While the rest of the world is distracted by the plummeting unemployment rates and trade deal hype, a funny (well not so funny) thing happened in the short-term funding markets in the world’s reserve currency.

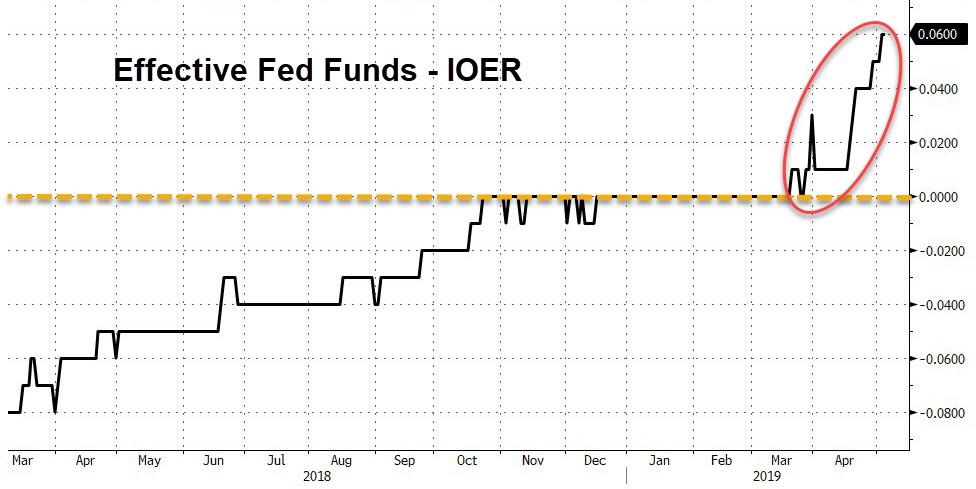

As we noted previously, something unexpected has been going on in overnight funding markets: ever since March 20, the Effective Fed Funds rate has been trading above the IOER. This is not supposed to happen.

As a reminder, ever since the financial crisis, in order to push the effective fed funds rate above zero at a time of trillions in excess reserves, the Fed was compelled to create a corridor system for the fed funds rate which was bound on the bottom and top by two specific rates controlled by the Federal Reserve: the “floor” for the corridor was the overnight reverse repurchase rate (ON-RRP) which usually coincides with the lower bound of the fed funds rate, while on top, the effective fed funds rate is bound by the rate the Fed pays on Excess Reserves (IOER), which served as the corridor “ceiling.”

Or at least that’s the theory. In practice, the effective FF tends to occasionally diverge from this corridor, and when it does, it prompts fears that the Fed is losing control over the most important instrument available to it: the price of money, which is set via the fed funds rate.

This week, The Fed tried to do something about it by cutting the IOER.

It has failed!

The effective fed funds rate fell to 2.41% on Thursday from 2.45%, according to New York Fed data. With the Federal Reserve’s 5bp cut to the interest on excess reserves (IOER) rate to 2.35%…

Fed effective rate on March 20 surpassed IOER for the first time since 2008, and it’s stayed above most days since.

This is a 6bps failure – worse than the 5bps spread BEFORE the Fed “tweaked”.

In other words, as one veteran funding market trader exclaimed, “it’s getting worse!”

Simply put, this is front and center a dollar liquidity shortage signal that The Fed is unable to solve… for now.

As Barclays’ Joseph Abate recently ominously concluded:

the large move also suggests that the banking sector is “nearing the steeply sloping part of the reserve demand curve” which means that “bank reserves are now significantly closer to what individual banks consider their ‘least comfortable level of reserves’ and thus banks are more willing to pay higher rates to retain these balances.”

In other words, some $1.5 trillion in excess liquidity created by the Fed is no longer enough for banks which are starting to scramble to obtain additional liquidity, which needless to say, is very troubling for a banking system which is supposedly “fortress” and “much more stable” than it was before the financial crisis. If anything, this means that even a modest liquidity draining crisis at any point in the future could have vastly more dire consequences than even the pessimists believe.

So what can the Fed do to regain control over interest rates?

According to Barclays to address the expected increase in fed funds volatility, the Fed could either end the balance sheet runoff this summer instead of waiting until September, create a standing repo facility – something which has been rumored for months – or conduct standard open market operations, injecting even more liquidity into the system.

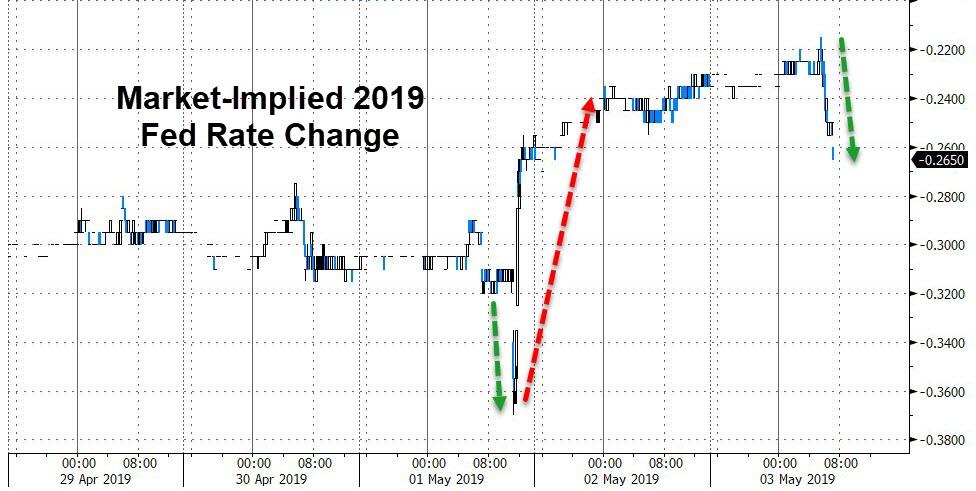

Is Larry Kudlow right? Is The Fed preparing to cut rates, despite Powell’s dismissal of directional bias? The market still thinks so…

Note, the market is shifting dovishly today despite the big beats in jobs, suggesting something else (cough liquidity cough) is affecting policy expectations.

via ZeroHedge News http://bit.ly/2VIk135 Tyler Durden