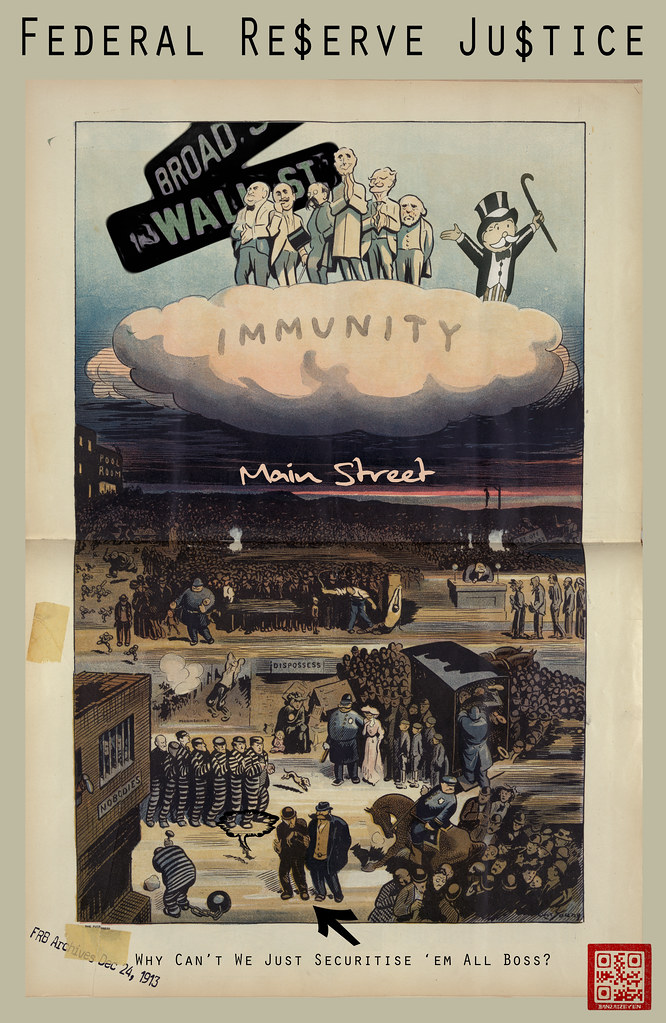

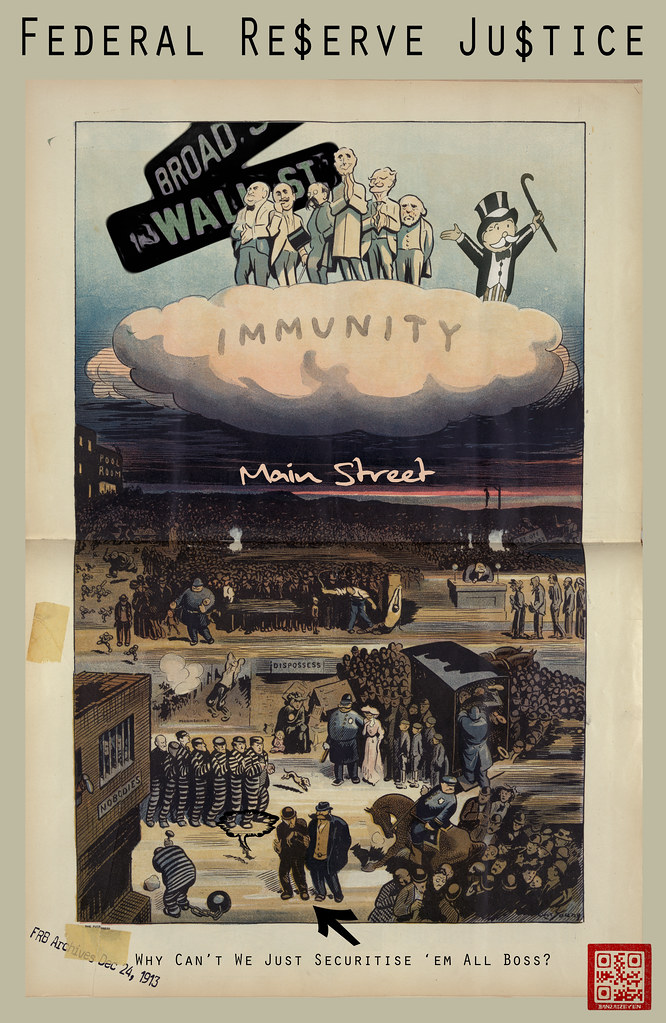

The Law demands that we atone

When we take things that we don’t own;

But leaves the lords and ladies fine

Who take things that are yours and mine…

Anonymous, circa 1764

.

.

The dice of this moron are loaded

All trust is our system’s eroded

But still he plays on

A Kleptocrat Con

He’ll play till the world has exploded

The Limerick King

.

.

.

.

.

.

.

.

We Americans are basically a very simple people.

Our formula for past successes has essentially been distilled as follows: maintain a can-do attitude, believe in the “American way”, honest hard work will be rewarded, abundant opportunity and upward mobility for all.

Those who play the prosperity game correctly may look forward to retirement in a spleniferous life of leisure and Obamacare.

Once upon a time, this is is what American Thanksgiving was supposed to look like…

Most Americans desperately cling to the foolish pipe dream of a notion that this Thanksgiving dream is still possible.

And for some PhD morons who evidently borrow subprime QE money to purchase shitty American vehicles made principally of plastic components sourced in Shenzen, the dream has been fullfilled.

Unfortunately, for reasons far to numerous to enumerate in this post, this is all just a Ponzi Pilgrim’s delusion.

There is one big kahuna of a fucking reason so very plainly obvious.

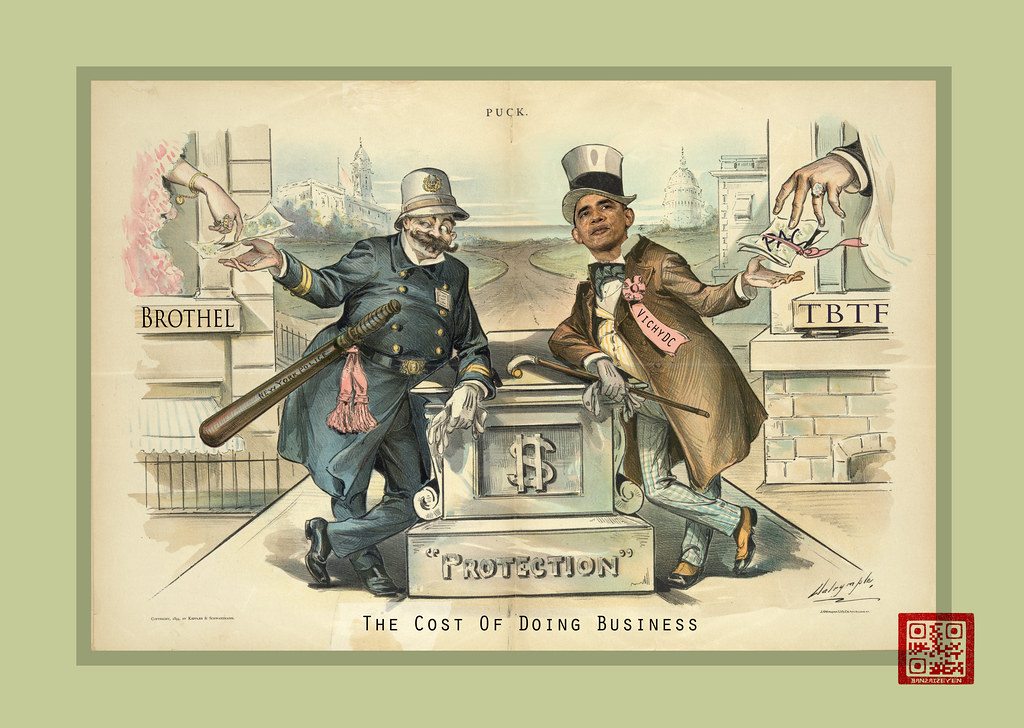

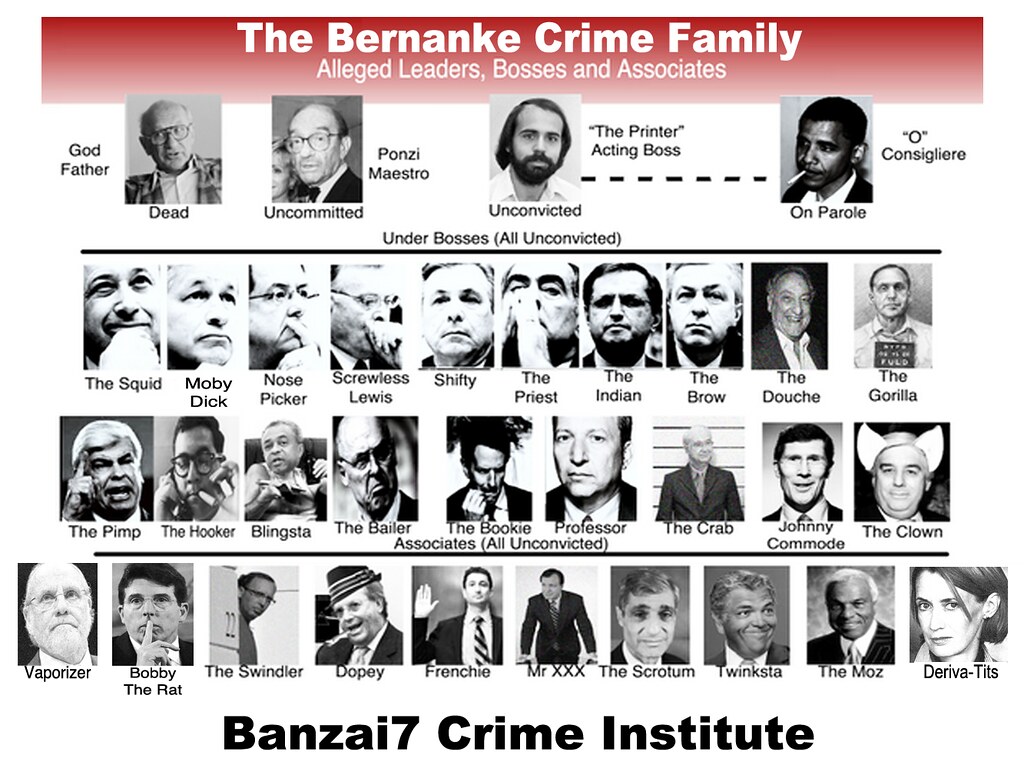

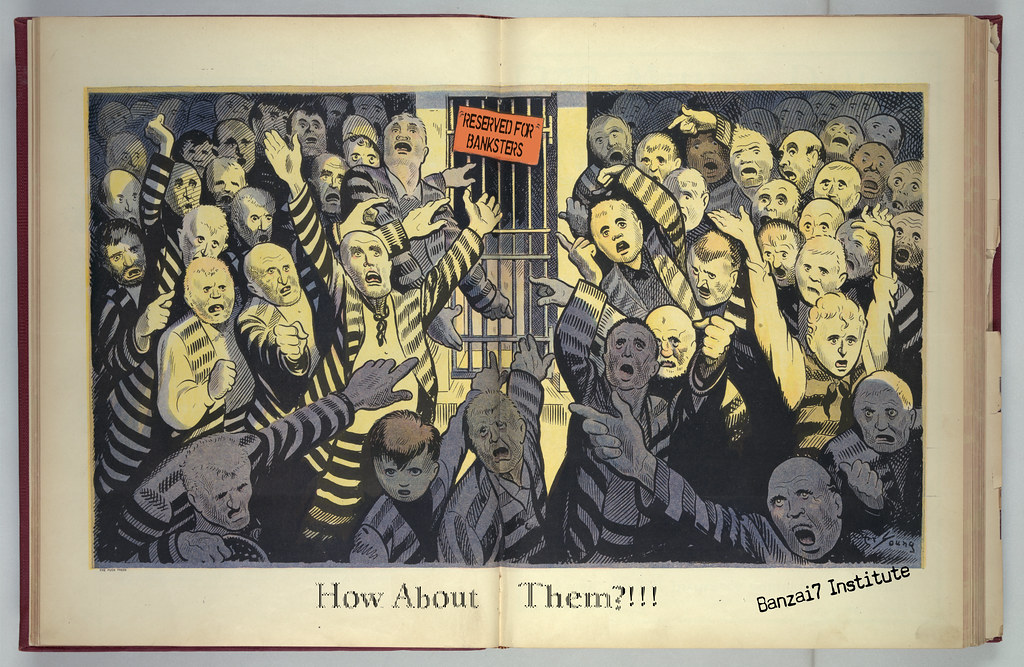

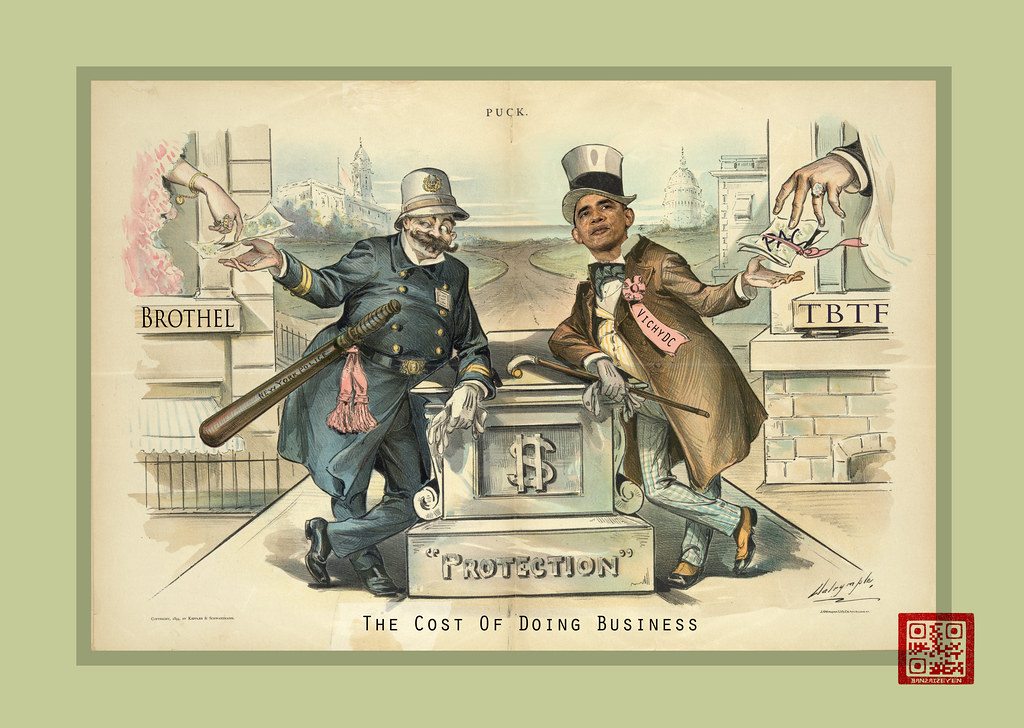

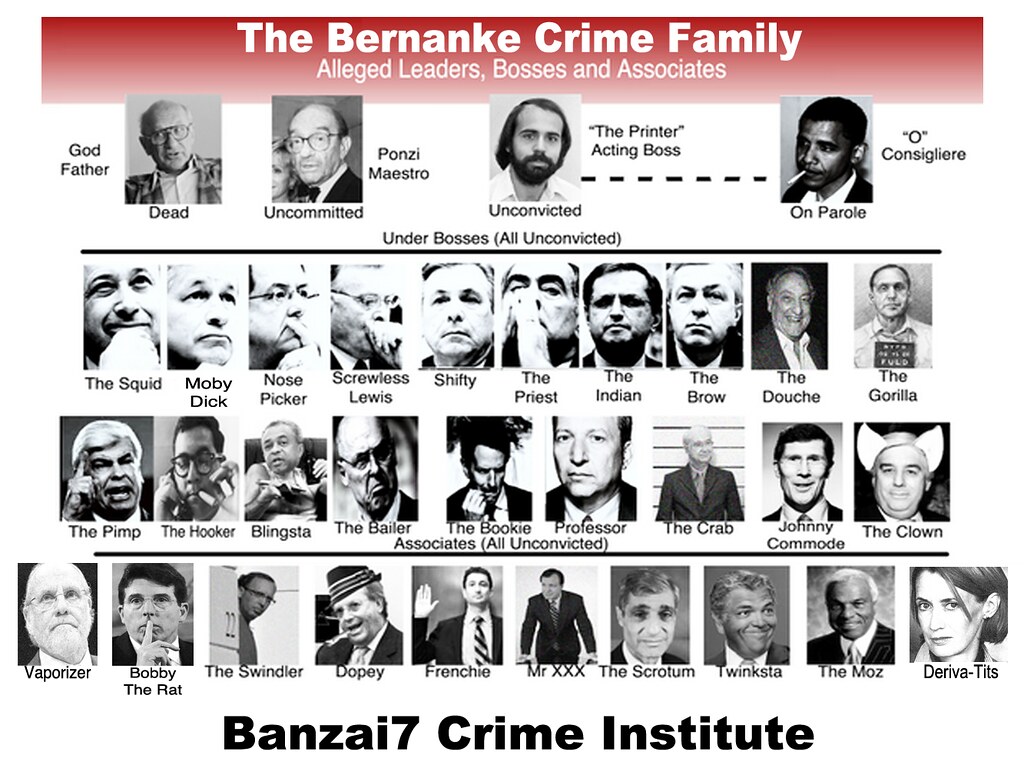

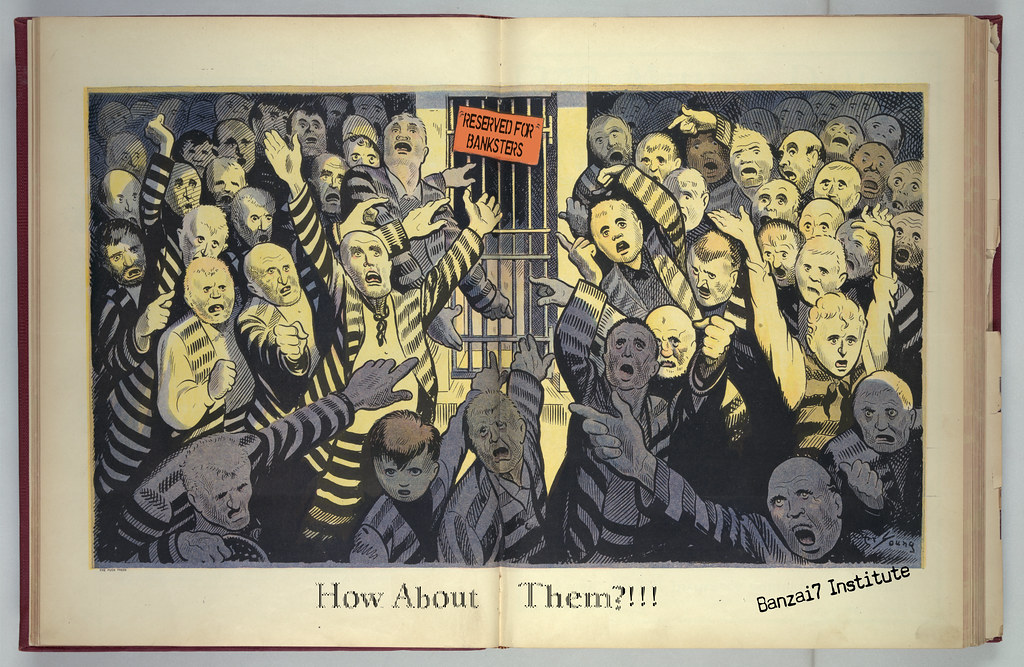

When it comes to ridding our fucking system of finance, the “fucking system” if you will, of all the learned fucking thieves sitting the top of the fucking Ponzi pyramid, we are hopelessly screwed up each and every one of our Holland and Lincoln Tunnels.

The same cheap fucking QE paper that buys those shitty vehicles will also pay the much ballyhooed $13 Billion JPM shyster fine. Half of JPM’s profits in 2013.

Gobble fucking Goebbels.

I won’t insult anyone’s fringe low brow intelligence by asking who has been convicted.

In any event, such a scenario is far to fetched to even consider.

Instead I will pose the following question:

The biggest mo

st egregious case of financial fraud and chicanery by a US banking institution measured by the fiat of the fine.

The biggest fine ever!

“Hoooly Cow!”–Phil Rizutto

Have the regulators who are in charge of the whole JP Clusterfuck (you know the ones who keep getting reappointed, promoted or hired by private equity firms) forced the Shyster in Chief of JP Cesspool to cede his shysterly position by resigning?

Is this something that could have happened? Of course it is.

Don’t believe me?

Go and ask our distinguished colleague Bill Black, Esq what he thinks.

Does the fact that the same schlemiel will remain in charge of the old JP Cesspit send the rest of us a message?

You better believe it does…

Whatcha are you gonna do sisters and brothers?

Sadly, for most of the rest of America it all boils down to this…

Goebbel, Goebbel, Goebbel!

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/h29V1pn_Cfk/story01.htm williambanzai7

![]()