The maestro clarifies his ‘experienced’ perspective of spotting bubbles in the following quote from his interview with Bloomberg TV’s Al Hunt:

“This does not have the characteristics, as far as I’m concerned, of a stock market bubble,”

Of course, as we noted here, some would beg to differ; but perhaps what would be useful is for the former Fed head to explain what ‘characteristics’ do constitute a bubble…

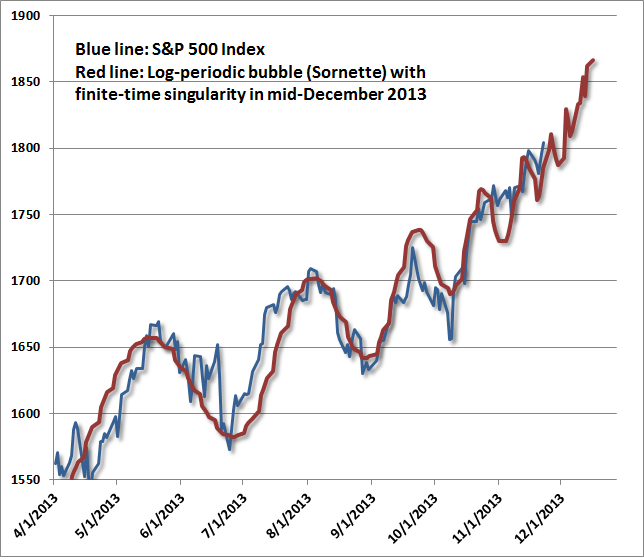

Nope, no bubble here…

And here’s his explanation…

“The stock price generally goes up about 7 percent a year for the long term,” Greenspan said. “It didn’t go anywhere since October 2007 and the result of that is we’re just now breaching that. We have had no growth in stock prices for years.”

But as we explained here, there is a reason the Fed can’t see the bubble (aside from not wanting to).

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/5nvIDYP2bjs/story01.htm Tyler Durden