Mayor Bloomberg’s crusade to micromanage what New Yorkers put in their mouth has so far failed, but that just means the attempt to impose the first “New Normal” nanny state, in which individual calorie consumption is regulated for the greater good by the even greater government, has simply shifted its geographic location. In this case to Mexico, which according to the OECD has surpassed the US as the world’s fattest country and is “notorious for its love of sweets, fried foods and pastries” and where as the WSJ reports, the lower House of Congress passed on Thursday a special tax on junk food that is seen as potentially the broadest of its kind, part of an ambitious Mexican government effort to contain runaway rates of obesity and diabetes.

Mexico’s weight problem in context:

The WSJ reports on what can only be described as Mike Bloomberg’s wet dream:

The House passed the proposed measure to charge a 5% tax on packaged food that contains 275 calories or more per 100 grams, on grounds that such high-calorie items typically contain large amounts of salt and sugar and few essential nutrients.

The tax, which was proposed just this week, is sure to stir controversy among big Mexican and foreign food companies that operate here. It comes on top of another planned levy on sugary soft drinks of 1 peso (8 U.S. cents) per liter that was passed by the same committee, an effort that New York Mayor Michael Bloomberg supported.

…

The taxes—both aimed at curbing consumption—have broad political support and were expected to later be approved by the Senate as part of a sweeping tax overhaul. The snack food levy is part of a bigger tax proposal from President Enrique Peña Nieto which aims to raise the government’s non-oil tax collections.

“This appears to be the most aggressive strategy anywhere in the world in recent years to improve diets via tax disincentives,” said Michael Jacobson, executive director of the Center for Science in the Public Interest in Washington.

Some have already cast the blame: TV zombies and undereducated “fatsos.”

“We’re a country of malnourished fatsos,” José Antonio Álvarez Lima, a former state governor turned newspaper columnist told Mexican political news website Animal Politico. He pegged part of the blame for Mexico’s high consumption of soda and snacks on incessant TV advertisements and poor education.

Mexico’s attempt to centrally-plan what’s for dinner naturally was met with the adoration of not just Mayor Mike, but every government apparatchik desperate to justify their non-value adding exietsnce. Such as this one:

Harold Goldstein, executive director of the California Center for Public Health Advocacy, called Mexico a role model, saying that the measures could protect the health of consumers while also shielding the economy from productivity losses and runaway public health costs.

Of course, if the “measures” fail at doing all those magical things, the government can just swoop in and start regulating the economy and productivity next, just as the Fed has been doing in the US for the past 5 years, with absolutely disastrous results.

Which is not to say Mexicans aren’t fat. As noted above, according to the OECD, the average Mexican is now fatter than the average American. Which means very, very fat.

Seven of 10 adults in Mexico, and a third of children, are either overweight or obese. Mexicans have now surpassed Americans for the title of the fattest country in the OECD, according to the organization.

All that fat has contributed to an alarming rise in chronic illnesses like adult-onset Type 2 diabetes, which afflicts an estimated 15% of Mexicans over the age of 20, the highest rate for any country with more than 100 million inhabitants. Illnesses related to excess weight cost the Mexican public health system more than $3 billion a year, according to the legislation.

On virtually every street corner in Mexico, makeshift stands sell the types of packaged items that will be taxed for the first time: potato chips, cookies, ice cream, fried corn chips, chocolates, candy, puddings and local sweets.

However, while those who revel in the government’s intellectual superiority, despite the vivid example of every centrally-planned economy crashing and burning in due course, some are quick to point out that this latest plan to micromanage consumption is idiocy. First, the big food companies:

Mexican industrial chamber Concamin estimates that processed food companies targeted by the new tax employ thousands of Mexicans and account for 4.1% of GDP. “We can’t allow last-minute taxes,” said Concamin president Francisco Funtanet, suggesting that companies might cut back on personnel and investment to absorb the tax hit.

Raul Picard, a top official at Concamin and owner of a chocolate company, argued that vice taxes could lead to a proliferation in contraband goods of questionable origin, possibly posing a threat to public health.

“There’s no such thing as junk food, just junk diets,” said Felipe Gómez, head of a regional food makers’ group in Jalisco state. Even so-called junk food has carbohydrates and calories that the body needs, Mr. Gómez argued.

But it’s not just the big corporations that are skeptical. So are normal people with some common sense.

Some ordinary Mexicans said a tax was unlikely to change their eating habits much.

Héctor Ortega, a 45-year-old operator of a street stand in downtown Mexico City, predicted that consumers may pull back briefly when prices rise, but then return to their old habits.

“Just like the cigarettes, people will go back to their old habits,” said Mr. Ortega. He said junk food was obviously unhealthy, but it was often the only thing that poorly paid office workers and students can afford. “This is a restaurant zone and the food here is expensive. For some people, these products are the only food available.”

Fernando González, 24, an office worker who frequents Mr. Ortega’s stand, is a big fan of sodas and gum, in particular. When the new prices kick in, he said, he won’t give up on his favorites, but will probably buy less chips and candy.

“It’s a craving, it’s an addiction, it’s something people enjoy,” he said of Mexicans and their treats.

The biggest irony, of course, is that the government “of the people”, in its very finite wisdom, will hurt those it supposedly cares about the most: the poor. Because the rich can afford to eat healthy. It is the poor who will merely have to pay more to satisfy their “food addictions.”

Academics say the move could hurt the poor because they spend a greater percentage of their income on cheap, packaged foods, but added that doing nothing was worse.

Sure. Which is why America no longer has a drug (or gun) problem. Oh wait.

![]()

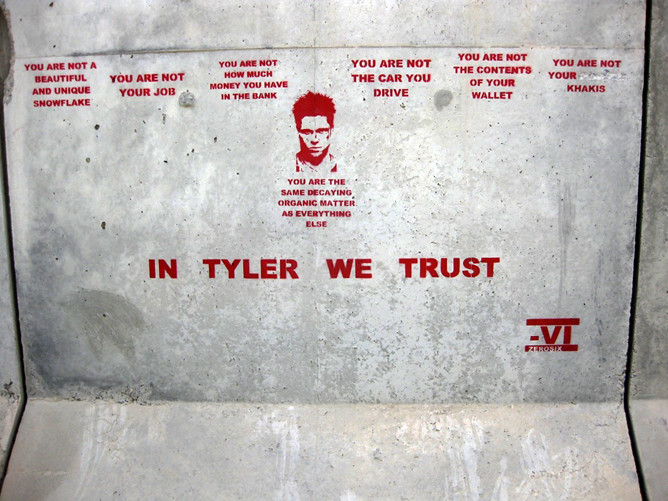

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/wKEwrWwJ0a4/story01.htm Tyler Durden