Click here to follow ZeroHedge in Real-time on FinancialJuice

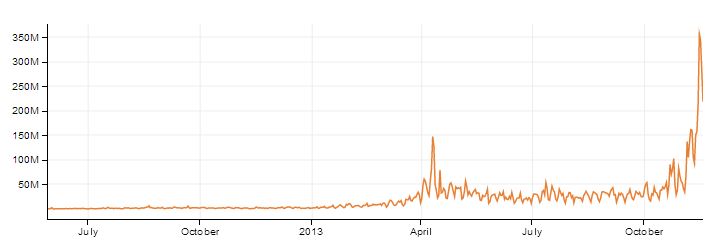

Five years ago it was worth $0. Then, a month and a half ago it went to $150 a piece. On Monday it shot to over $600. On Tuesday, the value rose to over $900, meaning a 6, 445%-increase in value since the start of the year. It plummeted to $531 at midday today and then recovered reaching $793 while being traded on the Asian markets. Bitcoin: it’s the bonanza of the century.

Volatility and hikes are based on nothing except speculation and the desire to make a mint, thinking that you can predict what the markets are going to do. But, will that Bitcoin volatility lead to a bubble? Or is it bringing in a new era of a new type of currency that people are willing to use and that merchants are now being forced to accept? It might never become a legitimate currency in the future, but that’s hardly important when you can make a profit from it. Of course central banks are at risk from the use of virtual currencies as it would mean that they would have little control over what we spend and how transactions are carried out. Is Bitcoin the death of our central banks?

Some might say that Bitcoin is associated with crime and is an easy way for illicit transactions to take place. Tell me one currency in the world that isn’t laundered these days? Tell me one place in the world where there is a currency that is clean? Pure snow-white virgin money doesn’t and never has existed. Just because it’s associated with crime doesn’t mean it’s not good for the rest of the world. All of the currencies of the world are associated with crime somehow. Perhaps after all the fall of the Dollar, the death of the greenback will not be because the Chinese have taken the world over and imposed the Renminbi as the reserve currency on the world. Perhaps it will be the Bitcoin that takes over the world economically today.

- When Bitcoin started out in 2009 after being founded by Satoshi Nakamoto (or under his real name of Gavin Andresen) one Bitcoin was worth $0.30.

- It rose to $32, but then fell to $2. There are some 12 million Bitcoins in circulation today and the number of Bitcoins issued every four years is reduced by 50% (and will be until that number reaches a circulation level of 21 million Bitcoins).

- The currency is already accepted on some of the world’s most highly-ranked internet sites today:

- WordPress.com ranked 22 in the world, offering custom-designed software and templates. They have accepted Bitcoins since November 2012.

- The Pirate Bay, ranked 108 in the world which started accepting Bitcoins in April 2013 for their music and move-software directory.

- Reddit, which ranks 117 in the world and accepted Bitcoins for the first time in February 2013 for the social and entertainment network site.

There are plenty more and they will be increasing in the future, simply because it’s the people that have decided that they are willing and ready to use Bitcoins as a means of exchange. Have the people started the demise of the Dollar and all other currencies? Are we living a moment in history that we shall look back upon in years to come as we wave goodbye to the hegemonic control of the politically-aided and biased reserve currency that is the greenback and that all other currencies are vying to overtake? Will they all lose out, because we have decided for it to happen? That will certainly wipe the smile off the faces of some at the top of the hill.

Gaining legitimacy is essential for the Bitcoin to be a valued and a valuable means of exchange. The difference between Bitcoin and any other currency that is controlled by a government is that Bitcoins have become accepted because the market has decided that they are. People want them and merchants accept them. It is not a political currency but quasi-commodity money. The number of transactions has suddenly increased since the start of November and it has now reached dizzy heights around the world. Even governments are starting to recognize the existence and the validity of Bitcoins today. Germany in August 2013 decided to recognize the virtual money as a real currency, legally and fiscally approving it is valid.

When Andresen spoke of begging Julian Assange not to use Bitcoin back in 2010 as a means of getting around the normal method of financial transactions and thus finding a route to funding WikiLeaks, he said ‘it will destroy us’ adding that they were too small a company to be able to deal with it. Although, with hindsight the ‘you-will-destroy-us’- statement probably had little to do with the nascent company not being able to cope with the financial trading of the currency that had been invented, but the fact that Bitcoin would have been closed down and nipped in the bud before it had got off to a start. Now we can see why Bitcoin wanted to steer away from that can of worms. It had greater things in its sights than WikiLeaks.

It’s a rare thing to have the opportunity today to choose which currency we want to use. Maybe this time the choice will be the right one. Maybe the central banks, the ones that have done the damage in the past and are continuing to do so today will have their power taken away from them.

Climbing the greasy pole that politics has become is nothing to do with who you are and what you say. It has everything to do with where you come from and what you have in the bank account to back you up.

Originally posted: Bitcoin Bonanza

The Super Rich Deprive Us of Fundamental Rights | Whining for Wine |Cost of Living Not High Enough in EU | Record Levels of Currency Reserves Will Hit Hard | Internet or

Splinternet | World Ready to Jump into Bed with China

Indian Inflation: Out of Control? | Greenspan Maps a Territory | Gold Rush or Just a Streak? | Obama’s Obamacare: Double Jinx | Financial Markets: Negating the Laws of Gravity |Blatant Housing-Bubble: Stating the Obvious | Let’s Downgrade S&P, Moody’s and Fitch For Once | US Still Living on Borrowed Time | (In)Direct Slavery: We’re All Guilty |

Technical Analysis: Bear Expanding Triangle | Bull Expanding Triangle | Bull Falling Wedge | Bear Rising Wedge | High & Tight Flag

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/z33hxJLc2f4/story01.htm Pivotfarm