After Jerome Powell sent stocks into a downward spiral on Wednesday with his view that low inflation is expected to be ‘transitory’, surprising the market with its hawkish overtones, Fed Vice Chairman Richard Clarida has once again been brought in to offer a safely dovish counterpoint.

Adding his voice to a chorus of dovish Fed officials speaking on Friday, Clarida reassured markets that inflation expectations are “stable” and that there is “no need” for the Fed to change its policy stance at the moment.

On the face of it, Clarida’s comments don’t offer much new:

- CLARIDA: INFLATION PRESSURES MUTED, EXPECTED INFLATION STABLE

- CLARIDA: WE’LL WEIGH `WHAT, IF ANY, FURTHER ADJUSTMENTS’ NEEDED

- CLARIDA: FED FUNDS RATE NOW IN RANGE OF NEUTRAL ESTIMATES

- CLARIDA SAYS FED CAN AFFORD TO BE DATA DEPENDENT

- FED’S CLARIDA SAYS U.S. ECONOMY IS IN A `VERY GOOD PLACE’

With stocks already in rally mode, Clarida’s comments didn’t elicit much of a reaction.

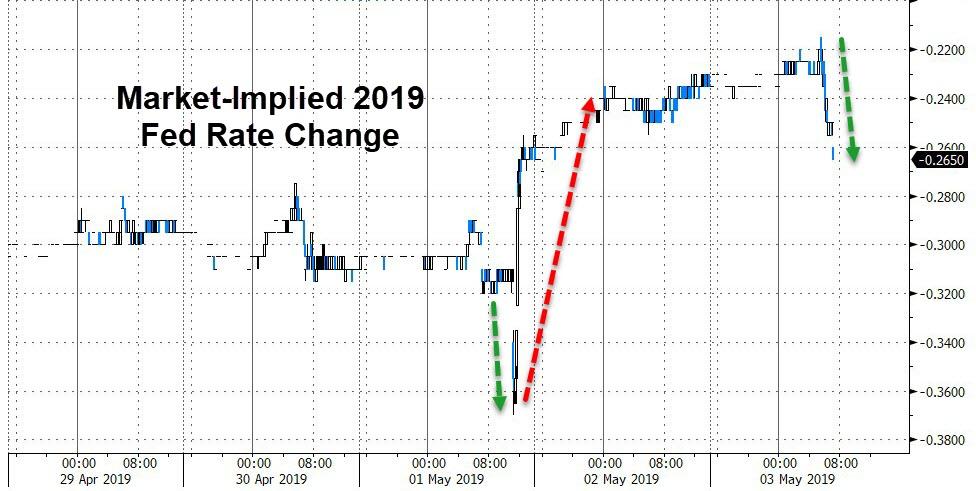

Though at least where rate-expectations are concerned, it appears the dovish offensive is having the desired effect.

On another note, analysts pointed out that New York Fed President John Williams released a paper that sounded ‘pretty darn dovish’:

This paper uses a standard New Keynesian model to analyze the effects and implementation of various monetary policy frameworks in the presence of a low natural rate of interest and a lower bound on interest rates. Under a standard inflation-targeting approach, inflation expectations will be anchored at a level below the inflation target, which in turn exacerbates the deleterious effects of the lower bound on the economy. Two key themes emerge from our analysis. First, the central bank can eliminate this problem of a downward bias in inflation expectations by following an average-inflation targeting framework that aims for above-target inflation during periods when policy is unconstrained. Second, dynamic strategies that raise inflation expectations by keeping interest rates “lower for longer” after periods of low inflation can both anchor expectations at the target level and further reduce the effects of the lower bound on the economy. Both of those “key themes” appear to argue for low interest rates, which probably explains the bid to fixed income.

via ZeroHedge News http://bit.ly/2LkXQfp Tyler Durden