Futures Flat With Many Markets Around The World Closed

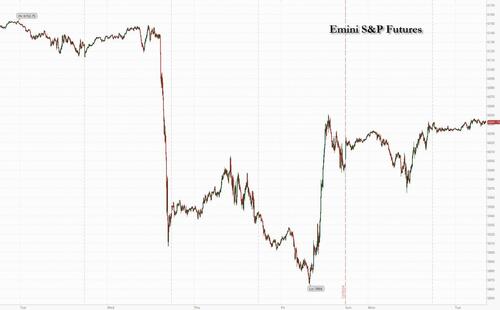

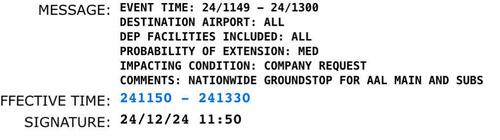

US equity futures traded flat in muted pre-holiday trading, signaling another subdued open on Wall Street after Monday’s tech-led rally. As of 8:00am, contracts on the S&P 500 gained about 0.1% and those on the Nasdaq 100 were 0.2% higher. American Airlines shares fell as much as 5.5% in premarket trading after the company grounded all flights nationwide, however the stock then rebounded after the grounding was promptly lifted. European bourses, at least those that are open, and Asian markets both gained. 10Y yields rose 2 basis points to trade above 4.60% for the first time since May, while the US dollar also gained. Oil was flat and bitcoin reversed some of yesterday’s losses. It’s a quiet calendar with just the Richmond Fed mfg index and the Philadelphia Fed non-mfg activity update.

In premarket trading, American Airlines shares fall 3.1% after the company grounded all flights nationwide, according to an FAA advisory. Arcadium Lithium shares gain 4% after the chemicals company said it obtained all shareholder approvals for a proposed acquisition by Rio Tinto. Chip stocks also rose following a strong session for the sector on Monday, and as US President Joe Biden’s administration launched a probe into Chinese-made chips. NeueHealth shares surged 61% after news of the health clinic company’s acquisition by New Enterprise Associates and other investors.

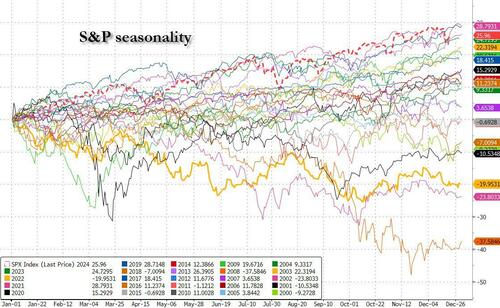

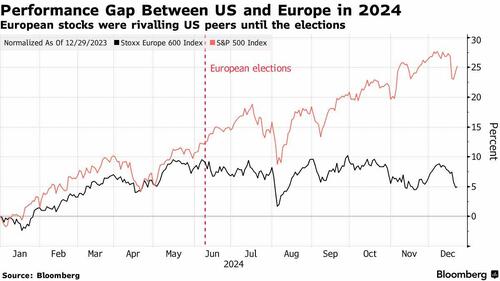

With just a few sessions left in 2024, the S&P 500 is on its way to record a stellar annual return and back-to-back years of more than 20% gains. The index has risen about 25% since the end of 2023 with the top seven biggest technology stocks accounting for more than half of the advance.

European stocks, by contrast, have lagged amid lackluster economic growth and political upheaval in France and Germany. The Stoxx 600 has dropped more than 4% since a September high, heading for its biggest quarterly loss in two years.

“The year is ending with a renewed strength in the US market, thanks to an increase in breadth,” said Alberto Tocchio, a portfolio manager at Kairos Partners. “The reality is that US growth has surprised everybody as it’s been very resilient, while unfortunately Europe is closing very downbeat as it still struggles to get some growth.”

European stocks follow Asian shares higher in subdued pre-holiday trading after a Wall Street rally fueled by megacap tech shares. All subindexes are up, with energy and travel and leisure leading the ascent. The Stoxx 600 added 0.3%, with many major markets closed including Germany, Switzerland and Italy; London, Amsterdam and Paris close early. France’s CAC40 is up 0.47%, and outperforming as investors seem to be taking well to the appointment of Eric Lombard as finance minister. Lombard is tasked with passing a 2025 budget and lowering the deficit. Prime Minister Bayrou said he aimed to reduce the country’s budget deficit to near 5%; he also provided a little relief in an interview following the appointment of the new cabinet saying the biggest companies shouldn’t take on all the burden of the deficit. China proxies in Europe are also finding a bit of support reports China plans more treasury issuances in 2025 with an emphasis on supporting the Chinese consumer. Among individual movers in Europe, Vistry Group plunged as much as 20% after the UK homebuilder lowered its earnings guidance for the third time in as many months. Renault shares rose as much as 1.9%. Oddo says the agreement between Nissan and Honda for a joint holding company is a positive for the French automaker, which is Nissan’s largest shareholder.

Earlier in the session, Asian stocks rose, with shares in Mainland China and Hong Kong among the best performers, while those in Japan were mixed. The MSCI Asia Pacific Index rose as much as 0.4%, with Alibaba and Samsung among the biggest boosts while Taiwan Semiconductor touched a new record high. Chinese stocks bounced after Reuters reported that policymakers are planning to sell 3 trillion yuan ($411 billion) in special treasury bonds in 2025, an increase from 1 trillion yuan this year. Honda Motor climbed as much as 14% after saying it will buy back as much as ¥1.1 trillion ($7 billion) of its stock. Nissan Motor shares slid as much as 7.3% in Tokyo after the company confirmed it’s in talks with Honda over a possible business integration. MSCI’s Asian equity benchmark is still headed for its first quarterly loss since September 2023, losing 6.8% over the period, even as the S&P 500 has risen 3.7%. Sentiment has soured in Asia in recent months due to concerns over higher global tariffs threatened by US President-elect Donald Trump, a stronger dollar and China’s lackluster economic recovery. Australian stocks edged higher after minutes from the central bank’s latest policy meeting showed it is more confident that inflation is moving toward its target, but will await additional data before making a decision on interest rates. Most Asian markets will be closed Wednesday except mainland China and Japan.

In Fx, Bloomberg’s gauge of the dollar was steady. The yen fluctuated amid meager volumes as Japanese finance minister Katsunobu Kato warned about excessive foreign-exchange moves.

In rates, treasuries extended Monday’s bear steepening move with yields cheaper by up to 2bp across the long-end, steepening 2s10s spread by an additional 1bp on the day and adding to Monday’s 3.5bp widening move. 10-year yields traded around 4.60%, cheaper by 1.5bp on the day with gilts lagging by an additional 4bp in the sector. Treasury spreads wider on the day, with the 2s10s topping at 26bp and just inside last week’s multi-month highs at 27.6bp. The US session includes early 11:30am New York 5-year note auction, which follows a decent 2-year result seen Monday. SIFMA recommend early 2pm New York close for the cash Treasuries market.

In commodities, oil climbed in subdued trading ahead of the holidays after a three-day selloff, with focus on a strengthening dollar and President-elect Donald Trump’s roiling of international politics. Gold edged higher.

Bitcoin is on the backfoot and holds around the USD 94k mark, whilst Ethereum edges higher after a run of losses this week.

US economic data calendar includes December Philadelphia Fed non-manufacturing activity (8:30am) and Richmond Fed manufacturing index (10am)

Market Snapshot

- S&P 500 futures up 0.1% to 6,043.25

- STOXX Europe 600 up 0.3% to 504.17

- MXAP up 0.3% to 181.57

- MXAPJ up 0.3% to 574.84

- Nikkei down 0.3% to 39,036.85

- Topix little changed at 2,727.26

- Hang Seng Index up 1.1% to 20,098.29

- Shanghai Composite up 1.3% to 3,393.53

- Sensex down 0.1% to 78,458.10

- Australia S&P/ASX 200 up 0.2% to 8,220.86

- Kospi little changed at 2,440.52

- Euro little changed at $1.0396

- Brent Futures up 0.6% to $73.09/bbl

- Gold spot up 0.1% to $2,615.21

- US Dollar Index up 0.11% to 108.16

Top Overnight News

- Fed announced it would soon seek comment on changes to bank stress tests to improve transparency and reduce volatility, a decision made due to the changing legal landscape, according to Reuters.

- Japan Rolls Out More Yen Warnings as Market Liquidity Thins

- Iran Oil Tycoon ‘Hector’ Plays Key Role in Arms Sales to Russia

- China Mulls Record $411 Billion Special Bonds, Reuters Says

- China Abruptly Changes Army General Overseeing Political Loyalty

- Biden to Decide on US Steel Acquisition After Panel Deadlocks

- Biden Team to Probe Chinese Chips, Setting Up Trump for Tariffs

- Bill Clinton Admitted to DC Hospital After Developing a Fever

- Fed Seeks to Smooth Capital Changes in Bank Stress Tests

- Tesla cuts the price of Model Y in China by CNY 10k

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly firmer in choppy trade following a similar session on Wall Street, where stocks experienced volatility with low volumes amid the Christmas period. ASX 200 swung between modest gains and losses with earlier downside led by gold miners. The ASX showed little reaction to RBA minutes, which offered no significant new information. Nikkei 225 was initially supported by recent JPY weakening, but gains were shortlived as USD/JPY slipped back to session lows and eventually under 157.00. Hang Seng and Shanghai Comp were firmer and outperformed regionally despite a lack of significant macro newsflow, although China convened a national fiscal work conference in Beijing, according to the Ministry of Finance, and said they will step up fiscal spending and accelerate spending speed in 2025.

Top Asian News

- China’s video game regulator approves 122 (prev. 112 M/M) domestic online games in December; approves 13 imported online games.

- Japanese PM Ishiba says will step up measures for increasing minimum wages. Adds that cabinet to approve fiscal 2025 budget on December 27.

- Japan’s PM Ishiba will work to eliminate the public’s uncertainty about the future in order to “boost private consumption”

- China is issuing a plan to encourage local gov’ts to introduce policies to bolster whole grain consumption, via State Media.

- China and Japan’s Foreign Ministers will meet on Dec 25th, according to China’s Foreign Ministry.

- South Korean Opposition Party is to propose the impeachment of acting President Han on Tuesday, via Yonhap.

- South Korean Opposition Party lawmaker says will wait until later this week to decide whether to submit bill to impeach acting President Han.

- China convened a national fiscal work conference in Beijing, according to the Ministry of Finance, and said they will step up fiscal spending and accelerate spending speed in 2025. Fiscal spending will focus more on people’s livelihood and boosting consumption. The government will arrange a larger scale of government bonds to provide more support for stabilising growth and will make efforts to fend off risks in key areas. Additionally, it will further increase transfer payments to local governments to strengthen their financial capacity and support the expansion of domestic demand. Plans include appropriately increasing the basic pensions for retirees and raising the basic pensions for urban and rural residents. Furthermore, China will improve tariff policies and deepen cooperation with ‘Belt and Road’ countries.

- Chinese authorities agreed to issue CNY 3tln in special bonds in 2025 (vs CNY 1tln in 2024), according to Reuters sources; part of proceeds will be use to recapitalise some large state-owned banks. Plans to use proceeds for consumer goods and industrial equipment trade-in schemes among others.

- Japanese Finance Minister Kato said it is important for currencies to move in a stable manner reflecting fundamentals, noting that there have recently been one-sided, sharp FX moves and expressing concern about recent FX moves. He stated that Japan will continue to coordinate with overseas authorities on forex policies and will take appropriate action against excessive moves, according to Reuters.

- High-level government review board has told White House it is unable to reach consensus on national security risks involved in Nippon Steel’s (5401 JT) acquisition of US Steel (X), according to WaPo. White House spokesperson then said they received the CFIUS evaluation and the President will review it, according to Reuters.

- BoK said it would deploy market stabilising measures should FX volatility increase and noted that the pace of household debt might rise with the easing of policy rates, according to Reuters.

European bourses, Stoxx 600 +0.3% are slightly firmer today, in holiday-thinned conditions and with newsflow light. European sectors hold a strong positive bias, in-fitting with the sentiment seen in Europe. Travel & Leisure takes the top spot, paring some of the hefty losses seen in the prior session. Insurance is found at the bottom of the pile, joined closely by Consumer Products and Services. US equity futures are mixed and lack any firm direction, ultimately trading on either side of the unchanged mark.

Top European News

- Vistry Shares Plunge on Third Profit Warning From Homebuilder

- Turkish Officials To Examine Syria’s Energy Infrastructure: Govt

- UK, French Stocks Rise in Thin Christmas Eve Trade; Vistry Sinks

- Germany Set For Wind Lull This Week With Low Holiday Demand

Central banks

- RBA Minutes (December meeting): Policy needed to be “sufficiently restrictive” until confidence on inflation was achieved. The Board had gained confidence on inflation since the prior meeting, but risks remained. Members noted that the Board had minimal tolerance for inflation remaining above target for too long. They stated that future data in line with or weaker than forecasts would give more confidence on inflation, at which point it would be appropriate to begin relaxing the degree of policy tightness. However, if data proved stronger than expected, it could indicate a longer period before easing policy. The Board observed signs that policy was not as restrictive as the current cash rate level would suggest. The labour market was resilient, while service inflation remained more persistent. Wages had slowed more than expected, potentially indicating that the labour market was not as tight as previously thought. Monthly CPI data suggested a modest downside risk to Q4 inflation forecasts. Additionally, upside inflation risks had diminished, while downside risks to economic activity had grown. The Board noted that more data and updated forecasts would be available by the February meeting. Members also stated that it was not possible to judge the impact of Trump’s policies on Australia until more details were known.

- BoJ October meeting minutes (two meetings ago): A few members said they must scrutinise the impact of the past interest rate hike on the economy and prices when deciding policy. One member said they must take time and be cautious when deciding on the timing of the next rate hike. Members shared the view that the BoJ would keep raising rates if the economy and prices moved in line with its forecast. Additionally, one member noted that it was desirable to gradually raise rates if underlying inflation accelerated as projected. Another member pointed out that market rates could be lower than levels considered appropriate based on the BoJ’s economic and price projections, as well as its guidance on monetary policy. Meanwhile, one member stated that it was hard to indicate with confidence the BoJ’s medium- to long-term rate hike path due to uncertainty over Japan’s neutral rate level and the transmission mechanism of monetary policy.

FX

- DXY is essentially flat and trading towards the upper end of a very tight 108.05-20 range, amid holiday-thinned conditions and ahead of Richmond Fed Index and US supply.

- EUR is incrementally on the backfoot and dipped just below the 1.04 mark in early European trade; confines for today at 1.0389-1.0410.

- GBP/USD has traded sideways in a very tight 1.2526-45 range, showing little momentum after reaching a broader 1.2526-1.2575 range earlier in the week.

- JPY is incrementally firmer thus far, but has traded sideways in the EU session. Overnight markets digested jawboning from Finance Minister Kato, which led the USD/JPY below 157.00; a level which has since been reclaimed. Japanese PM Ishiba said he will step up measures for increasing minimum wages; comments which sparked little move in the pair.

- Antipodeans are ever so slightly on the backfoot, with the Aussie unresponsive to RBA minutes. The minutes expressed confidence in inflation but cautioned that stronger-than-expected data could prolong the period before easing. AUD/USD and NZD/USD are tucked within yesterday’s respective 0.6218-46 and 0.5632-66 ranges.

- PBoC set USD/CNY mid-point at 7.1876 vs exp. 7.3031 (prev. 7.1870)

- RBI likely sold USD to limit INR fall, according to traders cited by Reuters.

Fixed Income

- Gilts opened lower by two ticks but has since slipped slightly to a 92.19 trough in thin conditions with newsflow essentially non-existent for the UK. In a 92.07-46 band, which takes Gilts below the 92.18 base from last Friday and below that the 91.87 contract trough from last Thursday as Gilts reacted to the FOMC from the night before.

- USTs are essentially flat in an extremely narrow 108-16 to 108-19+ band while the curve is, at the margin, steepening. As above, catalysts are light though the docket ahead includes a 2yr FRN and a 5yr Note auction. Ahead, it remains to be seen if any concession emerges into the US supply.

Commodities

- WTI and Brent began the European morning on a firmer footing and continued to inch a little higher; recent geopolitical updates suggest an Israel-Hamas deal may not be as imminent as previously anticipated. Additionally, Israeli press floated the possibility of troops remaining in Southern Lebanon longer than agreed under a separate deal. Brent’Feb 25 at the top end of the day’s range at around USD 73.20/bbl.

- Spot gold is on a slightly firmer footing and holds at the upper end of a tight USD 2612-2621/oz range; price action thus far has been very rangebound.

- 3M LME copper is on a firmer footing today, but still somewhat off the USD 9K mark (currently USD 8,972), in-fitting with the risk-tone and versus mostly subdued overnight price action.

US Event Calendar

- 08:30: Dec. Philadelphia Fed Non-Manufactu, prior -5.9

- 10:00: Dec. Richmond Fed Index, est. -10, prior -14

- 10:00: Dec. Richmond Fed Business Condition, prior 10

Tyler Durden

Tue, 12/24/2024 – 08:26

via ZeroHedge News https://ift.tt/7xqRBT8 Tyler Durden