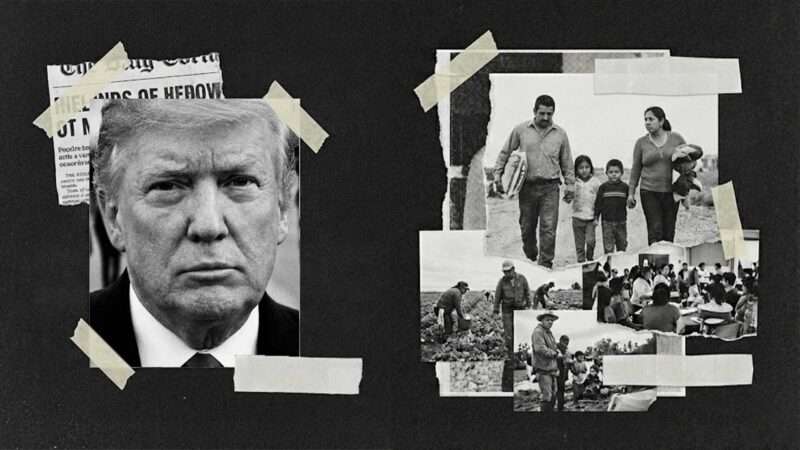

After Minneapolis Mayor Jacob Frey said he was proud that his city had the largest Somali community in the United States, President Donald Trump unleashed a vicious rant during a press conference ostensibly about the auto industry: “I wouldn’t be proud to have the largest Somalian―look at their nation. Look how bad their nation is. It’s not even a nation. It’s just people walking around killing each other…They have destroyed Minnesota.”

Trump also penned a social-media post claiming Somali gangs have taken over Minnesota and “are roving the streets looking for ‘prey’ as our wonderful people stay locked in their apartments and houses.” The Hennepin County District Attorney’s Office, which is the top law-enforcement agency overseeing the Minneapolis area, released a video debunking those claims. Nearly 90 percent of Somalis there are legal residents, with 58 percent of them having been born in the United States.

“They contribute nothing…I don’t want them in our country,” Trump added, as he has pushed forward a plan to reduce the nation’s refugee-acceptance program by 90 percent. Somalis actually have revived some downtrodden Minneapolis neighborhoods as they mostly pursue the American dream, but why pick nits? The bulk of the new refugees will be white South Africans, but I’m sure race has absolutely nothing to do with his latest immigration-related tirades and decisions.

It’s seems hardly a coincidence that Trump also has directed ire at Haitian immigrants in Ohio whom he falsely accused of eating pets. His decision to eliminate free-entry days at national parks on the Juneteenth holiday commemorating the end of slavery and Martin Luther King Jr. Day also don’t seem like coincidences. In reality, the only roving gangs that Twin-Cities residents need to worry about are the masked ICE patrols Trump has sent to the region, but that’s apparently the point.

Trump is maligning “garbage,” as he referred to a Somali member of Congress and her “friends,” to justify efforts to quash immigration from non-white countries. Can the GOP stop pretending otherwise?

Conservative media are focusing on Minnesota’s social programs, with City Journal‘s Christopher Rufo explaining that “fraud has allegedly been perpetrated by members of Minnesota’s sizeable Somali community” with “millions of dollars in stolen funds have been sent back to Somalia, where they ultimately landed in the hands of the terror group Al-Shabaab.” Minnesota’s Democratic politicians and media have been loath to “connect the dots” because of their “progressive pieties,” Rufo added.

That may be true and any fraud is appalling, but perhaps one reason for the lack of dot-connecting is Minnesota officials’ fear that the administration and its supporters would react as they have, by blaming the entire Somali community for the criminal acts of a few and using the scandal to justify heavy-handed immigration policies.

There are two schools of conservative immigration thought. The first, to which I subscribe, acknowledges immigrants often flee countries ravaged by crime, tyranny and disorder. That’s why many people come to the United States. Our nation’s settlers fled persecution. My father escaped Nazi Germany, which was literally putting people in ovens (although many Republicans lately have struggled with their views on such horrors). Under this long-standing view, Americans should welcome immigrants, but promote E Pluribus Unum.

The other conservative view, which is clearly embraced by national conservatives and populists, is that America is fundamentally a white, Christian nation and that immigration, to whatever limited degree we allow it, should align with those demographics. Some conservatives still tout the, “we’re only against illegal immigration” canard, but that’s not what’s going on here. Trump’s policies—along with much of the anti-immigration rhetoric on the right these days—are about limiting immigration in general. Minnesota’s Somalis and Springfield’s Haitians are, after all, primarily legal.

No one disputes that law-enforcement should clamp down on government fraud. The root problem is the government freebies themselves, which often are overly generous and lacking in oversight. But it’s not like fraud scandals are confined to immigrant and minority communities. One can find similar scandals involving any ethnic group (including native-born Americans).

The president always doubles down. Following the brouhaha over his comments, Trump said to supporters: “Why is it we only take people from sh**hole countries, right, why can’t we have some people from Norway, Sweden, just a few…We always take people from Somalia, places that are a disaster, dirty, filthy, disgusting, ridden with crime.” It’s clear what he’s saying.

By contrast, in his last presidential speech, Ronald Reagan said, “We lead the world because, unique among nations, we draw our people—our strength—from every country and every corner of the world. And by doing so we continuously renew and enrich our nation.” Reagan was right. Trump is wrong. Americans shouldn’t be ashamed that our nation is a beacon to the tired, poor, huddled masses, but we have reason to be ashamed of him.

This column was first published in The Orange County Register.

The post Trump's Somali Insults Are a Disgrace appeared first on Reason.com.

from Latest – Reason.com https://ift.tt/xtecsYX

via IFTTT