Authored by Lance Roberts via RealInvestmentAdvice.com,

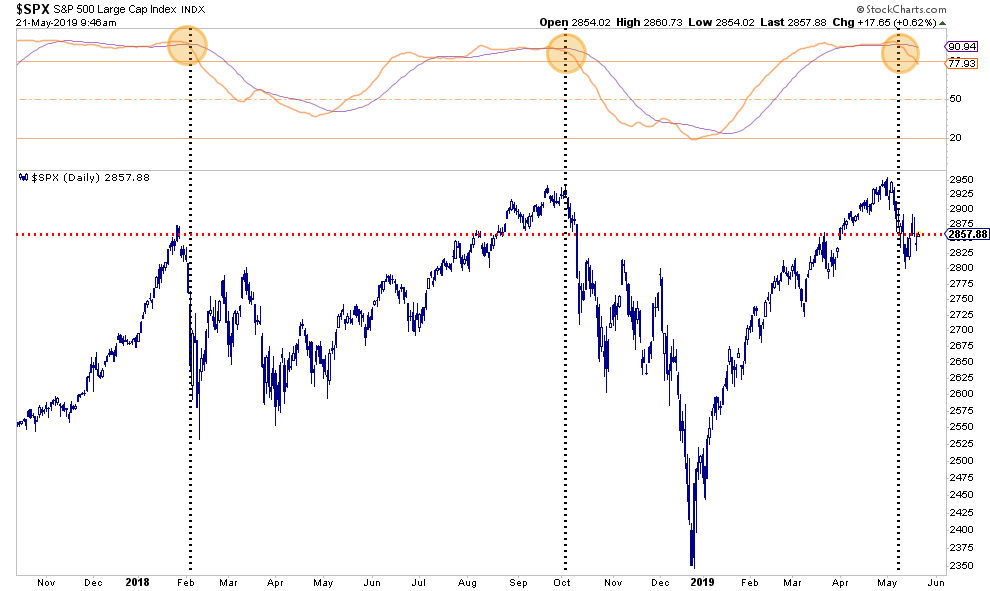

Over the last eighteen months, stocks have whipsawed within a massive trading range as “trade wars,” “tariffs,” and monetary policy actions from the Fed have lit up headlines. Despite the strong rally from the beginning of the year, investors are no better off today than they were at the beginning of 2018.

Does this mean the bull market is over? Or, is it just a pause before a continuation higher? Has the Federal Reserve figured out how to “end recessions?” Or, has the low interest rate environment over the last decade spurred another credit bubble?

Honestly, no one knows for sure where we are within the current cycle, but it is understood it will end.

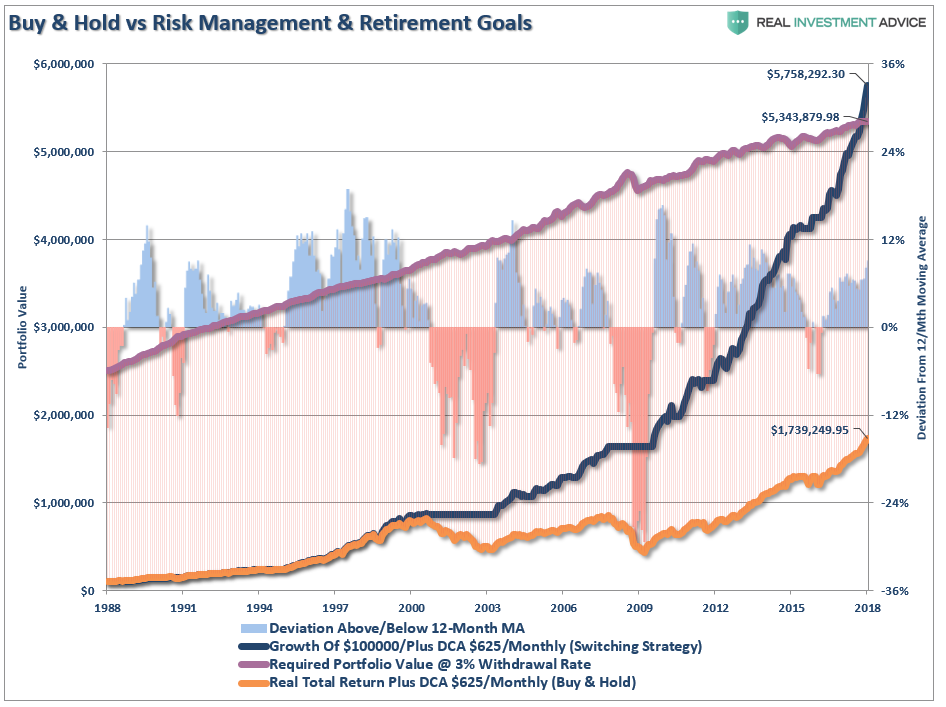

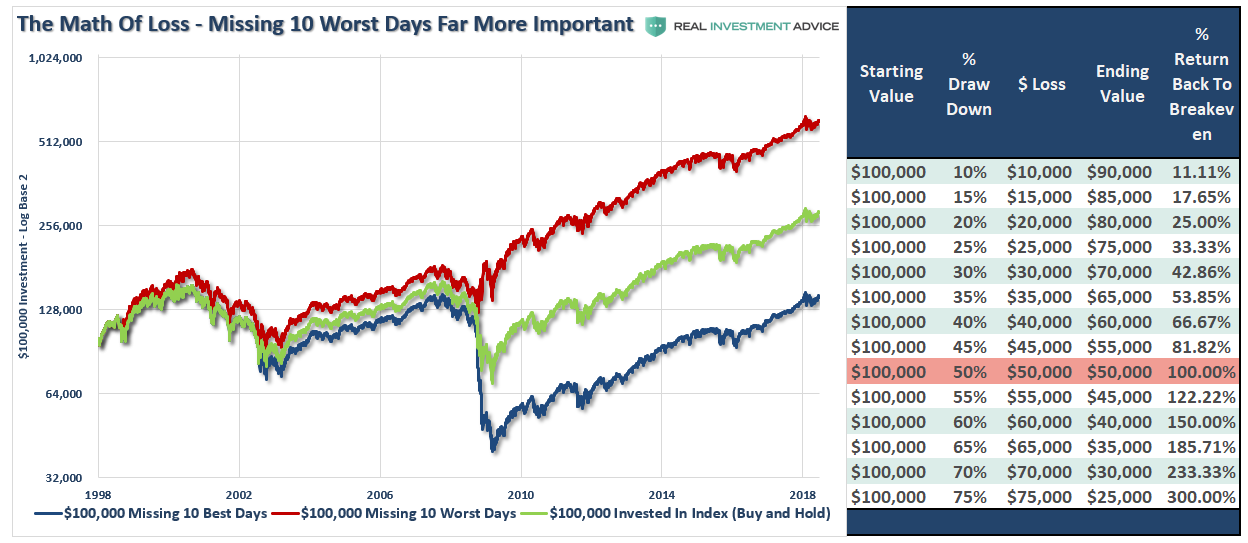

As a portfolio manager, I must stay invested during rising markets as our clients need returns in order to meet their investment goals. However, I must also protect that capital from major drawdowns which inflict far greater damage to financial goals than temporary underperformance.

This is a point missed by most individuals who take on far greater risks than they realize when chasing markets higher. It is also why we spend the majority of our time pointing out the relevant risks to capital.

Pointing out risks, analyzing those risks, and developing an “odds based” approach based on those risks is what guides our asset protection strategies within our long-biased portfolios. While ignoring those risks may lead to great gains in the short-term, the long-term destruction of capital combined with lost time is irreparable.

This is why we write the way we do. It is our “homework” behind our investment management strategies. Here are ten thoughts about investing and markets to consider. (I have provided links to relevant articles for more in-depth explanations.)

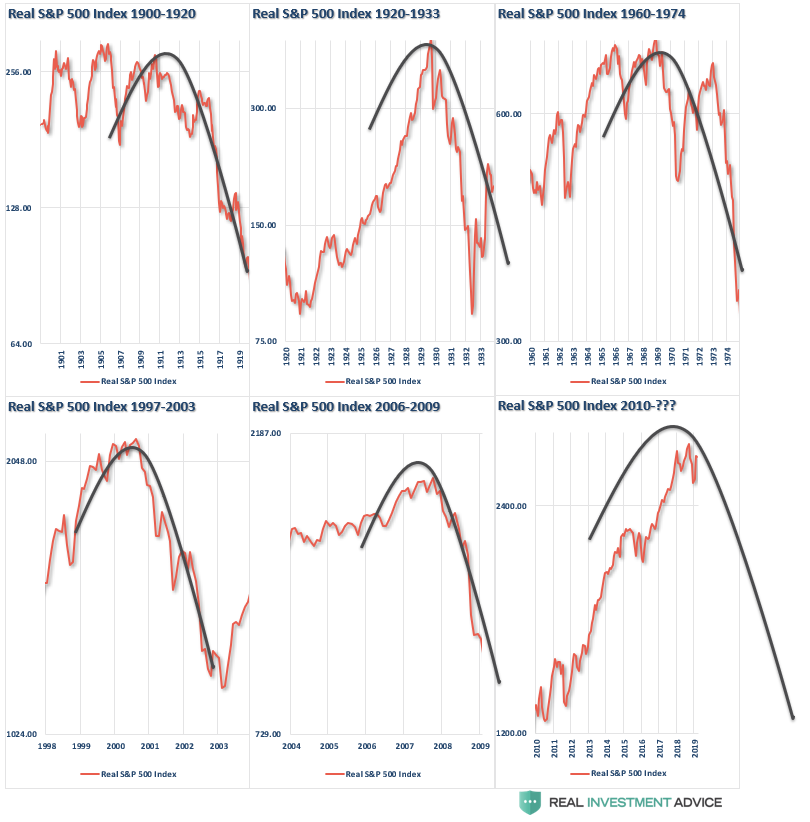

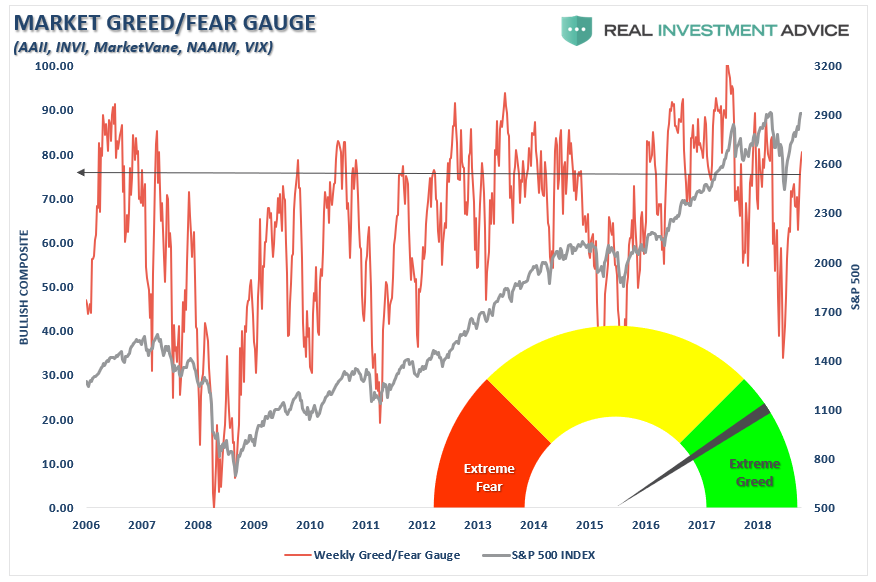

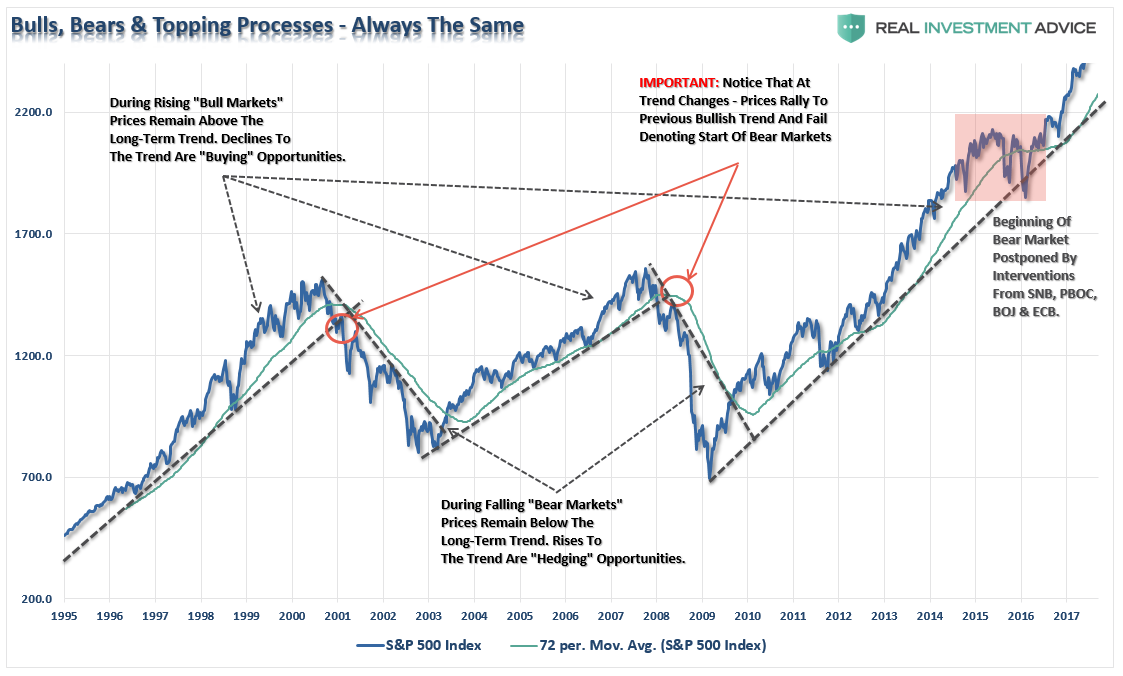

1. Markets are cyclical. Bull markets are a process. Bear markets are an event.

Read: A Different Way To Look At Market Cycles

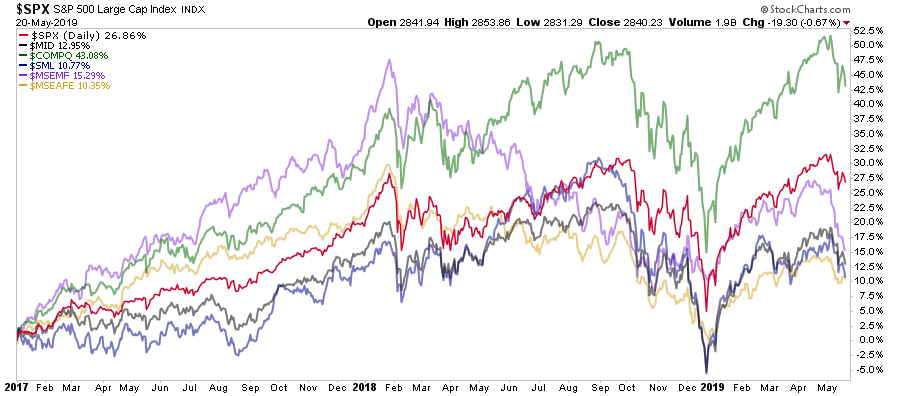

2. Diversification has become less beneficial as markets have become highly correlated.

Read: I Bought It For The Dividend

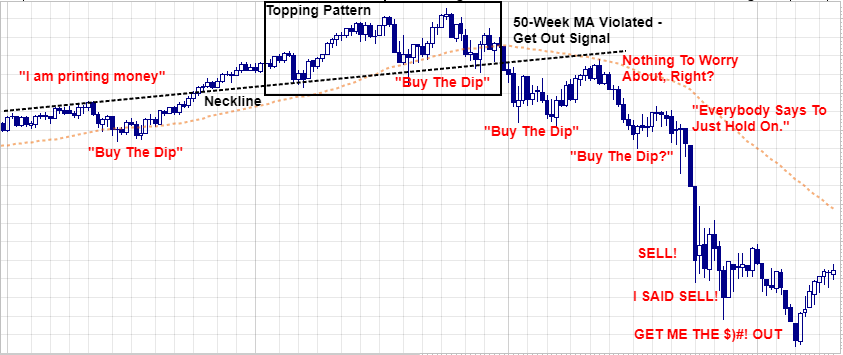

3. Follow the trend of the market. Have a simple method to define the direction of the trend and follow it accordingly. Being a bull during a bearish trend doesn’t work well.

Read: Portfolio Strategies For The Long Run

4. We will all be wrong from time to time. Staying wrong is problematic.

Read: The Math Of Loss

5. There is no “law” that says you have to remain “fully invested” at all times. Sometimes, cash is the best hedge against uncertainty.

Read: Eternal Bullishness & Willful Blindness

Also Read: Valuations, Returns & The Real Value Of Cash

6. Understanding the real meaning of “risk” and how to control it always leads to better outcomes. Professional gamblers know when “not to bet” on a losing hand.

Read: 15-Risk Management Rules For Every Investor

7. No one is right all the time. However, there are basic investing rules. that if followed. tend to reduce the loss of capital associated with being wrong.

Read: An Investors Desktop Guide To Trading

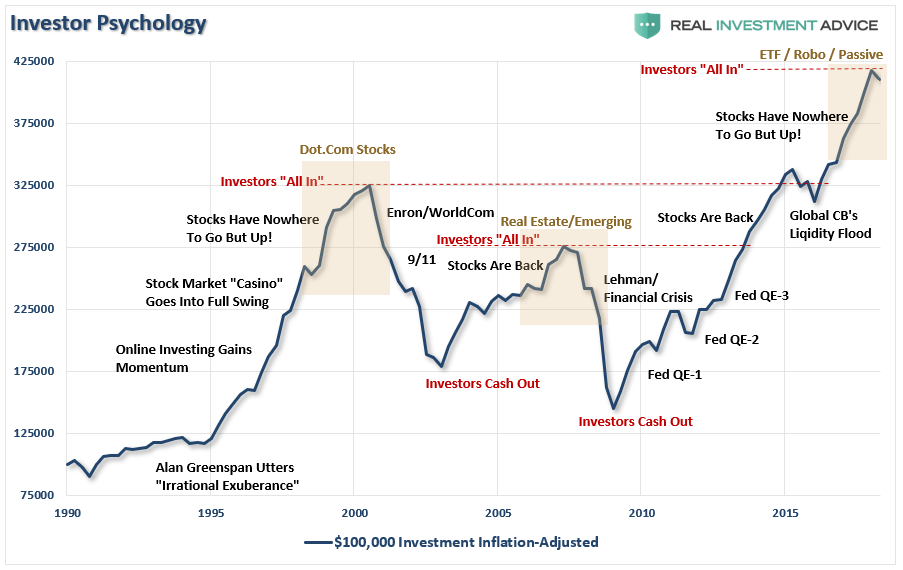

8. The markets are driven by the “herd” mentality which swings from optimism to pessimism driven by headlines and narratives. Excess optimism and excess pessimism denote the points where the most money is lost or made.

Read: 5-Universal Laws Of Human (Investment) Stupidity

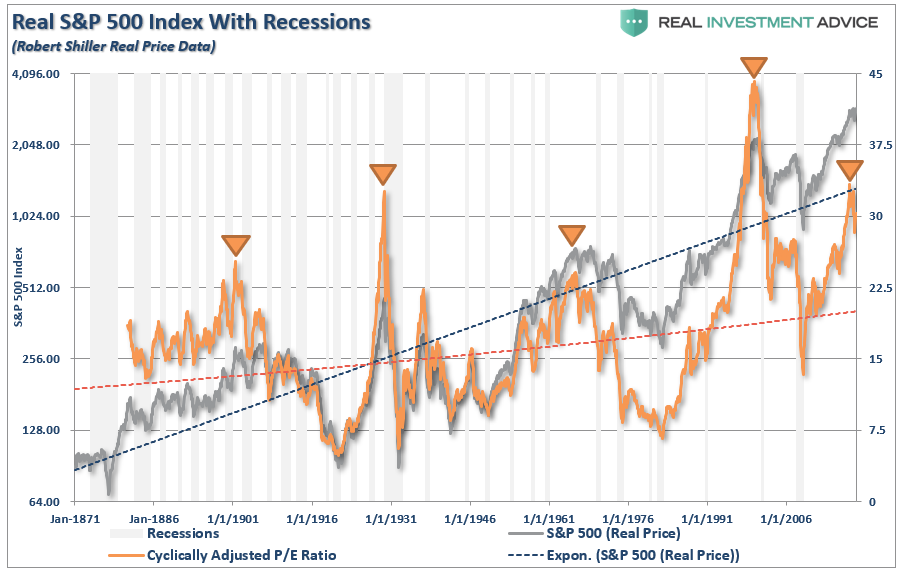

9. Valuations do matter.

Read: 7-Measures Suggests A Decade Of Low Returns

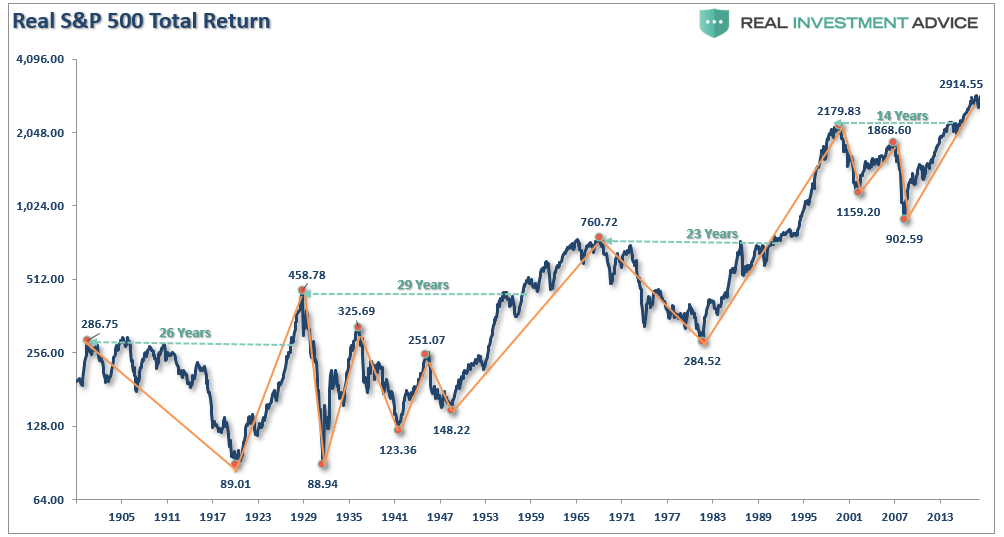

10. Understanding the importance of “time” is critical to investing success. While capital can always be regained, the loss of time cannot.

Read: Strike Three: The Next Bear Market Ends The Game

These are just reminders to keep you grounded in the reality of how money, and investing, REALLY work over the long-term. While it is easy to get lost in the excitement of the moment, the brutal return to reality has always been a costly lesson to re-learn.

via ZeroHedge News http://bit.ly/2X0fVk8 Tyler Durden