalism, in the Tom Friedman euphoric sense, is unwinding. Currency wars are wearing down the players, conflicts and tensions are breaking out where before there were only Wal-Mart share price triumphs and Foxconn profits. Both American and European middle-classes are too exhausted financially to continue the consumer orgy of the early millennium. The trade imbalances are horrific. Unpayable debt saturates everything. Sick economies will weigh down commodity prices except for food-related things. The planet Earth has probably reached peak food production, including peak fertilizer. Supplies of grain will be inadequate in 2014 to feed the still-expanding masses of the poor places in the world.

The nervous calm in finance and economies since 2008 has its mirror in the relative calm of the political scene. Uprisings and skirmishes have broken out, but nothing that so far threatens the peace between great powers. There have been the now-historic revolts in Egypt, Libya, Syria, and other Middle East and North African (MENA) states. Iraq is once again disintegrating after a decade of American “nation-building.” Greece is falling apart. Spain and Italy should be falling apart but haven’t yet. France is sinking into bankruptcy. The UK is in on the grift with the USA and insulated from the Euro, but the British Isles are way over-populated with a volatile multi-ethnic mix and not much of an economy outside the financial district of London. There were riots in — of all places — Sweden this year. Turkey entered crisis just a few weeks ago along with Ukraine.

I predict more colorful political strife in Europe this year, boots in the street, barricades, gunfire, and bombs. The populations of these countries will want relief measures from their national governments, but the sad news is that these governments are broke, so austerity seems to be the order of the day no matter what. I think this will prod incipient revolts in a rightward nationalist direction. If it was up to Marine LePen’s rising National Front party, they would solve the employment problem by expelling all the recent immigrants — though the mere attempt would probably provoke widespread race war in France.

The quarrel between China and Japan over the Senkaku Islands is a diversion from the real action in the South China Sea, said to hold large underwater petroleum reserves. China is the wo

rld’s second greatest oil importer. Their economy and the credibility of its non-elected government depends on keeping the oil supply up. They are a long way from other places in the world where oil comes from, hence their eagerness to secure and dominate the South China Sea. The idea is that China would make a fuss over the Senkaku group, get Japan and the US to the negotiating table, and cede the dispute over them to Japan in exchange for Japan and the US supporting China’s claims in the South China Sea against the other neighbors there: Vietnam, Indonesia, Malaysia, and the Philippines.

The catch is that Japan may be going politically insane just now between the rigors of (Shinzo) Abenomics and the mystical horrors of Fukushima. Japan’s distress appears to be provoking a new mood of nationalist militarism of a kind not seen there since the 1940s. They’re talking about arming up, rewriting the pacifist articles in their constitution. Scary, if you have a memory of the mid-20th century. China should know something about national psychotic breaks, having not so long ago endured the insanity of Mao Zedong’s Cultural Revolution (1966-71). So they might want to handle Japan with care. On the other hand, China surely nurtures a deep, deadly grudge over the crimes perpetrated by Japan in the Second World War, and now has a disciplined, world-class military, and so maybe they would like to kick Japan’s ass. It’s a hard one to call. I suspect that in 2014, the ball is in Japan’s court. What will they do? If the US doesn’t stay out of the way of that action, then we are insane, too.

That said, I stick by my story from last year’s forecast: Japan’s ultimate destination is to “go medieval.” They’re never going to recover from Fukushima, their economy is unraveling, they have no fossil fuels of their own and have to import everything, and their balance of payments is completely out of whack. The best course for them will be to just throw in the towel on modernity. Everybody else is headed that way, too, eventually, so Japan might as well get there first and set a good example.

By “go medieval” I mean re-set to a pre-industrial World Made By Hand level of operation. I’m sure that outcome seems laughably implausible to most readers, but I maintain that both the human race and the planet Earth need a “time out” from the ravages of “progress,” and circumstances are going to force the issue anyway, so we might as well kick back and get with the program: go local, downscale, learn useful skills, cultivate our gardens, get to know our neighbors, learn how to play a musical instrument, work, dine, and dance with our friends.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/88WpqDUbbiE/story01.htm Tyler Durden