Today’s AM fix was USD 1,311.25, EUR 971.30 and GBP 817.08 per

ounce.

Yesterday’s AM fix was USD 1,314.25, EUR 972.94 and GBP 823.47 per

ounce.

Gold inched down $0.60 or 0.05% yesterday, closing at $1,314.20/oz. Silver

slid $0.22 or 1.01% closing at $21.62. Platinum climbed $6.55 or 0.5% to

$1,450.25/oz, while palladium rose $7.46 or 1% to $745.25/oz.

Gold

in USD, 1 Year – (Bloomberg)

Gold has had five consecutive days of weakness as a stronger greenback has

led to traders selling gold on the COMEX. Even though the U.S. Fed maintained

their ultra loose monetary policies last week, maintaining $85 billion a month

in bond purchases, gold has lost its shine with momentum driven and computer

driven traders and hedge funds.

The sharp rise in the gold mining shares yesterday, the XAU was up 2.5% and

the HUI was up 2.9%, was encouraging for gold.

Declines are likely to be limited as lower prices is leading to physical

buying globally. While much of the focus continues to be on ETF selling and

Indian and more recently Chinese demand, some market participants fail to

realise the extent of global demand which remains broad based. This is seen in

the recent gold data out of Dubai and Turkey.

Turkey’s gold imports jumped more than threefold in October to 15.98 metric

tons, from 4.8 tons in September, according to the Istanbul Gold Exchange’s

website. That’s the highest since July, the data shows.

Turkey has already imported 251.4 metric tonnes in 2013, year to date,

meaning that it will come very close to or surpass the record import year in

2005 when 269.5 metric tonnes of gold were imported (see table below).

Year to date imports are more than double the amount of gold imports in 2012

and more than triple those in 2011.

Turkey’s gold sales to neighboring Iran declined to $1.5 billion so far this

year from a record $6.5 billion for all of last year. This may indicate a fall

in demand from Iran or that Iran is now importing gold from other countries such

as Dubai in the UAE.

Gold is being remonetised and becoming money again in Turkey. Unlike India

which has embarked on a campaign of repression against gold, the Turks are being

far more enlightened. They are allowing the considerable and growing gold

holdings of the population to be remonetised in order stimulate demand and grow

the economy.

The country’s central bank last year allowed commercial banks to hold a

portion of their lira reserves in gold and banks are making it easier to buy

gold in Turkey..

Some Turkish banks are now offering customers the ability to use their gold

based deposits for collateral on gold backed loans and using gold as access to

Turkish Lira or for access to credit cards.

Isbank and Turkiye Garanti Bankasi AS, the country’s biggest lender by market

value, offer gold-backed loans, where customers can bring jewellery or coins to

the bank and take out loans against their value. Garanti also has a credit card

linked to gold deposit accounts.

Government efforts to help ease the nation’s current account deficit are

encouraging householders to bring their gold coins which it is estimated that

there are $302 billion of hidden gold

stashed in homes in Turkey.

This hidden gold is second only to the U.S., and Turkish gold based deposit

accounts have grew 15% this year calculated until the end of July, which is a 3

fold increase in standard savings accounts according to the Turkish Central

Bank.

The gold accounts give customers an amount in Turkish lira equivalent to the

weight of the precious metal they deposit in the bank. Bank customers can then

withdraw cash or take out loans, while the bank is able to sell or hold onto the

gold.

Turkiye Is Bankasi AS (ISCTR), Turkey’s largest bank by assets, said gold

deposits increased 10 times in the two years through June.

The campaign by Turkey’s banks, featuring ads for “golden age” accounts and

products such as gold gift checks, is targeted at Turks who traditionally give

gold coins or jewellery as presents at weddings, births and circumcision

ceremonies. The custom gained popularity a decade ago as Turkey’s inflation rate

topped 70%, making gold an attractive store of wealth.

The World Gold Council estimates that by bringing 5,000 metric tons (5,512

tons) of gold bullion into the banking system — an amount greater in value than

Ireland’s GDP, Turkey aims to reduce gold imports and external borrowing.

Government statistics cite Turkey’s current-account deficit, has narrowed its

gap 23% from $77 billion (2011) to $59 billion (ending August). Record gold

sales from Turkish companies to the United Arab Emirates and Iran increased its

exports. Exports of precious metals to the UAE and Iran, climbed to $9.2 billion

(ending August 2012) from $645 million last year driven by western sanctions on

Iran.

Many of the gold exported is coming from the population that are shifting

their gold stash from their homes to the banks since Turkish gold production is

only 25 metric tons.

The Turkish Government endeavours include the August 16th central bank

decision to raise the proportion of reserves lenders can keep in gold to 30%

from 25%, having increased its efforts to get more bullion out of the homes and

into the monetary system.

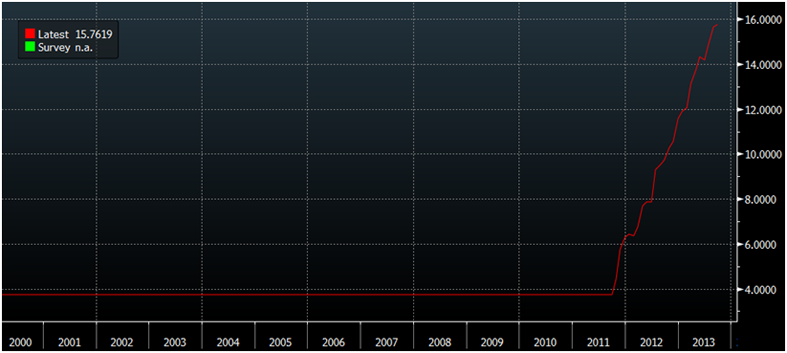

IMF

Turkey Gold in Mill Fin Troy Oz

Banks are diversifying and offering diversification with a range of gold

related services.

Turkey’s regulators have been discussing planned legislation to enable

customers to buy or sell gold at bank branches or transfer gold into other

accounts, according to an Aug. 29 report in Milliyet, a daily newspaper. Bank

Asya has said it will soon start purchasing and selling bullion at its

branches.

Jewellers in Istanbul’s Grand Bazaar, one of the world’s largest covered

markets, have opposed the move. They say banks buying and selling gold would cut

their revenue and push them into underground trading, according to

Bloomberg.

The 6th century-old Grand Bazaar houses 4,000 jewellers, and about 1.5 metric

tons of scrap gold is processed into bullion there every day, according to

Istanbul Gold Exchange data. Transaction volume totalled 8.5 billion liras ($4.7

billion) last year.

The move by the Turkish banks may soon be followed by

desperate banks in other emerging and developed markets.

Turkey has been aggressively adding to its gold reserves in recent years and

now has the world’s 11th-largest gold reserves. Its holdings rose to 15.762

million ounces or over 490 tonnes at the end of September (see chart above).

Gold is gradually being remonetised again in Turkey and this trend will soon

be seen globa

lly.

With gold soon to become a Tier 1 asset, banks will attempt to get a

significant amount of investment grade gold bullion onto their balance sheets in

order to buttress them.

Download

GoldCore’s Essential Guide To Silver Eagles here.

Like Our Facebook

Page For Interesting Breaking News, Insights, Blogs, Prizes and Special

Offers

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/hle-ilVep1M/story01.htm GoldCore