Authored by A Midwestern Doctor via The Forgotten Side of Medicine,

•Due to Alzheimer’s research focusing on a symptom of it (amyloid plaques), rather than its actual cause, Alzheimer’s has remained “incurable” for decades.

•Rather than being a single disease, Alzheimer’s has multiple different subtypes (e.g., those due to insulin resistance, nutritional deficiencies, inflammation, infections, or concussions), each of which requires a different treatments.

•Impaired blood circulation to the brain and lymphatic drainage from the brain are often the primary trigger which initiates the degenerative process seen in Alzheimer’s disease.

•Factors which impair this circulation (e.g., poor sleep) hence roughly double the risk of dementia, while treatments which improve this circulation frequently produce remarkable improvements for cognitive decline and dementia.

•DMSO, an effective treatment for brain injuries like strokes is well suited to address many of the root causes of dementia and reverse the degenerative state dying neurons get trapped in. Because of this, there are many reports of it reversing dementia and clinical trials in both humans and animals corroborating these improvements.

•This article will review the actual causes of dementias like Alzheimer’s and the forgotten therapies many have successful used to cure them.

Alzheimer’s dementia is one of the greatest medical challenged our country faces (e.g., places an incredible burden upon society (e.g., last year it was estimated to cost the United States 360 billion dollars). Yet, despite spending billions for research each year, cures remain elusive, something many believe results from the flawed belief eliminating the amyloid plaques associated with Alzheimer’s will fix it.

In turn, as I showed here:

-

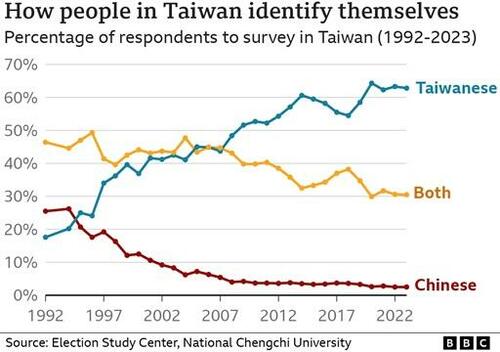

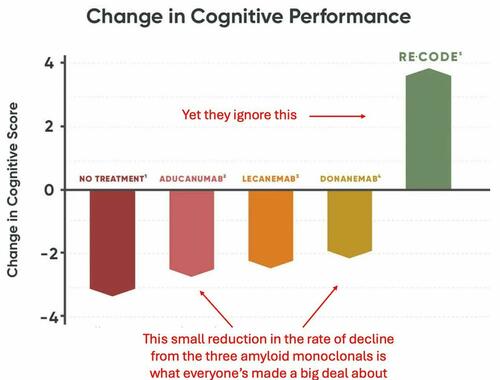

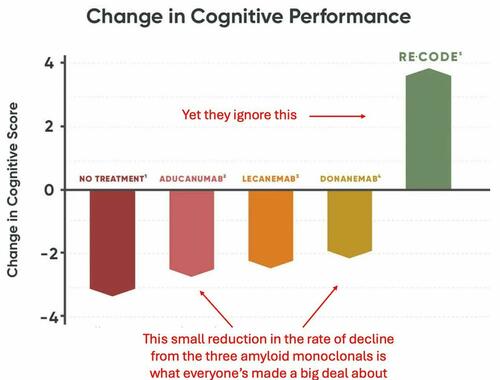

Decades of amyloid therapies have never produced a beneficial therapy.

-

The newest “breakthrough” amyloid eliminating monoclonal antibodies, at best, slightly slow the progression of Alzheimer’s while simultaneously causing a host of side effective including brain bleeding and swelling in over a quarter of recipients.

-

The entire amyloid industry rests upon a fraudulent study no one wanted to retract, likely due to how much was invested in the amyloid hypothesis.

In short, the money behind this juggernaut has caused research into the real causes of Alzheimer’s to be suppressed. For example, here I highlighted how coconut oil MCT’s (safely) do more than any of the costly amyloid drugs—yet virtually no one knows this.

Dale Bredesen’s Discovery

Many are also unaware a 2022 study that should have revolutionized the entire Alzheimer’s field:

That protocol was based on the insightful realizations that:

• Amyloid protein is a protective mechanism the brain uses to protect itself from stressors that endanger brain tissue—making attempt to treat Alzheimer’s by eliminating it doomed to fail.

• The brain is designed to be able to adapt to the needs of life, so it is always creating or pruning neural connections and brain cells. Alzheimer’s results from the loss of signals that sustain brain cells and the dismantling of neural connections outweighing the formation of new ones gradually compounding over the decades.

• Rather than there being one type of Alzheimer’s, there are actually multiple that each require different treatment approaches.

Note: beyond the 2022 trial which showed individually targeted therapies could shift the brain’s momentum from neurological degeneration to regrowth, a 2018 report of 100 patients from numerous providers also showed it treated Alzheimer’s, as did a 2024 case series of patients with remarkable results, and there are now neurologists around the country administering Bredesen’s protocol with success.

The Six Types of Alzheimer’s Disease

As this understanding of Alzheimer’s has produced real results, this suggests the causes of Alzheimer’s Bredesen identified indeed play a key role in the disease—particularly since many other datasets corroborate their contribution to Alzheimer’s. They are as follows:

Type 1 — Inflammatory

This form is driven by excessive inflammation, often metabolic or infectious in nature. Chronic activation of the immune system—due to factors such as insulin resistance, a poor diet, a leaky gut, or latent infections—leads the brain to engage in protective downsizing by removing synapses and neurons that are less essential for immediate survival. It often presents with classic Alzheimer’s memory loss and typically develops in the sixties to seventies.

Type 1.5 — Glycotoxic

This subtype arises from insulin resistance and chronically elevated blood sugar. It leads to both inflammatory and trophic deficiencies, and is driven by glycotoxicity and the accumulation of advanced glycation end products (AGEs), which impair cellular function and synaptic integrity. It typically appears in the late fifties to sixties.

Note: chronically elevated insulin promotes amyloid formation as the enzyme the body uses to break down insulin is the same enzyme it uses to break down amyloid plaques.

Type 2 — Atrophic

This type is caused by deficiencies in key nutrients, hormones, and other factors that provide trophic (supportive) signals to brain cells which then triggers a similar downsizing mechanism seen in Type 1. Type 2 tends to emerge about a decade later than Type 1.

Note: we find these nutritional deficiencies can result from poor circulation reducing existing nutrients reaching brain tissue, and hence often focus on improving circulation rather than extended supplementation.

Type 3 — Toxic

This subtype results from exposure to toxic substances that directly damage neurons. Common culprits include biotoxins, chronic infections, heavy metals, and industrial or household chemicals. Causative infections (discussed further here) include Cytomegalovirus, Human Herpesvirus 1 or 6, Lyme disease, dental bacteria that can travel to the brain (e.g. P. gingivalis) and various fungal infections (as mold toxins are notorious for causing cognitive impairment at all ages).

Type 3 uniquely causes widespread and often unpredictable neuronal death, occurs earlier in life—often between the forties and sixties—and is less strongly associated with genetic risk factors. Cognitive decline in this type is frequently accompanied by psychiatric symptoms, sensory changes, or executive dysfunction (e.g., difficulty with math, organization, executive tasks), rather than the more classic early Alzheimer’s memory loss.

Note: some of the most important neurotoxins to avoid are pharmaceuticals, and when I meet elderly individuals who have preserved their mental clarity, many report having largely avoided pharmaceuticals throughout their lives. Some of the most common problematic medications for brain health include certain high blood pressure medications (because they lower cerebral perfusion), statins (as they inhibit the production of compounds essential for brain function), acid reflux medications (which interfere with the absorption of vital brain nutrients—making it critical for everyone to have adequate stomach acid), antidepressants, antipsychotics, benzodiazepines, antihistamines (since, like many sleeping pills, they block restorative sleep), and anticholinergics (such as those prescribed for incontinence).

Type 4 — Vascular

In this form, chronic restriction of cerebral blood flow from existing vascular diseases leads to gradual neuronal injury and cognitive decline. Type 4 often appears in the seventies or beyond) and may overlap with other subtypes. It tends to affect processing speed, attention, and executive function rather than memory alone.

Note: rapid cognitive decline frequently followed COVID vaccination, and significantly overlapped with this type.

Type 5 — Traumatic

Severe head traumas or repeated concussions (e.g., in professional football players) sets off a cascade of chronic degenerative process which cause cognitive and emotional dysfunctional to appear years or decades after the injuries—making it critical to prevent these injuries and seek appropriate treatment when they happen.

Note: there are a variety of causes of dementia, many of which are frequently (roughly half the time1,2) misdiagnosed as Alzheimer’s. In many cases, these respond to the same treatments which reverse Alzhemer’s, but in other cases, require different treatments.

Healthy Fluid Circulation

Many practitioners I know who’ve successfully treating dementia with a variety of methods (listed here) all concluded it resulted from impairments of blood flow to the brain and lymphatic or venous drainage from it. For example:

•Zeta potential provides the disperse force which keeps constituents within fluids from agglomerating and clogging the circulatory vessels (e.g., vaccine frequently trigger detectable microstrokes by causing blood cells to clump together). In a myriad of illnesses, we find restoring the physiologic zeta potential (discussed here) is pivotal for restoring health—particularly those associated with aging, as zeta potential worsens with age (due to declining kidney function). In turn, one of the physicians who inspired my medical path did so because his practice revolved around treating zeta potential and he repeatedly achieved significant cognitive improvements for his aging patients.

Note: impaired zeta potential will also cause proteins (e.g., amyloids) to misfold and clump together.

•China recently developed a surgery (detailed here) to increase the lymphatic drainage from the brain. Due to its efficacy and low cost, it is being rapidly adopted around the country. In parallel, an American procedure was developed to increase venous drainage from the head and reported to greatly improve multiple sclerosis along with other chronic neuroimmune disorders (which distant colleagues witnessed).

Note: I have seen many other circulatory enhancing therapies (listed here) also improve cognitive decline and dementia.

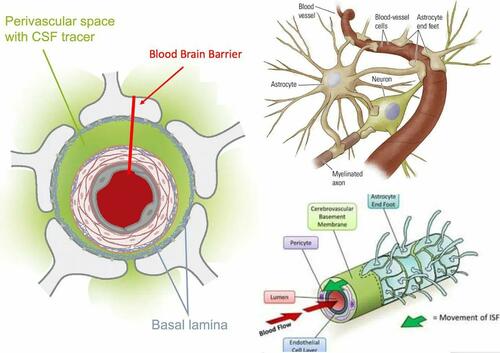

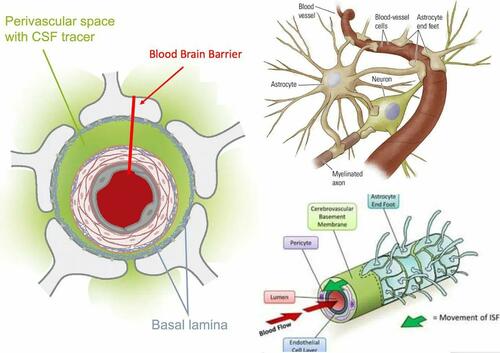

Furthermore, beyond blood being vital for neuronal survival, the proper clearance of waste products from the brain is as well. Unfortunately, due to how limited space is for the brain within the skull, robust lymphatic vessels do not exist, and instead, lymphatic drainage is created by astrocytes creating temporary lymphatic vessels around blood vessels during deep sleep.

This system, in turn, is highly vulnerable to disruption and numerous studies have now linked impaired glymphatic drainage to dementia (e.g., TBIs impair glymphatic drainage and adequate glymphatic drainage is required to eliminate amyloid from the brain)—which likely inspired the Chinese surgical procedure for dementia.

Due to the fragility of this system, things which disrupt it are quite consequential (e.g., poor zeta potential thickens and slows the drainage of glymphatic fluids). For example, as glymphatic drainage only occurs during deep sleep, poor sleep has been extensively linked to dementia (e.g., one study found sleep disruption increased dementia by 104%, another by 22-50%, and a third found a 139% increase—along with another finding sleep disruption caused a 71% increase in mild cognitive impairment).

Likewise, disrupted sleep was recently shown to accelerate the accumulation of amyloid plaques, and, in another study, to mitigate the cognitive impairment created by Alzheimer’s plaques. Unfortunately, the pathologic proteins in Alzheimer’s have been shown to directly disrupt restorative sleep and to take away the ability to recognize one is suffering from impaired sleep—demonstrating why it is so important to restore your healthy sleep before the momentum of dementia has entrenched itself.

Note: sleeping pills block restorative sleep, and have a variety of issues (e.g., they make users 2-5 times as likely to die1,2). Regarding dementia, multiple studies have found that sleeping pills increase the risk of it by 17-84%.1,2,3,4

The Life of Cells and Neuroplasticity

One of the things I continually marvel at about nature is not only the ability of a species to genetically adapt to its environment, but the inherent adaptability each organism has within its own lifespan to adapt to its environment. Within the human body, there are many systems that are designed to change based on the needs of one’s environment (e.g. this is why weight training creates larger muscles), and among the most adaptable is the nervous system.

So, at any given moment, neural circuits that support certain activities are reinforced, while other circuits are pruned and eventually disabled, a process that allows the nervous system to adapt to the complex needs of its environment. At the same time, many complex neurological and psychiatric disorders arise from a momentum being established where dysfunctional neurological circuits perpetually reinforce themselves.

For these disorders to be treated, a momentum must instead be established behind a healthy circuit (for those interested, this is the best book I have seen on that subject). This momentum is a key reason why it is so important to have healthy thought patterns and regularly actively exercise your brain (another core component of programs for preventing Alzheimer’s). If you do the opposite (e.g., watch TV all day or passively consume online content), dysfunctional patterns can become established habits, while neurological damage occurs as parts of the brain you need but under utilize are pruned away.

A key way the brain accomplishes this adaptability is by eliminating neurons that are no longer deemed essential. Bredesen’s theory of Alzheimer’s is that it results from the balance between preserving and eliminating neurons being shifted towards eliminating them, which inevitably will result in cognitive decline (hence making it critical to protect your brain early in the process of cognitive decline so it does not progress to dementia).

Within Bredesen’s model, the amyloid protein plays a key role in this process, as when it is initially formed as amyloid precursor protein (APP), it has the choice to be then split into two or four parts. If it is divided into two parts, those parts protect the neurological function in the brain. In comparison, if it is divided into four parts, the neurological function of the brain is damaged, and brain cells are eliminated. Interestingly, its splitting into four parts causes future APPs also to be split into four parts (which creates a downhill spiral). As a result, Brenden’s approach focuses on regaining a healthy momentum towards the two-part splitting while also providing the signals cells within the body require to survive.

The Cell Danger Response

When cells are exposed to external stressors, they often enter a primitive defensive metabolic cycle where they partially or fully “turn off” (e.g. mitochondrial respiration and protein synthesis within the cell decline) to protect themselves. Many chronic diseases, in turn, result from cells being trapped in this degenerative cycle (which often leads to cell death) rather than exiting it and resuming their normal function. Likewise, many therapies in regenerative medicine function by taking cells out of this frozen metabolic state.

Because of this, many complex illnesses (e.g., COVID vaccine injuries, fibromyalgia or autism) can only be treated if the underlying trigger for the cell danger response is removed, and then a regenerative therapy is provided which signals cells to exit the Cell Danger Response (CDR).

Similarly:

The principle that blocking protein synthesis prevents long-term memory storage was discovered many years ago. With age there is a marked decline of protein synthesis in the brain that correlates with defects in proper protein folding. Accumulation of misfolded proteins can activate the integrated stress response (ISR), an evolutionary conserved pathway that decreases protein synthesis. In this way, the ISR may have a causative role in age-related cognitive decline.

In turn, much in the same way treatments for the CDR often facilitate treating dementia, therapies which inhibit the ISR have been found to restore the structure and function of cells within the brain and improve a variety of age-related memory deficits.1,2

DMSO

Dimethyl sulfoxide has a variety of unique therapeutic properties which allow it to treat a variety of diseases (e.g., it is miraculous for strokes and brain injuries), and in the year since I began publicizing this forgotten therapy, I have received thousands of remarkable reports of it treating numerous “incurable illnesses.”

Much of this results from DMSO’s ability to restore normal circulation, protect cells from lethal stressors, and revive shocked cells trapped in the CDR. As such, since start the series, in addition to receiving many reports from readers who saved themselves or a loved one from a disabling stroke with DMSO, many have also shared stories like this:

My uncle’s wife has dementia and has been unable to speak for over a year. My mom recently visited them and told them about DMSO. He began to give his wife DMSO orally. After two week she began to talk again.

Numerous studies (detailed here), have corroborated DMSO’s ability to treat dementia. These include:

•When cerebral blood flow was permanently reduced in rats, one study found DMSO prevented the neuronal and memory loss that otherwise resulted while another found DMSO given afterwards treated it.1,2 Similar benefits have also been seen after Alzheimer’s was induced by injecting toxins into the brain,1,2. Likewise, in mice (or nematodes) engineered to develop Alzheimer’s, DMSO has been repeatedly shown to prevent the expected neurological damage.1,2,3

•DMSO has also been shown to prevent the neuronal damage from experimentally induced Parkinson’s and preserve the cognitive function of mice bred to rapidly develop severe degeneration of the cerebellum and brainstem.1,2

Note: IV DMSO is one of the few therapies I have come across which can halt Parkinson’s. To some extent oral DMSO helps as well (e.g., see this reader’s comment).

•DMSO has also been shown to treat scrapie (a neurodegenerative prion disease from abnormal protein aggregates) in hamsters, to increase the activity of ALP, the intercellular enzyme which eliminates cellular waste (including misfolded proteins) and, in a large number of studies, to treat amyloidosis (pathologic accumulations of pathologic proteins.

Note: we are currently corresponding with a reader who saw a remarkable response to DMSO for CJD (an incurable neurodegenerative prion disease).

In humans:

•18 patients with probable Alzheimer’s after three months, DMSO caused a significant improvement in memory, concentration, communication and orientation to time and space.

•In 104 elderly adults with organic brain disease from the common causes (e.g., strokes, atherosclerosis, Parkinson’s or head injuries), DMSO greatly improved their psychic and somatic function.1,2.

•In 100 patients with cerebrovascular diseases CVD, many of whom were senile, over 50 days, DMSO caused almost all to have a significant in their CVD, along with significant improvements in mood, mobility, and speech.

Conclusion

Medicine revolves around finding unique molecular targets for which disease specific treatments can be patented. Unfortunately, this model frequently fails in chronic illnesses, frequently leading to grotesque situations like the one described here, where natural therapies which can address the actual causes of devastating illnesses are sidelined to protect each disease’s lucrative “treatment” market.

This needs to change, and for the first time in my lifetime, thanks to MAHA, the political will at last exits to begin addressing the real reasons why there continues to be such much chronic illness in our society. The opportunity to make cognitive decline no longer be an inevitable aspect of aging is finally here—provided we seize it!

Author’s note: This is an abridged version of a longer article which discusses the actual causes and treatments for Alzheimer’s disease and the cognitive decline which precedes it. That article, along with additional links and references, can be read here. Additionally, a (recently updated) companion article on how DMSO treats neurological injuries (e.g., strokes, brain hemorrhages, traumatic brain injuries, spinal paralysis and developmental delay) can be read here.