As the father to sons who are 25 and 17 years old, I love Millennials and Gen Z. But it’s getting harder and harder to feel sympathy for kids born between 1981 and 2012 (give or take).

It’s not all or maybe even mostly their fault. Much of the problem stems from the ways in which the media covers the plight of younger Americans, especially the supposedly catastrophic amount of student-loan debt they have taken on simply to get a college degree which is now, we’re told, a nearly meaningless piece of paper that no longer “automatically” guarantees admission to the “middle class.” A recent story in The Wall Street Journal exemplifies this approach. It’s titled “Playing Catch-Up in the Game of Life: Millennials Approach Middle Age in Crisis” and promises “New data show they’re in worse financial shape than every preceding living generation and may never recover.” Mostly, it highlights individuals and couples who have tons of student debt and, as a result, supposedly can’t buy houses, have kids, or even get married.

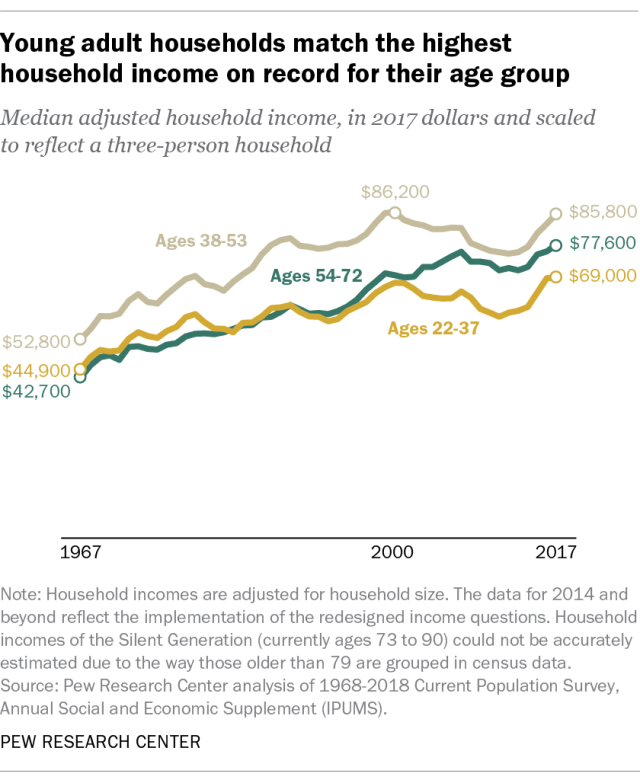

In fact, it’s far from clear that crude economics is driving, say, the reduction in fertility rates, which have been dropping for decades everywhere in the world and are tied to increases in female autonomy. And for all the talk about generational poverty, it’s not immediately clear that all is darkness. According to a Pew study in 2018, Millennial households now “match the highest household income for their age group.” Throw in higher rates of advanced education and the future actually looks promising. And it appears that Millennials may be better off in various ways than Gen X was at the same stage of life.

In any case, there is so much wrong with the narrative about student-loan debt that it’s hard to know where to start. In the first place, more people, including more low-income people, are going to college than ever before and college grads have much-higher lifetime earnings and much-lower unemployment rates than folks with just a high-school diploma, an associate’s degree, or a few years of college. As the economist Scott Winship has written, “If we’re counting rising student indebtedness on the debt side of the ledger, shouldn’t we count the value of the asset financed by the debt (human capital) on the asset side?” As important, despite the aggregate $1.5 trillion out there in student debt, the average and median amounts owed by individuals students are hardly breathtaking.

According to data from Lending Tree, for instance, about 70 percent of the Class of 2018 took out loans and their median monthly payment was $222. The average loan amount (which will be higher than the median) for graduates with debt was about $30,000. According to Pew,

The median borrower with outstanding student loan debt for his or her own education owed $17,000 in 2016. The amount owed varies considerably, however. A quarter of borrowers with outstanding debt reported owing $7,000 or less, while another quarter owed $43,000 or more.

So most borrowers are actually acting responsibly. College grads make about 80 percent more than high school grads, so taking on debt isn’t stupid. And even though college has been getting more expensive, the wage premium remains high enough that the number of years needed to recoup the price of college hasn’t increased for decades, according to work done by the New York Federal Reserve:

It’s extremely difficult to get straight answers about many aspects of education-related debt. Often, it’s not clear if the debt for a given year includes loans for grad school, including law school or medical school, which are not just much more expensive but also much more remunerative and optional. Ninety percent of law school grads borrow, for instance, and the average debt load is $127,000 for people attending private schools and $88,000 for those going to state schools. Three-quarters of med students take out loans that average around $200,000, but the typical doctor makes between $150,000 and $312,000 per year, so the debt isn’t particularly tough. Should we feel bad for lawyers and doctors?

It’s obviously preferable to graduate from college with little or no debt. But media accounts inevitably gravitate to people with eye-popping amounts of debt that are nobody’s fault but their own. Worse still, the reports rarely include any sort of detailed information that would allow a reader to get a better sense of the individual’s life choices. Yes, relatively cheap loans doubtless entice some people to go to college who wouldn’t if they had to pay higher interest rates (if student loans were dischargeable in bankruptcy proceedings, interest rates—even those offered by the federal goverment, which disburses about 90 percent of student-loan dollars—would be much higher). But ultimately the borrower has to take responsibility for his or her actions. I say that as someone who paid his way through undergraduate and graduate school and sweated blood every time I signed for a student loan. Youth is a time of great folly, yes, but you know exactly how much you’re going to be paying back for exactly how long.

In The Wall Street Journal story, we meet a 32-year-old woman living in Chicago who “is a renter who is single and earns $75,000 a year [working for the city]. She also owes $102,000 in student loans and $10,000 in credit-card debt.” Her salary is actually kind of great, especially for someone her age. The median household income for Chicago is about $53,000 and the median per capita income there is $33,000. She’s got three times the average student debt, but we have no way of knowing where she went to college or whether there’s a grad degree tucked into that.

Making $75,000 a year breaks down to $6,250 a month. Assume she’s paying 33 percent in total taxes, that brings her monthly take-home pay to about $4,200. Assuming she’s paying 7 percent on her loans, she’s on the hook for about $1,200 a month, leaving $3,000 to cover rent, food, and everything else. That’s not great, but it’s doable. In real dollars, it’s about $20,000 more than I was bringing home in the mid-’90s when I started at Reason and lived in Los Angeles with a non-working spouse and one-year-old son. Does she have roommates? Why did she spend so much on college? Reading this story made me think of last year’s Time cover story on teachers who supposedly had to work two or three extra jobs because they’re “not paid for the work [they] do.” So much of household finance is tied to spending levels and those are never really discussed.

We also meet a thirty-something couple that “run a financial-advice website, whittling away at their combined student debt of $377,000.” What? One of them is a lawyer, so let’s assume that explains as much as $127,000 of the debt went pay for a private-school law degree. There’s still a quarter of a million dollars in student debt to account for. The story doesn’t provide any extenuating circumstances and, to be honest, I can’t imagine any that would explain such as situation other than really dumb choices. Should we as a society be ready to forgive such mistakes via universal debt relief programs proposed by politicians such as Sens. Elizabeth Warren (D-Mass.) and Bernie Sanders (I-Vt.)? That seems like an insult and an outrage to everybody, parent and student alike, who scrimped and saved and went to schools they could afford.

In an AP story about Robert F. Smith, the billionaire who just announced he would pay off all the student debt of Morehouse College’s Class of 2019, we meet a 22-year-old finance major with an inexplicably and shockingly high amount of student debt: $200,000, an amount that would take him 25 years to pay off “at half his monthly salary, per his calculations.” When Smith made his pledge during Morehouse’s commencement, the student wept.

“I don’t have to live off of peanut butter and jelly sandwiches. I was shocked. My heart dropped. We all cried. In the moment it was like a burden had been taken off.”

Surely I’m not the only one who’s wondering how the hell someone—a finance major, of all people—ended up $200,000 in hock by graduation. Full list price for Morehouse is almost $50,000 a year, but the average net price is $32,000, after grants and scholarships are factored in. Even if he put all four years on loans, that should be $128,000, not $200,000. More to the point, who would do such a thing? The average net price of nearby Georgia State is $15,000. Borrowing $200,000 for a B.A. is simply inexplicable.

I’ve written often about how younger Americans are indeed being screwed by my own generation, the baby boomers. Old-age entitlements are a brutal form of generational warfare that systematically rob from the relatively young and poor and given to the objectively old and rich. The 2008 financial crisis has further beggared the young, who have also grown up in a century with lower-than-average economic growth (thank you, persistent deficit spending and massive national debt).

I’ve written often about how younger Americans are indeed being screwed by my own generation, the baby boomers. Old-age entitlements are a brutal form of generational warfare that systematically rob from the relatively young and poor and given to the objectively old and rich. The 2008 financial crisis has further beggared the young, who have also grown up in a century with lower-than-average economic growth (thank you, persistent deficit spending and massive national debt).

Older people in America have a lot of explaining to do, and we need to reform all sorts of policies that slow economic growth and direct all sorts of unearned wealth to people who don’t need it. But younger Americans—at least those who manage to royally screw up their finances by graduation day—also need to be held accountable.

from Latest – Reason.com http://bit.ly/2JwPgsg

via IFTTT